Introduction: Charting Your Course in Finance

Are you searching for a career that merges a passion for finance with a genuine desire to help people achieve their dreams? Do you envision yourself not just as an employee at a bank, but as a trusted financial partner in your community? If so, the role of a Relationship Banker at a powerhouse institution like JPMorgan Chase might be the perfect fit. This position is far more than a simple transaction-based job; it's the frontline of modern banking, where lasting client relationships are forged, and financial futures are shaped.

But beyond the mission, there's the practical question that every aspiring professional must ask: What is the real earning potential? A career as a Chase Relationship Banker offers a competitive compensation package that goes well beyond a simple hourly wage. While the specific figures can vary, a typical chase bank relationship banker salary package includes a solid base salary, often ranging from $48,000 to $70,000 per year, which is significantly enhanced by performance-based incentives, quarterly bonuses, and a world-class benefits package. For top performers in high-demand locations, total compensation can easily approach and even exceed six figures.

I remember early in my own career, feeling overwhelmed by financial jargon and a sea of impersonal banking options. The first time I sat down with a true relationship banker—someone who took the time to understand my goals instead of just pushing products—it was a revelation. That one conversation demystified my finances and set me on a path to financial literacy. This role holds the power to provide that same clarity and confidence to countless others, making it a profoundly impactful career choice.

This comprehensive guide is designed to be your definitive resource, whether you're a recent graduate exploring your options or a seasoned professional considering a career change. We will dissect every facet of the Chase Relationship Banker role, from daily responsibilities to long-term career trajectory, with a primary focus on providing an authoritative breakdown of salary potential.

### Table of Contents

- [What Does a Chase Relationship Banker Do?](#what-does-a-chase-relationship-banker-do)

- [Average Chase Bank Relationship Banker Salary: A Deep Dive](#average-chase-bank-relationship-banker-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is This the Right Career for You?](#conclusion-is-this-the-right-career-for-you)

What Does a Chase Relationship Banker Do?

At its core, a Relationship Banker (RB) at Chase is the primary point of contact for a portfolio of bank clients. Their mandate is to move beyond transactional interactions (like cashing a check or processing a deposit, which are typically handled by tellers) and build deep, advisory relationships. They are the financial quarterbacks for their clients, responsible for understanding their complete financial picture—from short-term needs to long-term aspirations—and connecting them with the right Chase solutions.

The role is a dynamic blend of customer service, sales, problem-solving, and financial guidance. RBs are expected to proactively engage with both new and existing customers to grow and retain their business. This isn't about high-pressure sales tactics; it's about consultative selling based on identified needs.

Core Responsibilities and Daily Tasks:

- Client Relationship Management: This is the cornerstone of the job. RBs are assigned a book of clients and are responsible for regular check-ins, life event follow-ups (e.g., marriage, new child, home purchase), and being their go-to person at the bank.

- Needs-Based Conversation and Product Cross-Selling: Through active listening and skilled questioning, an RB uncovers a client's financial needs. This could lead to opening a new checking or savings account, discussing mortgage or auto loan options, introducing credit card products with relevant rewards, or setting up a child's first savings account.

- Digital Engagement and Education: A key part of the modern RB role is helping clients embrace Chase's digital banking tools. This includes demonstrating how to use the mobile app, set up online bill pay, or use Zelle®, thereby enhancing the client's convenience and deepening their engagement with the bank.

- Referrals to Specialists: RBs are the hub of a wheel of financial experts. When a client's needs become more complex, the RB makes qualified referrals to partners within the bank, such as:

- Financial Advisors for investments, retirement planning, and wealth management.

- Small Business Specialists for business loans, merchant services, and treasury solutions.

- Home Lending Advisors for mortgages and home equity lines of credit.

The RB often earns incentive compensation for these successful referrals.

- Problem Resolution: When clients face complex issues that a teller can't resolve—such as fraud claims, unusual account activity, or fee disputes—the RB steps in to investigate, navigate the bank's internal systems, and provide a solution.

- Compliance and Operations: Banking is a highly regulated industry. RBs must adhere to all bank policies and federal regulations, including Know Your Customer (KYC) and Anti-Money Laundering (AML) rules, ensuring all paperwork and account openings are flawless.

