Are you the person who finds deep satisfaction in a perfectly balanced spreadsheet? Do you possess a keen eye for detail and an innate ability to see the financial story behind the numbers? If you’re looking for a career that places you at the operational heart of a business, managing its financial health and ensuring projects run smoothly, then the role of a Financial Coordinator might be your perfect fit. This position is far more than mere bookkeeping; it's a critical function that acts as the financial backbone of a department, project, or even an entire small-to-mid-sized company.

But beyond the responsibilities, what is the tangible reward? Understanding the financial coordinator salary landscape is a crucial step in mapping out your professional future. On average, professionals in this role can expect a competitive salary, with national averages typically falling between $55,000 and $70,000 per year. However, this figure is just the starting point. With the right experience, skills, and strategic career moves, top earners can command salaries well over $90,000.

I once worked on a major software implementation project that was spiraling out of control, both in timeline and budget. It was our Financial Coordinator, a quiet but incredibly sharp individual named Sarah, who saved us. By meticulously tracking vendor invoices against contract terms and flagging budget variances in real-time, she identified overspending weeks before our project management tools did. Her analysis gave us the data needed to renegotiate with a vendor, ultimately saving the project tens of thousands of dollars. It was a powerful lesson in how this role is not just about processing payments but about providing the critical intelligence that drives sound business decisions.

This guide will serve as your comprehensive roadmap to a career as a Financial Coordinator. We will dissect salary expectations, explore the factors that can maximize your earning potential, and provide a step-by-step plan to launch your career.

### Table of Contents

- [What Does a Financial Coordinator Do?](#what-does-a-financial-coordinator-do)

- [Average Financial Coordinator Salary: A Deep Dive](#average-financial-coordinator-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Financial Coordinator Do?

A Financial Coordinator is the linchpin of an organization's financial operations. While a CFO or Director of Finance sets the high-level strategy, the Financial Coordinator is on the ground, executing the daily tasks that ensure financial integrity and efficiency. They bridge the gap between departmental operations and the central accounting function, ensuring that all financial transactions are accurate, timely, and compliant with company policies and regulations.

Think of them as the air traffic controllers of an organization's finances. They monitor incoming and outgoing financial "traffic"—invoices, expense reports, purchase orders, and budget data—to prevent collisions (overspending), ensure smooth takeoffs (project kick-offs with proper funding), and guide everything to a safe landing (month-end closing).

Core Responsibilities and Daily Tasks:

The specific duties of a Financial Coordinator can vary based on the industry and company size, but they generally revolve around a core set of responsibilities:

- Budget Management and Tracking: Monitoring departmental or project-specific budgets, comparing actual spending against forecasted amounts, and preparing variance reports to flag potential overruns.

- Accounts Payable (AP) and Accounts Receivable (AR): Processing vendor invoices for payment, ensuring proper authorization and coding. They may also be involved in generating customer invoices, tracking payments, and following up on overdue accounts.

- Expense Report Processing: Reviewing and processing employee expense reports, ensuring they comply with company travel and expense policies.

- Financial Reporting: Assisting in the preparation of monthly, quarterly, and annual financial reports. This can include pulling data from accounting systems, reconciling accounts, and creating summaries for management.

- Procurement and Purchasing: Creating and managing purchase orders, verifying receipt of goods and services, and coordinating with vendors.

- Grant and Contract Management: In specialized environments like non-profits or research institutions, they manage the financial aspects of grants, ensuring that spending adheres to the strict guidelines set by the funding body.

- Financial Record-Keeping: Maintaining organized and accurate financial records, both digital and physical, to ensure a clean audit trail.

### A Day in the Life of a Financial Coordinator

To make this role more tangible, let's walk through a typical day for a Financial Coordinator at a mid-sized marketing agency.

- 9:00 AM - 10:30 AM: Morning Reconciliation & AP Review. The day begins by reviewing the bank accounts and credit card statements from the previous day, reconciling transactions in the accounting software (like QuickBooks or NetSuite). They then move to the Accounts Payable inbox, sorting new vendor invoices for a major client photoshoot and flagging any that are missing a required Purchase Order number.

- 10:30 AM - 12:00 PM: Project Budget Check-in. The coordinator meets with a Project Manager to review the budget for an upcoming video campaign. They pull a "budget vs. actual" report, showing that 70% of the freelance budget has already been spent with the project only 50% complete. Together, they identify the cause—higher-than-expected editing costs—and brainstorm solutions to present to the client.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 2:30 PM: Expense Reports & Vendor Communication. They process a batch of employee expense reports from a recent conference, ensuring all receipts are attached and policy limits weren't exceeded. They then call a printing vendor to clarify a discrepancy on a recent invoice, successfully negotiating a credit for a late delivery.

