Thinking about a career as the trusted financial intermediary in major life transactions? An Escrow Officer plays a pivotal, high-responsibility role in the world of real estate and finance. This career offers not only a stable and engaging professional path but also significant earning potential, with experienced officers in prime locations earning salaries well over $85,000 annually.

This guide provides a data-driven look into the salary of an Escrow Officer, exploring the key factors that influence your paycheck and the future outlook for this essential profession.

What Does an Escrow Officer Do?

Before diving into the numbers, it's crucial to understand the role. An Escrow Officer (also known as a Closing Agent or Title Officer) acts as a neutral and impartial third party in a contractual transaction, most commonly a real estate sale. Their primary duty is to ensure that all conditions of the agreement are met before any property or funds change hands.

Key responsibilities include:

- Holding and disbursing funds from a secure escrow account.

- Reviewing title reports to ensure the property has a "clear title" free of liens or claims.

- Preparing and verifying all legal documents, such as deeds and closing statements.

- Coordinating with buyers, sellers, real estate agents, and lenders.

- Facilitating the final "closing" of the transaction.

In essence, an Escrow Officer is the project manager and financial referee who ensures a complex transaction proceeds smoothly, securely, and according to the law.

Average Escrow Officer Salary

The salary for an Escrow Officer can vary significantly, but we can establish a strong baseline by looking at data from several authoritative sources. It's important to note that different platforms collect data in different ways, which accounts for the slight variations in averages.

- Salary.com: As of early 2024, the median annual salary for an Escrow Officer in the United States is approximately $57,700. The typical salary range falls between $49,800 and $66,900, but this can extend higher or lower based on the factors we'll discuss below.

- Glassdoor: This platform, which incorporates user-submitted data including base pay and additional compensation like bonuses, reports a higher total pay average. As of 2024, the average total pay is around $68,500 per year, with a "likely range" of $53,000 to $90,000.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups Escrow Officers under the broader category of "Title Examiners, Abstractors, and Searchers." For this group, the median annual wage was $51,820 as of May 2022 (the most recent comprehensive data available). The lowest 10 percent earned less than $33,500, while the top 10 percent earned more than $77,400.

Summary: A reasonable expectation for a mid-career Escrow Officer is a base salary in the $55,000 to $70,000 range, with significant potential for growth based on performance, location, and experience.

Key Factors That Influence Salary

Your specific salary as an Escrow Officer is not a single number but a spectrum. Several key factors will determine where you land on that spectrum.

Level of Education

Unlike many financial professions, a four-year college degree is not always a strict requirement to become an Escrow Officer. Many successful officers enter the field with a high school diploma and build their careers through on-the-job training, often starting as an Escrow Assistant.

However, a relevant degree—such as an associate's or bachelor's in finance, business, or real estate—can provide a competitive edge and potentially lead to a higher starting salary. More importantly, state-specific licensing and professional certifications (like those from the American Escrow Association) demonstrate a level of expertise and commitment that employers value and often reward with higher pay.

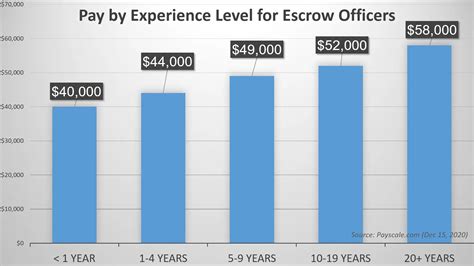

Years of Experience

Experience is arguably the most significant factor influencing an Escrow Officer's income. The career path has a clear and rewarding progression:

- Escrow Assistant (0-2 years): This entry-level position involves supporting a licensed officer with administrative and clerical tasks. Salaries typically range from $38,000 to $50,000.

- Escrow Officer (2-5 years): After gaining experience and licensure, an individual can manage their own files. Salaries move into the national average range of $50,000 to $75,000, often supplemented by bonuses based on the number of files closed.

- Senior Escrow Officer / Branch Manager (5+ years): Highly experienced officers who handle complex transactions or manage a team of officers command the highest salaries. It is common for these professionals to earn $75,000 to $100,000+, especially when factoring in performance bonuses and commissions.

Geographic Location

Where you work matters immensely. Salaries for Escrow Officers are closely tied to the cost of living and the volume of real estate activity in a specific market. States with booming real estate markets and high property values consistently offer the highest pay.

According to BLS and aggregator data, some of the top-paying states and metropolitan areas for this profession include:

- California: (Especially Los Angeles, San Francisco, and San Diego)

- Washington: (Especially the Seattle metropolitan area)

- New York

- Colorado

- District of Columbia

Working in a major metropolitan area within these states can add a premium of 20% or more to the national average salary.

Company Type

The type of company you work for also impacts your compensation structure.

- Title and Escrow Companies: These are the most common employers. Larger, national companies may offer more structured salary bands, comprehensive benefits, and clear paths for advancement. Boutique, local firms may offer more flexibility and potentially higher commission-based bonuses in competitive markets.

- Real Estate Law Firms: Law firms that handle real estate transactions often employ Escrow Officers or paralegals with escrow duties. Compensation here can be very competitive, especially at firms dealing with high-value properties.

- Banks and Lenders: Financial institutions also require escrow services for mortgages and refinancing. These roles often come with the strong corporate benefits packages associated with the banking industry.

Area of Specialization

Not all escrow transactions are created equal. Specializing in a particular niche can dramatically increase your earning potential. The primary distinction is between residential and commercial escrow.

- Residential Escrow: This involves handling the sale of single-family homes, condos, and smaller residential properties. It is the most common path and offers steady work.

- Commercial Escrow: This involves complex, high-value transactions for office buildings, retail centers, industrial properties, and land development. The deals are larger, the paperwork is more intricate, and the liability is greater. Consequently, Commercial Escrow Officers are specialists who command significantly higher salaries and bonuses, often exceeding $100,000 per year.

Job Outlook

The career outlook for Escrow Officers is directly linked to the health of the real estate market. The U.S. Bureau of Labor Statistics projects that employment for Title Examiners, Abstractors, and Searchers will show little or no change from 2022 to 2032, which is slower than the average for all occupations.

However, this statistic doesn't tell the whole story. While technology and automation are making some parts of the title search process more efficient, the need for a human expert to manage the complexities, legalities, and personal interactions of a closing remains strong. As long as people buy, sell, and refinance property, skilled and trustworthy Escrow Officers will be in demand. The cyclical nature of the real estate market means that demand will ebb and flow, but the fundamental need for the role persists.

Conclusion

A career as an Escrow Officer is a financially and professionally rewarding path for individuals who are detail-oriented, trustworthy, and thrive in a structured environment. While a starting salary may be modest, the potential for growth is significant.

Key Takeaways:

- Expect a median salary in the range of $55,000 to $70,000, with a wide variance based on several factors.

- Experience is paramount: Your earnings will grow substantially as you move from an assistant to a senior officer role.

- Location and specialization matter: Working in a high-activity real estate market or specializing in commercial transactions can catapult your income into the six-figure range.

- The career offers stability and is an indispensable part of the multi-trillion-dollar real estate industry.

For anyone looking to build a respectable and lucrative career without necessarily needing an advanced degree, becoming an Escrow Officer is an excellent and attainable goal.