### A Day in the Life of a Chase Relationship Banker

To make this tangible, let's walk through a typical day:

- 8:30 AM: Arrive at the branch. Review emails and voicemails. Huddle with the Branch Manager and fellow team members to discuss daily goals, promotions, and any operational updates.

- 9:00 AM: The branch opens. Greet the first walk-in client, who wants to discuss options for consolidating high-interest credit card debt. You analyze their situation and explore a personal loan or a Chase credit card with a promotional balance transfer offer.

- 10:15 AM: Your first scheduled appointment arrives. It's a young couple looking to buy their first home. You have a deep conversation about their savings, credit, and timeline. You pre-qualify them for a mortgage and schedule a warm hand-off meeting with the branch's dedicated Home Lending Advisor.

- 11:30 AM: Proactive outreach time. You review your client portfolio in the bank's CRM (Customer Relationship Management) system. You notice a client has a large, static balance in their checking account. You call them to discuss moving some of those funds into a high-yield savings account or a CD to earn better interest.

- 12:30 PM: Lunch break.

- 1:30 PM: A small business owner, a long-time client, comes in to deposit checks. You use the opportunity to ask how her business is growing. She mentions needing a new delivery van. This is a perfect opening to introduce your Business Banking partner to discuss a vehicle loan.

- 3:00 PM: You spend an hour on administrative tasks: processing the paperwork from the morning's new accounts, following up on client inquiries via email, and completing mandatory online compliance training.

- 4:00 PM: A client comes in frustrated because their debit card was declined. You calmly investigate, discover a fraud alert block, and work with the back-office team to verify the client's recent transactions and immediately lift the hold, turning a negative experience into a positive one.

- 5:00 PM: The branch doors close to the public. You spend the last 30 minutes tidying your desk, updating the CRM with notes from your day's interactions, and planning your outreach calls for tomorrow. You leave with a sense of accomplishment, having helped multiple people take a step forward in their financial lives.

Average Chase Bank Relationship Banker Salary: A Deep Dive

Understanding the compensation structure is critical for anyone considering this career. The chase bank relationship banker salary is not just a flat number; it's a multi-faceted package composed of a base salary, performance-based incentives, and comprehensive benefits. This structure is designed to reward hard work, client satisfaction, and achieving specific financial goals.

It's important to note that while we can provide very accurate ranges based on aggregated data, the term "Relationship Banker" at Chase can encompass different levels (e.g., Relationship Banker I, II, Senior). The figures below represent a blended average, which we will break down further in subsequent sections.

### National Averages and Typical Salary Ranges

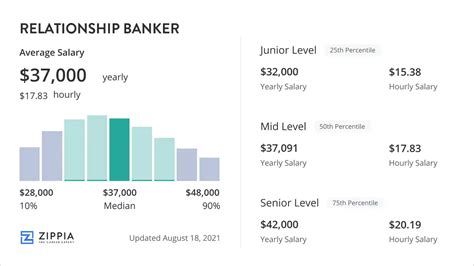

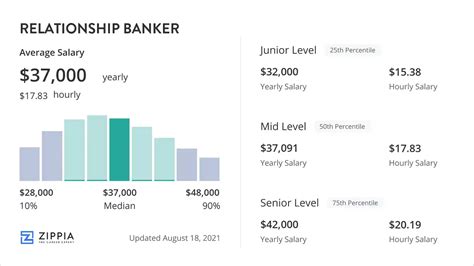

Based on an analysis of recent data from leading salary aggregators, the compensation landscape for a Chase Relationship Banker in the United States is as follows:

- Average Base Salary: Most sources place the average base salary for a Chase RB between $50,000 and $65,000 per year.

- Salary.com reports a median base salary for a "Relationship Banker II" in the U.S. at approximately $57,682, with a typical range falling between $50,580 and $65,112 (as of late 2023).

- Glassdoor data, which is user-submitted and specific to Chase, shows an average base pay of around $54,000 per year, with a "likely range" of $45,000 to $67,000.