- 2:30 PM - 4:00 PM: Month-End Prep. With the end of the month approaching, they begin pre-closing tasks. This involves creating journal entries for prepaid expenses, reviewing the fixed asset schedule, and sending out reminders to department heads to submit all final invoices for the period.

- 4:00 PM - 5:00 PM: Reporting & Planning. They finalize a weekly cash flow projection for the Director of Finance and respond to emails. Before logging off, they review their calendar for the next day, noting a meeting about a new software subscription and blocking off time to prepare the necessary cost-benefit analysis.

This example illustrates the blend of meticulous, independent work and collaborative, problem-solving activities that defines the Financial Coordinator role.

Average Financial Coordinator Salary: A Deep Dive

The financial coordinator salary is a compelling aspect of the career, offering a stable and competitive income with significant room for growth. While a single "average" salary provides a useful benchmark, the reality is a spectrum influenced by numerous factors we'll explore later.

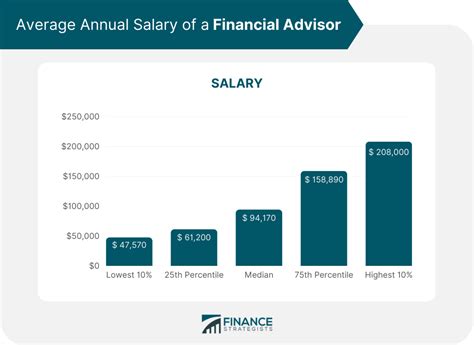

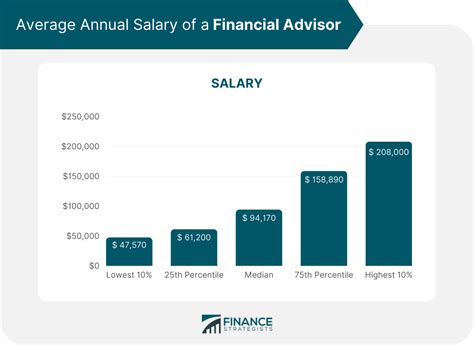

According to major salary aggregators updated for 2023 and 2024, the salary landscape for a Financial Coordinator in the United States breaks down as follows:

- Payscale.com reports the average base salary for a Financial Coordinator is $54,820 per year. The typical range falls between $42,000 and $74,000.

- Salary.com provides a slightly higher median salary, citing $65,101 per year, with the most common range being between $58,356 and $72,836.

- Glassdoor estimates a total pay average of $66,975 per year, which includes a base average of $58,382 and additional pay (bonuses, profit sharing) averaging $8,593.

Taking these sources into account, a realistic national average salary for a mid-level Financial Coordinator is approximately $60,000 to $68,000. However, entry-level positions will start lower, and senior or specialized roles in high-cost-of-living areas can command significantly more.

### Salary by Experience Level

Experience is arguably the single most powerful driver of salary growth in this profession. As you accumulate skills, demonstrate reliability, and take on more complex responsibilities, your value—and compensation—will increase accordingly.

Here is a typical salary progression you can expect throughout your career, compiled from industry data:

| Experience Level | Years of Experience | Typical Salary Range (Annual) | Key Responsibilities & Expectations |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 years | $45,000 - $55,000 | Focus on foundational tasks like data entry, processing invoices and expense reports, and basic account reconciliations under supervision. |

| Mid-Career | 2-5 years | $55,000 - $70,000 | Manages full-cycle AP/AR, assists with month-end closing, prepares budget variance reports, and operates with greater autonomy. May train junior staff. |

| Senior/Lead | 5-10 years | $70,000 - $90,000+ | Oversees complex budgets (e.g., multi-million dollar projects), develops financial procedures, performs in-depth financial analysis, and acts as a key advisor to department heads. May supervise a small team. |

| Specialist/Manager | 10+ years | $85,000 - $110,000+ | Often moves into a specialized role (e.g., Senior Grants Financial Coordinator, Project Finance Manager) or a broader Financial Manager position. Focus on strategic analysis, process improvement, and high-level financial oversight. |

*(Note: These are national averages. Geographic location and other factors can shift these ranges significantly.)*

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. When evaluating a job offer, it's essential to consider the entire compensation package, which can add substantial value.

