Decoding Your Earning Potential: A Comprehensive Guide to Credit Analyst Salaries

In the world of finance, credit analysts are the gatekeepers of risk, playing a critical role in the health and stability of the lending economy. If you have a sharp analytical mind and a passion for finance, this career path offers both intellectual challenge and significant financial rewards. But what can you realistically expect to earn?

This in-depth guide will break down the salary a credit analyst can command, exploring everything from national averages to the key factors that can dramatically increase your take-home pay. With salaries ranging from a solid starting point of around $60,000 for entry-level positions to well over $120,000 for senior, specialized roles, a career as a credit analyst is a lucrative and stable choice.

What Does a Credit Analyst Do?

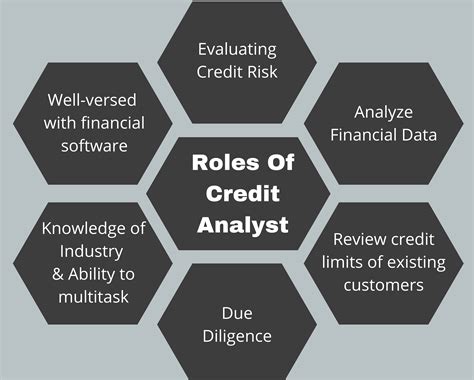

Before diving into the numbers, it's essential to understand the role. Think of a credit analyst as a financial detective. Their primary responsibility is to evaluate the creditworthiness of individuals or businesses applying for loans, credit lines, or other forms of financing.

Key responsibilities include:

- Analyzing Financial Statements: Scrutinizing income statements, balance sheets, and cash flow statements to assess financial health.

- Risk Assessment: Using financial ratios, industry trends, and qualitative data (like management quality) to determine the level of risk associated with a potential borrower.

- Due Diligence: Conducting research on clients and industries to build a complete financial picture.

- Reporting and Recommendation: Preparing detailed reports that summarize their findings and making a clear recommendation to approve, deny, or modify a credit request.

By making sound judgments, credit analysts help financial institutions minimize losses from bad loans and ensure capital is allocated wisely.

Average Credit Analyst Salary

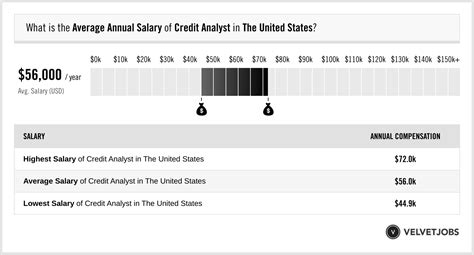

So, what does this critical work pay? While figures vary, we can establish a strong baseline by looking at data from several authoritative sources.

Across the United States, the median annual salary for a credit analyst typically falls in the range of $75,000 to $85,000.

Let's look at a few specific sources (data as of late 2023/early 2024):

- Salary.com reports the median U.S. salary for a Credit Analyst II (a mid-level role) to be around $82,490, with the typical range falling between $73,590 and $92,290.

- Payscale places the average credit analyst salary at $63,600, but this figure includes a wider range of entry-level positions. Their data shows a clear progression with experience, with late-career professionals earning an average of $85,000 or more.

- Glassdoor lists a national average base pay of $78,500 per year, with total pay (including potential bonuses) often reaching into the mid-$80,000s.

It is also useful to consider data from the U.S. Bureau of Labor Statistics (BLS). While the BLS doesn't have a dedicated category for "Credit Analyst," the role shares significant overlap with "Financial Analysts." For this broader category, the BLS reported a median annual wage of $99,030 in May 2023. This higher figure reflects the inclusion of highly paid analysts in investment banking and corporate finance, highlighting the upper potential of an analytical career path.

Key Factors That Influence Salary

Your base salary is just a starting point. Several key variables can significantly impact your earning potential. Understanding these factors is crucial for maximizing your income throughout your career.

### Level of Education

A bachelor's degree in finance, accounting, economics, or a related field is the standard entry requirement. However, advanced education can provide a substantial salary boost. Professionals with a Master of Business Administration (MBA) or a specialized master's degree like a Master of Science in Finance (MSF) often command higher starting salaries and are fast-tracked into senior or managerial roles, particularly at larger institutions.

