Navigating the professional world often feels like learning a new language—a language of contracts, benefits, and compensation structures. You've landed a promising job offer, and the word "salary" is front and center. It promises stability, a predictable paycheck, and a step up in your career. But as you envision the late nights and extra projects required to excel, a critical question surfaces: Does salary get paid overtime? The answer is far more complex than a simple "yes" or "no," and understanding its nuances is one of the most financially crucial aspects of your entire career.

This guide is designed to be your definitive resource, decoding the complex laws and unspoken rules that govern overtime for salaried professionals. We'll move beyond simple definitions to give you the strategic insights needed to protect your time, maximize your earnings, and make informed career decisions. The median salary for full-time wage and salary workers in the U.S. was approximately $59,540 per year in the fourth quarter of 2023, according to the U.S. Bureau of Labor Statistics (BLS). But what that salary truly means for your work-life balance and effective hourly wage depends entirely on your overtime eligibility. Early in my own career as a marketing coordinator, I was thrilled to get my first salaried position, assuming it was a mark of professional arrival. It was only after months of working 50-hour weeks for the same pay that I realized I was misclassified and was actually owed thousands in overtime—a lesson that fundamentally changed how I view and negotiate every job offer since.

This article will empower you with that same knowledge. We will dissect the legal framework, analyze salary data, and provide a clear roadmap for navigating your salaried career with confidence and authority.

### Table of Contents

- [What Does It Mean to Be a 'Salaried Employee'?](#what-does-it-mean-to-be-a-salaried-employee)

- [Salaried Employee Compensation: A Deep Dive](#salaried-employee-compensation-a-deep-dive)

- [Key Factors That Influence Salary and Overtime Eligibility](#key-factors-that-influence-salary-and-overtime-eligibility)

- [Job Outlook and the Future of Salaried Work](#job-outlook-and-the-future-of-salaried-work)

- [How to Successfully Navigate Your Salaried Career](#how-to-successfully-navigate-your-salaried-career)

- [Conclusion: Taking Control of Your Career and Compensation](#conclusion-taking-control-of-your-career-and-compensation)

What Does It Mean to Be a 'Salaried Employee'?

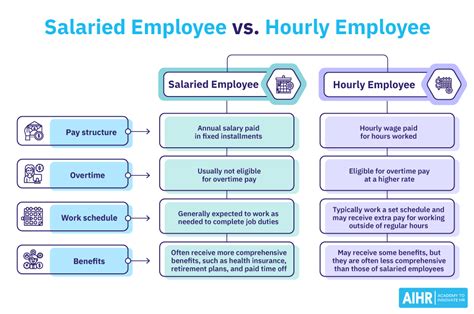

At its most basic, being a salaried employee means you receive a fixed, regular payment, typically expressed as an annual sum (e.g., $60,000 per year), that does not fluctuate based on the exact quantity or quality of work performed in a given pay period. However, this is just the starting point. The most critical distinction in the world of salaried work is not the payment method, but the legal classification that comes with it: Exempt vs. Non-Exempt.

This classification, governed by a federal law called the Fair Labor Standards Act (FLSA), is the sole determinant of whether a salaried employee is eligible for overtime pay.

- Non-Exempt Employees: These employees are *covered* by the FLSA's overtime rules. They must be paid overtime, typically at a rate of 1.5 times their regular hourly rate, for all hours worked over 40 in a workweek. While many non-exempt employees are paid hourly, it is perfectly legal for a company to pay a non-exempt employee a salary. In this case, their overtime pay is calculated by first determining their "regular rate" of pay (dividing the weekly salary by the number of hours it's intended to cover) and then paying 1.5x that rate for overtime hours.

- Exempt Employees: These employees are *exempt* from the FLSA's overtime rules. They are paid their full salary regardless of how many hours they work, be it 30 or 60 in a week. They are not legally entitled to additional pay for working more than 40 hours.