Common components of a Financial Coordinator's total compensation include:

- Bonuses: Annual or quarterly performance-based bonuses are common, especially in for-profit corporations. These can range from a few thousand dollars to 10-15% of your base salary, tied to individual performance, department goals, or overall company profitability.

- Profit Sharing: Some companies, particularly smaller, privately-held ones, offer a profit-sharing plan where a portion of the company's annual profits is distributed among employees. This provides a direct incentive to contribute to the company's financial success.

- Retirement Plans: A 401(k) or 403(b) (for non-profits) is a standard benefit. The key differentiator is the employer match. A company that matches your contributions up to, say, 5% of your salary is effectively giving you an instant 5% raise that gets invested for your future.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a critical component. Look at the quality of the plans offered—the deductibles, copays, and premium costs that you will be responsible for. Many companies now also offer wellness stipends for gym memberships or mental health apps.

- Paid Time Off (PTO): This includes vacation days, sick leave, and personal days. The standard is typically 2-3 weeks to start, often increasing with seniority. Generous PTO policies contribute significantly to work-life balance and overall job satisfaction.

- Professional Development: A great employer will invest in your growth. This can include tuition reimbursement for a Master's degree, funding for professional certifications (like a Certified Bookkeeper or a software-specific certification), and paid attendance at industry conferences.

When comparing offers, don't just look at the base salary. An offer with a slightly lower base but a generous 401(k) match, excellent health insurance, and a significant annual bonus could be far more valuable in the long run.

Key Factors That Influence Salary

While we've established a baseline for the financial coordinator salary, your specific earnings will be determined by a complex interplay of factors. Understanding and strategically navigating these elements is the key to maximizing your income potential throughout your career. This section provides an exhaustive breakdown of the variables that matter most.

### `

` Level of Education

Your educational background serves as the foundation for your career and directly impacts your starting salary and long-term growth trajectory.

- High School Diploma or Associate's Degree: It is possible to enter the field, often in a more junior "Financial Clerk" or "Accounting Assistant" role, with an Associate's degree in Accounting or a related field. However, your starting salary will likely be at the lower end of the spectrum (around $40,000 - $48,000), and your opportunities for advancement may be limited without further education.

- Bachelor's Degree (The Standard): A Bachelor's degree in Accounting, Finance, or Business Administration is the most common and preferred qualification for Financial Coordinator positions. It signals to employers that you have a comprehensive understanding of financial principles, corporate finance, and accounting standards (like GAAP). Graduates with a Bachelor's degree can expect to start in the $50,000 - $60,000 range, depending on location and internship experience. This degree is often a prerequisite for advancing to senior and management roles.

- Master's Degree (MBA or Master's in Finance/Accounting): While not typically required for a coordinator role, a Master's degree can provide a significant advantage, particularly for positions in complex industries or at large corporations. It can fast-track you to senior or analyst roles and command a salary premium of 10-20% over a Bachelor's degree alone. It is most valuable for those with long-term ambitions to become a Financial Controller or CFO.

- Professional Certifications: Certifications are a powerful way to validate your skills and boost your earning potential. They demonstrate a commitment to your profession and a mastery of specific knowledge areas.

- Certified Bookkeeper (CB): Offered by the American Institute of Professional Bookkeepers (AIPB), this certification is highly relevant for coordinators, as it validates skills in double-entry bookkeeping, payroll, and internal controls. It can add credibility and a modest salary bump.

- Software-Specific Certifications: Becoming a certified expert in a widely used ERP system (like SAP S/4HANA Finance or Oracle NetSuite) or accounting software (QuickBooks Online Advanced Certified ProAdvisor) can make you a highly sought-after candidate and justify a higher salary, as it reduces the training burden on an employer.

### `

` Years of Experience

As highlighted in the previous section, experience is paramount. However, it's not just about the number of years; it's about the *quality* and *complexity* of the experience gained.

- 0-2 Years (Foundation Building): In this stage, you're moving from theory to practice. Your salary (approx. $45k - $55k) reflects that you are learning the ropes. Your focus is on accuracy, efficiency in core tasks (AP/AR, data entry), and understanding company-specific processes.

- 2-5 Years (Developing Independence): Here, you have mastered the fundamentals and begin to operate more independently. You're trusted to handle the month-end close process with minimal supervision, generate reports, and communicate directly with vendors and department heads. Your salary grows to the $55k - $70k range as you prove your reliability and expand your skillset.

