Table of Contents

- [What Does a Danish Salary Tax Specialist Do?](#what-does-a-danish-salary-tax-specialist-do)

- [Average Danish Tax Specialist Salary: A Deep Dive](#average-danish-tax-specialist-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Danish Tax Right for You?](#conclusion-is-a-career-in-danish-tax-right-for-you)

Denmark. The word conjures images of minimalist design, *hygge*, and progressive social policies. It’s also synonymous with one of the most comprehensive welfare states in the world, funded by a famously complex and high-tax system. For many, the phrase "Denmark salary tax" sparks a mix of curiosity and apprehension. But for a select group of highly skilled professionals, it represents a challenging and incredibly rewarding career path. If you are analytical, meticulous, and fascinated by the intricate dance between law, finance, and business strategy, a career as a Danish Tax Specialist could be your calling.

This is not just a numbers game; it's about becoming a trusted advisor who navigates one of the world's most sophisticated fiscal landscapes. The demand for experts who can demystify the Danish tax code for both multinational corporations and high-net-worth individuals is perpetually strong, leading to exceptional job security and significant earning potential. According to data aggregated from sources like Glassdoor and Payscale, a mid-career Tax Consultant in Denmark can expect to earn a base salary between DKK 500,000 and DKK 750,000 annually (approximately $72,000 to $108,000 USD), with senior managers and partners earning substantially more.

I remember my first encounter with international tax law while helping a small tech firm expand into Europe. Navigating the Danish system felt like learning a new language, but the moment we successfully structured their payroll to be compliant and efficient was a profound victory. It was a clear demonstration that a tax specialist is not a mere compliance officer but a vital strategic partner in global business. This guide is built on that understanding—that behind the numbers and regulations lies a dynamic and intellectually stimulating profession.

This article will serve as your ultimate roadmap. We will dissect the role of a Danish Tax Specialist, conduct a deep dive into salary expectations, explore the factors that can maximize your earnings, analyze the long-term job outlook, and provide a concrete, step-by-step plan for launching your career in this elite field. Whether you're a student mapping out your future or a finance professional considering a specialization, prepare to uncover the lucrative and stable world of Danish salary tax.

---

What Does a Danish Salary Tax Specialist Do?

At its core, a Danish Salary Tax Specialist is a highly skilled professional who interprets, applies, and strategizes around Denmark's intricate tax laws, primarily as they relate to personal and corporate income. They are the essential bridge between individuals or companies and the Danish Tax Agency, *Skattestyrelsen*. Their work ensures compliance, minimizes tax burdens legally, and provides clarity in a system known for its complexity.

While the title might sound narrow, the role is multifaceted and varies depending on the specialist's focus—be it advising multinational corporations, guiding expatriates, or serving high-net-worth Danish residents. They are part accountant, part lawyer, and part business strategist, blending quantitative analysis with a deep understanding of legal frameworks.

Core Responsibilities and Daily Tasks:

A Danish Tax Specialist's responsibilities extend far beyond simply filling out tax returns. Their work is proactive, strategic, and advisory.

- Tax Advisory and Planning: This is the heart of the role. Specialists analyze a client's financial situation (or a company's operational structure) to develop long-term strategies that optimize their tax position. This could involve structuring executive compensation packages, advising on the tax implications of a business merger, or helping an expatriate take advantage of special tax schemes.

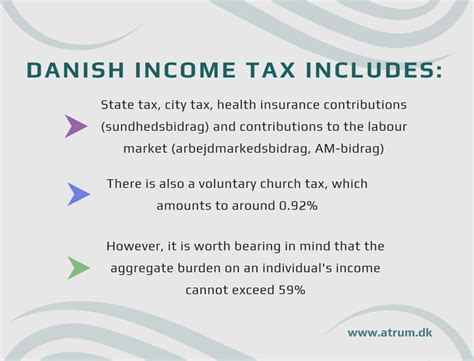

- Compliance and Reporting: Ensuring that all tax filings are accurate, complete, and submitted on time is a fundamental duty. This includes preparing and reviewing corporate income tax returns, individual tax returns (*årsopgørelse*), and ensuring correct withholding of A-tax (*A-skat*) and calculation of labor market contributions (*AM-bidrag*).

