Table of Contents

- [What Does an Escrow Assistant Do?](#what-does-an-escrow-assistant-do)

- [Average Escrow Assistant Salary: A Deep Dive](#average-escrow-assistant-salary-a-deep-dive)

- [Key Factors That Influence an Escrow Assistant's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Escrow Assistants](#job-outlook-and-career-growth)

- [How to Become an Escrow Assistant: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Is a Career as an Escrow Assistant Right for You?](#conclusion)

For many, the process of buying a home or closing a major business deal is a whirlwind of stress, paperwork, and confusing terminology. It’s a high-stakes moment where a single mistake can have significant financial consequences. But behind the scenes of every smooth real estate transaction is a team of meticulous, organized professionals ensuring every detail is perfect. At the heart of that team, you’ll often find the Escrow Assistant, the unsung hero of the closing table. If you're a highly organized individual with a keen eye for detail and a desire for a stable, rewarding career in the real estate and finance industry, understanding the escrow assistant salary and career path is your first step toward a fulfilling professional journey.

While not a role that grabs headlines, its importance cannot be overstated. An Escrow Assistant's salary typically ranges from $40,000 for entry-level positions to over $75,000 for experienced professionals in high-demand markets, with a national average hovering around $52,000 per year. I once sat in on a complex commercial real estate closing that nearly fell apart due to a last-minute lien discovery. It was the senior escrow assistant, with her encyclopedic knowledge of the file and unwavering calm, who quickly coordinated with legal teams to resolve the issue, saving the multi-million dollar deal. That moment solidified for me that this role is not merely administrative; it's the operational backbone that provides the security and trust essential to the entire industry.

This guide will serve as your definitive resource for everything you need to know about a career as an Escrow Assistant. We will dissect salary expectations, explore the factors that can increase your earning potential, analyze the job outlook, and provide a clear, step-by-step roadmap to help you launch your career.

What Does an Escrow Assistant Do?

An Escrow Assistant, sometimes called an Escrow Technician or Junior Escrow Officer, is a vital support professional who works under the supervision of an Escrow Officer or Closing Agent. They are responsible for handling the administrative and clerical duties necessary to facilitate the closing of a real estate transaction. In essence, they are the detail-oriented engine that keeps the complex machinery of an escrow file moving forward.

The core function of escrow is to have a neutral third party hold funds, documents, and assets in trust until all conditions of a contract between two parties (e.g., a buyer and seller) are met. The Escrow Assistant plays a hands-on role in managing this process from start to finish. Their work ensures that the transfer of property is conducted accurately, legally, and in accordance with the lender's instructions and the purchase agreement.

Core Responsibilities and Daily Tasks:

An Escrow Assistant's day is a dynamic mix of communication, document management, and meticulous data verification. Their duties are critical and multifaceted:

- Opening New Escrow Files: This is the first step. The assistant receives the purchase agreement and lender information, then opens a new file in the company’s system. They are responsible for ordering a title report and preparing initial welcome packages and instruction letters for all parties involved (buyers, sellers, agents, lenders).

- Document Preparation and Management: They draft and prepare various legal and financial documents required for closing, such as estimated closing statements, grant deeds, and escrow instructions. They are also the custodians of the file, ensuring every document received is correctly filed, logged, and accessible.

- Client and Stakeholder Communication: A significant portion of their day is spent on the phone and email. They act as a central point of contact, providing status updates, answering questions from real estate agents, lenders, buyers, and sellers, and requesting necessary information, such as hazard insurance policies or HOA documents.

- Clearing Title and Payoff Demands: The assistant reviews the preliminary title report for any "clouds" or issues, such as existing liens, judgments, or unpaid taxes. They work to resolve these by ordering payoff demands from existing mortgage holders or lienholders and coordinating with the title department.

- Financial Coordination: They receive and log earnest money deposits, prepare wire transfer instructions, and work closely with the Escrow Officer to ensure all funds are properly accounted for before closing.

- Pre-Closing Audit: Before the final signing, the Escrow Assistant conducts a thorough review of the entire file. They check that all conditions have been met, all documents are signed and notarized correctly, and all figures on the closing statement are accurate. This final quality check is crucial for preventing errors.

