Decoding Your Earning Potential: A Deep Dive into Venture Capital Salaries

For those with a passion for innovation, a sharp analytical mind, and a high tolerance for risk, a career in venture capital (VC) is often seen as the pinnacle. It's a world of high stakes and even higher rewards, where professionals identify and fund the startups that could become the next global titans. But beyond the thrill of the deal, what is the tangible financial reward? A venture capital salary can range from a solid six-figure income for junior professionals to multi-million-dollar annual earnings for successful partners.

This guide will break down the components of venture capital compensation, from entry-level analyst roles to the lucrative earnings of a managing partner, to help you understand your potential in this dynamic field.

What Does a Venture Capitalist Do?

Before we dive into the numbers, it's essential to understand the role. A venture capitalist is an investor who provides capital to startups and small businesses with high growth potential. Their job is a multifaceted blend of finance, strategy, and mentorship. Key responsibilities include:

- Sourcing Deals: Proactively finding promising startups through networking, industry events, and research.

- Conducting Due Diligence: Rigorously analyzing a company's business model, financials, market size, and leadership team to assess its investment-worthiness.

- Investing Capital: Structuring and executing investment deals on behalf of their firm’s fund.

- Supporting Portfolio Companies: Taking a board seat and acting as a strategic advisor to help founders navigate challenges, scale operations, and achieve a successful exit (like an IPO or acquisition).

The success of a VC is measured by the return they generate for their fund's investors (Limited Partners). This performance-driven reality is directly reflected in their compensation structure.

Average Venture Capital Salary

Venture capital compensation is complex, typically comprising two main parts: a base salary (paid from the fund's management fees) and a performance-based bonus known as carried interest.

According to data from Salary.com, the average Venture Capitalist salary in the United States is approximately $205,870 as of 2024, but the range is vast, typically falling between $154,640 and $259,190. This figure often represents the base salary and does not always include the full impact of bonuses or carried interest, which can significantly increase total compensation.

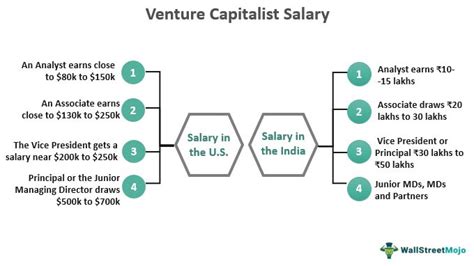

Here's a more granular look at typical compensation by role:

- Venture Capital Analyst (0-2 years): This entry-level role focuses on market research and initial deal screening. The base salary often ranges from $80,000 to $150,000, with a potential for a small annual bonus.

- Venture Capital Associate (2-5 years): Associates take on more responsibility in due diligence and financial modeling. Their base salary typically ranges from $150,000 to $250,000, plus a significant bonus.

- Principal / Vice President (5-10 years): At this level, professionals begin sourcing their own deals and may start to receive a small portion of the fund's carried interest. Total compensation, including base and bonus, can range from $250,000 to over $700,000.

- Partner / Managing Director (10+ years): Partners are the primary decision-makers who manage the fund and hold board seats. Their compensation is heavily weighted towards carried interest, which represents a share (typically 20%) of the fund's profits. While their base salary might be $300,000 to $1,000,000+, a successful partner in a high-performing fund can earn millions of dollars when the fund's investments achieve successful exits.

(Source: Salary.com, Glassdoor, and 2023-2024 VC & PE Compensation Reports)

Key Factors That Influence Salary

Your specific salary within these ranges is determined by several critical factors.

###

Level of Education

While there's no single required degree, a strong educational background is standard. A bachelor's degree in finance, economics, or business is common. However, what truly sets candidates apart is an advanced degree. An MBA from a top-tier business school (such as Harvard, Stanford, or Wharton) is a traditional and highly valued pathway into a post-MBA associate role. Furthermore, in specialized funds (like biotech or deep tech), advanced degrees like a Ph.D. or M.D. can be extremely valuable and command a higher starting salary.

###

Years of Experience

Experience is arguably the most significant driver of salary growth in venture capital. The career ladder is steep, and compensation rises dramatically with seniority. An Analyst with two years of experience will earn a fraction of a Partner with fifteen years of experience who has a proven track record of successful investments. Experience as a startup founder or an operator in a high-growth tech company is also highly prized and can allow professionals to enter the industry at a more senior level.

###

Geographic Location

As with most high-finance careers, location matters immensely. VC activity is concentrated in major tech hubs, which offer the highest salaries to attract top talent in a high-cost-of-living environment.

- San Francisco Bay Area / Silicon Valley: The epicenter of the VC world, consistently offering the highest compensation packages.

- New York City: A close second, with a strong focus on fintech, media, and enterprise software.

- Boston: A major hub for biotechnology and life sciences investing.

According to Payscale, a financial professional in San Francisco can expect to earn over 25% more than the national average, a premium that directly applies to venture capital roles.

###

Company Type (Fund Size)

The size of the venture capital firm, measured by its Assets Under Management (AUM), is a primary determinant of salary.

- Mega-Funds (e.g., Andreessen Horowitz, Sequoia Capital): These firms manage billions of dollars. Their 2% management fee (the standard "2 and 20" model) generates substantial revenue, allowing them to pay higher base salaries and bonuses.

- Mid-Sized Funds: These established firms offer competitive salaries that are often close to the industry average.

- Emerging or Micro-VCs: Smaller, newer funds have less AUM, which means lower management fees and, consequently, lower base salaries. Professionals at these firms are often betting on the upside of carried interest from a successful, concentrated portfolio.

###

Area of Specialization

The investment thesis of a fund also plays a role. A VC with deep, niche expertise in a hot sector like Artificial Intelligence, Biotechnology, or Cybersecurity may command a higher salary. This is because their specialized knowledge is critical for conducting accurate due diligence and providing valuable guidance to portfolio companies, making them a more valuable asset to the fund.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not have a separate category for venture capitalists. However, we can use the outlook for Financial Managers as a strong proxy. The BLS projects that employment for Financial Managers will grow by 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS attributes this growth to the increasing complexity of financial products and the need for expert financial management. While the overall sector is growing, it's crucial to note that venture capital represents a very small and highly competitive niche within this field. The number of available positions is limited, and competition for each opening is incredibly fierce.

Conclusion

A career in venture capital offers the potential for extraordinary financial returns and the unique opportunity to shape the future of technology and business. While entry-level salaries are strong, the true wealth-building potential lies in performance-based carried interest earned at the senior levels.

For those aspiring to enter this field, the key takeaways are:

- Compensation is a mix: Your earnings are a blend of a solid base salary and the massive potential of carried interest.

- Experience is king: Your value and compensation grow directly with your track record and seniority.

- Location and fund size matter: Working at a large fund in a major tech hub will yield the highest base salary.

- It's a marathon, not a sprint: Building a career to the partner level takes a decade or more of exceptional performance, strategic networking, and a bit of luck.

If you are driven, analytical, and passionate about innovation, the demanding but rewarding path of venture capital can lead to a career that is both intellectually and financially fulfilling.