Introduction

In the world of work, few things are as personal, motivating, and foundational as compensation. The number on a paycheck is more than just money; it's a measure of value, a tool for motivation, and the bedrock of financial security. For organizations, it's a strategic lever to attract top talent, retain high performers, and ensure fairness. But who are the architects behind these critical pay structures? Who ensures that a company’s compensation is competitive, equitable, and compliant with complex laws like the federal salaried minimum wage thresholds? The answer lies in the highly specialized and increasingly vital role of the Compensation Analyst.

This career path is a unique blend of art and science, demanding sharp analytical skills, deep empathy, and a strategic business mindset. It's for the professional who loves diving into data but also understands the human impact of their work. Financially, it's a rewarding field, with the U.S. Bureau of Labor Statistics reporting a median annual wage of $78,210 for Compensation, Benefits, and Job Analysis Specialists as of May 2023, with top earners exceeding $118,590. For those with a passion for numbers and a desire to shape the modern workplace, this career offers a direct and powerful way to make an impact.

I remember early in my career, I sat in a meeting where a newly hired Compensation Analyst presented their initial findings on our company's pay structure. It was a stark, data-driven revelation of internal inequities and external uncompetitiveness. Seeing the leadership team commit to a complete overhaul based on that analysis taught me that this role isn't just a back-office function; it's a catalyst for profound organizational change. This guide is for anyone who wants to be that catalyst.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation Analyst Do?

A Compensation Analyst is a specialized Human Resources professional who researches, analyzes, implements, and administers a company's compensation programs. Their primary objective is to ensure that the organization's pay practices are both internally equitable and externally competitive. This is a far more complex task than simply assigning a salary to a job title. It involves a delicate balance of market data, internal job architecture, legal compliance, and strategic business goals.

The core of the role revolves around data. Compensation Analysts are detectives of the labor market, constantly gathering and interpreting information to understand what other companies are paying for similar roles. They are also internal auditors, meticulously evaluating jobs within their own organization to determine their relative value and ensure that employees in comparable roles are paid fairly.

Core Responsibilities and Daily Tasks:

- Job Evaluation and Analysis: This is a foundational task. Analysts work with managers to understand the duties, responsibilities, and requirements of every role in the organization. They then use established methodologies (like point-factor or job ranking systems) to assign a "grade" or "level" to each job, creating a logical internal hierarchy.

- Salary Surveys and Market Pricing: Analysts participate in and analyze third-party salary surveys from firms like Radford, Mercer, or Willis Towers Watson. They benchmark their company's jobs against this market data to determine competitive salary ranges (minimum, midpoint, and maximum).

- Developing and Maintaining Salary Structures: Using the data from job evaluations and market pricing, they build and maintain the company's salary structure or "pay bands." This framework guides all pay decisions, from new hire offers to promotions and annual raises.

- Ensuring Legal Compliance: A critical part of the job is ensuring adherence to all relevant labor laws. This includes the Fair Labor Standards Act (FLSA), which governs overtime pay and the salary threshold for exempt employees (the "federal salaried minimum wage" threshold), as well as equal pay laws and emerging pay transparency legislation.

- Administering Incentive and Bonus Programs: They often manage the design and administration of short-term and long-term incentive plans, such as annual bonuses, sales commissions, and profit-sharing programs, ensuring they are motivating and aligned with business performance.

- Reporting and Analytics: They create detailed reports and presentations for HR leadership and company executives, providing insights on compensation trends, budget impacts, and the effectiveness of pay programs.

### A Day in the Life of a Compensation Analyst

To make this tangible, let's imagine a typical Tuesday for a Mid-Career Compensation Analyst named Alex at a mid-sized tech company.

- 9:00 AM - 10:30 AM: Market Data Analysis. Alex spends the morning in a massive Excel spreadsheet, matching the company's software engineering roles to data from a recently purchased tech salary survey. They are analyzing how the company's pay for "Senior Software Engineer" compares to the 50th and 75th percentiles in their geographic area, noting a potential gap that needs to be addressed before the next hiring push.

