A career as a Financial Consultant at a prestigious firm like Fidelity Investments offers a unique combination of purpose and high earning potential. For those with a passion for finance and a desire to help others achieve their long-term goals, it's a highly sought-after path. But what can you realistically expect to earn?

This in-depth guide will break down the salary for a Fidelity Financial Consultant, exploring the average compensation, the critical factors that influence your pay, and the promising outlook for this dynamic profession. While specific figures can vary, data from leading industry sources indicates that total compensation often exceeds $130,000, with top performers earning well over $200,000 annually.

What Does a Fidelity Investments Financial Consultant Do?

A Financial Consultant at Fidelity is a licensed financial professional who works directly with clients to help them navigate their financial lives. This is not just a sales role; it's a relationship-driven career built on trust and expertise. While responsibilities vary, the core of the job involves:

- Holistic Financial Planning: Assessing a client's complete financial picture, including investments, retirement goals, insurance needs, and estate planning.

- Developing Client Relationships: Acting as the primary point of contact and building long-term partnerships with a dedicated book of clients.

- Investment Strategy: Recommending and implementing suitable investment strategies using Fidelity's wide range of products and research.

- Client Education: Explaining complex financial concepts, market trends, and portfolio performance in a clear and understandable way.

- Goal-Oriented Advice: Helping clients plan for major life events like retirement, college savings, and wealth transfer.

Average Fidelity Investments Financial Consultant Salary

A key feature of a Financial Consultant's compensation is its structure, which typically includes a competitive base salary plus significant variable compensation (bonuses, commissions, or profit sharing). This "total compensation" figure is the most accurate reflection of earning potential.

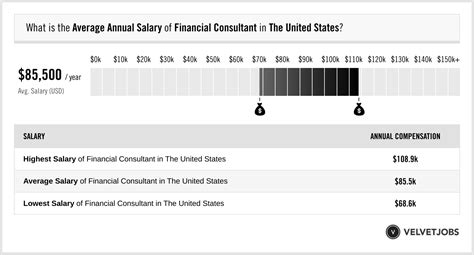

Based on recent data from several authoritative sources:

- Salary.com reports that the median total compensation for a Financial Consultant at Fidelity in the United States is approximately $145,567 as of late 2023. The typical range falls between $121,927 and $176,143, but can vary widely based on the factors discussed below.

- Glassdoor data corroborates this, showing an estimated total pay for a Fidelity Financial Consultant in the range of $120,000 to $185,000 per year, with a likely salary around $149,000. This figure includes an average base salary of approximately $78,000 and additional pay (bonuses/commissions) of around $71,000.

It's important to note that entry-level roles (like a Financial Representative) will start lower, while senior or Vice President-level consultants who manage larger books of business can significantly exceed these averages.

Key Factors That Influence Salary

Your salary isn't a single, fixed number. It's a dynamic figure influenced by a combination of your qualifications, performance, and market forces. Here are the most critical factors.

### Level of Education

A bachelor's degree in finance, economics, business, or a related field is the standard entry point for this career. However, advanced credentials are a powerful lever for increasing your value and earning potential. The most respected designation is the CERTIFIED FINANCIAL PLANNER™ (CFP®) certification. Earning your CFP® demonstrates a high level of expertise in retirement planning, insurance, investments, and ethics, often leading to higher-level roles and greater client trust. Additionally, holding key industry licenses like the Series 7 and Series 66 is a mandatory requirement for the role.

### Years of Experience

Experience is arguably the most significant driver of income growth for a Financial Consultant. As you build your skills and client base, your compensation grows accordingly.

- Early Career (0-3 Years): Professionals in the initial stages are focused on learning the business, passing licensing exams, and supporting senior consultants. Compensation is more heavily weighted toward base salary.

- Mid-Career (4-9 Years): With a proven track record, consultants manage their own client book. Variable compensation becomes a much larger portion of their total pay as they successfully grow their clients' assets.

- Senior Level (10+ Years): Senior and Vice President Financial Consultants often manage the firm's most valuable high-net-worth (HNW) clients. Their extensive experience commands the highest compensation, often exceeding $200,000 - $250,000+ annually.

### Geographic Location

Where you work matters. Salaries are adjusted based on the cost of living and the concentration of wealth in a specific region. Major financial hubs and high-cost-of-living areas typically offer higher base salaries and have a larger pool of affluent clients. According to U.S. Bureau of Labor Statistics (BLS) data for the broader "Personal Financial Advisor" category, top-paying metropolitan areas include:

- New York-Newark-Jersey City, NY-NJ-PA

- San Francisco-Oakland-Hayward, CA

- Boston-Cambridge-Nashua, MA-NH (Fidelity's headquarters)

- Washington-Arlington-Alexandria, DC-VA-MD-WV

Working in one of these competitive markets can significantly boost your earning potential compared to a smaller, rural market.

### Company Type

While this article focuses on Fidelity, understanding the industry landscape provides valuable context. Fidelity represents a large, full-service broker-dealer. This model offers immense brand recognition, extensive marketing support, and a steady stream of client leads from their massive retail platform. This structure provides a stable base salary with strong bonus potential. This contrasts with other models, such as:

- Independent Registered Investment Advisor (RIA): Offers greater autonomy and potentially a higher percentage payout on assets under management, but requires significant entrepreneurial effort to build a client base from scratch.

- Bank-Based Advisors: Leverage the bank's existing customer base for leads and often have a more structured, salary-heavy compensation plan.

### Area of Specialization

Developing a niche can make you a highly sought-after expert, leading to more referrals and higher compensation. Specialists who cater to specific, complex client needs are invaluable. Common areas of specialization include:

- High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) Clients: Managing portfolios for the wealthiest clients.

- Retirement Income Planning: Creating sustainable income strategies for retirees.

- Corporate Stock Plan Services: Helping executives and employees manage complex equity compensation (stock options, RSUs). This is a significant area of business for Fidelity.

- Estate and Trust Services: Working with clients on generational wealth transfer.

Job Outlook

The future for financial consultants is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment of personal financial advisors will grow 13 percent from 2022 to 2032, which is "much faster than the average for all occupations."

This robust growth is driven by several key trends:

1. The Retirement of Baby Boomers: This generation holds a significant amount of wealth and requires professional guidance as they transition into retirement.

2. Increased Financial Complexity: The proliferation of investment products and the decline of traditional pension plans mean more individuals need expert help to manage their own retirement savings.

3. Longer Lifespans: People are living longer, increasing the complexity and duration of financial planning.

Conclusion

A career as a Financial Consultant at Fidelity Investments is both professionally and financially rewarding. While a six-figure income is well within reach, your ultimate success hinges on a commitment to continuous improvement.

Key Takeaways:

- Strong Earning Potential: Total compensation packages frequently range from $120,000 to $185,000, with senior professionals earning significantly more.

- Compensation is Performance-Driven: Your ability to build relationships and grow your clients' assets directly impacts your variable pay.

- Credentials and Experience are Crucial: Earning your CFP® designation and building a multi-year track record are the surest paths to top-tier income.

- The Job Outlook is Excellent: The demand for skilled financial professionals is projected to grow rapidly over the next decade.

If you are driven, client-focused, and ready to build a career in finance, the role of a Financial Consultant at a firm like Fidelity offers a clear and lucrative path to success.