Introduction

Imagine being at the very center of a company's evolution, the architect of its future growth and transformation. You're in the room where billion-dollar decisions are made—decisions to acquire a competitor, merge with a strategic partner, or sell off a division to refocus the company's mission. This high-stakes, high-impact world is the domain of the corporate development professional. It's a career path that blends sharp financial acumen with profound strategic insight, and for those who excel, the rewards are substantial. A corporate development salary not only reflects the immense value these professionals bring but also serves as a gateway to the highest echelons of corporate leadership.

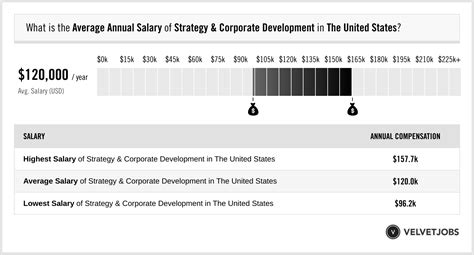

The compensation in this field is undeniably one of its biggest draws. While entry-level roles offer competitive starting pay, senior-level corporate development professionals, particularly those at the Vice President or Head of Corporate Development level, can command total compensation packages well into the six or even seven figures. The average base salary for a corporate development professional in the United States often hovers between $120,000 and $180,000, but this is merely the starting point. When you factor in significant annual bonuses, stock options, and other long-term incentives, the earning potential becomes truly exceptional.

I recall a conversation years ago with a mentor who had just led a major tech acquisition. He didn't talk about the complexity of the financial models or the late-night negotiations; he talked about the "beautiful moment" when he saw the two company cultures begin to click, knowing he had helped create something stronger than the sum of its parts. That's the essence of corporate development—it's not just about the numbers on a spreadsheet; it's about building lasting value. This guide will demystify the corporate development salary landscape and provide you with a comprehensive roadmap to navigate this challenging and incredibly rewarding career.

### Table of Contents

- [What Does a Corporate Development Professional Do?](#what-does-a-corporate-development-professional-do)

- [Average Corporate Development Salary: A Deep Dive](#average-corporate-development-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Corporate Development Professional Do?

At its core, the corporate development (often called "Corp Dev" or "CD") team acts as a company's internal investment bank and strategic think tank. Their primary mandate is to drive inorganic growth—that is, growth achieved through external means rather than internal operations. This function is critical for companies looking to expand their market share, enter new geographies, acquire new technology or talent, or respond to competitive pressures.

The responsibilities are broad and dynamic, revolving around the entire lifecycle of a strategic transaction. Think of it as a funnel: the team starts by evaluating hundreds of possibilities and narrows them down to a few actionable, value-creating deals.

Core Responsibilities and Typical Projects:

- Strategy and Sourcing: The process begins with strategy. Working closely with the executive leadership team (C-suite), the Corp Dev team helps define the company's strategic goals. Are they looking to expand their product line? Enter the European market? Acquire a key technology? Once the strategy is set, they actively source and identify potential targets for mergers, acquisitions, strategic investments, or partnerships. This involves market research, networking, and attending industry conferences.

- Valuation and Financial Modeling: Once a potential target is identified, the real analytical work begins. The team builds complex financial models to determine the target's value. This involves techniques like Discounted Cash Flow (DCF) analysis, comparable company analysis ("comps"), and precedent transaction analysis. They project potential synergies—cost savings or revenue opportunities that would result from the deal—and model their financial impact.

- Due Diligence: This is a crucial, exhaustive investigation into the target company. The Corp Dev team leads a cross-functional effort, coordinating with legal, finance, HR, and operational teams to scrutinize every aspect of the target's business. They examine financials, contracts, customer lists, intellectual property, and potential liabilities to ensure there are no hidden skeletons.

- Negotiation and Execution: Armed with their valuation and diligence findings, the team works with senior executives to structure and negotiate the terms of the deal. This includes the purchase price, payment structure (cash vs. stock), and key contractual terms in the purchase agreement.

- Post-Merger Integration (PMI): After a deal closes, the work isn't over. The Corp Dev team often plays a key role in overseeing the initial stages of integration, ensuring that the strategic rationale for the deal is realized and that the two organizations are combined smoothly to capture the anticipated synergies.

### A Day in the Life of a Corporate Development Associate

To make this more concrete, here’s a glimpse into a typical day:

- 8:00 AM: Start the day by catching up on market news, reading industry publications (like the Wall Street Journal or DealBook), and checking for any announcements concerning competitors or potential acquisition targets.

