In the fast-paced, high-stakes world of global finance, New York stands as the undisputed epicenter. For aspiring and established financial professionals, the designation of Certified Public Accountant (CPA) is more than just a license; it's a golden key. It unlocks doors to prestigious roles, complex challenges, and, most compellingly, a level of compensation that reflects the immense value CPAs bring to the economic engine of the Empire State. But what does that potential truly look like? What is the real story behind the numbers when it comes to a CPA salary in NY?

This guide is designed to be your definitive resource, moving beyond simple averages to provide a granular, multi-faceted analysis of what you can expect to earn as a CPA in New York. We will dissect the factors that command top-tier salaries, from the Big Four firms in Manhattan to burgeoning tech startups in Brooklyn and essential government roles in Albany. The path to becoming a CPA is a rigorous one, demanding intellect, dedication, and resilience. I remember once advising a newly licensed CPA who was weighing two offers: one from a prestigious but notoriously demanding audit firm and another from a mid-size company offering a better work-life balance but a lower starting salary. We mapped out not just the immediate pay, but the five-year growth trajectory of each path, considering bonuses, skill acquisition, and exit opportunities. It was a stark reminder that a salary is not just a number; it's the starting point of a strategic career journey. This guide will empower you to make those same strategic decisions with clarity and confidence.

We will explore everything from the foundational responsibilities of the role to the nuanced specializations that can add tens of thousands to your annual income. Whether you are a student mapping out your future, a professional considering a career change, or a current accountant aiming for the next level, this comprehensive analysis will provide the data-driven insights and actionable advice you need to navigate and maximize your career as a CPA in New York.

### Table of Contents

- [What Does a CPA in New York Do?](#what-does-a-cpa-in-new-york-do)

- [Average CPA Salary in NY: A Deep Dive](#average-cpa-salary-in-ny-a-deep-dive)

- [Key Factors That Influence Your New York CPA Salary](#key-factors-that-influence-your-new-york-cpa-salary)

- [Job Outlook and Career Growth for CPAs in New York](#job-outlook-and-career-growth-for-cpas-in-new-york)

- [How to Become a CPA in New York: Your Step-by-Step Guide](#how-to-become-a-cpa-in-new-york-your-step-by-step-guide)

- [Is a CPA Career in New York Right for You?](#is-a-cpa-career-in-new-york-right-for-you)

What Does a CPA in New York Do?

To understand the salary potential, we must first appreciate the scope and criticality of the CPA's role. A Certified Public Accountant is not merely a "numbers person" or a tax preparer, though those functions can be part of their job. A CPA is a licensed, strategic financial advisor held to a strict code of professional ethics. They are the guardians of financial integrity, the interpreters of complex regulations, and the architects of financial strategy for individuals, businesses, and organizations. In a complex market like New York, their expertise is indispensable.

The responsibilities of a CPA are diverse and can vary significantly based on their chosen path—public accounting, corporate (or "industry") accounting, government, or non-profit. However, the core of their work revolves around providing assurance, guidance, and compliance.

Core Responsibilities & Daily Tasks:

- Financial Reporting & Assurance: This is the bedrock of public accounting. CPAs in audit roles examine a company's financial statements to ensure they are accurate, complete, and compliant with Generally Accepted Accounting Principles (GAAP). Their independent opinion provides crucial assurance to investors, creditors, and regulators. A typical project involves planning the audit, testing internal controls, performing substantive testing of transactions and balances, and drafting the final audit report.

- Tax Compliance & Strategy: CPAs help individuals and corporations navigate the labyrinth of federal, state, and local tax laws. In New York, this is particularly complex, involving city-specific taxes and intricate state regulations. This goes beyond just filing returns; it involves strategic tax planning to minimize liability, advising on the tax implications of business decisions (like mergers or acquisitions), and representing clients before the IRS or the NYS Department of Taxation and Finance.

- Advisory & Consulting: This is a rapidly growing and often highly lucrative area. CPAs leverage their financial acumen to provide a wide range of consulting services. This can include forensic accounting (investigating financial fraud), litigation support, M&A due diligence, IT risk assessment, personal financial planning, and business valuation.

- Managerial & Corporate Accounting: CPAs working within a company ("in industry") are vital to its internal operations. They are involved in budgeting, forecasting, financial analysis, managing internal controls, and preparing financial statements for management and the board of directors. They are key players in strategic decisions, helping to model the financial impact of new products, market expansion, or capital investments.

### A "Day in the Life" of a Senior Tax Associate in a NYC Public Accounting Firm

To make this more tangible, let's imagine a day for "Alex," a Senior Tax Associate at a mid-sized firm in Midtown Manhattan during the busy spring season.

