Table of Contents

- [Introduction](#introduction)

- [What Does a Commercial Lender Do?](#what-does-a-commercial-lender-do)

- [Average Commercial Lender Salary: A Deep Dive](#average-commercial-lender-salary-a-deep-dive)

- [Key Factors That Influence a Commercial Lender's Salary](#key-factors-that-influence-a-commercial-lenders-salary)

- [Job Outlook and Career Growth for Commercial Lenders](#job-outlook-and-career-growth-for-commercial-lenders)

- [How to Become a Commercial Lender: Your Step-by-Step Guide](#how-to-become-a-commercial-lender-your-step-by-step-guide)

- [Conclusion: Is a Career in Commercial Lending Right for You?](#conclusion-is-a-career-in-commercial-lending-right-for-you)

Introduction

Are you analytical, driven, and fascinated by the engine of the economy—business? Do you envision a career where your financial acumen directly fuels growth, creates jobs, and builds communities? If so, the role of a commercial lender might be your ideal professional calling. It's a career path that offers a rare blend of financial analysis, strategic relationship building, and tangible impact, all while providing significant financial rewards. The potential commercial lender salary is a compelling draw, with experienced professionals often earning well into the six-figure range, but the true value lies in becoming a pivotal financial partner to the businesses that shape our world.

The career is more than just numbers on a spreadsheet; it's about understanding a business's story, its challenges, and its aspirations. I once had the privilege of working alongside a senior commercial lender who was helping a third-generation family manufacturing company secure a loan for a major equipment upgrade. Seeing the relief and excitement on the owner's face, knowing this loan would secure dozens of local jobs for another decade, crystallized the profound importance of this profession. Commercial lenders are the architects of economic opportunity, and for the right individual, the career is as fulfilling as it is lucrative.

This comprehensive guide will illuminate every facet of a commercial lending career. We will dissect the salary you can expect at every stage, explore the critical factors that can maximize your earnings, analyze the long-term job outlook, and provide a clear, actionable roadmap for how you can get started. Whether you are a student mapping out your future, a financial professional considering a pivot, or a current lender aiming for the next level, this article is your definitive resource.

---

What Does a Commercial Lender Do?

At its core, a commercial lender—often called a commercial loan officer or relationship manager—is a specialized financial professional responsible for originating, evaluating, and servicing loans for businesses, as opposed to individuals. These loans are the lifeblood of commerce, funding everything from a small business's first office space to a multinational corporation's new factory, a real estate developer's next high-rise, or a farm's seasonal operating needs.

The role is multifaceted, blending the analytical rigor of a credit analyst with the interpersonal finesse of a top-tier sales executive. Commercial lenders are not passive order-takers; they are proactive business developers. They build a "portfolio" of clients, becoming their trusted financial advisor. This involves deeply understanding their clients' industries, market positions, financial health, and strategic goals.

Core Responsibilities and Daily Tasks:

- Business Development & Networking: Actively seeking out new business clients through networking events, industry associations, referrals from accountants and attorneys, and cold outreach. This is the "hunting" aspect of the job.

- Client Relationship Management: Maintaining and deepening relationships with existing clients. This involves regular check-ins, understanding their evolving financial needs, and cross-selling other bank products like treasury management or wealth services.

- Financial Analysis & Underwriting: This is the critical analytical component. A lender collects and scrutinizes a company's financial statements (income statements, balance sheets, cash flow statements), tax returns, business plans, and market data. They perform detailed credit analysis to assess the "five Cs of credit":

- Character: The borrower's reputation and track record.

- Capacity: The ability to repay the loan (debt-service coverage ratio).

- Capital: The owner's equity or investment in the business.

- Collateral: Assets pledged to secure the loan.

- Conditions: The economic climate and the purpose of the loan.

- Loan Structuring & Negotiation: Based on the analysis, the lender structures a loan proposal. This includes determining the loan amount, interest rate, repayment term, covenants (conditions the borrower must follow), and collateral requirements. This proposal is then negotiated with the client.

- Credit Memorandum Preparation: The lender writes a detailed credit memorandum (or "credit memo") that presents the business case for the loan. This comprehensive document is presented to a loan committee or senior underwriter for approval.

- Loan Closing & Portfolio Management: Once a loan is approved, the lender works with legal teams and loan administrators to document and close the deal. Post-closing, they are responsible for monitoring the loan's performance and the client's financial health to mitigate risk.