- 9:00 AM: Team meeting to review the current deal pipeline. The Director of Corporate Development assigns tasks for the week. You are tasked with updating the valuation model for "Project Phoenix," a potential acquisition of a smaller tech startup.

- 10:30 AM: Jump into Excel. You spend the next few hours deep in financial modeling, updating assumptions based on new information received from the target company and refining your DCF analysis to present a new valuation range.

- 1:00 PM: Quick lunch while on a call with the legal team. They are conducting legal due diligence and have flagged a potential issue in one of the target's major customer contracts. You take notes to incorporate this risk into your analysis.

- 2:30 PM: Your Director asks you to prepare a few slides for an upcoming presentation to the CEO. You use PowerPoint to create clear, concise visuals that summarize your valuation findings and the strategic rationale for acquiring "Project Phoenix."

- 4:30 PM: Conference call with an external advisor—an investment banker who is helping source other potential deals in the same space. You discuss market trends and a few other companies that might be a good strategic fit.

- 6:00 PM: You spend the last part of your day responding to emails and preparing for tomorrow. You send your updated model and presentation slides to your Director for review, knowing there will likely be revisions. On deal-heavy days, work can easily extend late into the evening.

This role is a demanding blend of analytical rigor, strategic thinking, and project management, placing you at the center of the company's most critical decisions.

Average Corporate Development Salary: A Deep Dive

Compensation in corporate development is a significant draw, and for good reason. It's a high-impact role that requires a rare combination of financial expertise and strategic vision, and companies are willing to pay a premium for top talent. The salary structure is typically composed of a competitive base salary supplemented by a substantial performance-based bonus and, in many cases, long-term incentives like stock options or restricted stock units (RSUs).

It's important to note that a single "average" salary can be misleading due to the wide range of influencing factors, which we will explore in the next section. However, by examining data from reputable sources, we can establish a clear picture of the earning potential at various career stages.

According to Salary.com, as of late 2023, the median base salary for a Corporate Development Manager in the United States is approximately $157,639, with a typical range falling between $139,129 and $181,640. Similarly, Glassdoor reports a national average total pay (including bonuses and other compensation) of around $175,000 for a Corporate Development Manager.

Let's break this down by level of experience to provide a more granular view.

### Corporate Development Salary by Experience Level

The career path in corporate development is well-defined, with compensation scaling significantly at each promotional step. The titles may vary slightly by company (e.g., Associate vs. Senior Analyst), but the hierarchy is generally consistent.

| Career Stage | Typical Title(s) | Typical Years of Experience | Average Base Salary Range | Average Total Compensation Range (incl. Bonus) |

| ------------------------- | -------------------------------------------------- | --------------------------- | ------------------------------ | ---------------------------------------------- |

| Entry-Level / Analyst | Corporate Development Analyst | 0-3 years | $85,000 - $115,000 | $100,000 - $140,000+ |

| Mid-Career / Associate| Corporate Development Associate / Senior Analyst | 2-5 years | $110,000 - $150,000 | $140,000 - $200,000+ |

| Manager Level | Corporate Development Manager | 5-8 years | $140,000 - $180,000 | $180,000 - $275,000+ |

| Senior Manager / Director | Senior Manager / Director, Corporate Development | 8-12 years | $170,000 - $220,000 | $250,000 - $400,000+ |

| Executive Level | Vice President (VP) / Head of Corporate Development | 12+ years | $220,000 - $300,000+ | $400,000 - $1,000,000+ |

*Sources: Data compiled and synthesized from Salary.com, Glassdoor, Payscale, and executive search firm reports (2023-2024). Ranges are estimates and can vary significantly based on the factors discussed in the next section.*

### Deconstructing the Compensation Package

The figures in the table above only tell part of the story. A corporate development salary is a package, and the components beyond the base salary are where the wealth-building potential truly lies.

1. Base Salary:

This is your fixed, predictable income. As shown in the table, it grows steadily with experience and responsibility. It forms the foundation of your compensation but often represents only 50-70% of your total earnings, especially at senior levels.

2. Annual Bonus:

This is the most significant variable component. It is typically a percentage of your base salary and is tied to both individual and company performance. A key metric is "deal flow"—the number and success of transactions completed during the year.