- 10:30 AM - 11:30 AM: Meeting with a Department Manager. The Director of Marketing wants to create a new "Content Marketing Strategist" role. Alex meets with them to conduct a job evaluation, asking detailed questions about the role's responsibilities, required skills, and impact on the business to determine where it fits within the existing job architecture.

- 11:30 AM - 12:30 PM: FLSA Audit Prep. The company is growing, and Alex is proactively reviewing a list of roles currently classified as "exempt" from overtime. They are double-checking each role's duties against the Department of Labor's criteria to ensure they are correctly classified and meet the federal salaried minimum threshold, mitigating legal risk.

- 1:30 PM - 3:00 PM: Annual Compensation Cycle Planning. Alex joins a meeting with the Head of HR and the CFO to model different scenarios for the upcoming annual salary increase cycle. They present data on market movement and inflation, running calculations to show the budgetary impact of a 3%, 4%, or 5% merit increase pool.

- 3:00 PM - 4:30 PM: Building a Presentation. Alex begins building a PowerPoint deck for the executive team, visualizing the key findings from their software engineer pay analysis. They use charts and graphs to clearly illustrate the market gap and propose new, competitive salary ranges for those critical roles.

- 4:30 PM - 5:00 PM: Ad-Hoc Request. An HR Business Partner pings Alex with an urgent question: "We have a candidate for a Product Manager role asking for a salary that's above the top of our range. Can you pull some data to see if their request is reasonable for their level of experience?" Alex quickly consults market data and internal equity to provide a data-backed recommendation.

Average Compensation Analyst Salary: A Deep Dive

The salary for a Compensation Analyst is a direct reflection of the value they bring to an organization—optimizing one of the largest corporate expenses (payroll) while ensuring the company can attract and retain the talent it needs to thrive. Compensation is a well-remunerated field within HR, with strong earning potential that grows significantly with experience and specialization.

When analyzing salary data, it's important to look at multiple sources to get a balanced view. The U.S. Bureau of Labor Statistics (BLS) provides the most comprehensive, government-backed data, while salary aggregators like Salary.com, Payscale, and Glassdoor offer real-time, user-submitted data that can capture more recent market fluctuations.

National Averages and Salary Ranges

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Compensation, Benefits, and Job Analysis Specialists" was $78,210 in May 2023. This is the midpoint, meaning half of the professionals in this field earned more, and half earned less. The BLS data also shows a wide range, illustrating the potential for growth:

- Lowest 10% earned less than: $50,580

- Highest 10% earned more than: $118,590

Salary aggregator sites provide a similar, often slightly higher, picture.

- Salary.com, as of late 2023, reports the median base salary for a Compensation Analyst II (typically a mid-career professional) in the United States is $84,003, with a typical range falling between $75,695 and $92,987.

- Payscale.com lists the average salary for a Compensation Analyst at $73,267 per year, with a common range of $56,000 to $98,000.

- Glassdoor, which incorporates user-submitted data including base pay and additional compensation, estimates the total pay for a Compensation Analyst in the U.S. is around $90,951 per year, with a likely range of $73,000 to $114,000.

The slight variation between sources is normal and can be attributed to different methodologies and data sets. The consistent theme is a strong median salary well above the national average for all occupations, with a clear path to a six-figure income.

Salary by Experience Level

Compensation for this role climbs steadily with experience. As analysts move from executing tasks to designing strategy and managing teams, their value and pay increase accordingly.

| Experience Level | Typical Title(s) | Typical Salary Range (Base Pay) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Compensation Analyst I, HR Analyst (Comp Focus) | $55,000 - $75,000 | Assisting with salary survey submissions, running basic reports, conducting initial job description reviews, data entry into HRIS. |

| Mid-Career (3-8 years) | Compensation Analyst II, Senior Compensation Analyst | $75,000 - $100,000 | Managing salary survey participation, market pricing jobs independently, administering bonus cycles, advising HRBPs and managers on pay decisions. |

| Senior / Lead (8-15 years) | Lead/Principal Analyst, Compensation Manager | $100,000 - $150,000+ | Designing new compensation programs (e.g., sales incentive plans), managing the entire annual compensation cycle, leading major projects, mentoring junior analysts. |

| Executive / Director (15+ years) | Director of Compensation, VP of Total Rewards | $150,000 - $250,000+ | Setting the overall compensation and total rewards strategy for the entire organization, presenting to the Board of Directors' Compensation Committee, managing a team of analysts and managers. |

