Introduction

Imagine standing at the intersection of Wall Street and Silicon Valley. In one hand, you hold the complex, high-stakes world of global finance. In the other, you wield the power of sophisticated mathematics, cutting-edge data science, and elite programming skills. This is the domain of the financial engineer, one of the most intellectually demanding, financially rewarding, and impactful careers in the modern economy. If you are driven by complex problem-solving and aspire to a career that offers both immense intellectual challenge and extraordinary compensation, you have arrived at the right place.

The allure of a financial engineer's salary is undeniable, with entry-level professionals often commanding six-figure incomes and seasoned experts reaching compensation packages well into the high six or even seven figures. But this career is about more than just the numbers on a paycheck. It's about architecting the very systems that power our financial markets, from pricing exotic derivatives to developing the algorithmic trading strategies that execute billions of dollars in trades in microseconds.

I once mentored a brilliant Ph.D. in astrophysics who felt her skills in mathematical modeling were too abstract for the "real world." After discovering financial engineering, she found her calling. Today, she applies the same rigorous logic she once used to model star formations to manage multi-billion dollar portfolio risk for a major hedge fund, finding immense satisfaction in solving tangible, high-stakes problems. Her story is a testament to the transformative power of this unique profession.

This guide will serve as your comprehensive roadmap, demystifying every aspect of a financial engineer's compensation and career trajectory. We will dissect salary data from authoritative sources, explore the key factors that can dramatically increase your earning potential, and provide a step-by-step plan to launch your own successful career.

---

### Table of Contents

- [What Does a Financial Engineer Do?](#what-is-a-financial-engineer)

- [Average Financial Engineer Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion](#conclusion)

---

What Does a Financial Engineer Do?

A financial engineer, often called a "quant" (quantitative analyst), is a highly specialized professional who applies mathematical and engineering methodologies to solve complex financial problems. They are the architects and innovators behind the financial instruments, models, and systems that underpin the global markets.

At its core, the role is about managing risk and creating value through quantitative analysis. They don't just analyze the market; they build the tools to analyze it, predict its movements, and capitalize on opportunities. This involves a unique blend of three critical disciplines:

1. Financial Theory: Deep understanding of asset pricing, portfolio theory, derivatives, and risk management.

2. Mathematical Modeling: Expertise in calculus, statistics, probability, stochastic processes, and numerical analysis.

3. Computational Skills: Proficiency in programming languages like Python and C++, database management, and machine learning techniques.

Their work is less about traditional financial advising and more about building the engine of modern finance. They design and implement the complex algorithms for high-frequency trading, create sophisticated models to price derivatives that have no market price, and develop risk management systems to protect financial institutions from catastrophic losses.

### Daily Tasks and Typical Projects

The day-to-day responsibilities of a financial engineer can vary significantly based on their specific role (e.g., sales and trading, risk management, quantitative development) and employer. However, some common tasks and projects include:

- Model Development and Validation: Building, testing, and maintaining mathematical models for pricing securities (like options, swaps, and other derivatives), predicting market trends, or assessing credit risk.

- Strategy Backtesting: Using historical data to test the potential profitability and risk of new trading strategies before they are deployed with real capital.

- Software Development: Writing, debugging, and optimizing the code (often in C++ for speed or Python for analysis) that implements financial models and trading algorithms.

- Risk Analysis: Running simulations (like Monte Carlo methods) to model potential market scenarios and quantify a portfolio's exposure to various risk factors (market risk, credit risk, liquidity risk).

- Data Analysis and Management: Cleaning, manipulating, and analyzing vast datasets to uncover patterns, anomalies, and opportunities.

- Collaboration: Working closely with traders, portfolio managers, and IT professionals to translate complex quantitative concepts into practical, profitable applications.

### A "Day in the Life" of a Quantitative Analyst at an Investment Bank

To make this tangible, let's walk through a hypothetical day for a mid-level quant working on an equity derivatives desk.

- 7:00 AM: Arrive at the office. The first hour is spent catching up on overnight market movements in Asia and Europe. Review the performance of the desk's existing positions and check for any alerts or errors from the automated risk systems.

- 8:00 AM: Participate in the morning strategy meeting with traders. Discuss market sentiment, upcoming economic data releases, and potential trading opportunities. A trader might ask, "Can you model the volatility impact of the Fed's announcement this afternoon on our options portfolio?"

- 9:30 AM (Market Open): The trading floor is buzzing. The quant's focus is on monitoring the performance of the pricing models in real-time. Are they accurately reflecting market prices? Is the trading system executing as expected? They might spend this time debugging a small issue in the pricing library or recalibrating a volatility surface model.

- 11:00 AM: Deep work session. The primary project is developing a new pricing model for an exotic, non-standard derivative product a client has requested. This involves writing Python code to implement the mathematical formula, running it against test data, and documenting the methodology.

- 1:00 PM: Lunch, often eaten at the desk to stay close to the market.

- 2:00 PM: Meet with the IT infrastructure team. The new model needs to be integrated into the bank's main trading system, which requires careful planning for deployment, performance testing, and ensuring it doesn't slow down other critical processes.

- 4:00 PM (Market Close): The pace slows slightly. Time to run end-of-day risk reports. The quant runs a series of simulations to calculate the desk's "Greeks" (Delta, Gamma, Vega, Theta), Value at Risk (VaR), and other key risk metrics. These reports are crucial for the bank's leadership and regulators.