- Total Compensation (Base + Incentives): This is where the picture becomes much more compelling. The incentive portion of the pay can be substantial.

- Glassdoor reports an average additional pay (including cash bonus, commission, etc.) of approximately $9,000 to $12,000 per year.

- This pushes the average total compensation into the $63,000 to $77,000 range for a typical performer. Top-tier bankers in prime locations can significantly exceed this.

It is crucial to understand that Chase operates on a "pay-for-performance" model. Your ability to meet and exceed goals directly impacts your take-home pay.

### Salary Brackets by Experience Level

Like any professional career, compensation grows with experience, skill, and a proven track record of success. Here's a typical progression:

| Experience Level | Typical Title(s) | Average Base Salary Range | Potential Total Compensation Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Relationship Banker I | $45,000 - $55,000 | $50,000 - $65,000 | Learning core products, handling consumer accounts, focusing on foundational sales goals (e.g., new checking accounts, credit cards), making referrals. |

| Mid-Career (2-5 years) | Relationship Banker II, Senior Relationship Banker | $55,000 - $70,000 | $65,000 - $85,000+ | Managing a larger and more complex client portfolio, handling basic small business accounts, mentoring junior bankers, consistently exceeding goals. |

| Senior/Lead (5+ years) | Senior RB, Private Client Banker, Assistant Manager | $65,000 - $80,000+ | $80,000 - $110,000+ | Handling high-net-worth clients (as a Private Client Banker), specializing in business banking, taking on leadership roles, driving branch-wide initiatives. |

*Note: These ranges are illustrative and can be heavily influenced by the factors discussed in the next section.*

### Deconstructing the Full Compensation Package

The advertised salary is only one piece of the puzzle. A comprehensive offer from a top-tier employer like JPMorgan Chase includes several valuable components:

1. Base Salary: The fixed, predictable portion of your pay, received bi-weekly or monthly. It provides financial stability.

2. Incentive Compensation/Bonus: This is the variable, performance-based component. It's typically paid out quarterly. The plan is structured around meeting specific goals, which might include:

- Volume Goals: Number of new checking/savings accounts opened.

- Balance Growth: Net increase in client deposits and investments.

- Referral Goals: Number of qualified referrals made to partners (mortgage, investments, business banking) that result in closed business.

- Client Satisfaction Scores: Measured through customer surveys.

A well-defined scorecard tracks progress, and payouts are tiered based on the level of achievement.

3. Retirement Savings: Chase offers a robust 401(k) plan. Typically, the company will match a certain percentage of your contributions. For example, they might match 100% of the first 5% of pay you contribute, which is essentially a 5% bonus vested over time.

4. Health and Wellness Benefits: This is a significant part of the total value. It includes comprehensive medical, dental, and vision insurance for employees and their families. Chase also offers wellness programs, employee assistance programs (EAP) for mental health support, and other related benefits.

5. Paid Time Off (PTO): A generous package for vacation, sick days, and personal days, which increases with tenure at the company.

6. Parental Leave: Industry-leading parental leave policies for primary and non-primary caregivers.

7. Tuition Assistance & Professional Development: Chase often supports employees pursuing further education or relevant certifications (like FINRA licenses) that can advance their careers within the firm.

8. Banking Benefits: Employees typically receive preferential rates on banking products, such as mortgages, loans, and fee waivers on premium bank accounts.

When evaluating a chase bank relationship banker salary, it's essential to calculate the total value of this entire package, as benefits like a strong 401(k) match and low-cost health insurance can be worth thousands of dollars annually.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, a Relationship Banker's actual salary is determined by a complex interplay of several key factors. Understanding these variables is crucial for negotiating your offer and maximizing your long-term earning potential. This section, the most detailed in our guide, will break down each of these influencers.

###

Geographic Location: The Cost-of-Living Multiplier

Where you work is arguably the single most significant factor influencing your base salary. Banks like Chase use sophisticated geographical pay differentials to account for the vast differences in the cost of living and labor market competition across the United States. A salary that is considered excellent in a small Midwestern city would be unlivable in Manhattan or San Francisco.