*(Salary ranges are estimates compiled from BLS, Salary.com, and Payscale data for major U.S. markets and are subject to change based on the factors discussed in the next section.)*

Beyond the Base Salary: Understanding Total Compensation

For a Compensation Analyst, "salary" is just one piece of the puzzle—both for the employees they support and for themselves. Total compensation is a more accurate measure of earnings and includes several key components:

- Annual Bonus / Short-Term Incentives (STI): This is the most common form of additional cash compensation. It's typically a percentage of base salary (e.g., 5-15% for an analyst, 15-30%+ for a manager/director) and is tied to both individual and company performance. Almost all mid-to-large companies offer this to their compensation professionals.

- Profit Sharing: Some companies distribute a portion of their annual profits to employees. This is less predictable than an annual bonus but can be a significant addition to income in profitable years.

- Equity / Long-Term Incentives (LTI): While more common in publicly traded companies and tech startups, equity can be a substantial part of compensation, especially at senior levels. This can come in the form of stock options, Restricted Stock Units (RSUs), or performance shares. A Director of Compensation at a large tech firm might have an LTI package worth tens or even hundreds of thousands of dollars vesting over several years.

- Comprehensive Benefits: As experts in the broader "Total Rewards" space, Compensation Analysts work for companies that typically offer robust benefits packages. This includes high-quality health, dental, and vision insurance; generous 401(k) matching contributions (a significant financial benefit); paid time off; and often other perks like tuition reimbursement, wellness stipends, and flexible work arrangements.

When considering a job offer in this field, it's crucial to evaluate the entire package. A role with a slightly lower base salary but a larger bonus target and a generous 401(k) match could be more lucrative in the long run.

Key Factors That Influence Salary

While the national averages provide a useful benchmark, a Compensation Analyst's actual salary is determined by a complex interplay of several factors. Understanding these variables is key to negotiating a competitive salary and maximizing long-term earning potential. As an analyst yourself, you would use these same factors to determine pay for others, so it's essential to apply that same critical lens to your own career.

### Level of Education

Education forms the foundation of a Compensation Analyst's skill set, and employers are willing to pay a premium for advanced knowledge.

- Bachelor's Degree: This is the standard entry requirement. A Bachelor of Science (BS) or Bachelor of Business Administration (BBA) in Human Resources, Finance, Business Administration, Economics, or Mathematics is most common. This degree equips candidates with the foundational quantitative and business acumen needed for an entry-level role, typically placing them in the starting salary bracket of $55,000 to $75,000.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA), a Master's in Human Resource Management (MHRM), or a Master's in Industrial-Organizational Psychology, can significantly boost earning potential and accelerate career progression. It signals a deeper level of strategic thinking and business knowledge. Professionals with a relevant Master's degree can often command a starting salary 10-20% higher than those with only a Bachelor's and may be fast-tracked for senior analyst or management roles. A graduate from a top MBA program entering a compensation role at a Fortune 500 company could see a starting salary approaching $100,000.

- Professional Certifications: In the world of compensation, certifications are highly respected and directly impact salary. The gold standard is the Certified Compensation Professional (CCP®) designation from WorldatWork. Earning this certification demonstrates a mastery of core compensation principles, from job analysis and base pay administration to market pricing and global remuneration. According to Payscale, professionals holding a CCP can earn nearly 10% more than their non-certified peers. Other valuable certifications include the Professional in Human Resources (PHR) or Senior Professional in Human Resources (SPHR) from HRCI, which provide a broader HR context.