### A Day in the Life of a Commercial Lender

To make this tangible, let's walk through a typical day:

- 8:00 AM - 9:00 AM: Arrive at the office, grab coffee, and review the pipeline. Check emails for any urgent client needs or updates from the credit department. Review the day's calendar and prepare for upcoming meetings by briefly reviewing client files.

- 9:00 AM - 11:00 AM: Dive into a complex credit analysis for a prospective client—a mid-sized logistics company seeking a line of credit to manage cash flow. This involves spreading their financials in a specialized software, calculating key ratios, and identifying potential risks and mitigants.

- 11:00 AM - 12:00 PM: Team meeting with the credit department to discuss the logistics company deal and another pending real estate loan. The lender presents the rationale, answers tough questions from the credit manager, and strategizes on the best way to structure the loan to get it approved.

- 12:00 PM - 1:30 PM: Networking lunch with a local CPA. The goal is to build rapport and discuss mutual clients, positioning the lender (and their bank) as the go-to financial partner for the CPA's business clients.

- 1:30 PM - 3:00 PM: On-site visit with an existing client, a manufacturing firm. This isn't just a social call; it's a "field audit." The lender tours the facility, discusses recent performance with the CFO, and assesses the condition of the equipment that serves as collateral for their loan.

- 3:00 PM - 5:00 PM: Back at the office, it's time for administrative work. The lender writes up the detailed credit memorandum for the logistics company loan, responds to a dozen emails, and follows up with a client whose loan is maturing soon to discuss renewal options.

- 5:00 PM onwards: The day often doesn't end at 5. Many lenders attend after-hours chamber of commerce meetings, charity events, or other networking functions to build their professional presence and source new deals.

---

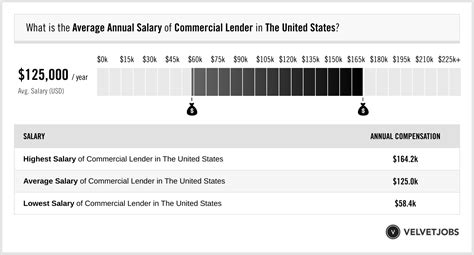

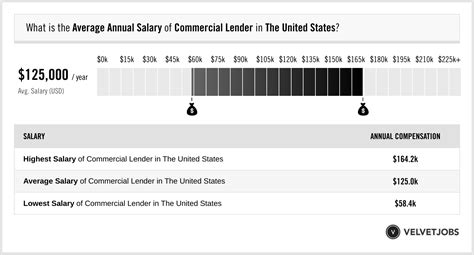

Average Commercial Lender Salary: A Deep Dive

The compensation for a commercial lender is one of the most attractive aspects of the career, offering a strong base salary supplemented by significant variable pay. Unlike many salaried roles, a lender's income is directly tied to their performance, creating a high ceiling for top producers.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all loan officers was $75,290 as of May 2023. However, this figure includes consumer, mortgage, and other types of loan officers. Commercial lenders, due to the complexity of their work and the size of the transactions, typically earn significantly more.

More specialized sources provide a clearer picture:

- Salary.com reports that the median base salary for a Commercial Loan Officer II (a mid-career professional) in the United States is $84,105, with a typical range falling between $73,346 and $96,934 as of late 2023. For a Senior Commercial Loan Officer (Officer III), the median base salary jumps to $118,290.

- Glassdoor lists the total pay for a Commercial Lender in the U.S. at an average of $135,145 per year, with a likely total pay range of $96,000 to $192,000. This figure crucially includes base salary plus additional pay like cash bonuses, commission, and profit sharing.

- Payscale corroborates this, showing an average base salary around $79,800, but with bonuses reaching up to $50,000 and total pay extending to over $150,000 for experienced professionals.

The key takeaway is that base salary is only part of the story. Total compensation is a much more important metric in this field.

### Salary Progression by Experience Level

Your earning potential grows substantially as you gain experience, build a client portfolio, and demonstrate a track record of sourcing and closing sound loans.