An employer cannot simply declare an employee "exempt" because they pay them a salary. To be legally classified as exempt, an employee must meet specific criteria defined by the Department of Labor (DOL), involving their salary amount and their specific job duties.

### Daily Tasks and Projects: An Illustrative Comparison

To make this distinction crystal clear, let's imagine two salaried marketing professionals working at the same company, both earning an annual salary of $55,000.

#### A Day in the Life: "Alex," a Non-Exempt Salaried Marketing Coordinator

- 8:55 AM: Alex logs into the company's time-tracking software.

- 9:00 AM - 12:00 PM: Alex's tasks are well-defined and procedural. He schedules social media posts using a pre-approved content calendar, pulls data for weekly performance reports using a standard template, and responds to customer comments based on a company style guide.

- 12:00 PM - 1:00 PM: Alex clocks out for an unpaid lunch break.

- 1:00 PM - 5:00 PM: He continues with his tasks, including data entry for a new marketing campaign and coordinating logistics for a small trade show, following a checklist provided by his manager.

- 5:30 PM: A rush project comes in from a senior manager. It involves compiling a large contact list that must be ready by the morning. Alex stays to work on it.

- 7:05 PM: Alex finishes the task and carefully clocks out. The extra 2 hours and 5 minutes he worked will be automatically calculated as overtime on his next paycheck. His focus is on accurately completing assigned tasks within a structured framework and logging his time precisely.

#### A Day in the Life: "Ben," an Exempt Salaried Marketing Manager

- 8:45 AM: Ben starts his day by reviewing his project pipeline and a list of strategic goals. He does not log his time.

- 9:00 AM - 12:00 PM: Ben's work involves significant discretion and independent judgment. He meets with the sales team to analyze last quarter's performance and brainstorm a new promotional strategy. He then spends two hours developing a creative brief for an external advertising agency, outlining campaign goals, target audience, and key messaging. He has the authority to approve the agency's initial concepts.

- 12:30 PM - 1:00 PM: Ben eats lunch at his desk while responding to emails.

- 1:00 PM - 5:00 PM: He interviews a candidate for a junior position on his team, making the hiring recommendation to the department director. He then finalizes the quarterly marketing budget, reallocating funds from an underperforming channel to a more promising one.

- 5:30 PM: Ben remembers he needs to prepare a presentation for a major client meeting the next morning.

- 7:30 PM: After finishing the presentation deck, he checks his email one last time and heads home. The extra 2.5 hours he worked are considered part of his professional responsibility. His compensation is tied to the successful management of his domain (projects, budget, personnel) rather than the specific hours worked.

The key difference lies in the nature of the work. Alex performs routine tasks under direct supervision. Ben exercises independent judgment, makes significant decisions, and manages major projects or parts of the business. This "duties test" is what, along with the salary threshold, legally separates them, and it's the foundation upon which your overtime rights are built.

Salaried Employee Compensation: A Deep Dive

Understanding compensation for salaried roles requires looking beyond the single number on your offer letter. The total picture includes the base salary, your overtime eligibility (or lack thereof), and other forms of compensation that contribute to your overall financial well-being.

First, it's crucial to establish a baseline. Since "salaried employee" is a payment classification, not a job title, we will look at salary data for common, typically salaried professions to provide a realistic benchmark. All data is subject to frequent change and varies widely based on the factors discussed in the next section.

National Average Salaries for Common Salaried Professions (as of early 2024):

- Software Developer:

- Median Salary: Approximately $132,000 per year according to the U.S. Bureau of Labor Statistics (BLS).

- Typical Range: Salary.com reports a range typically falling between $117,100 and $149,400.

- Marketing Manager:

- Median Salary: Approximately $140,040 per year according to the BLS.

- Typical Range: Payscale shows a range from roughly $52,000 for entry-level roles to over $120,000 for experienced managers.

- Accountant:

- Median Salary: Approximately $78,000 per year according to the BLS.

- Typical Range: Glassdoor reports a total pay range of $66,000 to $92,000, including bonuses and other compensation.