### A Day in the Life of an Escrow Assistant

To make this role more tangible, let's walk through a typical day:

8:30 AM: Arrive at the office, grab a coffee, and immediately dive into your email inbox. You see a new purchase contract sent over by a real estate agent last night. Your first task is to open a new escrow file for the "Smith to Jones" property sale. You enter all the primary data into the system (SoftPro, RamQuest, or a similar platform), order the preliminary title report, and draft welcome letters for the buyer and seller.

10:00 AM: You switch gears to an existing file that's scheduled to close next week. You review the title report and see an old tax lien. You spend the next hour on the phone with the county recorder's office to get the exact payoff amount and the proper procedure for releasing the lien upon closing.

11:00 AM: A lender for another file emails you the final loan documents. You meticulously review them to ensure the loan amount, interest rate, and borrower names match the escrow instructions. You then prepare the final closing statement (the HUD-1 or Closing Disclosure) for the Escrow Officer to review and approve.

12:30 PM: Lunch break. A much-needed pause to clear your head.

1:30 PM: You spend the afternoon juggling multiple files. You follow up with a real estate agent who hasn't sent over the home inspection report. You call a buyer to confirm they have their cashier's check ready for closing tomorrow. You process an earnest money deposit that was just dropped off at the front desk.

3:00 PM: The Escrow Officer asks you to "package out" a file that just closed. This involves preparing all the final documents to be sent to the lender, ensuring the deed is sent for recording at the county office, and preparing checks to be disbursed to the seller, agents, and any other paid parties.

4:30 PM: You conduct a final audit on a file set to sign tomorrow morning. You create a checklist and go through it line by line: Is the hazard insurance policy in the file? Are all signatures present on the addendums? Do the numbers on the settlement statement balance to the penny?

5:00 PM: You do one last check of your email, update your task list for tomorrow, and head home, knowing your attention to detail helped several families get one step closer to their dream home.

This "day in the life" illustrates the critical nature of the role. It requires a unique blend of customer service skills, financial acumen, and an almost obsessive attention to detail.

Average Escrow Assistant Salary: A Deep Dive

Understanding the financial compensation is a critical part of evaluating any career path. The escrow assistant salary is influenced by a confluence of factors, which we will explore in the next section, but it's important to first establish a solid baseline. The role offers a competitive wage, particularly given that a four-year college degree is not always a strict requirement.

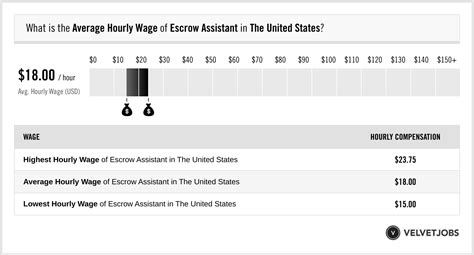

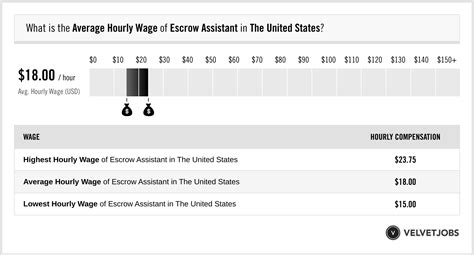

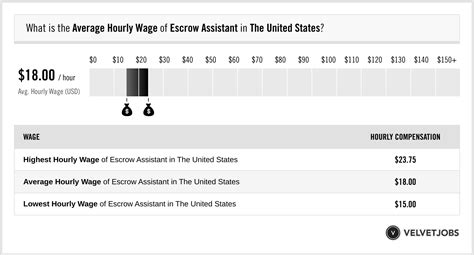

### National Averages and Typical Salary Ranges

Across the United States, the salary for an Escrow Assistant shows a consistent and promising range. By synthesizing data from several authoritative sources, we can paint a clear picture of earning potential.

- Salary.com: As of late 2023 and early 2024, Salary.com reports that the average Escrow Assistant salary in the United States is $52,192 per year. The typical salary range falls between $46,149 and $59,504. This range represents the bulk of professionals in the field, excluding the lowest 10% and highest 10% of earners.

- Payscale.com: This platform, which relies on user-reported data, shows a similar average base salary of approximately $48,500 per year. It highlights that total pay, including potential bonuses and profit-sharing, can extend this figure significantly, often reaching up to $65,000.