### Years of Experience

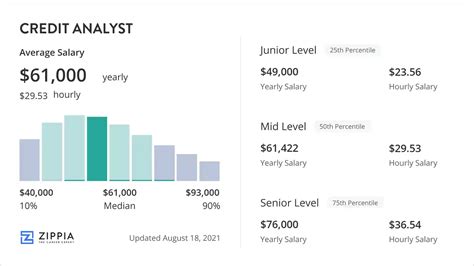

Experience is arguably the most significant driver of salary growth. The career ladder and its corresponding pay bumps typically look like this:

- Entry-Level Credit Analyst (0-2 years): In this stage, you're learning the fundamentals. Expect a salary range of $60,000 to $75,000.

- Mid-Career Credit Analyst (3-9 years): With proven skills and the ability to handle more complex portfolios, your salary will grow into the $75,000 to $100,000 range. You may hold a title like Credit Analyst II or III.

- Senior Credit Analyst / Credit Manager (10+ years): Seasoned experts who manage teams, handle the largest client accounts, or set credit policy can earn $100,000 to $130,000+. Top performers in high-stakes environments can exceed this significantly.

### Geographic Location

Where you work matters. Major financial hubs with a high concentration of banks and corporations, along with a higher cost of living, offer much higher salaries. For example, a credit analyst in New York, NY, San Francisco, CA, or Boston, MA will almost certainly earn more than one in a smaller midwestern city. According to Salary.com's location-based tools, salaries in major metropolitan areas can be 15-25% higher than the national average.

### Company Type

The type of company you work for is a massive differentiator in compensation.

- Commercial and Retail Banks: The most common employers for credit analysts. They offer competitive, stable salaries and a traditional career path.

- Investment Banks & Private Equity: These firms deal with complex, high-stakes transactions like leveraged buyouts and large corporate bond issues. The work is demanding, but compensation, especially bonuses, is significantly higher.

- Credit Unions: These member-owned institutions often have a community focus. Salaries may be slightly lower than at large commercial banks, but they often offer excellent benefits and a better work-life balance.

- Fintech Companies: The burgeoning financial technology sector relies on credit analysts for underwriting and risk modeling. They offer competitive salaries, often supplemented with stock options, in a fast-paced, innovative environment.

- Corporations (B2B): Large companies that sell goods or services to other businesses on credit (e.g., manufacturing, technology) employ credit analysts to manage their accounts receivable risk. Salaries are competitive with the banking sector.

### Area of Specialization

Not all credit analysis is the same. Specializing in a particular area can unlock higher earning potential.

- Commercial Credit: Analyzing loans for small-to-medium-sized businesses. This is the core of the profession with a wide salary range based on the size of the loans.

- Corporate/Investment-Grade Credit: Analyzing multi-million or billion-dollar credit facilities and bonds for large, publicly traded companies. This is a highly analytical and lucrative field.

- Consumer Credit: Focusing on mortgages, auto loans, and credit cards. While essential, these roles are often more process-driven and typically fall on the lower end of the analyst salary scale.

- High-Yield or Distressed Debt: A highly specialized and complex field involving the analysis of companies with poor credit ratings. This area carries high risk and commands very high salaries for its experts.

Job Outlook

The future for skilled credit analysts looks bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for the related category of "Financial Analysts" will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by an increasingly complex global economy, the continuous development of new financial products, and an ever-present need for rigorous risk management. As technology automates more routine tasks, the demand for analysts who can perform deep, insightful, and strategic evaluations will only increase.

Conclusion

A career as a credit analyst offers a clear path to a comfortable and rewarding financial future. With a solid starting salary and a national median approaching six figures, the profession provides excellent financial stability.

The key takeaway is that your earning potential is largely in your hands. By focusing on continuous learning, gaining experience with complex portfolios, considering advanced education, and strategically choosing your location, employer, and specialization, you can build a highly successful and lucrative career as a gatekeeper of the financial world. It is an ideal path for anyone who is analytical, detail-oriented, and ready to make a tangible impact.