- International and Expatriate Tax Services: Denmark's position as a global business hub creates immense demand for specialists in cross-border taxation. This involves advising on tax treaties to prevent double taxation, navigating the rules for foreign income, and guiding expats through unique Danish programs like the highly attractive Expat Tax Scheme (forskerordningen), which offers a significantly reduced flat tax rate for a limited period.

- Liaison with Tax Authorities: When *Skattestyrelsen* has questions or initiates an audit, the tax specialist acts as the client's primary representative. They prepare documentation, articulate the client's tax positions, and negotiate resolutions. This requires impeccable communication skills and a commanding knowledge of tax law.

- Research and Analysis: Tax laws are not static. Specialists spend a considerable amount of time researching new legislation, court rulings, and administrative pronouncements from the tax authorities to keep their clients informed and their strategies current.

A Day in the Life of a Senior Tax Consultant in Copenhagen:

To make this tangible, let's imagine a typical Tuesday for "Mette," a Senior Tax Consultant at a major accounting firm in Copenhagen.

- 9:00 AM - 10:30 AM: Mette starts her day reviewing emails and prioritizing tasks. Her top priority is a call with the HR director of a US-based tech company planning to open a Danish office. She spends an hour preparing, reviewing notes on the US-Denmark tax treaty and modeling the comparative costs of hiring employees versus using independent contractors.

- 10:30 AM - 12:00 PM: The video conference with the US client. Mette confidently explains the Danish payroll system: the distinction between A-tax and B-tax, the mandatory 8% *AM-bidrag*, and the ATP pension contributions. She fields complex questions about the 27% Expat Tax Scheme, outlining the strict eligibility criteria for their key hires.

- 12:00 PM - 1:00 PM: Lunch with her team. This is an informal but important time to discuss ongoing cases, share insights from recent interactions with *Skattestyrelsen*, and mentor junior associates.

- 1:00 PM - 3:30 PM: Deep work. Mette dives into a complex transfer pricing analysis for a large Danish pharmaceutical client. This involves ensuring that transactions between the Danish parent company and its foreign subsidiaries are priced at "arm's length" to comply with both Danish and international OECD guidelines. The work is meticulous, requiring both economic modeling and legal interpretation.

- 3:30 PM - 4:30 PM: Mette reviews the annual tax return for a high-net-worth individual that a junior associate prepared. She flags a missed deduction for home office expenses and adds a note explaining a complex stock option transaction, preempting potential questions from the tax authorities.

- 4:30 PM - 5:30 PM: She dedicates the last hour to professional development, reading a new ruling from the Danish National Tax Tribunal (*Landsskatteretten*) that could impact how stock-based compensation is taxed. She summarizes the key points and drafts a memo to share with her department, ensuring the entire team stays ahead of the curve.

This snapshot reveals a career that is anything but monotonous. It's a dynamic blend of client interaction, deep analytical work, and continuous learning, with a direct and tangible impact on business and personal finance.

---

Average Danish Tax Specialist Salary: A Deep Dive

A career as a tax specialist in Denmark is not only intellectually rewarding but also financially lucrative. The combination of high demand for expertise and the critical nature of the work translates into strong compensation packages. Salaries are competitive with other elite professions in finance and law, and they grow significantly with experience and specialization.

It's important to note that compensation in Denmark is more than just the monthly paycheck. The total package often includes a substantial mandatory pension contribution (*firmapension*), comprehensive health benefits, and other perks. When evaluating salary data, we will focus on the base salary (*grundløn*) but also acknowledge these crucial components. All figures are presented in Danish Kroner (DKK), with approximate US Dollar (USD) conversions for international context (using a rough exchange rate of 7 DKK to 1 USD).

National Salary Averages and Ranges

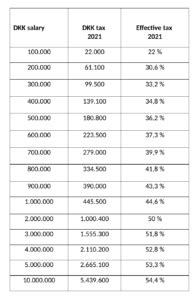

Based on an aggregation of data from professional recruitment firms, salary aggregators like Payscale and Glassdoor, and industry reports, the salary landscape for a tax specialist in Denmark is robust.

