For analytical minds who seek both stability and a sense of mission, a career in the federal government holds a unique appeal. But beyond the promise of public service, there lies a complex and fascinating world dedicated to one of the government's most critical functions: ensuring its millions of employees are paid fairly and competitively. If you've ever found yourself performing a federal salaries lookup and wondered about the system behind the numbers, you may have inadvertently stumbled upon a highly rewarding career path: the Federal Compensation Analyst. This role is the engine behind the federal pay system, a profession that blends data science, human resources, and public policy into a vital function of government.

This career offers a clear, structured path to a six-figure salary, exceptional benefits, and unparalleled job security. The average salary for experienced compensation specialists within the federal government often falls between $90,000 and $150,000, depending on location and responsibility, with senior experts and managers earning even more. I once spoke with a senior compensation program manager at the Department of Energy who described their job not as simply "setting pay," but as "building the financial framework that allows scientists, engineers, and public servants to tackle the nation's greatest energy challenges." That perspective powerfully reframes this role from a technical, back-office job to a mission-enabling profession that is integral to national progress.

This comprehensive guide will demystify the world of federal compensation analysis. We will explore everything from the day-to-day responsibilities and salary potential to the specific skills you need to launch and advance your career. Consider this your definitive roadmap to a profession that is as intellectually stimulating as it is impactful.

### Table of Contents

- [What Does a Federal Compensation Analyst Do?](#what-does-a-federal-compensation-analyst-do)

- [Average Federal Compensation Analyst Salary: A Deep Dive](#average-federal-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Your Federal Salary](#key-factors-that-influence-your-federal-salary)

- [Job Outlook and Career Growth for Federal Compensation Professionals](#job-outlook-and-career-growth)

- [How to Get Started in a Federal Compensation Career](#how-to-get-started-in-this-career)

- [Is a Career in Federal Compensation Right for You?](#conclusion)

What Does a Federal Compensation Analyst Do?

A Federal Compensation Analyst, often titled as a Human Resources Specialist (Compensation) or a Program Analyst (Compensation Policy), is a highly specialized professional responsible for the design, administration, analysis, and management of the pay systems within a U.S. federal agency. Their primary objective is to ensure that the government can recruit, retain, and motivate a qualified workforce by offering competitive and equitable compensation packages, all while adhering to a complex web of laws, regulations, and policies.

Unlike in the private sector where pay can be highly discretionary, federal compensation is governed by a structured and transparent framework. The work of a Federal Compensation Analyst revolves around navigating and implementing this framework effectively. Their expertise is crucial for maintaining the operational integrity of their agency and ensuring fairness for its employees.

Core responsibilities include:

- Position Classification: This is a cornerstone of the job. Analysts evaluate the duties and responsibilities of a specific job (a "position") and assign it the appropriate occupational series and grade level within the General Schedule (GS) or other applicable pay system. This determination directly dictates the position's salary range.

- Salary and Wage Administration: They are the masters of the federal pay scales. This involves setting pay for new hires, processing promotions, and administering within-grade step increases. They also manage special pay systems like the Federal Wage System (FWS) for blue-collar workers.

- Compensation Surveys and Analysis: To ensure federal pay remains competitive, analysts study salary data from the U.S. Bureau of Labor Statistics (BLS) and private sector surveys. This analysis informs the annual adjustments to locality pay and the creation of Special Salary Rates (SSRs) for in-demand jobs like cybersecurity specialists or medical officers.

- Policy Development and Interpretation: Analysts interpret dense regulations from the Office of Personnel Management (OPM) and Title 5 of the U.S. Code (the law governing the civil service). They often draft agency-specific policies and provide authoritative guidance to managers and employees on complex pay matters, such as recruitment incentives, retention allowances, and overtime pay.

- Program Management: Senior analysts may manage specific pay programs, such as performance-based awards, student loan repayment benefits, or the agency's overall salary budget projections.

### A Day in the Life of a Federal Compensation Analyst (GS-12)

To make this role more tangible, let's walk through a typical day for a mid-career analyst working at an agency headquarters in Washington, D.C.

- 8:00 AM - 9:00 AM: The day begins by reviewing overnight emails and a daily digest from federal HR news sites like FedSmith. An urgent email from a manager in the IT department requires immediate attention: they want to hire a new data scientist and need to know the maximum possible starting salary they can offer to compete with a private sector offer. The analyst flags this for follow-up.

