Introduction

For countless ambitious professionals in accounting, consulting, and advisory services, the phrase "making partner at Deloitte" represents the zenith of a career. It's a goal synonymous with industry leadership, immense responsibility, and, of course, a highly lucrative compensation package. But what does a Deloitte Touche partner salary *truly* look like? The answer is far more complex and nuanced than a single number can convey, involving a sophisticated blend of salary, bonuses, and equity draws that can range from impressive to astronomical.

The journey to this pinnacle is a marathon of dedication, strategic maneuvering, and relentless performance. As a career analyst who has guided numerous senior managers and directors in the Big Four, I've seen firsthand the intense focus required to build a business case for partnership. One professional I advised, a senior manager in the technology consulting practice, described the final two years before her promotion as "building a company within a company," a testament to the entrepreneurial spirit required for the role. This guide will demystify the entire process, providing a comprehensive, data-driven look at the compensation, responsibilities, and roadmap to becoming a partner at Deloitte Touche Tohmatsu Limited, one of the most prestigious professional services networks in the world.

### Table of Contents

- [What Does a Deloitte Partner Do?](#what-does-a-deloitte-partner-do)

- [Deloitte Partner Salary: A Deep Dive](#deloitte-partner-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started on the Path to Partnership](#how-to-get-started-on-the-path-to-partnership)

- [Conclusion](#conclusion)

---

What Does a Deloitte Partner Do?

Becoming a partner at Deloitte signifies a fundamental shift in professional identity. The role transcends that of a mere employee; a partner is an owner, a leader, and a primary driver of the firm's revenue and reputation. While senior managers are masters of project delivery and team management, partners operate at a strategic altitude, focusing on the long-term health and growth of the business. Their responsibilities can be broken down into four core pillars:

1. Business Development & Sales ("Rainmaking"): This is arguably the most critical function of a partner. They are expected to cultivate a robust network of C-suite relationships, identify client needs, and sell large-scale, multi-year engagement projects. A partner's value is often directly measured by the size of their "book of business"—the total revenue they generate for the firm. This involves constant networking, developing thought leadership, speaking at industry conferences, and crafting compelling proposals.

2. Client Relationship Management & Quality Assurance: Partners serve as the ultimate point of accountability for the firm's most important clients. They don't manage the day-to-day project tasks but are responsible for the overall health of the client relationship. This means ensuring the highest quality of service delivery, managing escalations, navigating complex client politics, and acting as a trusted strategic advisor to senior executives.

3. People & Practice Leadership: A partner is a leader of leaders. They are responsible for mentoring and developing the next generation of talent, including senior managers and directors who are on their own partnership track. They conduct performance reviews, make promotion decisions, and are responsible for the overall morale, utilization, and profitability of their teams. They also contribute to the strategic direction of their specific practice area (e.g., Cloud Engineering, M&A Tax, etc.).

4. Firm Stewardship: As part-owners of the business, partners are expected to be stewards of the Deloitte brand and culture. This involves participating in internal committees, driving firm-wide initiatives (such as diversity and inclusion or new technology adoption), managing practice-level profit and loss (P&L), and upholding the firm's rigorous ethical and compliance standards.

### A Day in the Life of a Deloitte Consulting Partner

To make this tangible, here is a fictional but representative glimpse into a typical day for a partner in the Strategy & Analytics practice:

- 7:00 AM - 8:30 AM: Start the day by reviewing overnight emails from global teams. Triage urgent client issues. Read industry news (Wall Street Journal, Financial Times) to stay ahead of market trends relevant to key accounts.

- 8:30 AM - 9:00 AM: Internal check-in call with the senior manager leading a major digital transformation project for a Fortune 500 client. Discuss progress, potential risks, and a recent senior stakeholder concern.

- 9:00 AM - 10:30 AM: Co-lead a steering committee meeting (virtual) with the CIO and COO of that same client. Present the project's quarterly progress, provide strategic advice on change management, and secure buy-in for the next phase.

- 10:30 AM - 12:00 PM: Final review and sign-off on a multi-million dollar proposal for a new prospective client in the healthcare sector. Provide critical feedback to the proposal team on the pricing model and value proposition.

- 12:00 PM - 1:30 PM: Business development lunch with a former colleague who is now the CFO at a rapidly growing tech company. The goal is not to sell directly but to strengthen the relationship and understand their upcoming business challenges.