- 5-10 Years (Becoming a Strategic Partner): At this senior level, you transition from a purely transactional role to a more analytical and strategic one. You're not just processing data; you're interpreting it. You might be managing the budget for a multi-million dollar capital project, identifying cost-saving opportunities, improving financial workflows, and mentoring junior coordinators. This is where salaries push into the $70k - $90k+ bracket. Your value lies in your ability to provide financial insights that guide business decisions.

### `

` Geographic Location

Where you work has a dramatic impact on your paycheck. Salaries are closely tied to the cost of living and the demand for financial professionals in a given metropolitan area. A $60,000 salary in a low-cost-of-living city might offer more disposable income than a $75,000 salary in an expensive coastal metropolis.

High-Paying Metropolitan Areas:

Cities with major corporate headquarters, thriving tech sectors, or high concentrations of financial services firms typically offer the highest salaries.

- San Jose, CA: Average salaries can be 25-35% above the national average.

- New York, NY: A major financial hub, with salaries often 20-30% higher.

- San Francisco, CA: Similar to San Jose, with a very high cost of living driving up wages.

- Boston, MA: Strong biotech, tech, and education sectors create high demand.

- Washington, D.C.: Government contractors, non-profits, and associations pay competitive rates.

- Seattle, WA: The booming tech industry has pushed all professional salaries upward.

Average-Paying Metropolitan Areas:

Large cities in the Midwest and Southeast often align closely with the national average salary figures.

- Chicago, IL

- Dallas, TX

- Atlanta, GA

- Denver, CO

Lower-Paying Areas:

Rural areas and smaller cities with lower costs of living will naturally have salary ranges below the national average. While the dollar amount is lower, your purchasing power may be comparable.

Important Note: The rise of remote work has slightly complicated this factor. Some companies now offer location-agnostic pay, while others use a "localized" compensation model, adjusting your salary based on where you live, even if you are fully remote. This is a critical question to ask during the interview process for any remote role.

### `

` Company Type & Size

The type of organization you work for will influence not only your salary but also the company culture, benefits, and career path.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured bonus programs. They have well-defined pay bands for each role. The work is often more specialized, meaning you might be the Financial Coordinator for *just* the Marketing department or *only* handle capital expenditure tracking. The environment is more formal, but opportunities for internal advancement can be plentiful.

- Startups and Small/Mid-Sized Businesses (SMBs): Base salaries may be slightly lower than at large corporations. However, this can be offset by other forms of compensation like stock options or equity, which could become highly valuable if the company succeeds. The role is often much broader, giving you exposure to all aspects of finance and operations—a fantastic learning experience. The environment is typically more fast-paced and less formal.

- Non-Profit Organizations: Salaries in the non-profit sector are generally 5-15% lower than in the for-profit world. However, these roles often come with excellent benefits, better work-life balance, and a strong sense of mission. Specialized roles, like a Grants Financial Coordinator, require unique skills and can be quite competitive.

- Government (Local, State, Federal): Government salaries are often competitive with the private sector, particularly when you factor in the robust benefits packages, including pensions (which are rare elsewhere), job security, and generous paid leave. The work is highly structured and process-driven.

- Healthcare and Education (Universities, Hospitals): These large, stable institutions are major employers of Financial Coordinators. Salaries are often in line with the national average. These roles frequently involve specialized knowledge, such as managing research grants, departmental budgets within a university, or patient billing and insurance reconciliation in a hospital setting.

### `

` Area of Specialization

Within the "Financial Coordinator" title, there are numerous specializations that can impact earning potential. Developing expertise in a high-value area can make you a more valuable and higher-paid asset.

- Project Finance Coordinator: Working in industries like construction, engineering, or IT consulting, these coordinators manage the budgets for large, complex, multi-year projects. They track costs, labor, materials, and milestones. Due to the high financial stakes, these roles often pay a premium.

- Grants Financial Coordinator: Common in universities, research institutions, and non-profits, this role involves managing the entire financial lifecycle of government or foundation grants. It requires meticulous adherence to complex compliance rules and reporting standards, making it a valuable niche.

- Clinical Trials Financial Coordinator: In the pharmaceutical and biotech industries, this highly specialized role manages the financial aspects of clinical trials, including patient stipends, site payments, and vendor contracts. The complexity and regulatory oversight (FDA rules) mean these roles are often very well-compensated.

- IT Financial Coordinator: This position focuses on managing the technology budget of an organization. It involves tracking software licenses, hardware purchases, cloud computing costs (e.g., AWS, Azure), and vendor contracts. As tech spending becomes a larger part of every company's budget, this specialization is growing in demand.

### `

` In-Demand Skills

Beyond your formal education and experience, the specific skills you possess are what truly set you apart and give you leverage in salary negotiations.