### Years of Experience

Experience is arguably the single most significant factor in salary growth for a Compensation Analyst. The career path offers a clear and lucrative trajectory as one moves from tactical execution to strategic leadership.

- Analyst I (0-2 Years): At this stage, you are learning the ropes. Your work is heavily supervised, focusing on data collection and basic analysis. The salary range is typically $55,000 - $75,000. The primary goal is to build technical proficiency in Excel and HRIS systems and to understand the company's specific compensation philosophy.

- Analyst II / Senior Analyst (3-8 Years): You are now a fully proficient, independent contributor. You can manage complex projects like annual salary survey submissions and market pricing for entire departments. You begin to advise managers and HR partners. This is where salaries see a significant jump, moving into the $75,000 - $100,000+ range. A Senior Analyst with in-demand skills at a high-paying company can easily exceed six figures.

- Compensation Manager (8-15 Years): This is the leap from individual contributor to people leader and strategist. You are responsible for designing and implementing compensation programs, managing a team of analysts, and overseeing the entire annual compensation cycle. Your influence is company-wide. Base salaries for managers typically start around $110,000 and can extend to $150,000 or more, complemented by a substantial bonus percentage (15-25%).

- Director/VP of Total Rewards (15+ Years): At the executive level, your focus is entirely strategic. You are responsible for the entire "Total Rewards" philosophy, which includes compensation, benefits, equity, and recognition. You present to the board's Compensation Committee and ensure the company's rewards strategy aligns with its long-term business goals. Base salaries here are often in the $170,000 - $250,000+ range, with total compensation (including large bonuses and equity grants) potentially reaching $300,000 to $500,000+ at large, public companies.

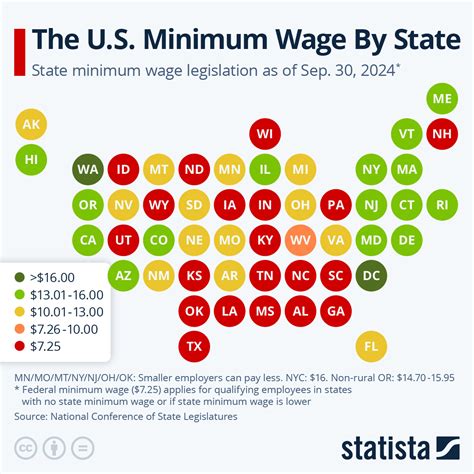

### Geographic Location

Where you work has a massive impact on your paycheck. Companies adjust their salary ranges based on the local cost of labor and cost of living. A Compensation Analyst in a high-cost metropolitan area can earn significantly more than someone in the exact same role in a smaller, rural market.

High-Paying Metropolitan Areas:

- San Francisco Bay Area, CA (San Jose-Sunnyvale-Santa Clara & San Francisco-Oakland-Hayward): Consistently the highest-paying region in the country, driven by the high concentration of major tech companies. According to BLS data, the annual mean wage for compensation specialists here is $124,190 and $111,720, respectively. Salaries on sites like Salary.com can show median pay exceeding $130,000.

- New York, NY: As a global financial hub, New York offers lucrative opportunities in the finance and corporate sectors. The BLS reports a mean wage of $102,690 in the New York-Newark-Jersey City metro area.

- Boston, MA & Washington, D.C.: These cities, with strong tech, biotech, and government contracting sectors, also command high salaries. BLS data shows mean wages of $95,590 for Boston and $104,780 for the D.C. area.

- Seattle, WA: Home to tech giants like Amazon and Microsoft, Seattle is another top-tier market with a BLS mean wage of $100,030.

Lower-Paying Areas:

In contrast, non-metropolitan and rural areas in states with lower costs of living will have significantly lower salary ranges. For example, BLS data shows that states like Mississippi, Arkansas, and South Dakota have statewide mean wages for this profession in the $60,000 - $65,000 range.

The Remote Work Effect: The rise of remote work has introduced a new complexity. Some companies pay based on the employee's location, adjusting salary down if they move to a lower-cost area. Others have adopted a single national pay scale, creating arbitrage opportunities for employees. This is a dynamic trend that Compensation Analysts themselves are now responsible for navigating.