- 1:30 PM - 3:00 PM: Participate in the partnership admissions committee meeting to discuss and vet candidates for promotion to director.

- 3:00 PM - 4:00 PM: Mentoring session with a high-performing senior manager. Discuss their career goals, provide feedback on their development plan, and help them strategize how to build their internal network.

- 4:00 PM - 5:30 PM: Join a webinar as a panelist on "The Future of AI in Financial Services," a key piece of their thought leadership and personal brand-building efforts.

- 5:30 PM - 7:00 PM: Catch up on the day's emails, approve team expenses, and review the P&L statement for their practice area.

- 7:00 PM onwards: Attend a charity gala or industry networking event, or host a dinner for a key client visiting from out of town.

This schedule highlights the constant context-switching required—from client service to sales, from people management to firm strategy—that defines the life of a Deloitte partner.

---

Deloitte Partner Salary: A Deep Dive

Analyzing a Deloitte partner's compensation is complex because it's not a single, fixed salary. The structure changes dramatically upon making partner, moving from a traditional employee model to an ownership model. It's crucial to distinguish between the different types of partners and the components of their pay.

The most significant distinction is between Salaried Partners (or Principals/Managing Directors) and Equity Partners.

- Salaried Partners/Principals: This is often the first step into the partnership. These individuals hold the title and responsibilities of a partner but are still technically employees of the firm. They earn a high base salary plus a significant performance-based bonus. They do not share in the firm's profits directly. This structure is common in advisory and consulting arms and for partners who are specialists in a niche area but may not have a massive book of business yet.

- Equity Partners: This is the traditional and most lucrative form of partnership. Equity partners are part-owners of the firm. They contribute capital to the firm (a "buy-in") and in return receive a share of its annual profits. This share is distributed in the form of "draws" throughout the year, rather than a monthly salary. Their total compensation is directly tied to the overall financial performance of the firm and their individual contribution to it.

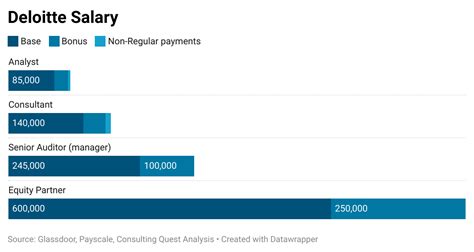

### Average Salary and Compensation Ranges

Due to the private nature of partnership compensation, precise figures are closely guarded. However, based on data compiled from industry reports, anonymous submissions on platforms like Glassdoor and Fishbowl, and journalistic investigations into Big Four pay, we can establish reliable ranges.

- National Average (Total Compensation): Across all partner types, service lines, and geographies in the United States, the average total compensation for a Deloitte partner is estimated to be between $650,000 and $850,000 per year. However, this average hides a vast range.

- Typical Range (Total Compensation): A more realistic range for total annual compensation is $450,000 to over $3,000,000.

- First-year salaried partners in less profitable service lines or smaller markets might be at the lower end of this spectrum.

- Senior equity partners leading major global accounts or entire practice areas in high-demand fields like M&A or Strategy Consulting can easily exceed the $3 million mark.

Here is a breakdown of compensation by level, illustrating the significant jump in earning potential.

| Level / Title | Typical Base Salary / Draw | Typical Bonus / Profit Share | Estimated Total Annual Compensation (USD) |

| :--- | :--- | :--- | :--- |

| Director / Senior Manager (Pre-Partner) | $200,000 - $350,000 | $50,000 - $150,000 | $250,000 - $500,000 |

| Salaried Partner / Principal (Year 1-3) | $350,000 - $500,000 | $100,000 - $300,000 | $450,000 - $800,000 |

| Equity Partner (Mid-Career) | N/A (Receives profit draws) | N/A (Receives profit draws) | $750,000 - $1,500,000 |

| Senior Equity Partner / Practice Leader | N/A (Receives profit draws) | N/A (Receives profit draws) | $1,500,000 - $3,000,000+ |

*Sources: Data compiled and synthesized from Glassdoor, Payscale, Fishbowl, Wall Street Journal reports, and Financial Times analyses on professional services compensation (as of 2023-2024).*

### Breakdown of Compensation Components

Understanding the pieces that make up the whole is key.

1. Base Salary (For Salaried Partners): This is the guaranteed portion of their income, paid bi-weekly or monthly. It's competitive but constitutes a smaller percentage of their total take-home pay compared to lower-level roles.