High-Value Hard Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a master. This means going beyond basic formulas and SUM(). You need to be proficient in VLOOKUPs/HLOOKUPs (and now XLOOKUP), PivotTables, INDEX-MATCH, conditional formatting, and data visualization (charts and graphs). The ability to build a small financial model or dashboard in Excel is a huge plus.

- ERP/Accounting Software Proficiency: Experience with enterprise-level systems is a major differentiator.

- Tier 1 (Large Corp): SAP, Oracle NetSuite, Microsoft Dynamics 365

- Tier 2 (Mid-Market): QuickBooks Online/Desktop, Sage Intacct, Xero

- Having hands-on experience with the specific system a company uses can make you an ideal candidate.

- Financial Reporting & Analysis: The ability to not just pull numbers but to understand what they mean. This includes creating Budget vs. Actual (BvA) reports, writing concise summaries of financial performance, and identifying trends in spending.

- Data Visualization Tools: While not always required, familiarity with tools like Tableau or Power BI can elevate your role from a coordinator to a financial analyst, enabling you to create interactive dashboards for management.

Essential Soft Skills:

- Impeccable Attention to Detail: A single misplaced decimal point can have significant consequences. This skill is the absolute bedrock of the profession.

- Strong Communication Skills (Written and Verbal): You will need to clearly explain financial concepts to non-financial people (like project managers or department heads), write professional emails to vendors, and create clear, easy-to-read reports.

- Problem-Solving and Critical Thinking: When a budget doesn't balance or an invoice seems incorrect, you need the analytical skills to investigate the issue, identify the root cause, and propose a solution.

- Organization and Time Management: You will be juggling multiple deadlines, priorities, and requests simultaneously (e.g., processing urgent payments while also working on month-end closing). The ability to stay organized is crucial.

- Ethical Judgment and Discretion: You will be handling sensitive financial information. Demonstrating a high level of integrity and confidentiality is essential for building trust.

Job Outlook and Career Growth

When considering any career path, long-term stability and opportunities for advancement are just as important as the starting salary. For Financial Coordinators, the future is best described as one of evolution, not extinction.

The U.S. Bureau of Labor Statistics (BLS) provides employment projections for related occupations. The most relevant category is "Bookkeeping, Accounting, and Auditing Clerks" (SOC 43-3031). The BLS projects a 5 percent decline in employment for this group from 2022 to 2032.

At first glance, this might seem alarming. However, it is crucial to understand the story *behind* this number. The projected decline is almost entirely concentrated in roles focused on routine, manual data entry and basic clerical tasks. These are the very functions being automated by accounting software, artificial intelligence (AI), and cloud-based platforms.

The good news is that the core functions of a Financial Coordinator—coordination, analysis, problem-solving, communication, and budget oversight—are becoming *more* valuable, not less. The role is shifting away from being a "data enterer" and toward being a "data interpreter" and "financial navigator." Companies still need a human to manage the software, analyze the output, enforce policies, communicate with stakeholders, and investigate discrepancies.

Emerging Trends and Future Challenges:

To thrive in the coming decade, Financial Coordinators must embrace the following trends:

1. Increased Automation: AI-powered tools can now scan invoices, code expenses, and perform basic reconciliations automatically. The coordinator of the future will supervise these systems, manage exceptions, and focus their time on higher-value analysis.

2. Focus on Data Analytics: The ability to use data to tell a story is becoming a core competency. Instead of just reporting that a project is over budget, the future coordinator will analyze the data to explain *why* it's over budget and model the impact of potential solutions.

3. Cloud-Based Systems: The shift to cloud ERPs like NetSuite and QuickBooks Online is nearly complete. Expertise in these platforms, including their reporting and integration capabilities, is no longer optional.

4. Enhanced Cybersecurity Awareness: As financial data moves to the cloud, coordinators are on the front lines of preventing fraud. They must be vigilant in spotting phishing attempts, verifying vendor payment information, and following strict security protocols.

5. Emphasis on Soft Skills: As routine tasks are automated, skills like communication, collaboration, and strategic thinking become paramount. Your ability to work with a project manager to solve a budget issue is more valuable than your ability to key in 100 invoices per hour.

How to Stay Relevant and Advance Your Career:

Your career path doesn't end at "Senior Financial Coordinator." This role is a fantastic launchpad for several more senior positions.

- Career Advancement Path:

- Financial Coordinator -> Senior Financial Coordinator -> Staff Accountant / Senior Accountant

*