- Overall National Average Salary: For a professional with the title of "Tax Consultant" or "Tax Advisor," the national average base salary typically falls between DKK 540,000 and DKK 650,000 per year (approximately $77,000 - $93,000 USD).

However, this average figure masks a very wide range, heavily influenced by the factors we will explore in the next section. An entry-level associate will earn far less than a senior manager at a "Big Four" accounting firm or an in-house tax director at a multinational corporation.

A more useful way to understand the potential is to break it down by experience level.

Salary by Experience Level

The career trajectory in tax advisory is well-defined, with clear steps from junior to senior levels, each accompanied by a significant jump in compensation.

| Experience Level | Typical Title(s) | Average Annual Base Salary (DKK) | Average Annual Base Salary (Approx. USD) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Tax Associate, Junior Tax Consultant, Revisor Trainee | DKK 380,000 - DKK 480,000 | $54,000 - $69,000 | Supporting senior staff, preparing basic tax computations, data gathering, research tasks, compliance work. |

| Mid-Career (3-7 Years) | Tax Consultant, Senior Tax Associate, Tax Advisor | DKK 500,000 - DKK 750,000 | $71,000 - $107,000 | Managing a portfolio of smaller clients, handling more complex compliance, drafting advisory memos, mentoring junior staff. |

| Senior-Level (8-15+ Years) | Senior Tax Manager, Senior Tax Consultant, Tax Director | DKK 800,000 - DKK 1,200,000+ | $114,000 - $171,000+ | Leading client engagements, developing tax strategies, managing teams, business development, specializing in high-value areas. |

| Partner / Director Level | Partner (Accounting/Law Firm), Head of Tax (Corporate) | DKK 1,500,000 - DKK 3,000,000+ | $214,000 - $428,000+ | Firm leadership, driving firm strategy, managing the largest client relationships, significant business origination. |

*Sources: Salary data is an aggregation and synthesis of figures reported by Glassdoor, Payscale, and major Danish and international recruitment agencies specializing in finance and accounting roles. Figures are indicative and can vary based on the factors discussed in the next section.*

Dissecting the Full Compensation Package

The base salary is only one piece of the puzzle in Denmark. A typical compensation package for a professional tax specialist includes several other valuable components:

- Pension (*Firmapension*): This is a critical and substantial part of Danish compensation. It's common for companies to contribute an additional 10-15% of the base salary to a private pension fund on the employee's behalf. For a senior manager earning DKK 900,000, this could mean an extra DKK 90,000 - DKK 135,000 in deferred compensation each year.

- Bonuses: Performance-based bonuses are common, especially in larger firms and in roles with business development responsibilities. For a Senior Manager, a bonus could range from 10% to 25% of their base salary, tied to individual, team, and firm performance.

- Health Insurance (*Sundhedsforsikring*): While Denmark has a public healthcare system, many professional firms offer supplementary private health insurance. This provides faster access to specialists and treatments, and is a highly valued benefit.

- Paid Time Off and Flexibility: Denmark is known for its excellent work-life balance. A standard contract includes 5-6 weeks of paid vacation per year. Increasingly, firms also offer flexible working hours and remote work options.

- Other Perks: Depending on the company and seniority, other benefits can include a company car or transportation allowance, a company-paid mobile phone and internet connection, subsidized lunch programs (*frokostordning*), and extensive funding for continuous professional education.

When considering a job offer in Denmark, it is essential to evaluate the total value of this entire package, not just the headline salary number. The mandatory pension contributions, in particular, represent a significant boost to long-term wealth accumulation.

---

Key Factors That Influence Your Salary

While the average salary data provides a solid baseline, your actual earnings as a Danish Tax Specialist will be determined by a combination of personal qualifications, career choices, and market dynamics. Understanding these levers is crucial for maximizing your income potential throughout your career. This section, the most detailed in our guide, breaks down the six primary factors that shape your paycheck.