- Human Resources Manager:

- Median Salary: Approximately $130,000 per year according to the BLS.

- Typical Range: Salary.com indicates a common range between $115,100 and $146,500.

*Sources: U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, Salary.com, Payscale, Glassdoor. Data accessed in early 2024.*

### Salary Brackets by Experience Level

Salary progression is a primary driver of long-term career satisfaction. For most exempt professional roles, compensation grows significantly with experience, as greater responsibility and expertise are brought to bear.

Here is a representative table showing how salaries might progress in a professional field like project management, a role that is almost always salaried and typically exempt.

| Experience Level | Typical Title | Annual Salary Range (Illustrative) | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level | Project Coordinator | $55,000 - $75,000 | 0-2 years of experience. Often performs non-exempt duties like scheduling, tracking, and reporting under close supervision. May be eligible for overtime. |

| Mid-Career | Project Manager | $80,000 - $120,000 | 3-8 years of experience. Manages projects, budgets, and timelines with considerable autonomy. Almost always classified as exempt. |

| Senior | Senior Project Manager | $115,000 - $160,000 | 8-15 years of experience. Manages complex, high-stakes programs or a portfolio of projects. May supervise other project managers. Clearly exempt. |

| Leadership | Director of Project Mgmt. | $150,000 - $220,000+ | 15+ years of experience. Sets departmental strategy, manages the entire project management office (PMO), and has significant budgetary authority. Clearly exempt. |

*Salary ranges are illustrative and compiled from aggregate data from sources like Payscale and Glassdoor for project management roles in major U.S. markets.*

### The Hidden Variable: Calculating Your *Effective* Hourly Rate

For an exempt employee, the base salary is just one part of the equation. The most critical calculation you can make is your effective hourly rate. This reveals the true value of your time and helps you compare a demanding exempt role with a potentially more lucrative non-exempt one.

Formula: `Effective Hourly Rate = Annual Salary / (Average Weekly Hours Worked * 52 Weeks)`

Let's compare two offers:

- Offer A (Exempt): $80,000 salary. The company culture expects an average of 50 hours per week.

- `$80,000 / (50 hours * 52 weeks) = $80,000 / 2,600 hours = $30.77 per hour`

- Offer B (Non-Exempt): $70,000 salary ($33.65/hour for a 40-hour week). This role also requires an average of 50 hours per week.

- Weekly Pay Breakdown:

- First 40 hours: `40 * $33.65 = $1,346`

- Next 10 hours (overtime): `10 * ($33.65 * 1.5) = 10 * $50.48 = $504.80`

- Total Weekly Pay: `$1,346 + $504.80 = $1,850.80`

- Total Annual Pay: `$1,850.80 * 52 weeks = $96,241.60`

In this realistic scenario, the lower base salary results in over $16,000 more in annual income due to guaranteed overtime pay. This calculation is essential when evaluating a job offer for an exempt position where you anticipate working long hours.

### Beyond the Base: Other Compensation Components

Total compensation for salaried professionals, especially in senior roles, often includes more than just the base pay.

- Bonuses: These are often tied to individual, team, or company performance. They can range from a few thousand dollars to a significant percentage of one's annual salary.

- Profit Sharing: A plan that gives employees a share in the company's profits. This is more common in private companies or partnerships.

- Stock Options/Restricted Stock Units (RSUs): Common in startups and publicly traded tech companies, these provide an ownership stake in the business, which can be highly lucrative if the company performs well.

- Benefits Package: The value of health insurance, retirement contributions (e.g., 401(k) matching), paid time off, and other perks can add tens of thousands of dollars to your total compensation package and should be carefully evaluated.

When considering a salaried role, you must analyze the entire compensation structure to understand its true value.

Key Factors That Influence Salary and Overtime Eligibility

Your compensation and, critically, your right to overtime pay, are not determined by a single factor. They are the result of a complex interplay between federal and state law, your personal qualifications, and the specifics of your employer. Understanding these factors is the key to protecting your rights and maximizing your earning potential.