- 8:30 AM: Alex arrives, grabs coffee, and immediately reviews their calendar and a prioritized task list. The first item is a complex C-Corporation tax return for a major real estate client with properties across the Tri-State area. They check for any overnight emails from the client or the engagement partner.

- 9:00 AM: Alex dives into the tax software, reviewing the trial balance provided by the client's internal accounting team. They meticulously tie out the book income to the financial statements and begin making tax adjustments for things like depreciation, meals and entertainment expenses, and state tax liabilities.

- 11:00 AM: A junior associate, "Ben," stops by Alex's desk with a question about a partnership return. Alex spends 20 minutes walking Ben through the concept of partnership basis and how to properly allocate income among partners, seeing it as a key part of their senior role to mentor junior staff.

- 12:30 PM: Quick lunch at their desk while listening to a webinar on recent changes to New York State's pass-through entity tax (PTET) to ensure they are applying the latest guidance for their clients.

- 1:30 PM: Alex joins a video call with the CFO and Controller of a tech startup client. They discuss the R&D tax credit, and Alex explains the documentation requirements and the potential tax savings, providing clear, actionable advice.

- 3:00 PM: Alex shifts focus back to the real estate client. They have identified a potential issue with how the client classified certain repair expenses and draft a concise, professional email to the client's Controller to request clarification and supporting documents.

- 5:00 PM: The engagement Partner requests a quick update. Alex provides a status report on the real estate return, highlighting the outstanding issue and the estimated completion timeline.

- 6:30 PM: After making significant progress on the return and clearing out their inbox, Alex reviews their workpapers, leaving detailed notes for their final review by the manager tomorrow. They log their time for the day and head home, knowing another demanding but rewarding day awaits.

This example illustrates the blend of technical expertise, client communication, problem-solving, and mentorship that defines the modern CPA's role in New York.

Average CPA Salary in NY: A Deep Dive

Now, let's get to the core of the query: the numbers. A CPA salary in New York is not a single figure but a wide spectrum influenced by a multitude of factors we will explore in the next section. However, by synthesizing data from authoritative sources, we can establish a clear and reliable picture of the earning potential. New York, and particularly New York City, consistently ranks as one of the highest-paying locations for accounting professionals in the United States, a direct reflection of the high cost of living and the immense concentration of financial activity.

### National vs. New York State: The Big Picture

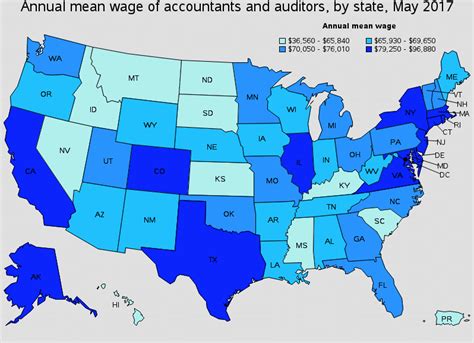

First, it's essential to set a national baseline. According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for accountants and auditors was $79,880 as of May 2023. The top 10 percent of earners, often those with CPA licenses and significant experience in high-demand fields, earned more than $141,680.

Now, let's zoom in on New York. The data clearly shows a significant "New York premium."

- According to the BLS, the annual mean wage for accountants and auditors in New York State was $110,670 as of May 2023, making it the second highest-paying state in the nation, just behind the District of Columbia.

- Salary aggregators provide a more real-time and role-specific view. As of late 2023/early 2024:

- Salary.com reports the average Certified Public Accountant I (entry-level) salary in New York, NY, is $81,592, but the range for an experienced CPA can extend well into the $150,000 - $250,000+ range at senior and management levels. The overall average for a CPA in NYC is often cited between $115,000 and $130,000.

- Glassdoor places the average total pay (including base and additional pay like bonuses) for a CPA in New York, NY, at approximately $124,000 per year, with a likely range between $95,000 and $162,000.

- Payscale reports a similar average base salary of around $101,000 for a CPA in NYC, with the range for experienced professionals reaching up to $160,000+ before bonuses.

Key Takeaway: While the national median is around $80,000, CPAs in New York can expect to start their careers near that number and will quickly surpass the national average, with a typical mid-career salary well into six figures.