- Glassdoor.com: Based on thousands of salary reports, Glassdoor estimates the total pay for an Escrow Assistant to be around $55,837 per year in the United States, with a likely range between $46,000 and $69,000. This "total pay" figure includes base salary as well as additional cash compensation.

- Indeed.com: Indeed aggregates data from job postings and user submissions, reporting an average base salary of $47,935 per year.

Synthesized National Average: Taking these sources into account, a realistic national average base salary for an Escrow Assistant is in the $48,000 to $53,000 range. However, the *total compensation* potential is often higher, pushing the practical average into the mid-$50,000s.

### Salary Progression by Experience Level

One of the most appealing aspects of this career is the clear and direct correlation between experience and income. As you gain expertise, master the complexities of the role, and prove your reliability, your value—and your salary—increases accordingly.

Here is a breakdown of typical salary expectations based on years of experience, compiled from industry data:

| Experience Level | Years of Experience | Typical Annual Salary Range | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level Escrow Assistant | 0-2 years | $40,000 - $48,000 | Opening files, data entry, ordering documents, basic client communication, supporting a senior officer. Focus is on learning the process. |

| Mid-Career Escrow Assistant | 2-5 years | $48,000 - $60,000 | Managing a larger pipeline of standard files, clearing title issues, preparing closing statements, more direct client interaction, training junior staff. |

| Senior Escrow Assistant | 5-10+ years | $60,000 - $75,000+ | Handling complex files (commercial, REO, short sales), assisting multiple Escrow Officers, performing pre-closing audits independently, acting as a team lead. |

| Escrow Officer (Career Progression) | 8+ years | $70,000 - $120,000+ | Managing the entire closing process, signing authority, business development, managing a team of assistants, liable for the transaction's success. |

*Note: These are general ranges and can be significantly higher in major metropolitan areas with high costs of living and bustling real estate markets.*

### Beyond the Base Salary: Understanding Total Compensation

An Escrow Assistant's earnings are not limited to their hourly wage or annual salary. The title and escrow industry is heavily transaction-based, and compensation structures often reflect this.

- Bonuses: This is the most common form of additional compensation. Bonuses are typically tied to performance metrics.

- Per-File Bonus: Some companies offer a small bonus for each file the assistant successfully helps to close. This directly incentivizes efficiency and volume.

- Team/Branch Bonus: Bonuses may be tied to the monthly or quarterly profitability of the escrow unit or branch office. When the team does well, everyone shares in the success.

- Annual Bonus: A year-end bonus may be given based on individual performance and overall company profitability. According to Payscale, annual bonuses can range from $500 to over $7,000.

- Profit Sharing: Some companies, particularly privately held or smaller firms, may offer a profit-sharing plan. A percentage of the company's annual profits is distributed among employees, which can be a significant addition to income in good years.

- Overtime Pay: As an Escrow Assistant is typically a non-exempt role under the Fair Labor Standards Act (FLSA), they are eligible for overtime pay (1.5 times their regular hourly rate) for any hours worked over 40 in a week. Given the cyclical nature of real estate (with month-end and quarter-end rushes), overtime is a common and reliable way to boost earnings.

- Standard Benefits: In addition to direct compensation, a comprehensive benefits package adds significant value. This almost always includes:

- Health, dental, and vision insurance

- 401(k) retirement plans, often with a company match

- Paid time off (vacation, sick leave, holidays)

- Life and disability insurance

- Opportunities for paid professional development and certifications

When evaluating a job offer, it's crucial to look at the entire compensation package. A role with a slightly lower base salary but a generous bonus structure and excellent benefits might be more lucrative overall than a job with a higher base salary and nothing else.

Key Factors That Influence an Escrow Assistant's Salary

While we've established a baseline salary, the actual amount an Escrow Assistant earns can vary dramatically. Several key factors act as levers, capable of pushing your salary well above the national average. As a career analyst, I advise aspiring professionals to strategically focus on these areas to maximize their earning potential throughout their careers. This is where you move from being a passive job-taker to an active career-builder.

###

Level of Education and Professional Certifications

While a four-year bachelor's degree is not a universal requirement for an Escrow Assistant role, education and credentials play a significant role in setting you apart and justifying a higher starting salary.

- Minimum Education: A high school diploma or GED is the standard minimum requirement. Candidates with this background typically start at the lower end of the salary scale and prove their value through on-the-job performance.