###

The Legal Foundation: The Fair Labor Standards Act (FLSA)

This is the cornerstone of all overtime law in the United States. The FLSA mandates that for an employee to be "exempt" from overtime, they must satisfy three tests:

1. The Salary Basis Test: The employee must be paid on a salary basis, meaning they receive a predetermined amount of pay each pay period that is not subject to reduction because of variations in the quality or quantity of the work performed.

2. The Salary Level Test: The employee must be paid a salary that meets a minimum specified amount. As of January 1, 2020, the federal threshold is $684 per week, or $35,568 per year. *Note: The Department of Labor has proposed significant increases to this threshold, so it is vital to check the current standard.* If you are paid a salary below this level, you are automatically non-exempt and eligible for overtime, regardless of your job duties.

3. The Duties Test: This is the most complex and often misapplied test. The employee’s primary job duties must meet the criteria for one of the FLSA's specific exemptions. The most common are:

- Executive Exemption: The employee's primary duty must be managing the enterprise or a recognized department. They must customarily and regularly direct the work of at least two or more other full-time employees and have the authority to hire or fire other employees (or their suggestions on these matters must be given particular weight). Think: Department Director, Shift Supervisor.

- Administrative Exemption: The employee's primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. Critically, their primary duty must include the exercise of discretion and independent judgment with respect to matters of significance. This is a common point of misclassification. An executive assistant who simply manages a calendar is likely non-exempt. An executive assistant who also manages the office budget, negotiates with vendors, and plans major company events is likely exempt. Think: Human Resources Manager, Financial Analyst, Marketing Strategist.

- Professional Exemption (Learned and Creative):

- Learned Professional: The primary duty is work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction. Think: Doctors, Lawyers, Engineers, Accountants, Scientists.

- Creative Professional: The primary duty is work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor. Think: Graphic Artists, Writers, Musicians, Actors.

- Computer Employee Exemption: The employee must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field. Their primary duties must consist of tasks like the application of systems analysis techniques, or the design, development, documentation, analysis, creation, testing, or modification of computer systems or programs. *Note: Employees engaged in the manufacture or repair of computer hardware are typically not exempt under this provision.*

- Outside Sales Exemption: The employee's primary duty must be making sales or obtaining orders or contracts, and they must be customarily and regularly engaged *away from* the employer's place of business.

Misclassification is common. Many employers mistakenly believe that putting an employee on salary or giving them an impressive title like "manager" automatically makes them exempt. If an employee's actual day-to-day duties do not align with these specific tests, they may be legally entitled to back pay for overtime.

###

Level of Education

While a college degree itself doesn't automatically make you exempt, it is often a prerequisite for jobs that fall under the "Learned Professional" exemption.

- Direct Impact: Certain degrees are explicitly linked to exempt status. Lawyers (J.D.), doctors (M.D.), and certified public accountants (CPAs) hold roles where the educational requirement is central to their professional exemption.

- Indirect Impact: A bachelor's or master's degree (e.g., an MBA) qualifies you for higher-level positions that are more likely to involve the strategic decision-making and managerial duties required for the Administrative or Executive exemptions. A candidate with a master's degree in marketing is more likely to be hired as a "Marketing Strategist" (exempt) than a "Marketing Assistant" (likely non-exempt). Advanced certifications, such as a Project Management Professional (PMP) or a senior-level cybersecurity certification, can also serve as evidence of the advanced knowledge required for exemption.

###

Years of Experience

Experience is directly correlated with both salary and the likelihood of being classified as exempt.

- Entry-Level (0-2 years): Employees in their first professional roles often perform tasks that are more procedural and less strategic. A junior accountant may spend their days on data entry and reconciliation, tasks that don't meet the "discretion and independent judgment" standard. They are more likely to be salaried non-exempt, earning overtime. Their base salary will be at the lower end of the professional scale.