### Salary by Experience Level in New York

Experience is arguably the single most powerful driver of salary growth. The journey from a newly licensed CPA to a seasoned partner or CFO is marked by substantial increases in compensation. Here’s a typical salary progression you can expect in New York, primarily focusing on the high-demand NYC market.

| Career Stage | Typical Experience | Common Titles | Estimated NY Base Salary Range | Source(s) |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | Staff Accountant, Audit Associate, Tax Associate | $75,000 - $95,000 | Salary.com, Glassdoor, Industry Reports |

| Mid-Career | 3-5 Years | Senior Accountant, Senior Auditor, Senior Tax Associate | $95,000 - $135,000 | Salary.com, Glassdoor, Robert Half |

| Experienced | 6-10 Years | Accounting Manager, Tax Manager, Audit Manager, Controller | $130,000 - $185,000 | Salary.com, Payscale, Robert Half |

| Senior/Executive | 10+ Years | Senior Manager, Director, Partner, VP of Finance, CFO | $185,000 - $350,000+ | Salary.com, Executive Recruiters |

*Disclaimer: These ranges are estimates for the NYC metropolitan area and can vary. They represent base salary and do not include the significant additional compensation discussed below.*

### Beyond the Base Salary: Understanding Total Compensation

A New York CPA's salary is only part of the story. Total compensation is a much more accurate measure of earning potential, and in finance-heavy roles, it can significantly exceed the base salary.

- Annual Bonuses: This is the most common form of additional compensation. In public accounting, bonuses are tied to individual and firm performance and can range from 5% to 20% of base salary for associates and seniors, and significantly more (20-50%+) for managers and partners. In corporate finance, bonuses are often tied to company profitability (EBITDA, net income) and can be a substantial part of the package.

- Profit Sharing: Some firms, particularly smaller to mid-sized public accounting firms, offer profit-sharing plans where a portion of the firm's profits is distributed to employees. This helps align employee incentives with the firm's success.

- Stock Options & Equity: This is most common in two scenarios: (1) at publicly traded companies, where senior-level CPAs (like Controllers or VPs of Finance) may receive Restricted Stock Units (RSUs) or stock options as part of their long-term incentives, and (2) at startups, where equity can be a major component of compensation, offering high-risk, high-reward potential.

- Signing Bonuses: To attract top talent, especially from Big Four firms or for specialized roles, companies in New York frequently offer signing bonuses, which can range from $5,000 to $25,000 or more.

- Benefits Package: While not direct cash, the value of a strong benefits package in a high-cost area like New York cannot be overstated. This includes:

- Health Insurance: Premium medical, dental, and vision plans with low employee contributions.

- Retirement Savings: Generous 401(k) matching programs (e.g., matching 50-100% of employee contributions up to 6% of salary).

- Paid Time Off (PTO): Competitive vacation, sick, and personal day allowances.

- Professional Development: Reimbursement for CPA license fees, Continuing Professional Education (CPE) costs, and other certifications.

- Other Perks: Commuter benefits, wellness stipends, subsidized gym memberships, and flexible spending accounts.

When evaluating a job offer, a savvy CPA looks at the entire package. A role with a $130,000 base salary and a 20% bonus potential ($156,000 total cash) is significantly different from a role with a $140,000 base salary but no bonus.

Key Factors That Influence Your New York CPA Salary

While averages provide a useful benchmark, your individual salary as a CPA in New York will be determined by a specific combination of factors. Mastering and strategically navigating these variables is the key to maximizing your earning potential. This is where you move from being a passenger in your career to being the driver.

###

1. Level of Education & Certifications

The foundation of a CPA career is education, but not all educational paths are created equal in the eyes of employers.

- The 150-Hour Rule: To be licensed as a CPA in New York, you need 150 semester hours of college education. A standard bachelor's degree is only 120 hours. Therefore, a graduate degree is the most common path to fulfilling this requirement.

- Master of Science in Accounting (MAcc/MSA): This is the most direct route. A MAcc program is specifically designed to provide the advanced accounting coursework needed for the CPA exam and to meet the 150-hour rule. Graduates with a MAcc are often seen as more prepared for the technical rigors of the job and may command a slight starting salary premium over those with only a bachelor's degree.

- Master of Business Administration (MBA) with Accounting Concentration: An MBA from a top-tier business school can be a powerful salary booster, particularly for those aiming for leadership roles in corporate finance (e.g., Controller, VP Finance, CFO). While a general MBA isn't enough, one with a strong accounting focus provides both the technical skills and the broader strategic, leadership, and management training that is highly valued. An MBA from a school like NYU Stern or Columbia Business School can lead to significantly higher starting salaries and a faster track to executive positions.

- Additional Certifications: While the CPA is the gold standard, layering on other certifications can enhance your expertise and pay, especially in specialized niches:

- Certified Fraud Examiner (CFE): Essential for forensic accounting roles.

- Certified Information Systems Auditor (CISA): Commands a premium in the high-demand field of IT audit.