2. Performance Bonus (For Salaried Partners): This is a substantial, variable cash payment awarded annually. It's determined by a combination of factors: personal performance (sales and revenue generated), team/practice performance, and overall firm performance.

3. Profit Share / Draw (For Equity Partners): This is the holy grail. Equity partners are allocated a certain number of "units" or "points" in the firm. The value of each unit is determined by the firm's total distributable profit for the year. A partner's total draw is their unit allocation multiplied by the unit value. More senior partners and higher performers are allocated more units.

4. Buy-In (For Equity Partners): This is the capital contribution an equity partner must make to the firm, essentially buying their stake. This can be a significant amount, often ranging from $150,000 to over $500,000, which is typically paid over several years, often with the help of a firm-sponsored loan. When a partner retires, they are paid back their capital contribution.

5. Benefits and Perks: Beyond cash compensation, partners receive a top-tier benefits package. This includes:

- Generous Retirement Plans: Substantial contributions to 401(k)s and often a pension plan or other capital accumulation plans.

- Cadillac Health Insurance: Premium health, dental, and vision insurance with low deductibles.

- Executive Perks: Business-class travel, car allowances or services, club memberships, and a significant expense account for business development.

- Sabbatical Programs: Opportunities for extended paid leave after a certain number of years of service as a partner.

The compensation structure is designed to heavily incentivize the behaviors the firm values most: selling new business, growing the firm's profits, and stewarding the brand for the long term.

---

Key Factors That Influence Salary

The vast range in partner compensation—from half a million dollars to several million—is not random. It is dictated by a confluence of factors that the firm uses to calculate an individual's value. Aspiring partners must understand and strategically navigate these variables throughout their careers.

###

1. Service Line: The Most Powerful Differentiator

Within Deloitte, not all business is created equal in terms of profitability. The service line a partner belongs to is the single biggest determinant of their earning potential. The hierarchy generally follows the margin profile of the work.

- Consulting (Highest Potential): This is typically the most lucrative practice.

- Strategy & M&A (S&A / Monitor Deloitte): Partners who advise on corporate strategy, mergers, acquisitions, and divestitures command the highest fees and thus have the highest earning potential. Their work is directly tied to the most critical decisions a CEO or board makes. Total compensation can regularly exceed $1.5 million - $2 million.

- Technology Consulting (e.g., Cloud, AI, Cyber): As technology becomes central to every business, partners specializing in high-demand areas like cloud transformation, AI implementation, and cybersecurity have seen their value skyrocket. Compensation is very strong, often in the $800,000 to $1.5 million range.

- Human Capital & Operations: While still highly profitable, these areas may have slightly lower margins than pure strategy, with partner compensation more likely in the $700,000 to $1.2 million range.

- Risk & Financial Advisory (RFA): This is a broad and highly profitable area. Partners focusing on regulatory compliance, forensic accounting, and transaction advisory services can earn in a similar range to consulting partners, often $750,000 to $1.4 million, especially in hot areas like financial crime and cybersecurity risk.

- Tax: Tax is a consistent and profitable service line. Partners specializing in high-value areas like International Tax, Transfer Pricing, and M&A Tax are highly compensated, often earning between $600,000 and $1.3 million. Partners focused on more commoditized compliance work will be at the lower end of that range.

- Audit & Assurance (Lowest Potential, a Crucial Role): Audit is the bedrock of the firm and a massive revenue generator, but it is also the most regulated and price-sensitive service line, leading to lower margins. While still earning an exceptional living, audit partners typically have the lowest compensation ceiling among all service lines. A first-year audit partner might start around $450,000 - $500,000, with senior partners on major public accounts earning up to $800,000 - $1 million.

###

2. Geographic Location and Market Size

Where a partner is based has a significant impact on their compensation, driven by both the cost of labor and the concentration of large clients.

- Tier 1 Major Markets (Highest Pay): Cities like New York, San Francisco, London, and Hong Kong are home to the world's largest corporate headquarters and financial institutions. The deal sizes are larger, the billing rates are higher, and the competition for talent is fiercer. Partners in these markets sit at the top of the pay scale. A partner in NYC might earn 20-30% more than a partner with a similar role in a smaller city.

- According to Salary.com, the cost of living in New York City is significantly higher than in other major US cities, and compensation for top executives reflects this premium.