- Mid-Career (3-8 years): As professionals gain experience, they are entrusted with more responsibility. That junior accountant may be promoted to a Senior Accountant role, where they now analyze financial statements, advise management on spending, and help prepare the company budget. These duties likely qualify them for the administrative exemption. Their salary increases substantially to reflect this higher level of responsibility, and they lose overtime eligibility.

- Senior/Leadership (8+ years): At this stage, professionals are not just performing tasks; they are setting strategy and managing people. They clearly meet the Executive or high-level Administrative exemption criteria. Their compensation shifts further away from hourly work and more towards performance-based incentives like large bonuses and stock options.

###

Geographic Location

While the FLSA sets the federal floor, many states and even some cities have enacted their own labor laws that provide greater protection for employees. This is a critical factor that can change your overtime eligibility.

- Higher Salary Thresholds: Several states require employers to pay a much higher salary than the federal minimum of $35,568/year to classify an employee as exempt.

- California: As of 2024, the salary threshold for exempt employees is two times the state minimum wage for full-time employment, which amounts to $66,560 per year.

- New York: The thresholds vary by region, with a high of $1,200 per week ($62,400 per year) in New York City, Westchester, and Long Island, and slightly lower rates for the rest of the state.

- Washington: The state is phasing in increases, with the 2024 threshold at 2 times the state minimum wage, or approximately $67,724.80 per year.

- Stricter Duties Tests: Some states have more stringent definitions for their duties tests, making it harder for employers to classify employees as exempt. California, for example, has a quantitative rule requiring an exempt employee to spend more than 50% of their time performing exempt duties.

High-Paying vs. Low-Paying Areas:

Salaries for the same exempt role can vary dramatically based on the cost of living and demand for talent in a specific metropolitan area. According to Glassdoor data, a Software Engineer in San Francisco, CA, might earn a median salary of $160,000, while the same role in St. Louis, MO, might earn closer to $100,000. When accepting an exempt role in a high-cost-of-living area, it is crucial to negotiate a salary that accounts for both the higher expenses and the likelihood of unpaid overtime.

###

Company Type & Size

The culture and resources of a company heavily influence compensation and work expectations.

- Startups: Often cash-poor but equity-rich, startups may offer lower base salaries for exempt roles but compensate with significant stock options. The culture often demands very long hours, making the effective hourly rate quite low if the equity doesn't pay off.

- Large Corporations: Tend to have more structured and competitive salary bands, generous benefits packages, and clearer job-leveling, making exemption classifications more standardized (though not always correct). They have larger HR and legal departments focused on compliance.

- Non-Profits: Generally offer lower salaries than for-profit companies for similar roles. However, they may offer better work-life balance and other non-monetary benefits. They are still subject to the same FLSA rules.

- Government: Government jobs at the federal, state, and local levels have very rigid pay scales (like the GS scale for federal employees) and well-defined job classifications. Overtime rules are typically followed very strictly, and many salaried "professional" roles may still be non-exempt and eligible for overtime pay or compensatory time off.

###

In-Demand Skills

For exempt professionals, whose value is measured by results rather than hours, possessing high-value, in-demand skills is the most direct way to increase your salary. These are skills that allow you to contribute directly to revenue, reduce costs, or solve complex business problems.

- Technical Skills: Cloud Computing (AWS, Azure, GCP), Cybersecurity, Artificial Intelligence/Machine Learning, Data Science (Python, R, SQL), and Full-Stack Development.

- Business Skills: Financial Modeling, Digital Marketing (SEO/SEM), Agile/Scrum Project Management, Business Development and Complex Sales, and Product Management.

- Soft Skills: Leadership and People Management, Strategic Thinking, Negotiation, and Complex Problem-Solving.

An exempt employee who cultivates these skills can command a significant salary premium, which is the primary financial offset for the lack of overtime pay.