- Associate's or Bachelor's Degree: Holding a degree, particularly in fields like Business Administration, Finance, Accounting, or Real Estate, can provide a distinct advantage. Employers often view these candidates as having a stronger foundational knowledge of financial principles, legal concepts, and professional communication. This can translate to a starting salary that is 5% to 15% higher than a candidate without a degree. A degree also signals a level of discipline and commitment that is highly valued.

- Professional Certifications: This is arguably the most impactful educational factor for career growth and salary enhancement. Industry-specific certifications demonstrate a commitment to the profession and a verified level of expertise. They are a powerful negotiating tool. Key certifications include:

- State-Specific Certifications: Some states, like California and Washington, have their own certification or licensing programs for escrow professionals. The California Escrow Association (CEA) offers designations like Certified Escrow Technician (CET) and Certified Escrow Officer (CEO). Achieving these requires passing exams and accumulating experience, and they are highly respected.

- National Certifications: The American Escrow Association (AEA) offers professional designations that are recognized nationwide, such as the Professional Designation (PD) award. These credentials show you have met a high national standard of ethics and knowledge.

- Notary Public Commission: While a basic requirement for many roles, being a commissioned Notary Public is essential. It's a non-negotiable skill that allows you to officiate at signings.

- Title Professional Designations: For those working in a combined title and escrow company, designations from the American Land Title Association (ALTA) can also be beneficial.

Impact on Salary: Holding one or more relevant certifications can increase an Escrow Assistant's salary by $3,000 to $10,000 annually. A Senior Escrow Assistant with multiple state and national designations is a highly valuable asset and can command a salary at the very top of the pay scale.

###

Years of Experience and Career Trajectory

Experience is the single most powerful determinant of an Escrow Assistant's salary. The escrow process is laden with nuance and potential pitfalls that can only be mastered through hands-on practice. Each closed file is a lesson in problem-solving.

- 0-2 Years (The Learning Phase): At this stage, you are absorbing information. Your primary value is in your ability to learn quickly, follow instructions precisely, and handle basic administrative tasks flawlessly. Your salary will be in the entry-level range, $40,000 - $48,000, as the company is investing heavily in your training.

- 2-5 Years (The Competent Professional): You've seen a few real estate cycles and can now handle most standard residential resale and refinance files with minimal supervision. You understand how to read a title report, clear common issues, and communicate confidently with clients. Your increased efficiency and reliability warrant a significant pay increase into the $48,000 - $60,000 range. You may begin training newer assistants.

- 5-10+ Years (The Senior Expert): You are no longer just an assistant; you are a linchpin. You can handle the most complex and high-liability files—commercial properties, short sales, REO (bank-owned) properties, and construction loans. You proactively identify problems before they arise and are the go-to person for the Escrow Officer when challenges emerge. Your expertise and leadership capabilities place your salary in the $60,000 to $75,000+ bracket. At this stage, the next logical step is a promotion to Escrow Officer, which comes with another substantial pay increase.

The salary curve is steep in the first five years as you transition from a trainee to a productive member of the team. Growth continues steadily as you take on more complex work and leadership responsibilities.

###

Geographic Location

Where you work has a profound impact on your paycheck. Salaries for Escrow Assistants are not uniform across the country; they are heavily influenced by the local cost of living and the vitality of the regional real estate market. High-volume, high-value markets demand more skilled professionals and pay accordingly.

High-Paying States and Metropolitan Areas:

States with booming real estate markets and high costs of living consistently offer the highest salaries. According to data from Salary.com and Indeed job postings, top-paying locations include:

- California: Cities like San Jose, San Francisco, and Los Angeles often see salaries 20-35% above the national average. A senior assistant in the Bay Area could easily earn over $80,000.

- Washington: The Seattle metropolitan area, driven by a strong tech economy, is another high-paying market, often 15-25% above average.

- New York: Particularly in New York City and its surrounding suburbs, compensation is significantly higher to account for the extreme cost of living.

- Colorado: Denver's fast-growing real estate market has pushed salaries upward.

- Massachusetts: The Boston area is another high-cost, high-salary region.

Average and Lower-Paying Regions:

Conversely, salaries tend to be closer to or slightly below the national average in states with a lower cost of living and less frantic real estate activity. This includes many states in the:

- Midwest: (e.g., Ohio, Indiana, Missouri)

- Southeast: (e.g., Alabama, Mississippi, South Carolina), with the exception of major hubs like Atlanta or Miami.