###

1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation of your career and a primary determinant of your starting salary and long-term earning potential. In a field as technical as tax, employers place a very high premium on proven expertise.

Foundational Degrees:

A bachelor’s degree in Economics, Business Administration, Finance, Accounting, or Law is the standard entry requirement. However, in the competitive Danish market, a Master’s degree is often the de facto standard for top-tier roles. Prestigious programs from institutions like Copenhagen Business School (CBS) or Aarhus University are highly regarded by employers.

The most direct and respected academic path for a tax career within an accounting framework is the Master of Science in Business Economics and Auditing (*Cand.merc.aud. - CMA*). This degree is specifically designed to lead into the auditing and tax advisory profession and is a prerequisite for the highest professional certification.

The Impact of Elite Certifications:

While a Master's degree gets you in the door, elite professional certifications are what unlock the highest levels of the profession.

- *Statsautoriseret Revisor* (State-Authorised Public Accountant): This is the gold standard certification in Denmark, analogous to a CPA in the United States, but with a notoriously rigorous qualification process. To achieve this title, a candidate must complete the Cand.merc.aud. degree, undertake at least three years of practical training at an approved accounting firm, and pass a demanding set of written and oral examinations. A professional holding the *Statsautoriseret Revisor* title can expect a significant salary premium—often 20-30% or more—over non-certified peers with similar experience. They are qualified to sign audit reports and are seen as the highest authority in accounting and tax matters.

- *Advokat* (Lawyer) with Tax Specialization: The other primary path to the top of the profession is through law. An individual who has completed a law degree (*Cand.jur.*), passed the bar, and then specializes in tax law is highly sought after, particularly in tax litigation, M&A, and complex corporate structuring. Tax lawyers often work in specialized law firms or in the tax departments of the "Big Four," commanding salaries on par with their *Statsautoriseret Revisor* counterparts.

- International Certifications: While less common and not a substitute for Danish credentials, certifications like the US CPA or the UK's ACA/CTA can be valuable for specialists focusing on international tax, particularly when advising clients from those specific countries.

###

2. Years of Experience (The Career Trajectory)

Tax advisory is a field where experience compounds in value. Your salary doesn't just increase linearly; it grows exponentially as you transition through distinct career stages, moving from execution to management and finally to strategic leadership.

- Analyst/Associate Stage (0-3 years): In your first few years, your primary role is to learn and execute. You'll perform compliance tasks, conduct research, and support senior team members. Your salary will be at the lower end of the scale (e.g., DKK 380k-500k), but you are being paid to absorb knowledge and skills at an accelerated rate, typically within a structured training environment like a "Big Four" firm.

- Consultant/Senior Stage (3-7 years): This is the most significant growth phase. Having mastered the fundamentals, you now manage client relationships directly, handle more complex advisory work, and begin to develop a niche. Your salary sees a substantial jump (e.g., DKK 500k-750k) as you become a reliable profit-generator for the firm. Your performance bonus also becomes a more significant part of your compensation.

- Manager/Senior Manager Stage (8-15 years): At this level, your focus shifts from doing the work to managing the work and the people who do it. You are responsible for leading engagement teams, managing budgets, reviewing the work of junior staff, and nurturing key client relationships. Your expertise is deep, and you are a go-to person for complex issues. Salaries move firmly into the high-end range (e.g., DKK 800k-1.2M+), and your bonus potential is significant.

- Director/Partner Stage (15+ years): Reaching this pinnacle means you have transitioned from a technical expert to a business leader. Your responsibilities include strategic planning for the tax practice, bringing in new business, and serving as the ultimate relationship partner for the firm's most important clients. Compensation at this level is a mix of a high base salary and a share of the firm's profits, often reaching well into the millions of DKK annually.

###

3. Geographic Location

While Denmark is a relatively small country, there is a distinct salary differential based on location, driven primarily by the concentration of corporate headquarters and the cost of living.