Job Outlook and the Future of Salaried Work

The landscape of salaried, professional work is constantly evolving, shaped by technology, economic shifts, and changes in labor law. Understanding these trends is key to building a resilient and rewarding career.

The overall job outlook for professional and business services occupations—a sector dominated by salaried employees—is strong. The BLS projects this sector to grow faster than the average for all occupations, adding hundreds of thousands of new jobs over the next decade.

Projected Growth for Key Salaried Professions (2022-2032):

- Software Developers: Projected to grow by 25%, which is much faster than the average. The demand for new applications on mobile devices and the rise of the Internet of Things are major drivers.

- Financial Managers: Projected to grow by 16%, much faster than average, as the complexity of the global financial environment increases.

- Management Analysts (Consultants): Projected to grow by 10%, also much faster than average, as organizations seek efficiency and guidance on navigating market changes.

- Market Research Analysts and Marketing Specialists: Projected to grow by 13%, much faster than average, driven by the need for data-driven marketing strategies.

*Source: U.S. Bureau of Labor Statistics Occupational Outlook Handbook, accessed early 2024.*

This robust growth indicates strong, ongoing demand for the skilled, exempt professionals who perform these roles. However, the nature of this work is changing.

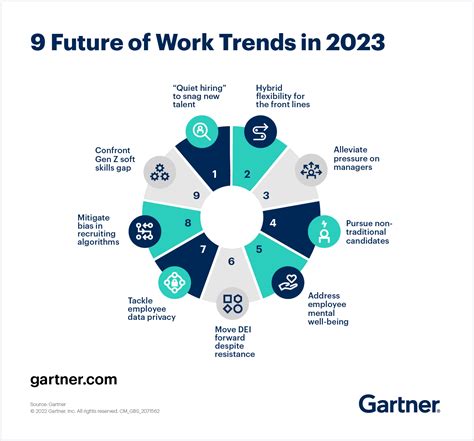

### Emerging Trends and Future Challenges

1. The Rise of Remote and Hybrid Work: The widespread adoption of remote work has blurred the lines between work and home life. For exempt employees, this can lead to an "always-on" culture, making it harder to disconnect and increasing the risk of burnout. The lack of a physical separation between the office and home means professionals must be more disciplined in setting boundaries to protect their personal time.

2. Increased Scrutiny on Employee Classification: There is growing legal and social momentum to re-evaluate who qualifies as an exempt employee. The Department of Labor's proposed rule changes to significantly raise the salary threshold for exemption is a primary example. If enacted, millions of lower-paid salaried workers could become non-exempt and eligible for overtime, fundamentally changing the compensation structure for many roles.

3. Automation and AI: Artificial intelligence will automate many of the routine, procedural tasks currently performed by both non-exempt and some entry-level exempt workers. The future value of salaried professionals will increasingly lie in their ability to perform tasks that require creativity, critical thinking, strategic planning, and complex human interaction—the very core of the exempt duties tests.

4. The Gig Economy and Contract Work: Some companies are shifting away from hiring full-time exempt employees and are instead engaging highly skilled professionals as independent contractors for project-based work. This offers more flexibility but lacks the stability, benefits, and legal protections (like workers' compensation and unemployment insurance) of traditional employment.

### How to Stay Relevant and Advance in a Salaried Career

To thrive in this changing environment, salaried professionals must be proactive and strategic.

- Embrace Lifelong Learning: The skills that make you valuable today may be obsolete in five years. Continuously invest in upskilling and reskilling, focusing on areas that are resistant to automation, such as leadership, strategic analysis, and creative problem-solving. Pursue advanced certifications and stay current with industry trends.

- Develop Your Business Acumen: Understand how your work contributes to the company's bottom line. The more you can demonstrate a direct link between your efforts and the company's success (e.g., increased revenue, saved costs, improved market share), the more leverage you will have in salary negotiations.

- Master the Art of Negotiation: Since your salary is fixed, your initial negotiation is paramount. Go into every negotiation armed with market data for your role, location, and experience level