- Analysts/Associates: Bonuses might range from 15% to 40% of base salary.

- Managers: Bonuses can climb to 30% to 60%.

- Directors/VPs: It's common for bonuses to be 50% to 100% (or even more) of the base salary in a good year with high deal activity.

3. Long-Term Incentives (LTI):

This is where compensation becomes truly lucrative, especially at large, publicly traded companies. LTIs are designed to retain top talent and align their interests with long-term shareholder value.

- Restricted Stock Units (RSUs): You are granted company shares that vest over a set period (typically 3-4 years). This can add tens or even hundreds of thousands of dollars to your annual compensation.

- Stock Options: These give you the right to buy company stock at a predetermined price. If the company's stock price rises significantly, these options can become extremely valuable.

- Profit Sharing: Some private companies may offer a share of the profits, which can be substantial.

4. Other Benefits:

Beyond direct compensation, corporate development roles at reputable firms come with excellent benefits packages, including:

- Comprehensive health, dental, and vision insurance.

- Generous 401(k) matching programs.

- Paid time off (PTO) and parental leave.

- Potential for tuition reimbursement for an MBA or other advanced degree.

When considering a corporate development role, it's crucial to evaluate the entire compensation package. A role with a slightly lower base salary but a more aggressive bonus structure and generous LTI grants at a high-growth company could be far more lucrative in the long run than a role with a higher base salary at a more stagnant company.

Key Factors That Influence Salary

While the average salary data provides a great baseline, your specific corporate development salary will be determined by a confluence of critical factors. Understanding these levers is essential for maximizing your earning potential throughout your career. This is the most important section for anyone looking to strategically plan their path in this field.

###

1. Level of Education

Your educational background is the foundation upon which your corporate development career is built. While a bachelor's degree is the minimum requirement, the type of degree and any advanced qualifications can significantly impact your starting salary and long-term trajectory.

- Bachelor's Degree: A degree in a quantitative field like Finance, Economics, Accounting, or Business Administration is standard. Graduates from top-tier undergraduate business programs often command a salary premium and have access to the most competitive Analyst programs. A high GPA (3.5+) from a reputable university is often a screening criterion for the best roles.

- Master of Business Administration (MBA): The MBA is the great accelerator in the corporate development world. For many, it's the pivot point from a junior role (like an analyst in banking or consulting) into a post-MBA Associate or Manager role in corporate development. An MBA from a top-15 business school (e.g., Harvard, Stanford, Wharton, Booth, Kellogg) can unlock opportunities at the most prestigious companies and significantly boost earning potential. It's not uncommon for an MBA graduate entering a Corp Dev role to see their pre-MBA compensation double. The degree signals a high level of business acumen, strategic thinking, and a powerful professional network.

- Professional Certifications: While not always required, certifications can enhance your credibility and lead to higher pay.

- Chartered Financial Analyst (CFA): The CFA charter is the gold standard for investment and valuation professionals. Earning it demonstrates deep expertise in financial modeling, portfolio management, and ethics. It is highly respected in Corp Dev and can give you a distinct advantage.

- Certified Public Accountant (CPA): A CPA is particularly valuable for roles that require deep dives into financial statements and accounting due diligence. It shows a mastery of accounting principles, which is critical for assessing the financial health of a target company.

###

2. Years and Type of Experience

Experience is, without a doubt, the single most powerful determinant of a corporate development salary. However, it's not just about the number of years; it's about the *quality* and *relevance* of that experience.

- The "Classic" Feeder Paths: The most lucrative Corp Dev roles are often filled by professionals with 2-4 years of experience in one of the following fields:

- Investment Banking (IB): This is the most common and sought-after background. IB analysts are rigorously trained in financial modeling, valuation, and deal execution. Companies are willing to pay a premium for this "plug-and-play" skillset, as it dramatically reduces the training curve.

- Big 4 Transaction Advisory Services (TAS/M&A): Professionals from firms like Deloitte, PwC, EY, and KPMG who work in their M&A or transaction diligence groups have fantastic experience in the nuts and bolts of deals, particularly financial due diligence.

- Strategy Consulting: Consultants from firms like McKinsey, BCG, and Bain bring elite strategic thinking and problem-solving skills, which are invaluable for the sourcing and strategic rationale phases of a deal.

