When you receive a job offer or negotiate a raise, the most prominent number is almost always the salary. But what does that figure truly represent? Understanding the concept of "basic salary" is the first and most critical step in evaluating your compensation, planning your finances, and charting your career's financial trajectory. It's the bedrock upon which your entire earnings package is built. This article will define basic salary, explore the key factors that determine its size, and empower you to become a more informed professional.

What is Basic Salary?

In the simplest terms, basic salary is the fixed, regular amount of money an employer pays an employee for their work over a specific period, typically stated as an annual figure (e.g., $60,000 per year). This amount is paid before any additions, like bonuses or overtime pay, and before any deductions, like taxes, health insurance premiums, or retirement contributions.

Think of it as the core component of your compensation agreement. It is the guaranteed income you can count on in each pay period, barring any changes to your employment status.

It's crucial to distinguish basic salary from other related terms:

- Gross Salary: This is your basic salary *plus* any additional earnings like bonuses, allowances (e.g., for housing or transport), and overtime pay. It's your total pre-tax earnings.

- Net Salary (or Take-Home Pay): This is the actual amount of money that gets deposited into your bank account after all deductions—such as federal and state taxes, Social Security, Medicare, 401(k) contributions, and health insurance costs—have been taken out of your gross salary.

- Total Compensation: This is the most comprehensive view of your earnings. It includes your basic salary, bonuses, and the financial value of all benefits, such as stock options, retirement matching, health insurance coverage, and paid time off.

Understanding this distinction is vital. A job offer with a high basic salary but poor benefits could be less valuable than an offer with a slightly lower basic salary but an excellent total compensation package.

Average Salary: Putting Basic Salary in Context

While there is no universal "average basic salary" that applies to everyone, we can look at national data to get a baseline. According to the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers in the United States was $1,145 in the fourth quarter of 2023. This translates to a median annual basic salary of approximately $59,540.

However, this is just a national median. To make this concept more concrete, let's examine a specific role. For a Financial Analyst, a common professional role, the salary landscape looks like this:

- The BLS reports the median annual wage for financial analysts was $96,220 as of May 2022.

- According to Payscale.com, the average *base salary* for a Financial Analyst is around $71,500 per year, with a typical range falling between $55,000 for entry-level positions and $97,000 for experienced professionals.

- Glassdoor reports a similar average base pay of $80,500 per year, but its "Total Pay" estimate, which includes bonuses and other cash compensation, is around $93,000.

This data clearly shows how the basic salary is the foundation, with additional compensation creating a higher overall earnings figure.

Key Factors That Influence Your Basic Salary

Your basic salary isn't a random number. It's determined by a complex interplay of various factors. Understanding these levers is key to maximizing your earning potential throughout your career.

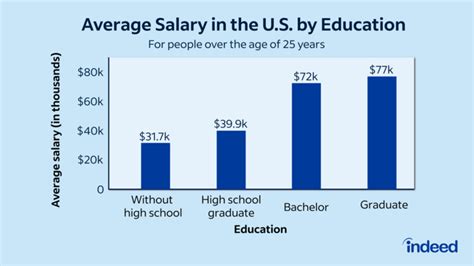

Level of Education

Generally, a higher level of formal education correlates with a higher basic salary. An employer sees an advanced degree (like a Master's, MBA, or Ph.D.) as a signal of specialized knowledge, dedication, and analytical prowess. For example, a candidate with a Master's in Finance will likely command a higher starting basic salary for a Financial Analyst role than a candidate with only a Bachelor's degree, all other factors being equal.

Years of Experience

Experience is arguably the most significant driver of basic salary growth. Companies pay for proven expertise and a track record of success.

- Entry-Level (0-2 years): Professionals at this stage are typically offered a lower base salary as they are still learning and require more supervision.

- Mid-Career (3-8 years): With several years of experience, employees have developed valuable skills and can manage projects independently, justifying significant salary increases.

- Senior/Lead (8+ years): Senior professionals are paid a premium for their deep industry knowledge, leadership skills, and ability to drive strategy.

Using our Financial Analyst example from Payscale, the journey from an entry-level salary near $55,000 to a senior-level salary approaching $100,000 is a direct result of accumulated experience.

Geographic Location

Where you work matters immensely. Companies in major metropolitan areas with a high cost of living must offer higher basic salaries to attract and retain talent. According to data from Salary.com, a Marketing Manager in San Francisco, CA, can expect a basic salary approximately 26% higher than the national average, while the same role in Biloxi, MS, might be 12% lower. This "cost-of-living adjustment" is a critical factor in evaluating job offers in different cities.

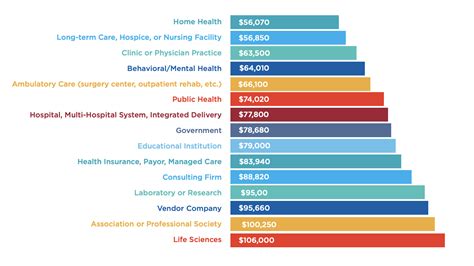

Company Type and Industry

The type of company you work for and the industry it operates in have a major impact.

- Company Size: Large, established corporations (like those in the Fortune 500) often have structured pay bands and can offer higher and more stable basic salaries.

- Startups: Early-stage startups may offer a lower basic salary but compensate with potentially lucrative stock options or a more significant ownership stake.

- Industry: Industries with high demand for talent and high-profit margins, such as technology, pharmaceuticals, and finance, typically offer higher basic salaries than industries like retail or non-profit.

Area of Specialization

Within any given profession, certain specializations are more in-demand than others. For example, within the field of software engineering, an engineer specializing in Artificial Intelligence (AI) or Cybersecurity will almost certainly command a higher basic salary than a generalist web developer due to the specialized skills and high market demand.

Career Outlook and Salary Growth

Your basic salary is not static; it is designed to grow over time. The BLS Occupational Outlook Handbook is an excellent resource for understanding the growth prospects of specific careers. For example, the employment of financial analysts is projected to grow 8 percent from 2022 to 2032, much faster than the average for all occupations.

This positive outlook means that competition for skilled analysts will likely remain strong, creating upward pressure on wages. Your basic salary will typically increase through:

1. Annual Merit Increases: Most companies offer a 3-5% raise each year based on performance.

2. Promotions: Earning a promotion to a higher level of responsibility usually comes with a substantial salary jump, often in the 10-20% range.

3. Changing Jobs: Moving to a new company is often the fastest way to achieve a significant increase in your basic salary, as you can negotiate from a position of strength based on your newly acquired skills and market value.

Conclusion: You Are the Architect of Your Earnings

Defining basic salary is more than a simple vocabulary lesson; it's about understanding the core of your financial relationship with your employer.

Key Takeaways:

- Basic salary is your fixed, guaranteed pay before any extras are added or deductions are made.

- It is the foundation of your gross salary and total compensation package.

- Your basic salary is determined by your education, experience, location, company, and specialization.

- Understanding these factors gives you the power to negotiate effectively and make strategic career choices.

By mastering this fundamental concept, you transform from a passive recipient of a paycheck into an active architect of your financial future. Use this knowledge to evaluate offers, plan your career path, and ensure you are being compensated fairly for the valuable work you do.