For those with a keen eye for detail and a passion for financial integrity, a career as a financial accountant offers a stable and rewarding path. It's a profession that forms the bedrock of business, ensuring that companies operate with clarity and compliance. But beyond the professional satisfaction, what is the earning potential?

A financial accountant's salary is not just a single number; it's a dynamic range influenced by a variety of key factors. While entry-level positions might start around $60,000, experienced professionals with specialized skills in high-demand markets can command salaries well over $120,000.

This guide will break down the typical financial accountant salary, explore the factors that drive your earning potential, and provide a clear outlook on the future of this essential profession.

What Does a Financial Accountant Do?

Before diving into the numbers, it's important to understand the role. A financial accountant is responsible for tracking, recording, and reporting a company's financial transactions. Their primary goal is to produce accurate and timely financial statements—including the balance sheet, income statement, and cash flow statement—for external stakeholders like investors, lenders, and regulatory bodies.

Key responsibilities include:

- Maintaining the general ledger.

- Performing month-end and year-end closing processes.

- Ensuring compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Preparing financial statements and supporting documentation for audits.

- Analyzing financial data to identify trends and ensure accuracy.

In essence, they are the guardians of a company's financial history, presenting it clearly and accurately to the outside world.

Average Financial Accountant Salary

Salary data can vary slightly based on the source and its methodology, but a clear picture emerges when we synthesize information from leading authorities.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all "Accountants and Auditors" was $81,360 in May 2023. The lowest 10 percent earned less than $50,530, while the highest 10 percent earned more than $141,680.

Salary aggregator websites provide data more specific to the "Financial Accountant" title:

- Salary.com reports that the median salary for a Financial Accountant in the United States is approximately $72,800, with a typical range falling between $66,500 and $79,800.

- Payscale shows an average base salary of around $66,000 per year, with a common range from $51,000 to $87,000.

- Glassdoor lists a total pay average of about $76,000 per year for financial accountants in the U.S.

Summary: A typical financial accountant can expect to earn a salary ranging from $65,000 to $85,000, with significant potential for growth based on the factors below.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of your qualifications, choices, and market forces. Here are the five most significant factors.

###

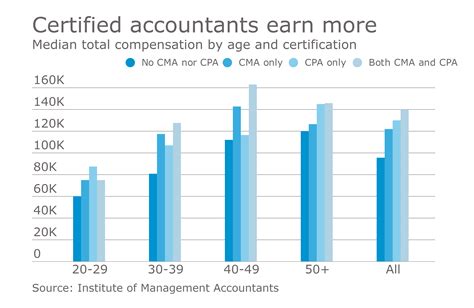

Level of Education and Professional Certifications

Your educational background is the foundation of your career. While a bachelor's degree in accounting or a related field is the standard entry requirement, advanced credentials can significantly boost your earnings.

- Bachelor's Degree: This is the minimum requirement to enter the field.

- Master's Degree: A Master of Accountancy (MAcc) or Master of Science in Accounting (MSA) can lead to higher starting salaries and open doors to leadership and specialized roles.

- Certified Public Accountant (CPA): This is the gold standard in the accounting industry. Earning your CPA license is arguably the single most impactful step you can take to increase your salary and career opportunities. Many studies suggest that CPAs earn a 10-15% salary premium over their non-certified peers. It signals a high level of expertise and is often a prerequisite for senior and managerial positions.

###

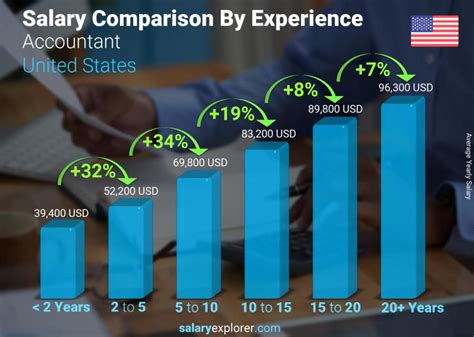

Years of Experience

As with most professions, experience pays. Your salary will grow as you move from executing tasks to managing processes and eventually leading teams.

- Entry-Level (0-2 years): Professionals in this stage are learning the fundamentals. Expect a salary in the range of $55,000 to $70,000.

- Mid-Career (3-8 years): With solid experience, accountants take on more complex responsibilities, like leading month-end closes or mentoring junior staff. Salaries typically range from $70,000 to $95,000.

- Senior/Managerial (8+ years): Senior financial accountants and accounting managers oversee entire reporting functions, manage teams, and engage in strategic financial analysis. At this level, salaries frequently exceed $100,000, with top positions reaching $130,000 or more.

###

Geographic Location

Where you work matters. Salaries are often adjusted to the cost of living and the demand for talent in a specific region. Major metropolitan areas with large corporate headquarters tend to offer the highest salaries.

According to BLS data, the top-paying states for accountants include:

- District of Columbia

- New York

- California

- New Jersey

- Massachusetts

An accountant in a major city like San Francisco or New York City can expect to earn significantly more than someone in a similar role in a smaller, rural town.

###

Company Type

The type and size of the company you work for play a crucial role in compensation.

- Public Accounting (e.g., "The Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering competitive starting salaries but also demanding long hours. It's often seen as a career accelerator.

- Large Corporations: Publicly traded companies often have complex reporting requirements (e.g., SEC filings), leading them to pay higher salaries to attract top talent.

- Small and Medium-Sized Businesses (SMBs): While base salaries might be slightly lower, these companies can offer better work-life balance and broader, more hands-on experience.

- Government and Non-Profit: These sectors typically offer lower base salaries but compensate with exceptional job security, robust benefits packages, and a strong sense of public service or mission.

###

Area of Specialization

Within financial accounting, certain high-demand specializations can command premium pay. These roles require a deeper level of technical knowledge and expertise.

- SEC Reporting: Accountants who specialize in preparing and filing documents with the Securities and Exchange Commission are highly valued at public companies.

- Technical Accounting: This involves researching and interpreting complex accounting standards to advise on the treatment of unusual or new transactions.

- Financial Reporting Manager: This role oversees the entire financial reporting process and is a direct step toward a controller or CFO position.

- Forensic Accounting: While a distinct field, it builds on financial accounting principles to investigate fraud and financial discrepancies.

Job Outlook

The future for financial accountants is bright and stable. The BLS projects that employment for accountants and auditors will grow 4 percent from 2022 to 2032. This growth is driven by a need for financial accountability, increasingly complex global regulations, and a heightened focus on preventing financial fraud.

As long as businesses exist, there will be a need for skilled professionals to manage and report on their financial health, ensuring strong and consistent demand for financial accountants.

Conclusion

A career as a financial accountant is a reliable and lucrative choice for detail-oriented individuals. While the national average salary provides a solid benchmark, your personal earning potential is firmly within your control.

To maximize your salary, focus on these key takeaways:

1. Invest in Credentials: Earning your CPA license is the most effective way to accelerate your career and boost your income.

2. Gain Diverse Experience: Build a strong foundation and seek roles with increasing complexity and responsibility.

3. Be Strategic About Location and Industry: Target high-growth areas and industries that value your skills.

By strategically developing your skills and credentials, you can build a financially rewarding and professionally fulfilling career as a financial accountant.

Sources:

- *U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Accountants and Auditors. (Data from May 2023).*

- *Salary.com, Financial Accountant Salary Data. (Accessed 2024).*

- *Payscale.com, Financial Accountant Salary Data. (Accessed 2024).*

- *Glassdoor.com, Financial Accountant Salary Data. (Accessed 2024).*