Example Comparison: An Escrow Assistant with 3 years of experience might earn $50,000 in Des Moines, Iowa, but the same professional could command $65,000 in Denver, Colorado, and $75,000 in San Jose, California. It's essential to weigh the higher salary against the increased cost of housing, taxes, and daily expenses in these premium markets.

###

Company Type and Size

The type of company you work for also dictates compensation structures and overall earning potential.

- National Title & Escrow Companies (e.g., Fidelity National Financial, First American, Old Republic): These large, publicly traded corporations often offer very structured salary bands. They typically provide higher base salaries and exceptional benefits packages (robust 401k matches, comprehensive health insurance). The work environment is more corporate, with standardized procedures. Bonus structures may be less aggressive but are often more stable and predictable.

- Independent/Boutique Escrow Companies: Smaller, local firms may offer a slightly lower base salary but compensate with a more aggressive bonus structure. A per-file or percentage-based bonus can lead to very high earnings in busy years. These companies often provide a more entrepreneurial culture and faster hands-on learning, but benefits might be less comprehensive.

- Real Estate Law Firms: Some law firms have their own closing departments. Working here as an assistant (often called a "Real Estate Paralegal" or "Closing Coordinator") can be lucrative, especially if you are involved in complex commercial transactions. The environment is highly professional and legally focused.

- Builder/Developer In-House Escrow: Large home builders sometimes have their own in-house escrow divisions. These roles offer deep specialization in "new build" transactions and can be very stable, as your pipeline of files is directly fed by the builder's sales.

###

Area of Specialization

Within the escrow world, not all transactions are created equal. Developing expertise in a specific, high-value niche can dramatically increase your worth.

- Residential Resale: This is the most common specialization and forms the foundation of the industry. It involves standard sales between a buyer and a seller.

- Refinance ("Refi"): Specializing in refinance transactions can lead to high-volume work, as these files are typically faster and less complex than sales.

- Commercial Escrow: This is the big league. Commercial transactions involve multi-million dollar properties, complex financing, and sophisticated corporate clients. They are document-heavy and require an extremely high level of diligence. Senior assistants who can expertly handle commercial files are in high demand and can command salaries at the very top of the pay scale.

- REO (Real Estate Owned) / Foreclosure: These are properties owned by banks after a foreclosure. These files have unique requirements and timelines set by the bank. Expertise in this area is valuable, especially during economic downturns.

- Short Sales: These transactions, where a lender agrees to accept less than the total mortgage amount owed, are notoriously complex and require intense negotiation and coordination. An assistant who can navigate this process is a specialist.

Moving from a general residential assistant to a commercial or short sale specialist is a clear path to a higher salary.

###

In-Demand Skills

Finally, your specific skill set is a direct driver of your value. Beyond just being "organized," certain quantifiable and soft skills can make you a top-tier candidate worthy of a top-tier salary.

High-Value Hard Skills:

- Escrow Software Proficiency: Mastery of industry-standard software like SoftPro, RamQuest, FAST, or ResWare is non-negotiable. Being an expert user who can leverage the software for maximum efficiency is a huge plus.

- Fast and Accurate Typing Speed: A typing speed of 60+ WPM with high accuracy is often a prerequisite. Time is money, and the ability to draft documents and correspondence quickly is essential.

- Understanding of TRID: Deep knowledge of the TILA-RESPA Integrated Disclosure (TRID) rule, which governs the Closing Disclosure and Loan Estimate, is critical. The ability to prepare and balance a Closing Disclosure accurately is one of the most valued skills.

- Title Curative Knowledge: The ability to not just spot a title issue but to understand the steps needed to resolve it (e.g., obtaining a subordination agreement, helping to clear a judgment) makes you far more than an assistant.

Crucial Soft Skills:

- Extreme Attention to Detail: A single misplaced decimal point or misspelled name can derail a closing. Your ability to catch errors is your greatest asset.

- Exceptional Communication: You must be able to clearly and professionally explain complex topics to anxious clients, demanding agents, and busy lenders, both verbally and in writing.

- Problem-Solving and Critical Thinking: When a last-minute issue arises, do you panic or do you calmly assess the situation and propose a solution? The latter is what earns you respect and higher pay.

- **