| Experience Level | Typical Title(s) | Average Base Salary Range | Typical Total Compensation Range (with Bonus/Commission) | Description |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-3 years) | Credit Analyst, Junior Commercial Lender, Commercial Loan Officer I | $60,000 - $80,000 | $65,000 - $95,000 | Focus is on learning the fundamentals of credit analysis and supporting senior lenders. Bonus potential is often lower and more team-based. |

| Mid-Career (4-8 years) | Commercial Lender, Commercial Loan Officer II, AVP/VP | $80,000 - $120,000 | $100,000 - $180,000+ | Manages a small-to-medium sized portfolio of their own clients. Has lending authority for smaller deals. Incentive pay becomes a significant part of total compensation. |

| Senior (8+ years) | Senior Commercial Lender, VP/Senior VP, Relationship Manager | $120,000 - $160,000+ | $180,000 - $300,000+ | Manages a large, complex portfolio of high-value clients. Often has significant lending authority and mentors junior lenders. Bonus/commission can equal or exceed base salary. |

| Executive/Management | Team Lead, Market President, Chief Credit/Lending Officer | $160,000 - $250,000+ | $250,000 - $500,000+ | Manages a team of lenders, a geographic market, or the entire lending function of the bank. Compensation is tied to the overall profitability of their division. |

*(Salary data is an aggregation and synthesis of information from Salary.com, Glassdoor, and Payscale, updated for 2023/2024 trends.)*

### Deconstructing the Compensation Package

Understanding the components of a lender's pay is crucial. It's rarely just a flat salary.

- Base Salary: This is the guaranteed portion of your income. It provides stability and is typically determined by your experience level, the size of the bank, and your geographic location. As shown in the table, this steadily increases with seniority.

- Bonuses & Commissions (Incentive Pay): This is the variable, performance-driven component and is where top lenders make their money. It's a powerful motivator. Incentive plans vary widely by institution but are generally based on a few key metrics:

- Loan Volume: A percentage of the total dollar amount of loans you close. For example, a lender might earn a certain number of "basis points" (1 basis point = 0.01%) on each funded loan.

- Revenue Growth: Based on the interest income and fees generated by your portfolio.

- Cross-Selling: Incentives for successfully referring clients to other bank departments like treasury/cash management, wealth management, or merchant services.

- Portfolio Quality: Some banks include "kickers" for maintaining a high-quality loan book with few delinquencies, and penalties or "clawbacks" for loans that go bad.

- Referrals: Bonuses for bringing in new, profitable client relationships.

- Profit Sharing: Some institutions, particularly smaller community banks or credit unions, may offer a profit-sharing plan where a portion of the bank's overall profits are distributed to employees, often as a contribution to their retirement accounts.

- Standard Benefits: Like any professional role, this includes health, dental, and vision insurance; a 401(k) retirement plan (often with a company match); paid time off; and life and disability insurance.

- Perks: Depending on the bank and seniority, perks can include a car allowance (for client visits), a budget for entertaining clients, and payment of professional association dues.

When evaluating a job offer, it is critical to look at the Total Compensation Structure. A lower base salary with a highly achievable, uncapped incentive plan can be far more lucrative than a higher base salary with a modest, capped bonus.

---

Key Factors That Influence a Commercial Lender's Salary

While experience is the primary driver, a multitude of interconnected factors can dramatically influence a commercial lender's salary and overall earning potential. A strategic approach to managing these elements can add tens, or even hundreds, of thousands of dollars to your income over the course of your career. This section provides an exhaustive breakdown of those factors.

### 1. Level of Education and Certifications

While a specific degree is not always a hard requirement, your educational background sets the foundation for your analytical skills and can influence your starting salary and long-term trajectory.

- Bachelor's Degree: This is the standard entry-level requirement. Degrees in Finance, Accounting, Economics, or Business Administration are most sought-after as they provide a direct and relevant knowledge base in financial statement analysis, corporate finance, and economic principles. A high GPA from a reputable university can give you a competitive edge for premier credit training programs at larger banks.

- Master of Business Administration (MBA): An MBA is generally not required for a successful lending career, but it can be a powerful accelerator, particularly for those aiming for senior leadership. An MBA from a top-tier business school can:

- Significantly boost starting salaries for those entering the field post-MBA.

- Fast-track promotions to Vice President, Senior VP, and management roles like Team Lead or Market President.

- Provide a powerful network of contacts that can be invaluable for business development.

- The ROI of an MBA is highest when it facilitates a pivot into a higher-paying segment of finance or accelerates a clear path to executive leadership.

- Professional Certifications: Certifications demonstrate a commitment to the profession and a mastery of specialized knowledge. They can be a significant differentiator in hiring and promotions. The most respected certification in commercial lending is the Risk Management Association's (RMA) Credit Risk Certified (CRC) designation.

- RMA-CRC: Earning the CRC designation signifies a high level of expertise in credit risk analysis. It requires passing a rigorous exam and having a certain number of years of relevant experience. Many banks encourage and will pay for their lenders and analysts to pursue this certification, as it signals to clients and regulators a commitment to sound underwriting. Holding a CRC can directly support a case for a higher salary or a promotion.