### Company Type & Size

The type of organization you work for plays a huge role in both the amount and structure of your pay.

- Large Corporations (Fortune 500): These companies typically offer the most structured and often highest base salaries and benefits. They have established pay bands, formal annual review cycles, and significant resources for data and tools. A Senior Compensation Analyst at a company like Google, Johnson & Johnson, or JPMorgan Chase will likely have a higher base salary and more robust bonus and equity potential than at a smaller firm.

- Tech Startups (Pre-IPO): Startups may offer a lower base salary compared to established corporations. However, they often compensate for this with significant equity grants (stock options). This is a high-risk, high-reward proposition. If the company is successful and goes public or is acquired, that equity can be worth far more than the foregone salary. The work environment is also typically faster-paced and less structured.

- Non-Profit Organizations: Non-profits and educational institutions generally have tighter budgets and, as a result, pay less than for-profit companies. The BLS notes that compensation specialists in "Educational Services" have a lower mean wage than those in "Professional, Scientific, and Technical Services." The tradeoff is often a better work-life balance and a mission-driven culture.

- Government (Federal, State, Local): Government compensation roles offer excellent job security and benefits, particularly pensions, which are rare in the private sector. Pay is determined by a rigid pay scale, like the federal General Schedule (GS) scale. A Compensation Analyst (often titled "HR Specialist - Compensation") might fall in the GS-11 to GS-14 range, which in 2024 corresponds to a salary range of roughly $72,553 to $134,449, depending on grade and step, with additional locality pay adjustments.

### Area of Specialization

Within the field of compensation, specialization can lead to higher earnings and more focused career paths.

- Executive Compensation: This is one of the most lucrative specializations. These professionals focus exclusively on designing pay packages for top-level executives (C-suite). The work involves complex elements like deferred compensation, performance-based equity, and navigating SEC disclosure rules. Senior managers and directors in this niche can command salaries well into the $200,000s.

- Sales Compensation: Another high-demand specialty. Sales compensation analysts design and administer complex commission and bonus plans for sales teams. This requires a deep understanding of sales cycles, performance metrics, and motivation. Because these plans directly drive revenue, experts in this area are highly valued, with earning potential similar to or exceeding generalists.

- International/Global Compensation: For large multinational corporations, managing pay across different countries is a major challenge. Global compensation specialists deal with currency fluctuations, varying tax laws, local market practices, and mobility/expatriate pay packages. This expertise is rare and highly compensated.

- Benefits Strategy: While often a separate role (Benefits Analyst), sometimes it falls under a broader "Total Rewards" umbrella. Specializing in the strategic design of health, wellness, and retirement programs can also be a viable and well-paid path.

### In-Demand Skills

Beyond your degree and experience, a specific set of technical and soft skills can make you a more effective—and thus more highly paid—Compensation Analyst.

- Advanced Microsoft Excel: This is non-negotiable. You must be an Excel wizard, proficient in VLOOKUPs, INDEX/MATCH, pivot tables, complex formula writing, and data modeling. The ability to write macros using VBA is a significant plus.

- HRIS/HCM Systems Knowledge: Experience with major Human Resources Information Systems (HRIS) or Human Capital Management (HCM) platforms like Workday, SAP SuccessFactors, or Oracle is critical. The compensation module within these systems is your primary workspace.

- Data Visualization Tools: The ability to communicate complex data simply is a superpower. Proficiency in tools like Tableau or Power BI to create insightful dashboards and presentations can set you apart and justify a higher salary.

- Statistical Analysis: A solid understanding of statistical concepts like regression analysis, standard deviation, and market indexing allows you to perform more sophisticated analyses and provide more credible recommendations.

- Legal Knowledge: Deep familiarity with the Fair Labor Standards Act (FLSA), Equal Pay Act, and emerging state-level pay transparency laws is essential. Being the go-to expert on compliance is a highly valuable trait.

- Business Acumen and Communication: Ultimately, data is useless if you