- Tier 2 Major Markets: Cities like Chicago, Los Angeles, Dallas, and Atlanta also have strong business communities and offer very high compensation, though slightly below the absolute peak of Tier 1 markets.

- Tier 3 & Regional Markets: Partners based in smaller cities like Omaha, Minneapolis, or Charlotte will have lower compensation packages. While their earnings are still immense by any normal standard, they reflect the lower cost of living and the smaller scale of the clients and projects in that region. A partner in a regional office might earn $500,000 - $700,000, whereas their equivalent in a Tier 1 market could be earning over $1 million.

###

3. Years of Experience and Seniority within the Partnership

Partnership is not a flat structure. There is a clear hierarchy and a progression of earnings over time.

- First-Year Partner: The first few years are about proving oneself at the new level. Compensation is at its lowest point in the partnership journey but represents a massive leap from the pre-partner director level.

- Mid-Career Partner (Years 4-10): By this stage, a partner has an established book of business, a strong network, and a track record of success. Their unit allocation (for equity partners) increases significantly, leading to a substantial rise in total compensation, often breaking the seven-figure mark.

- Senior Partner / Practice Leader (Years 10+): These are the firm's leaders. They may lead an entire industry practice (e.g., National Retail Sector Leader), a key geographic office, or a global client account. They have the highest unit allocations and are responsible for the firm's most critical relationships and strategic direction. Their compensation is at the very top of the spectrum.

###

4. Individual Performance: The "Eat What You Kill" Factor

Ultimately, partner compensation is a meritocracy based on contribution. The most important metric is sales and managed revenue. A partner who consistently brings in $20 million in annual revenue will earn significantly more than a partner who brings in $5 million, even if they are in the same service line and have the same title. Other performance metrics include:

- Chargeability/Utilization of their teams: How profitable are the projects they sell and manage?

- Cross-selling: How effective are they at bringing in other Deloitte service lines to their clients?

- Thought Leadership: Is their reputation enhancing the Deloitte brand?

- People Development: Are they successfully mentoring and retaining top talent?

###

5. Level of Education and Certifications

By the time one reaches the partner level, education is less of a direct salary driver and more of a "ticket to the game" that was earned years ago. However, certain credentials are foundational for specific career paths.

- CPA (Certified Public Accountant): This is non-negotiable for partners in the Audit & Assurance and Tax practices. It's the license to practice.

- MBA (Master of Business Administration): An MBA from a top-tier business school (e.g., Wharton, Harvard, INSEAD) is extremely common, almost a prerequisite, for partners in the Strategy Consulting practice (Monitor Deloitte). It helps build the analytical rigor and alumni network necessary to succeed.

- JD (Juris Doctor), CFA (Chartered Financial Analyst), PMP (Project Management Professional): Other advanced degrees and certifications can be highly valuable for niche areas within RFA and Consulting, further solidifying a partner's expertise and value.

###

6. In-Demand Skills for Maximizing Partner Earnings

Beyond credentials, a specific set of high-value skills separates top-earning partners from the rest:

- Rainmaking/Business Development: The #1 skill. The ability to build C-suite relationships from scratch and convert them into revenue-generating projects.

- Executive Presence: The ability to command a room of senior executives with confidence, credibility, and gravitas.

- Strategic Thinking: The ability to see beyond the immediate problem and advise clients on long-term market trends and competitive dynamics.

- Thought Leadership: Being a recognized expert in a specific domain, sought after for conference keynotes and media commentary.

- P&L Management: The financial acumen to manage a practice or large account as a profitable business unit.

- Complex Problem-Solving: The intellectual horsepower to deconstruct highly ambiguous and challenging business problems and architect solutions.

A professional who excels in all these areas, in a high-margin service line and a major market, is positioned to reach the highest echelons of Deloitte's partner compensation structure.

---

Job Outlook and Career Growth

The career outlook for top-level executives and advisors, such as Deloitte partners, is intrinsically linked to the health of the global economy and the professional services industry. While the U.S. Bureau of Labor Statistics (BLS) does not track "Big Four Partners" as a specific category, we can analyze proxy occupations like "Top Executives" and "Management Analysts" (the pool from which future partners are drawn) to understand the broader trends.

### Job Growth Projections

The BLS projects that employment for Management Analysts will grow by 10 percent from 2022 to 2032, which is much faster than the average for all occupations. This indicates a strong and sustained demand for consulting and advisory services. The BLS notes that "demand for consulting services is expected to grow as organizations seek ways to improve efficiency and control costs." This is the core business of Deloitte.