- Chartered Financial Analyst (CFA): Highly valuable for CPAs in investment management, equity research, or M&A advisory.

- Personal Financial Specialist (PFS): A credential for CPAs who specialize in personal financial planning.

Impact on Salary: A candidate with a MAcc or a relevant MBA will typically start at the higher end of the entry-level salary band. Holding a CISA or CFE can add a 5-15% salary premium for specialized roles.

###

2. Years of Experience (The Career Trajectory)

As detailed in the previous section, experience is the primary engine of salary growth. Here’s a more granular look at the value proposition at each stage:

- 0-2 Years (Associate Level): At this stage, you are learning the fundamentals. Your value is in your ability to learn quickly, execute tasks diligently, and be a reliable team member. Salary growth is steady but not dramatic. The primary goal is absorbing as much knowledge as possible.

- 3-5 Years (Senior Level): This is a critical inflection point. As a senior, you are no longer just executing tasks; you are beginning to manage them. You're responsible for reviewing the work of junior staff, managing smaller engagements or sections of larger ones, and having direct client contact. Your value increases exponentially, and this is where you see the first major jump in salary. Leaving public accounting after reaching the "Senior" level is a very common and lucrative exit strategy.

- 6-10 Years (Manager Level): As a manager, you transition from managing work to managing people and client relationships. You are responsible for budgets, staffing, and the overall success of multiple engagements. Your technical skills are assumed; your value is now in your project management, leadership, and business development abilities. Salaries and bonuses rise substantially to reflect this responsibility.

- 10+ Years (Senior Manager/Director/Partner/Executive): At this pinnacle, you are a leader of the business.

- In Public Accounting, partners are part-owners of the firm, responsible for bringing in new business, managing a large portfolio of clients, and setting firm strategy. Their compensation is a share of the firm's profits and can easily reach the high six or even seven figures.

- In Industry, a CPA might become a Director of Finance, a Corporate Controller, or ultimately the Chief Financial Officer (CFO). In these roles, you are part of the executive team shaping the entire company's financial future. Compensation is a mix of high base salary, significant annual bonuses, and long-term incentives like stock equity, often totaling $300,000 to $500,000 or more for large corporations.

###

3. Geographic Location (Within New York)

Even within a high-paying state, location matters. The financial gravity of New York City creates a salary hierarchy across the state.

- New York City (The Five Boroughs): This is the highest-paying region in the state and one of the highest in the world for finance professionals. The sheer density of Fortune 500 headquarters, major financial institutions, and all Big Four and major national accounting firms creates intense competition for talent, driving salaries upward to offset the extremely high cost of living.

- NYC Suburbs (Long Island, Westchester County): Salaries in these areas are also very strong, often only slightly below NYC levels. Many large corporations have headquarters or major offices here (e.g., in White Plains, Melville). The compensation remains high to attract talent that might otherwise commute to the city.

- Upstate New York (Albany, Buffalo, Rochester, Syracuse): Salaries in major upstate cities are noticeably lower than in the NYC metro area. However, the cost of living is also substantially lower. A $100,000 salary in Buffalo or Rochester provides a significantly different lifestyle than the same salary in Manhattan. While the nominal figures are lower, the real-world purchasing power can be quite comparable or even better. Albany, as the state capital, has a strong concentration of government accounting roles.

Salary Comparison Example (Mid-Career CPA):

- New York City: $125,000

- White Plains (Westchester): $118,000

- Albany: $105,000

- Buffalo: $98,000

*Source: Analysis based on data patterns from Salary.com and Payscale cost-of-living calculators.*

###

4. Company Type & Size

Where you work is as important as what you do. The culture, work-life balance, and compensation structure vary dramatically across different types of employers.

- Public Accounting - The Big Four (Deloitte, PwC, EY, KPMG): These firms offer the most prestigious entry point into the profession. They typically pay the highest starting salaries and bonuses for entry-level talent. The work is demanding, with long hours, but the training is world-class, and the resume credential is unparalleled. A few years at a Big Four firm in NYC is a springboard to high-level roles in any other sector.

- Public Accounting - Mid-Size and Regional Firms (e.g., BDO, Grant Thornton, RSM, or NY-specific firms): These firms offer a compelling alternative. Salaries may be slightly lower than the Big Four, but they often provide a better work-life balance and broader exposure to different aspects of an engagement earlier in one's career. You might work on the entire audit for a mid-sized client, rather than just a small section of a massive conglomerate's audit.

- Corporate/Industry Accounting - Fortune 500: Working "in-house" for a large, publicly traded company. These roles often offer better work-life balance than public accounting, strong benefits, and competitive salaries, especially at the manager level and above. Roles include internal audit, financial reporting (SEC), and financial planning & analysis (FP&A).