High-Paying Metropolitan Areas:

Major financial hubs and high-cost-of-living (HCOL) cities will always command the highest salaries. In these markets, banks must pay a premium to attract and retain talent.

- New York, NY: As Chase's headquarters and the world's financial capital, salaries here are at the top of the scale. A mid-career RB could see a base salary well north of $70,000, with total compensation easily pushing into the high five figures or low six figures.

- San Francisco Bay Area, CA (San Francisco, San Jose): The high cost of housing and intense competition for talent from the tech industry drive salaries up. Expect compensation packages similar to or even exceeding those in New York.

- Boston, MA: Another major financial and tech hub with a high cost of living, resulting in premium pay.

- Los Angeles, CA & Chicago, IL: Large, competitive markets where salaries are significantly above the national average to reflect the local economy.

Average-Paying Metropolitan Areas:

These are typically large cities in states with a more moderate cost of living. Salaries are competitive and offer a very comfortable lifestyle.

- Dallas/Fort Worth, TX

- Atlanta, GA

- Phoenix, AZ

- Charlotte, NC (A major banking hub)

- Denver, CO

Lower-Paying Areas:

Salaries will be closer to the lower end of the national range in smaller cities, towns, and rural areas where the cost of living is substantially lower. However, the purchasing power of that salary may be just as strong, if not stronger, than a higher salary in an HCOL city.

- Des Moines, IA

- Omaha, NE

- Little Rock, AR

Example Comparison (Illustrative Base Salary for a Mid-Career RB):

- San Francisco, CA: $72,000

- Chicago, IL: $65,000

- Phoenix, AZ: $60,000

- Kansas City, MO: $56,000

To get a precise estimate, you can use tools like Salary.com's "Salary Wizard" and input the job title and a specific zip code to see the local pay scale.

###

Years of Experience and Proven Performance

Experience is a direct proxy for competence and value in this role. A seasoned banker brings a level of expertise, client management skill, and market knowledge that an entry-level employee simply doesn't have. This is reflected directly in their compensation trajectory.

- 0-2 Years (Foundation Building): The focus is on learning the products, processes, and sales skills. Compensation is weighted more heavily toward the base salary as you build your client book. You are proving your potential.

- 2-5 Years (Proficiency and Growth): By this stage, you have a proven track record. You can handle more complex client conversations, manage a larger portfolio, and consistently meet or exceed your incentive goals. Your base salary sees a significant jump, and your variable incentive pay becomes a much larger and more consistent part of your total earnings. You are a reliable, core member of the branch team.

- 5-10+ Years (Mastery and Leadership): Senior RBs are masters of their craft. They have deep, multi-generational relationships with their best clients. They often act as mentors to junior bankers and may take on supervisory responsibilities. Their expertise allows them to identify highly lucrative opportunities (like referrals for wealth management or large business loans) that generate significant incentive pay. Their base salary is at the top of the band, and their total compensation reflects their status as a top producer. This is the stage where a move to a more specialized, higher-paying role like Private Client Banker becomes a real possibility.

Performance is intertwined with experience. Two bankers with five years of experience can have vastly different incomes. The one who consistently ranks in the top 10% of their peer group for sales and client satisfaction will earn substantially more through quarterly bonuses than the one who just meets the minimum goals.

###

Level of Education and Professional Certifications

While a bachelor's degree is not always a strict requirement to get an entry-level RB position (especially for candidates with strong sales or customer service backgrounds), it is highly preferred by Chase and can significantly impact your starting salary and long-term career ceiling.

- High School Diploma/GED: Sufficient for some entry-level positions, but you may start at the lower end of the pay scale. You will need to demonstrate exceptional skill and drive to advance at the same pace as colleagues with degrees.

- Bachelor's Degree: This is the standard for professional roles at Chase.

- Relevant Majors: Degrees in Finance, Business Administration, Economics, or Marketing are most directly applicable and are viewed favorably. They provide a strong foundation in the principles that underpin the role.

- Other Majors: A degree in Communications, Psychology, or Liberal Arts can also be valuable, as they demonstrate critical thinking, writing, and interpersonal skills. You'll need to supplement this with a demonstrated interest in and knowledge of finance.