- Salary Growth Trajectory by Experience:

- Analyst (0-3 Years): Typically hired straight from undergrad or after 1-2 years in a less intensive finance role. The focus is on learning the ropes, supporting senior team members, and mastering the technical skills (Excel and PowerPoint).

- Associate (2-5 Years): This is often a post-MBA role or a promotion for a high-performing analyst (or a lateral move from investment banking). Associates take on more responsibility, manage analysts, and begin to lead smaller parts of the deal process. This is where a significant salary jump occurs.

- Manager (5-8 Years): At this level, you are managing entire deal processes from start to finish. You have significant interaction with senior leadership and external advisors. Compensation becomes heavily tied to performance and deal success.

- Director/VP (8+ Years): These are senior leaders responsible for setting strategy, sourcing major deals, leading negotiations, and managing the entire Corp Dev function or a significant part of it. Their compensation package is heavily weighted towards bonuses and long-term equity, reflecting their direct impact on the company's future. Total compensation can easily exceed $500,000 and reach seven figures at large, active companies.

###

3. Geographic Location

Where you work matters—a lot. Salaries are adjusted for the cost of living and the concentration of corporate headquarters and deal activity. Major financial and tech hubs offer the highest salaries but also come with a much higher cost of living.

- Top-Tier Cities (Highest Salaries):

- New York, NY: The epicenter of finance. Competition is fierce, but compensation is at the top of the market.

- San Francisco Bay Area, CA (incl. Silicon Valley): The heart of the tech industry, where tech M&A drives incredibly high compensation packages, often with a significant equity component.

- Boston, MA: A major hub for biotech, pharma, and technology.

- Los Angeles, CA: A growing hub for media, entertainment, and tech.

- Second-Tier Cities (Strong Salaries):

- Chicago, IL

- Dallas/Houston, TX (strong in energy M&A)

- Seattle, WA

- Atlanta, GA

- Salary Comparison Example: A Corporate Development Manager in San Francisco might earn a base salary of $185,000, while the same role in a mid-sized city like Charlotte, NC might offer $150,000. While the San Francisco salary is higher in absolute terms, the lower cost of living in Charlotte could mean the professional there has greater disposable income. When evaluating offers, it's essential to use a cost-of-living calculator to compare the true value of the compensation packages.

###

4. Company Type & Size

The type of company you work for dramatically shapes your compensation structure and overall experience.

- Large Public Corporations (Fortune 500): These companies (e.g., Google, Microsoft, Disney, Johnson & Johnson) offer some of the highest and most structured compensation packages. You'll find competitive base salaries, well-defined bonus targets, and substantial RSU grants that vest over time. The work involves large, complex, and often international deals.

- Private Equity-Backed Portfolio Companies: These companies are owned by a PE fund, and the Corp Dev role is laser-focused on growth through "buy and build" acquisition strategies. Compensation can be very lucrative and may include a direct equity stake in the company ("carry"), which can lead to a massive payday if the company is sold successfully.

- High-Growth Startups (Late-Stage/Unicorns): These companies, particularly in the tech sector, may offer a slightly lower base salary but compensate with a very large grant of stock options. This is a high-risk, high-reward scenario. If the company has a successful IPO or is acquired, those options could be worth millions. The role is often more entrepreneurial and less structured.

- Mid-Sized and Private Companies: These roles offer a great work-life balance compared to the high-pressure environments above. The salaries are still competitive but may have a lower bonus and LTI component. The deals are often smaller but provide a chance to have a huge, visible impact on the company's success.

###

5. Area of Specialization (Industry)

The industry your company operates in plays a significant role in determining salary. Corp Dev professionals with deep subject matter expertise in a "hot" sector are in high demand.

- Technology: This is consistently one of the highest-paying sectors. M&A is a primary growth driver for big tech, and deep knowledge of software, AI, cybersecurity, or fintech is extremely valuable.

- Healthcare & Pharmaceuticals/Biotech: This is another top-paying industry. The M&A landscape is complex, driven by drug pipelines, patent expirations, and R&D. Expertise in this area is rare and highly compensated.

- Energy: Particularly in oil and gas, M&A is cyclical but can be very lucrative. Expertise in asset valuation and commodity markets is key.

- Financial Services: Banks, insurance companies, and asset managers are constantly involved in M&A to gain scale and expand service offerings.

- Media & Telecommunications: This sector is undergoing massive transformation, leading to constant consolidation and strategic M&A activity.