For Top Executives, the BLS projects a growth rate of 3 percent, which is about average. However, the role of a Deloitte partner is a hybrid of executive leadership and management consulting, and the high growth in the latter field paints a very positive picture for the firm's future.

The demand for Deloitte's services is driven by several enduring and emerging trends:

- Digital Transformation: Companies across all sectors continue to invest billions in moving to the cloud, leveraging data analytics, implementing AI, and modernizing their core systems. This is a massive tailwind for Deloitte's Consulting and RFA practices.

- Cybersecurity Threats: As cyber-attacks become more sophisticated, the need for expert cybersecurity consulting and assurance services is a board-level concern, ensuring a steady stream of high-margin work.

- Regulatory Complexity: Ever-changing regulations in areas like finance (e.g., Basel IV), data privacy (e.g., GDPR, CCPA), and environmental reporting create a constant need for advisory and assurance services.

- ESG (Environmental, Social, and Governance): Companies are under increasing pressure from investors and regulators to improve and report on their ESG performance. This has created an entirely new and rapidly growing advisory service line for firms like Deloitte.

- Mergers & Acquisitions: In a dynamic economy, M&A activity remains a key strategy for growth, fueling demand for Deloitte's transaction advisory, tax structuring, and post-merger integration services.

### Future Challenges and Staying Relevant

Despite the positive outlook, the profession is not without its challenges. The primary challenge is the threat of disruption from new technologies and business models.

- AI and Automation: Artificial intelligence is a double-edged sword. While it creates immense consulting opportunities, it also has the potential to automate many of the traditional, rules-based tasks in audit and tax, potentially commoditizing parts of the business. Partners of the future must be adept at selling and integrating AI-driven solutions rather than relying on billable hours from large teams performing manual work.

- Competition: The competitive landscape is intensifying. Beyond the other Big Four firms (PwC, EY, KPMG), Deloitte competes with elite strategy houses (McKinsey, BCG, Bain), major tech companies (Accenture, IBM), and a growing number of specialized boutique advisory firms.

### Advice for Advancement and Long-Term Growth *After* Making Partner

Making partner is not the end of the career ladder. To stay relevant and continue to advance within the partnership, individuals must:

1. Embrace Lifelong Learning: A partner who was an expert in ERP systems a decade ago must now be an expert in cloud and AI. Continuous learning and re-skilling are non-negotiable.

2. Build a Legacy: The most respected senior partners are those who build something that lasts beyond their own book of business—a new methodology, a thriving new practice area, or a reputation for mentoring a generation of successful leaders.

3. Expand from "Seller-Doer" to "Strategist-Leader": As partners become more senior, they must transition from directly selling and overseeing projects to setting the strategic direction for their entire practice. This means focusing on which markets to enter, which services to develop, and how to allocate firm resources for long-term growth.

4. Cultivate a Global Network: The most valuable partners can serve global clients seamlessly. This requires building strong relationships with other Deloitte partners around the world to bring the full force of the global firm to bear for their clients.

The career path of a Deloitte partner offers exceptional long-term security and growth for those who can adapt to the evolving demands of the market.

---

How to Get Started on the Path to Partnership

The journey to a Deloitte partner salary is a 15-to-20-year ultramarathon that begins on day one of your career. It requires a long-term vision and a consistent record of exceptional performance. Here is a step-by-step guide for aspiring professionals.

### Step 1: Lay the Academic and Entry-Level Foundation (Years 0-2)

- Education: Earn a bachelor's degree in a relevant field (Accounting, Finance, Economics, Computer Science, Engineering) from a top-tier university. A high GPA (3.5+) is essential. For consulting tracks, an MBA from an M7 or T15 business school is a significant accelerator.

- Certifications: Begin working towards foundational certifications immediately. If you're in audit or tax, your top priority is passing the CPA exam as quickly as possible.

- Get Your Foot in the Door: The most common entry points are as a campus hire (Analyst/Associate) or an experienced hire from industry. Secure an internship at Deloitte or another Big Four firm during college—this is the single best pathway to a full-time offer. Perform flawlessly during your internship.

- Excel as an Analyst: In your first two years, focus on being the best "doer" possible. Be technically proficient, reliable, detail-oriented, and absorb everything you can from your seniors. Your goal is to