The Real Differentiator: Professional Licenses and Certifications

This is where you can truly separate yourself and unlock higher earning potential. The most valuable certifications for a Relationship Banker are the FINRA (Financial Industry Regulatory Authority) licenses.

- Securities Industry Essentials (SIE) Exam: This is an introductory-level exam that covers broad, fundamental securities-related knowledge. The key advantage is that you can take the SIE without being sponsored by a firm. Passing the SIE before you even apply for a job makes you an incredibly attractive candidate. It signals serious intent and reduces the training time and cost for the employer.

- FINRA Series 6 & Series 63: To actually sell certain investment products (like mutual funds and variable annuities), a banker must pass the Series 6 and Series 63 exams. Chase will sponsor high-performing RBs to obtain these licenses. A licensed banker has a significant advantage:

- Higher Salary Band: Licensed RBs are often in a higher pay grade.

- Expanded Product Suite: They can have deeper conversations about wealth building and sell investment products, leading to more revenue for the bank.

- Increased Incentive Potential: They earn commissions on investment products, which can be much larger than incentives on standard banking products.

- Certified Financial Planner (CFP®): While not required for the RB role itself, studying for or obtaining the CFP® certification is the gold standard for personal finance professionals. It signals a deep commitment to ethical, holistic financial planning and is a common goal for those looking to advance into a full-fledged Financial Advisor role.

###

Area of Specialization and Career Path

The standard "Relationship Banker" role is just one stop on a broader career path. As you gain experience, you can move into specialized roles within the branch ecosystem that come with higher responsibilities and, consequently, a higher chase bank relationship banker salary structure.

- Relationship Banker (Consumer/Mass Market): The foundational role focusing on the general consumer population.

- Small Business Specialist: An RB who focuses primarily on the needs of small business clients. This requires knowledge of business checking accounts, cash management services (treasury), merchant processing, and business credit/loans. These roles often have a higher base salary and incentive structure due to the more complex and profitable nature of business banking.

- Private Client Banker (Chase Private Client): This is a significant step up. Private Client Bankers work exclusively with high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. The asset thresholds to qualify for Chase Private Client are substantial (typically starting at $150,000 - $250,000 in investable assets and growing from there). The salary structure reflects this elite client base:

- Base Salary: Often starts in the $75,000 - $95,000+ range.

- Total Compensation: Can easily reach well into the six figures ($120,000 - $200,000+) as it is heavily driven by large bonuses tied to asset growth and complex solution delivery.

- Requirements: A bachelor's degree, FINRA Series 6 & 63 licenses, and a pristine track record of performance are mandatory.

###

In-Demand Skills: The Tools That Boost Your Value

Beyond your formal qualifications, the specific skills you cultivate will directly impact your performance and pay.

Critical Soft Skills:

- Relationship Building & Empathy: The ability to build genuine rapport and trust. Can you make a client feel heard and understood?

- Active Listening: The skill of hearing not just what the client is saying, but what they *mean*. This is how you uncover unstated needs.

- Consultative Sales Acumen: The ability to diagnose a need and confidently recommend a solution without being pushy. It's about problem-solving, not product-pushing.

- Communication Skills (Verbal and Written): Can you clearly explain complex financial topics in simple terms? Can you write professional, follow-up emails?

- Resilience and a Positive Attitude: You will face rejection and challenging client situations. The ability to bounce back and stay motivated is key to long-term success in a goals-based environment.

Essential Hard Skills:

- Deep Product Knowledge: You must be an expert on Chase's entire suite of consumer and small business products and services.

- CRM Software Proficiency: Chase uses sophisticated CRM systems (like Salesforce) to manage client relationships. The ability to effectively use this tool for tracking, outreach, and portfolio management is non-negotiable.

- Digital Fluency: You need to be an expert user and teacher of the bank's digital platforms, from the mobile app to the online portal.

- Financial Needs Analysis: The ability to look at a client's basic financial information and identify opportunities or risks.

- Regulatory Compliance: A firm understanding of KYC, AML, and other banking regulations to ensure every action is compliant and risk-free.

Developing a reputation for excellence in these areas will make you a top performer, directly impacting your bonus checks and positioning