Understanding the Exempt Employee Minimum Salary: Are You Being Paid Correctly?

For many professionals, landing a salaried position feels like a significant career milestone. It often implies a level of trust, responsibility, and freedom from the hourly clock. However, being "salaried" is not just a pay structure; it's tied to a crucial legal classification under the Fair Labor Standards Act (FLSA): exempt vs. non-exempt. Understanding this distinction, particularly the minimum salary required to be classified as exempt, is vital for protecting your rights and ensuring you are compensated fairly.

As of July 1, 2024, the federal minimum salary threshold for most exempt employees will rise to $43,888 per year, with a further increase to $58,656 on January 1, 2025. This article will break down what this means for you, how your salary is determined, and what factors are at play.

What Does It Mean to Be an "Exempt Employee"?

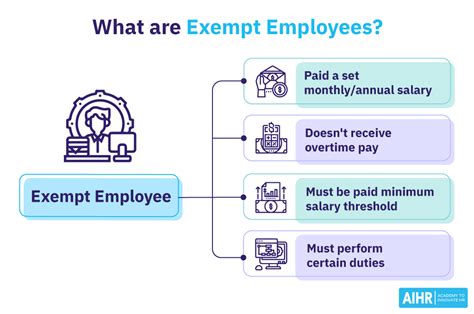

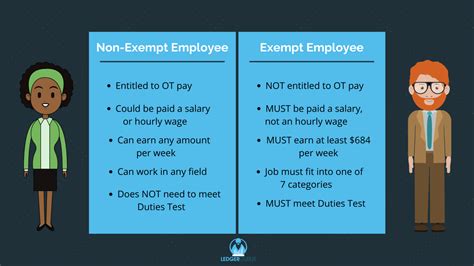

First, let's clarify the terminology. An "exempt" employee is exempt from federal overtime pay requirements. This means that, unlike their non-exempt counterparts, they are not legally entitled to receive time-and-a-half pay for any hours worked over 40 in a workweek.

To classify an employee as exempt, employers must satisfy three specific tests as defined by the U.S. Department of Labor (DOL):

1. The Salary Basis Test: The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee must be paid a salary that meets a minimum specified amount. This is the central focus of our article.

3. The Duties Test: The employee’s primary job duties must involve executive, administrative, or professional tasks as defined by the DOL's regulations.

Crucially, an employer cannot simply call you "exempt" because you are paid a salary. All three tests must be met.

The Current Exempt Employee Minimum Salary

This is the most critical and frequently changing piece of the puzzle. The salary level test sets a floor for exempt status. If you earn less than this threshold, you are generally considered non-exempt and are eligible for overtime pay, regardless of your job title or duties.

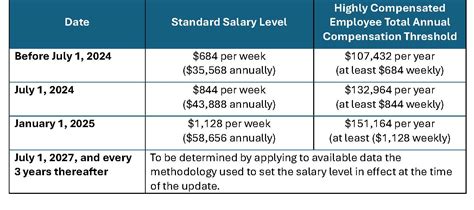

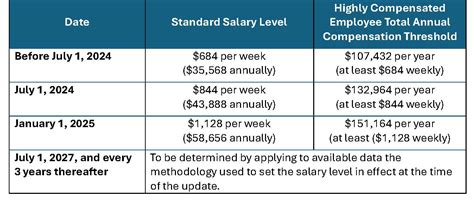

According to the U.S. Department of Labor's 2024 Final Rule, the federal minimum salary threshold is increasing significantly:

- Effective July 1, 2024: The threshold rises to the equivalent of $844 per week (or $43,888 annually).

- Effective January 1, 2025: The threshold will rise again to $1,128 per week (or $58,656 annually).

Future updates will occur every three years to reflect current wage data.

It's also important to note the "Highly Compensated Employee" (HCE) exemption, which has a much more streamlined duties test. The total annual compensation requirement for HCEs is also rising:

- Effective July 1, 2024: The HCE threshold rises to $132,964 per year.

- Effective January 1, 2025: The HCE threshold rises to $151,164 per year.

Key Factors That Influence Your Salary and Exempt Status

While the federal threshold sets the legal minimum, your actual salary and whether you qualify as exempt depend on a complex interplay of factors.

###

Geographic Location

This is arguably the most significant factor after the duties test. Federal law sets the floor, but many states and cities have set a much higher bar. Employers in these locations must adhere to whichever salary threshold is higher and more protective of the employee.