- Copenhagen (København): The capital is the undisputed epicenter of business and finance in Denmark. It hosts the headquarters of most major Danish multinational corporations (like Maersk, Carlsberg, and Novo Nordisk) and is the primary location for the Danish offices of international banks and the "Big Four" accounting firms. Consequently, salaries for tax specialists in Copenhagen are the highest in the country, often 10-20% above the national average. The higher cost of living, particularly for housing, is a key factor in this salary premium.

- The Triangle Region (Aarhus, Vejle, Kolding): Aarhus, Denmark's second-largest city, is a major economic hub with a strong university and a growing business sector. The broader "Triangle Region" is an industrial and commercial powerhouse. Salaries here are very competitive but tend to lag slightly behind Copenhagen, perhaps by 5-10%.

- Other Major Cities (Odense, Aalborg): These cities have robust local economies and host offices for national accounting and law firms. Salaries will be solid and offer an excellent standard of living due to a lower cost of living than Copenhagen, but they will generally be closer to or slightly below the national average.

For a tax professional, a career based in Copenhagen generally offers the highest earning potential and the most opportunities for specialization in high-value international tax work.

###

4. Company Type & Size

The type of organization you work for has a profound impact on your salary, work culture, and career path.

- The "Big Four" Accounting Firms (PwC, Deloitte, EY, KPMG): These firms are the largest employers of tax specialists and are often considered the premier training ground. They offer highly structured career paths, exposure to the largest and most complex clients, and excellent international mobility. While starting salaries might be merely competitive, the potential for rapid advancement and high earnings at the manager and partner levels is enormous. The work is demanding, with long hours expected, especially during peak seasons.

- Mid-Tier and National Accounting Firms (e.g., BDO, Grant Thornton, Beierholm): These firms offer a different value proposition. While they may not always have the global reach of the Big Four, they often provide a better work-life balance. They serve a mix of large domestic companies and small-to-medium-sized enterprises (SMEs). Salaries are competitive but may peak slightly lower than at the Big Four, though partner compensation can still be very substantial.

- In-House Corporate Tax Departments: Large multinational corporations (e.g., Novo Nordisk, Ørsted, LEGO) have their own sophisticated in-house tax departments. Moving "in-house" from an advisory firm is a common career move for experienced professionals. The work is focused solely on the company's own tax affairs. Base salaries are often higher than in advisory firms for a comparable level of experience, and the work-life balance is typically much better. However, the bonus potential might be less, and the career path can be less structured.

- Specialized Tax Law Firms: These boutique firms focus on the highest-end, most complex tax issues, often related to litigation, M&A, and wealth structuring. They employ a mix of tax lawyers and other tax specialists. Working here requires an elite level of expertise, and compensation is at the very top of the market, often rivaling or exceeding Big Four partner pay.

###

5. Area of Specialization

Just as doctors specialize, so do tax professionals. Developing deep expertise in a high-demand niche is one of the most effective ways to accelerate your career and boost your salary.

- International Tax / Cross-Border Taxation: This is arguably the most lucrative specialization in a globalized economy like Denmark's. Experts who understand tax treaties, the Expat Tax Scheme, and the tax implications of global mobility are invaluable to multinational companies and their employees.

- Transfer Pricing: A highly specialized and quantitative sub-field of international tax. Transfer pricing experts ensure that transactions between related entities across different countries are priced at "arm's length." Given the intense focus on this area by tax authorities worldwide, specialists are in extremely high demand and command premium salaries.

- Mergers & Acquisitions (M&A) Tax: M&A tax specialists advise on the tax implications of buying, selling, and restructuring businesses. The work is high-stakes, transaction-based, and directly impacts the financial success of a deal. This is a high-pressure, high-reward field.

- Indirect Tax (VAT / *Moms*): Value-Added Tax (*moms* in Danish) is a complex area, especially for companies involved in cross-border trade of goods and services within the EU and globally. Experts in VAT are crucial for ensuring compliance and optimizing cash flow.

- Corporate Tax: This is the foundational area of specialization, focusing on the tax compliance and planning for corporations of all sizes. While broader, deep expertise in corporate tax is always in demand, especially for those who can navigate complex reorganizations and financing structures.

###

6. In-Demand Skills

Beyond