###

6. In-Demand Skills

Finally, your specific skillset can create a salary premium. Beyond the basics, mastering these skills will make you a more valuable—and thus, higher-paid—candidate.

- Advanced Financial Modeling: You must be an Excel wizard. This means being able to build a three-statement operating model, a discounted cash flow (DCF) model, a merger model (accretion/dilution), and potentially a leveraged buyout (LBO) model from scratch, quickly and accurately.

- Valuation Expertise: Deeply understanding the nuances of different valuation methodologies and being able to defend your assumptions to a skeptical CFO or CEO is a high-value skill.

- Negotiation and Influence: The ability to articulate a position clearly, persuade counterparts, and navigate complex negotiations is what separates senior leaders from junior analysts.

- Strategic Acumen: This is the ability to see the "big picture." Can you understand market trends, assess competitive landscapes, and identify how a potential transaction fits into the company's broader strategic goals?

- Cross-Functional Project Management: A deal has dozens of moving parts and involves legal, HR, accounting, and operations teams. The ability to lead this complex orchestra and drive the project to completion is critical.

- Communication & Presentation Skills: You must be able to distill vast amounts of complex information into a clear, compelling narrative for an executive audience. Mastery of PowerPoint is non-negotiable.

Job Outlook and Career Growth

For those considering a career in corporate development, the long-term prospects are exceptionally strong. While the U.S. Bureau of Labor Statistics (BLS) does not have a dedicated category for "Corporate Development," we can analyze related, and often prerequisite, professions to gauge the outlook.

The BLS projects that employment for Financial Analysts (a common entry point) is expected to grow by 8% from 2022 to 2032, which is much faster than the average for all occupations. Similarly, the outlook for Management Analysts (a role that involves strategic advisory) is projected to grow by 10% over the same period. This robust growth is fueled by an increasingly complex global economy, the continuous need for companies to adapt and grow, and the rise of data-driven decision-making.

Corporate development sits at the intersection of these trends. As long as capitalism and competition exist, companies will need to grow, and inorganic growth through M&A, partnerships, and strategic investments will remain a vital tool.

### Emerging Trends and Future Challenges

The world of corporate development is not static. Professionals who stay ahead of these trends will be the most successful and highest-paid in the coming decade.

- The Rise of Data Analytics and AI: Corp Dev teams are increasingly using data science and AI tools to screen for targets more efficiently, conduct more sophisticated due diligence, and model synergies with greater accuracy. Professionals who are comfortable with data visualization tools (like Tableau) and have a basic understanding of data analytics will have an edge.

- ESG (Environmental, Social, and Governance) as a Deal Driver: ESG factors are no longer a footnote in due diligence; they are a core part of the strategic rationale. Acquirers are now scrutinizing a target's environmental impact, labor practices, and governance structure. Future Corp Dev leaders will need to be experts in evaluating ESG risks and opportunities.

- Cross-Border and Complex Carve-Outs: As globalization continues, the ability to execute complex international deals across different regulatory environments is a highly prized skill. Similarly, large corporations are increasingly divesting non-core assets through "carve-outs," which are notoriously complex transactions that require specialized expertise.

- The Cyclical Nature of M&A: The M&A market is cyclical and heavily influenced by economic conditions, interest rates, and CEO confidence. During economic downturns, deal flow can slow significantly. This is a challenge of the profession. However, strong Corp Dev teams use these slower periods to focus on strategy, refine their target lists, and prepare for the next upswing. They may also focus on divestitures or strategic partnerships rather than large acquisitions.

### How to Stay Relevant and Advance Your Career

Advancement in corporate development is a direct result of the value you create. Here’s how to ensure a steep upward trajectory:

1. Become a Deal "Athlete": Don't just be a modeler or a project manager. Strive to get exposure to the entire deal lifecycle, from sourcing and negotiation to integration. The more versatile you are, the more valuable you become.

2. Develop Deep Industry Expertise: Choose an industry that interests you and become a true expert. Read everything, go to conferences, and network with industry leaders. When you can talk about market trends with the same authority as a CEO in that sector, you've reached a new level.

3. Build Your Internal Network: Your success depends on your ability to work with and influence others within your company. Build strong relationships with leaders in legal, finance, product, and sales. They are your partners in due diligence and integration.

4. Cultivate Your External Network: Maintain relationships with investment bankers, consultants, and other Corp Dev professionals. This network is an invaluable source of market intelligence and potential deal flow.