- 9:00 AM - 11:00 AM: Time for deep work. The analyst is working on a major project: a "desk audit" for a team of contract specialists who believe their positions are misclassified at the GS-11 level and should be GS-12s. This involves meticulously reviewing their position descriptions, interviewing the employees and their supervisor to understand the true scope of their work, and comparing their duties against OPM's official classification standards.

- 11:00 AM - 12:00 PM: The analyst meets with the IT manager from the morning email. They discuss the data scientist position, exploring options like using "superior qualifications" to justify a higher starting step within the grade and checking if the position is covered by a Special Salary Rate (SSR). They advise the manager on how to write the justification memo.

- 12:00 PM - 1:00 PM: Lunch break, often spent with fellow HR specialists discussing challenging cases or new policy changes.

- 1:00 PM - 3:00 PM: The analyst participates in their team's bi-weekly policy review meeting. Today's topic is the agency's implementation of a new OPM regulation regarding recruitment and relocation bonuses. The team debates how to apply the new flexibility to hard-to-fill positions in remote locations.

- 3:00 PM - 4:30 PM: The analyst turns back to the desk audit project, beginning to draft the official evaluation statement. This document must be a rigorous, legally defensible analysis that clearly explains the rationale for either upgrading the positions or maintaining their current grade.

- 4:30 PM - 5:00 PM: Before logging off, the analyst processes a few routine pay-setting actions in the HR information system and responds to a handful of employee inquiries about their pay stubs and leave accrual.

This "day in the life" illustrates the blend of analytical rigor, regulatory expertise, and client consultation that defines the role. It's a job for problem-solvers who enjoy structure and complexity in equal measure.

Average Federal Compensation Analyst Salary: A Deep Dive

When you perform a "federal salaries lookup," you're tapping into one of the most transparent pay systems in the country. Unlike the private sector, federal pay for "white-collar" professional roles is not a secret. It is primarily determined by the General Schedule (GS) pay system, which is a standardized scale of base pay rates administered by the U.S. Office of Personnel Management (OPM).

The salary of a Federal Compensation Analyst is a function of two primary components: their Grade and their Locality.

1. Grade Level: This reflects the level of difficulty, responsibility, and qualifications required for the position. Grades range from GS-1 to GS-15.

2. Locality Pay: This is a geographically-based percentage adjustment added to the base GS pay to account for significant differences in the cost of labor across the United States.

Therefore, there is no single "average salary." Instead, there are predictable salary bands based on experience and location. For our analysis, we will use the official 2024 General Schedule Pay Tables from OPM as our primary source.

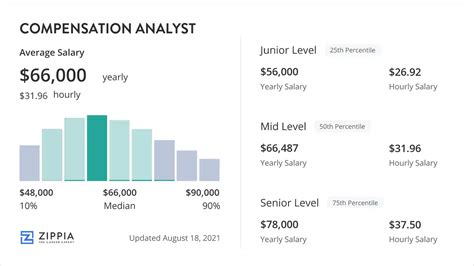

### Federal Compensation Analyst Salary by Experience Level

Here is a breakdown of the typical career and salary progression for a Federal Compensation Analyst. The salary ranges shown include the lowest locality pay ("Rest of U.S.") and one of the highest (San Francisco-Oakland-San Jose, CA) to illustrate the significant impact of location.

| Experience Level | Typical GS Grade | Annual Salary Range (Rest of U.S. Locality - 2024) | Annual Salary Range (San Francisco Locality - 2024) | Description |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | GS-7 / GS-9 | $44,233 - $66,419 | $55,191 - $82,883 | Recent graduates or individuals with limited specialized experience. Tasks are developmental, focusing on learning classification standards and basic pay setting under close supervision. |

| Mid-Career | GS-11 / GS-12 | $64,957 - $99,230 | $81,061 - $123,822 | Seasoned professionals who can independently handle complex classification cases, provide authoritative advice to managers, and analyze salary data. This is the full-performance journeyman level for many analysts. |

| Senior/Expert | GS-13 / GS-14 | $92,575 - $139,395 | $115,528 - $173,950 | Highly experienced analysts who serve as technical experts, lead major compensation projects, draft agency-wide policy, or manage a team of junior analysts. |

| Executive/Manager| GS-15 | $126,810 - $164,858| $158,252 - $191,900* | Top-level program managers and supervisors responsible for an entire agency's compensation program. *Note: GS-15 pay is capped at the rate for Level IV of the Executive Schedule ($191,900 in 2024).* |

*Source: U.S. Office of Personnel Management (OPM), 2024 General Schedule (GS) Pay Calculator.*

As you can see, the progression is clear and substantial. An analyst can realistically expect their salary to more than double over the course of a full career, purely through promotions and standard step increases.