- Other Certifications: While less common for general commercial lenders, certifications like the Certified Treasury Professional (CTP) can be valuable for those who want to excel at cross-selling and advising on corporate cash management.

### 2. Years of Experience (The Career Trajectory)

As detailed in the salary table, experience is arguably the single most important factor. The progression is logical: you begin by learning the technical skills and gradually transition to applying those skills in a revenue-generating, relationship-management capacity.

- The Credit Analyst Foundation (Years 0-3): Nearly all great commercial lenders start their careers as Credit Analysts. This is where you build the bedrock of your skills. You are not yet responsible for sourcing deals but for underwriting them. You learn to tear apart financial statements, identify risks, and write the credit memos that justify the bank's lending decisions. Pay is modest, but the training is invaluable.

- The Junior Lender Stage (Years 2-5): After proving your analytical prowess, you move into a production role. You may inherit a small portfolio of less-complex clients or be paired with a senior lender. Your focus shifts to developing sales and relationship skills while still being heavily involved in the underwriting. Your incentive compensation begins to grow as you start to close your own deals. Salary.com data shows a Commercial Loan Officer I in this stage earning a median base of around $68,000, with total compensation reaching the $75,000-$90,000 range.

- The Established Producer (Years 5-10): Now a Commercial Loan Officer II or AVP/VP, you are a fully functioning lender. You have a solid book of business, a strong network of referral sources, and a degree of autonomy. You can handle more complex deals and have lending authority up to a certain threshold. This is where total compensation really begins to take off, with total pay packets of $120,000 to $180,000+ becoming common, as per Glassdoor and industry observations.

- The Senior Relationship Manager (Years 10+): As a Senior VP or top-tier producer, you handle the bank's most important and complex relationships. You might specialize in a lucrative niche (discussed below). Your job is almost entirely focused on high-level relationship management, strategic advice, and sourcing large, profitable deals. Your analytical work is supported by a team of junior lenders and analysts. Base salaries can reach $150,000-$170,000+, but total compensation, driven by massive incentive payouts, can easily soar past $250,000 or $300,000.

### 3. Geographic Location

"Location, location, location" doesn't just apply to real estate; it's a massive determinant of a commercial lender's salary. Pay scales are adjusted for cost of living and the concentration of business activity.

- Top-Tier Metropolitan Areas: Major financial hubs like New York City, San Francisco, Los Angeles, Boston, and Chicago offer the highest salaries. This is due to a higher cost of living and, more importantly, a greater density of large corporations, which means larger, more complex, and more profitable loan opportunities. A senior lender in NYC might earn 20-30% more than a counterpart with the same experience in a mid-sized city. For instance, Salary.com shows the median base for a Commercial Loan Officer III in New York, NY is $144,320, significantly higher than the national median of $118,290.

- High-Growth Secondary Cities: Cities like Austin, Denver, Charlotte, Nashville, and Seattle are also becoming hotspots for commercial lenders. Rapid population and business growth create a high demand for commercial loans to fund new construction, corporate relocations, and business expansion. Salaries in these cities are highly competitive and often rival those in top-tier metros when cost of living is factored in.

- Mid-Sized and Rural Markets: Lenders in smaller cities and rural areas will generally see lower base salaries and total compensation. The deal sizes are smaller, and the cost of living is lower. However, these roles can offer an excellent work-life balance and the opportunity to become a pillar of the local business community. A lender at a community bank in a rural area might focus more on agricultural loans or small business (SBA) loans.

### 4. Company Type and Size

The type of institution you work for has a profound impact on your compensation structure, the types of deals you work on, and the overall company culture.

- Large National / Money Center Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo):

- Pros: Highest potential salaries and bonuses. Access to the largest and most complex deals (syndicated loans, large corporate finance). Sophisticated training programs. Brand recognition.

- Cons: Highly structured and siloed. You may be a small cog in a huge machine. High pressure and demanding sales goals. Less autonomy. Compensation plans can be complex and may change frequently.

- Regional Banks (e.g., KeyBank, Truist, U.S. Bank):

- Pros: Often the "sweet spot" for many lenders. They offer competitive compensation, a good mix of deal sizes, and more autonomy than money center banks. Strong brand recognition within their geographic footprint.

- Cons: May not have the capacity for the multi-billion dollar deals that the largest banks handle. Can still be quite bureaucratic.

- Community Banks:

- Pros: Deep connection to the local community. More autonomy and a broader range of responsibilities. Simpler, more direct compensation plans. Better work-life balance. You can see your direct impact on local businesses.