- Corporate/Industry Accounting - Startups & Tech: This is a high-risk, high-reward environment. Base salaries might be lower than at a large corporation, but the compensation package could include significant stock options that could be worthless or worth a fortune depending on the company's success. The work is often fast-paced and less structured, requiring a CPA who is adaptable and can build financial processes from the ground up.

- Government (Federal, State, City): Roles with agencies like the IRS, SEC, NYS Comptroller's Office, or NYC Comptroller's Office offer the greatest job security and work-life balance. Base salaries are generally lower than in the private sector, but the benefits packages, including pensions, are often superior.

- Non-Profit: Working for a non-profit or educational institution is driven by a passion for the mission. Compensation is almost always lower than in the for-profit sectors, but the work can be incredibly rewarding.

###

5. Area of Specialization

Within the CPA world, not all practice areas are compensated equally. As you advance, specialization is the key to becoming a highly sought-after (and highly paid) expert.

- Audit/Assurance: The traditional path. It provides a fantastic foundation and is always in demand. Compensation is strong and follows the general trajectory outlined above.

- Tax: Similar to audit in terms of demand and structure. However, highly specialized tax areas can command a premium.

- International Tax: In a global hub like NYC, experts who understand cross-border transactions and transfer pricing are invaluable. This is a very lucrative niche.

- M&A Tax: CPAs who advise on the tax structure of mergers and acquisitions play a critical role in high-stakes deals and are compensated accordingly.

- Advisory/Consulting (The Highest Paying): This is where the top salaries are often found. These roles require a blend of deep accounting expertise and strategic business acumen.

- Transaction Advisory Services (TAS/M&A): Professionals in this group perform financial due diligence on deals. The work is intense and project-based, and compensation is very high, often rivaling that of investment banking at the junior levels.

- Forensic Accounting: Investigating white-collar crime, financial disputes, and fraud. It's a fascinating field that pays a premium for its investigative nature.

- IT Audit & Cybersecurity Risk: With the rise of digital business, CPAs who can audit and advise on IT systems, controls, and cybersecurity risks are in extremely high demand. A CPA with a CISA certification is in a powerful negotiating position.

###

6. In-Demand Skills

Your resume is more than a list of jobs; it's a portfolio of skills. Cultivating the right skills can directly translate to a higher salary.

- Technical Skills:

- Data Analytics & Visualization: Proficiency in tools like Tableau, Power BI, and Alteryx is no longer a "nice to have"; it's becoming a core competency. CPAs who can not just analyze data but also present it in a compelling, visual way are more effective advisors.

- Advanced Excel: Mastery of pivot tables, complex formulas, VLOOKUP/INDEX(MATCH), and macros is a baseline expectation.

- ERP Systems Knowledge: Experience with large-scale Enterprise Resource Planning systems like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valuable for industry roles.

- AI and Automation: A forward-looking CPA is learning about how robotic process automation (RPA) and artificial intelligence can streamline compliance tasks, freeing them up for higher-value advisory work.

- Soft Skills:

- Communication & Presentation: The ability to explain complex financial concepts to non-financial stakeholders (like a CEO or a marketing team) is a superpower.

- Business Acumen: Understanding the "why" behind the numbers. A great CPA doesn't just report what happened; they understand the business operations and market forces that drove the results and can advise on future strategy.

- Leadership & Mentorship: As you become more senior, your ability to lead teams, mentor junior staff, and manage client relationships becomes your most valuable asset.

- Negotiation: This applies not just to deals, but to your own career. The ability to articulate your value and negotiate your compensation is a skill that pays direct dividends.

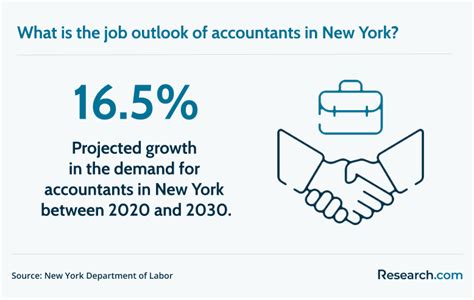

Job Outlook and Career Growth for CPAs in New York

A high salary today is attractive, but long-term career stability and growth potential are what make a profession a truly wise investment of your time and effort. For CPAs, especially in a dynamic economic hub like New York, the future looks both promising and transformative.

### The Data-Driven Outlook

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative long-term forecast. In its 2022-2032 projections, the BLS estimates that employment for accountants and auditors will grow by 4 percent nationwide. This translates to about **126,5