### A Deeper Look at the Total Compensation Package

The salary figures above are only part of the story. The total compensation for a federal employee is significantly enhanced by a suite of benefits that are often more generous and secure than those in the private sector.

- Federal Employees Retirement System (FERS): This is a three-tiered retirement plan that provides a powerful combination of benefits for long-term financial security.

1. FERS Basic Benefit: A defined-benefit pension plan. After meeting service requirements, you receive a guaranteed monthly payment for life. The government contributes the vast majority of the cost.

2. Thrift Savings Plan (TSP): A defined-contribution plan, similar to a 401(k). The government automatically contributes 1% of your basic pay and provides a dollar-for-dollar match for the first 3% you contribute, plus 50 cents on the dollar for the next 2%. This amounts to a 5% agency match if you contribute at least 5% yourself.

3. Social Security: You also pay into and receive Social Security benefits upon retirement.

- Federal Employees Health Benefits (FEHB) Program: Widely regarded as one of the best employer-sponsored health insurance programs in the country. It offers a wide variety of plans (HMOs, PPOs, etc.) to choose from, and the government covers a significant portion (typically 72%) of the premiums. This coverage can be carried into retirement.

- Leave Benefits: Federal employees enjoy generous time off.

- Annual Leave (Vacation): You accrue 13 days per year for the first 3 years of service, 20 days per year for the next 12 years, and 26 days per year after 15 years of service.

- Sick Leave: You accrue 13 days of sick leave per year, with no limit on the amount that can be carried over from year to year.

- Other Benefits: The list goes on, including life insurance (FEGLI), flexible spending accounts (FSAFEDS), student loan repayment programs at some agencies, and extensive employee assistance programs (EAPs).

When you combine a competitive base salary with this robust benefits package, the true value of federal employment becomes clear. For many, the stability and long-term financial security offered by the FERS pension and subsidized health benefits are worth just as much, if not more, than a slightly higher base salary in the private sector.

Key Factors That Influence Your Federal Salary

While the GS system provides a structured framework, your specific salary within that system is determined by a confluence of factors. Understanding these levers is key to maximizing your earning potential throughout your federal career. This is the most critical information to grasp when moving beyond a simple "federal salaries lookup."

### The Core of Federal Pay: Grade and Step

The single most important factor determining your salary is your assigned Grade and Step.

- Grade (GS-1 to GS-15): As discussed, the grade level is tied to the complexity and responsibility of the position. A promotion from one grade to the next (e.g., from a GS-12 to a GS-13) results in a significant pay increase. Your primary career goal should be to qualify for and compete for positions at progressively higher grades.

- Step (1 to 10): Within each grade, there are 10 salary steps. These steps represent longevity and performance. New employees almost always start at Step 1 of their grade. You then advance through the steps based on a set schedule, provided your performance is satisfactory:

- Steps 1-4: Advance one step each year.

- Steps 5-7: Advance one step every two years.

- Steps 8-10: Advance one step every three years.

This system guarantees a predictable pay increase even without a promotion. A GS-12, Step 1 in the "Rest of U.S." locality earns $77,488 in 2024. After four years of successful performance, they will be a GS-12, Step 4, earning $85,738—an increase of over $8,000 without changing jobs. This built-in progression is a powerful wealth-building tool.

### Geographic Location: The Power of Locality Pay

Where you work is the second most critical factor. The federal government recognizes that the cost of labor varies dramatically across the country. To account for this, they add Locality Pay on top of the base GS salary.