- Cons: Lower overall compensation ceiling due to smaller deal sizes. Fewer resources and less sophisticated technology. Career advancement might be slower.

- Credit Unions:

- Pros: Strong member-focused culture. Often offer excellent benefits and work-life balance. Less emphasis on high-pressure sales.

- Cons: As non-profits, their compensation, particularly the bonus component, is typically lower than for-profit banks. Business lending is often a smaller part of their overall operation, leading to fewer opportunities.

- Non-Bank Lenders (FinTech, Private Credit Funds, Life Insurance Companies):

- Pros: This is a rapidly growing and often highly lucrative area. Private credit funds and other alternative lenders can be very aggressive with compensation and offer highly entrepreneurial environments.

- Cons: Less job security. Compensation can be "eat what you kill" and almost entirely commission-based. May lack the stability and brand reputation of a traditional bank.

### 5. Area of Specialization

Generalist commercial lenders are common, but specializing in a high-demand niche can make you a more valuable and higher-paid asset.

- Commercial Real Estate (CRE): This is one of the largest and most common specializations. CRE lenders finance everything from office buildings and retail centers to apartment complexes and industrial warehouses. It's a complex field requiring knowledge of property valuation, construction, and lease structures. Top CRE lenders who can handle multi-million dollar development projects are among the highest earners.

- Commercial & Industrial (C&I): This is the other major category. C&I lenders provide working capital lines of credit, equipment loans, and acquisition financing to operating businesses (manufacturers, distributors, service companies, etc.). This requires a deep understanding of business operations and cash flow cycles.

- SBA Lending: Specializing in loans backed by the U.S. Small Business Administration (SBA). This requires navigating government programs and regulations but serves a critical market segment. SBA specialists are always in demand.

- Asset-Based Lending (ABL): A highly specialized field focused on lending against a company's accounts receivable and inventory. It's crucial for businesses in industries with high working capital needs, like manufacturing and distribution. ABL is more complex and riskier, and skilled lenders are well-compensated.

- Healthcare Finance: Lending to physician groups, hospitals, and senior living facilities. This niche requires understanding complex billing cycles and healthcare regulations.

- Agricultural (Ag) Lending: Dominant in rural markets, this specialization focuses on the unique needs of farms and agribusinesses, including seasonal operating lines, land, and equipment financing.

### 6. In-Demand Skills

Beyond your resume, the specific skills you cultivate and demonstrate daily are what truly unlock higher pay.

- Hard Skills:

- Advanced Financial Modeling: The ability to build complex, dynamic financial models to project a company's future performance and its ability to service debt under various scenarios.

- Credit Underwriting and Risk Analysis: This is the non-negotiable foundation. The ability to quickly and accurately assess risk is what protects the bank's capital and builds trust with the credit department.

- Loan Structuring and Covenants: The creativity to structure a loan that meets the client's needs while including covenants that protect the bank is a high-value art form.

- Soft Skills:

- Sales Acumen and Business Development: The best lenders are not just analysts; they are hunters. The ability to build a network, generate leads, and close new business is what directly drives your incentive pay.

- Negotiation: You negotiate constantly—with clients on terms, with the credit department on structure, and with attorneys on documentation. Strong negotiators achieve better outcomes for both the client and the bank.

- Relationship Management: The ability to build deep, trust-based advisory relationships turns a one-time transaction into a long-term, profitable client. This is the key to building a sustainable portfolio.

- Communication & Presentation Skills: The ability to clearly articulate a complex financial situation in a written credit memo or in a verbal presentation to a loan committee is critical for getting deals approved.

---

Job Outlook and Career Growth for Commercial Lenders

For those considering a career as a commercial lender, the long-term outlook is stable and promising, though it is evolving with technology and economic shifts. As long as businesses need capital to grow, start, and operate, there will be a need for skilled professionals to facilitate that process.

### The Data-Driven Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for all loan officers is expected to show little or no change from 2022 to 2032, which at first glance might seem discouraging. The BLS projects a 1 percent decline, which is slower than the average for all occupations.

However, it is crucial to look beyond this headline number. The BLS Occupational Outlook Handbook for Loan Officers states, "Overall employment of loan officers is projected to decline slightly... However, about 19,700 openings for loan officers are projected each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire."

This means that while the overall number of roles may not expand dramatically, there will be consistent and significant hiring activity to replace a retiring workforce. Furthermore, the decline is more likely to impact more easily automated roles like consumer and mortgage processing,