- California: As of 2024, the minimum salary for exempt employees is $66,560 per year, which is twice the state's minimum wage for full-time employment. (Source: California Department of Industrial Relations).

- New York: New York's requirements vary by location. For 2024, the minimum is $1,200/week ($62,400 annually) in New York City and its suburbs (Nassau, Suffolk, Westchester) and $1,124.20/week ($58,458.40 annually) for the rest of the state. (Source: New York State Department of Labor).

- Washington: In 2024, the salary threshold is 2 times the state minimum wage, amounting to $67,724.80 per year for all employers. (Source: Washington State Department of Labor & Industries).

###

The "Duties Test": Your Area of Specialization and Education

Your job responsibilities are the bedrock of the exemption test. Your level of education often qualifies you for roles that meet these duties. Even if you earn over the salary threshold, you cannot be classified as exempt unless your primary duties fall into one of these categories:

- Executive Exemption: Primary duty is managing the enterprise or a department. Must customarily direct the work of at least two other full-time employees and have the authority to hire or fire (or have significant influence on these decisions).

- Administrative Exemption: Primary duty is performing office or non-manual work directly related to the management or general business operations. Must include the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption: This splits into two types:

- Learned Professional: Requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., lawyers, doctors, accountants, engineers). This is where a specific degree (Bachelor's, Master's, Ph.D.) is often a prerequisite.

- Creative Professional: Requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., artists, musicians, writers).

###

Years of Experience

Experience directly correlates with salary and responsibility. An entry-level employee and a senior-level employee in the same role may be classified differently.

- Entry-Level (0-2 years): Professionals in their first few years may have a salary closer to the exemption threshold. Their duties may also be more task-oriented and less autonomous, potentially making them non-exempt even if their salary qualifies.

- Mid-Career (5-10 years): With growing experience comes higher pay and greater responsibility. Professionals at this stage typically earn well above the minimum threshold and their duties (e.g., managing projects, supervising staff) more clearly fit the administrative or executive exemption tests. According to Salary.com, a Project Manager's salary in the U.S. typically ranges from $98,000 to $120,000, placing them firmly in exempt territory.

- Senior/Executive Level (15+ years): Senior leaders and executives almost always qualify as exempt due to high salaries and managerial duties.

###

Company Type and Industry

The company you work for dramatically impacts pay structures.

- Large Corporations: Major tech companies, financial institutions, and pharmaceutical firms often have salary bands that start well above the highest state-level exemption threshold, even for entry-level roles.

- Startups: A tech startup may offer a competitive salary to attract talent, but roles can be fluid. It's important here to ensure the *actual duties* match the exempt classification.

- Non-Profits and Public Sector: These organizations may have tighter budgets, with salaries for some professional roles hovering closer to the exemption threshold. The recent federal increases will have a significant impact on these sectors.

Job Outlook: The Impact of a Rising Threshold

While there is no "job outlook" for the category of "exempt employee," the changing salary threshold has a major impact on the U.S. job market. According to the U.S. Department of Labor, the 2024 rule changes will make approximately 4 million more workers newly eligible for overtime protections.

This creates two primary scenarios:

1. Reclassification: Employers may reclassify salaried employees who fall below the new threshold to non-exempt, hourly status. These employees will then be eligible for overtime pay.

2. Salary Increases: To avoid the administrative complexity of tracking hours and paying overtime, some employers will choose to raise the salaries of affected employees to meet the new, higher threshold, keeping them in the exempt category.

This shift empowers workers and could lead to broad wage growth in administrative and professional fields where salaries have stagnated near the old threshold.

Conclusion: Know Your Worth and Your Rights

Understanding your classification as an exempt or non-exempt employee is more than an academic exercise—it is fundamental to your financial well-being.

Key Takeaways:

- It's Not Just About a Salary: To be exempt, your role must pass the salary basis, salary level, AND duties tests.

- The Salary Bar is Rising: The federal minimum salary to be considered exempt is increasing substantially in 2024 and 2025, bringing overtime protections to millions.

- Location, Location, Location: Your state may have much higher salary requirements than the federal government. Always check local laws.

- Your Duties Matter Most: Your job title is irrelevant; your actual day-to-day responsibilities determine if you can be legally classified as exempt.

As you navigate your career, be proactive. Use resources like the BLS, Payscale, and Glassdoor to research what your specific job title pays in your geographic area. Most importantly, familiarize yourself with the Department of Labor's guidelines. Being an informed employee is the first step to ensuring you are valued and compensated correctly for your hard work and expertise.