In 2024, there are over 50 different locality pay areas. The difference can be staggering. For example, let's compare the annual salary for a GS-13, Step 1 position in several different locations:

| Locality Pay Area | Locality Pay Percentage (2024) | GS-13, Step 1 Annual Salary |

| :--- | :--- | :--- |

| Rest of United States (Base Rate) | 16.82% | $92,575 |

| Kansas City, MO-KS | 18.00% | $93,521 |

| Phoenix, AZ | 21.05% | $95,966 |

| Denver, CO | 29.87% | $102,896 |

| Washington, D.C.-Baltimore, MD | 33.26% | $105,620 |

| New York, NY | 37.95% | $109,403 |

| San Francisco-Oakland-San Jose, CA | 45.41% | $115,528 |

*Source: U.S. Office of Personnel Management (OPM), 2024 Salary Tables.*

As this table clearly shows, the same job with the same level of responsibility can pay over $22,000 more per year simply based on its location. High-cost metropolitan areas like San Francisco, Los Angeles, New York, and Washington D.C. offer the highest salaries to offset the higher cost of living and compete in those labor markets. When searching on USAJOBS.gov, always pay close attention to the location listed, as it will dramatically impact your potential earnings.

### Level of Education and Experience: Qualifying for Higher Grades

Your education and experience don't directly translate to a higher salary in the way a private sector bonus might. Instead, they are the keys to qualifying for higher-graded positions from the start. OPM sets minimum qualification standards for each grade level.

Here’s a general guide for how education typically qualifies you for entry-level professional roles:

- GS-5: Bachelor's degree.

- GS-7: Bachelor's degree with "Superior Academic Achievement" (e.g., a 3.0+ GPA) or one full year of graduate-level education.

- GS-9: Master's degree or equivalent graduate degree (e.g., an LL.B. or J.D.).

- GS-11: Ph.D. or equivalent doctoral degree.

Experience can often be substituted for education. The standard is that one year of "specialized experience" equivalent to the work of the next lower grade level can qualify you. For example, to qualify for a GS-12 position, you generally need at least one year of experience performing work at a level of difficulty and responsibility equivalent to the GS-11 grade.

The Strategy: Earning a Master's degree in a relevant field like Human Resources, Public Administration (MPA), or Business Administration (MBA) is one of the most effective ways to accelerate your federal career. It can allow you to bypass the lower grades and start directly at a GS-9 level, putting you on a faster track to reach the lucrative GS-12, GS-13, and GS-14 levels.

### Company (Agency) Type and Special Pay Systems

While most federal agencies use the General Schedule (GS), some are authorized by Congress to have their own unique pay systems, often to compete for highly specialized talent. These are known as "alternative pay systems."

For example:

- Financial Regulatory Agencies: Agencies like the Securities and Exchange Commission (SEC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve Board often have their own pay scales that are significantly higher than the GS scale to attract top-tier financial and legal talent.

- The Federal Aviation Administration (FAA): The FAA uses a "Core Compensation" pay band system for many of its employees, including air traffic controllers, which offers more flexibility and higher pay potential than the rigid GS step structure.

- The Intelligence Community: Agencies like the CIA and NSA have their own pay structures that are not always public but are designed to be highly competitive for individuals with security clearances and specialized skills.

Even within the GS system, certain agencies are more likely to utilize special pay flexibilities. A compensation analyst at the Department of Defense working on cybersecurity pay policy might have access to more tools (like special rates and recruitment bonuses) than an analyst at a smaller, more administrative agency.

### Area of Specialization: Special Salary Rates (SSRs)

For certain high-demand occupations where the government struggles to compete with private sector pay, OPM can authorize Special Salary Rates (SSRs). These are higher salary tables that replace the base GS pay table for specific jobs in specific locations.

A Compensation Analyst's job often involves administering these SSRs, but the role itself is not typically covered by one. However, it's a critical factor to understand about the federal pay landscape. SSRs are most common for:

- Information Technology (IT) / Cybersecurity Specialists (2210 series)

- Engineers (0800 series)

- Medical and Public Health Professionals

- Certain Law Enforcement positions

For example, a GS-12 IT Specialist in a standard locality might earn $77,488. But if they are covered by an SSR table for cybersecurity roles, their starting salary could be over $90,000.

### In-Demand Skills That Boost Your Value

While the GS system is structured, possessing specific, high-value skills makes you a more competitive candidate for promotions and for coveted, high-graded positions. These are the skills that allow you to tackle the most complex and visible projects, leading to faster advancement.