- 5:30 PM: The day's core tasks are done. The final part of the day might be spent on research—reading academic papers on new machine learning techniques for forecasting or learning a new feature in a C++ library that could optimize a process.

- 6:30 PM - 7:00 PM: Head home, already thinking about the modeling challenges of tomorrow.

This "day in the life" illustrates the intense, fast-paced, and intellectually stimulating nature of the job. It's a role for those who thrive under pressure and enjoy solving complex, multi-disciplinary puzzles with real-world financial consequences.

Average Financial Engineer Salary: A Deep Dive

The compensation for a financial engineer is among the highest for any profession requiring a similar level of education, a direct reflection of the immense value they create and the scarcity of their specialized skill set. It's crucial to understand that a financial engineer's pay is rarely just a base salary; it's a comprehensive package heavily weighted towards performance-based bonuses.

### National Averages and Salary Ranges

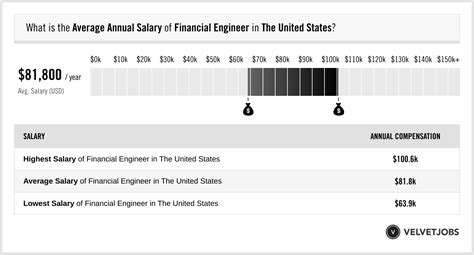

While the U.S. Bureau of Labor Statistics (BLS) does not have a dedicated category for "Financial Engineer," it groups them within related professions like "Financial and Investment Analysts, and Financial Risk Specialists." The BLS reports a median annual wage of $96,220 as of May 2022 for this broad category. However, this figure significantly *understates* the reality for a true financial engineer or quant. The BLS data includes a wide range of less specialized financial analyst roles, pulling the median down.

More specialized and accurate data from industry-specific salary aggregators paint a much clearer picture:

- Salary.com reports that the median base salary for a Financial Engineer in the United States is approximately $118,500 per year as of late 2023, with a typical range falling between $107,990 and $130,490.

- Glassdoor provides a similar estimate, with an average base salary of around $134,000 per year. Importantly, Glassdoor also calculates "total pay," which includes bonuses and other compensation, bringing the average to over $155,000.

- Payscale shows an average base salary of $111,000, with a reported range from $76,000 for the bottom 10% to over $158,000 for the top 10% in base pay alone.

These figures confirm that a typical starting point is well into the six figures, but the real story lies in the career progression and the massive upside potential.

### Salary by Experience Level

Compensation grows exponentially with experience, responsibility, and a proven track record of profitability or effective risk management. Here's a typical breakdown of expected total compensation (base + bonus) at a top-tier institution like an investment bank or hedge fund:

| Experience Level | Years of Experience | Typical Total Compensation Range (Base + Bonus) | Role & Responsibilities |

| ----------------------- | ------------------- | ----------------------------------------------- | ------------------------------------------------------------------------------------------------------------------- |

| Entry-Level/Analyst | 0-2 years | $120,000 - $200,000+ | Fresh from a Master's or Ph.D. program. Focus on model support, data analysis, coding, and learning from senior quants. |

| Mid-Career/Associate | 3-6 years | $200,000 - $400,000+ | Owns specific models or projects. More autonomy, direct interaction with traders, and mentor junior analysts. |

| Senior/Vice President | 7-12 years | $400,000 - $750,000+ | Leads a small team, responsible for a significant product area or trading strategy. Significant P&L responsibility. |

| Director/Principal | 12-15+ years | $750,000 - $1,500,000+ | Manages a larger group or desk. Sets strategic direction for quantitative research. Significant client or business impact. |

| Managing Director/Partner | 15+ years | $1,500,000 - $5,000,000+ | Head of a major division (e.g., Head of Quantitative Strategies). A top-level executive with firm-wide influence. |

*Note: These are estimates for high-paying sectors like investment banking and hedge funds in major financial hubs. Compensation can vary significantly based on the factors discussed in the next section.*

### The All-Important Bonus: Deconstructing Total Compensation

For a financial engineer, the base salary is just the starting point. The annual performance bonus is where the truly life-changing money is made. It is not an afterthought; it is a fundamental and expected part of the compensation structure.

- Bonus Structure: Bonuses are directly tied to performance—both individual and firm-wide. For a quant on a trading desk, this might be linked to the profitability (P&L) of the strategies they helped develop. For a risk quant, it might be tied to the successful management and mitigation of portfolio risks.

- Bonus Size: It's common for bonuses to be a significant percentage of the base salary.

- Junior Level: Bonuses might range from 20% to 50% of base salary.

- Mid-Level: Can easily reach 50% to 100% of base.

- Senior Level: Bonuses of 100% to 200%+ of base salary are not uncommon, especially in a good year for the firm.

- Other Compensation Components:

- Profit Sharing: Common in hedge funds and proprietary trading firms, where employees receive a direct cut of the firm's profits.

- Stock Options/Restricted Stock Units (RSUs): More common in publicly traded banks and FinTech companies, these tie compensation to the long-term performance of the company's stock.

- Sign-On Bonus: Often offered to lure top talent, especially those graduating from elite MFE programs or coming from a competitor. These can range from $20,000 to over $100,000.

- Deferred Compensation: A portion of the bonus may be deferred and paid out over several years, often in stock, to incentivize long-term commitment.

Understanding this complete picture is essential. When evaluating a job offer, a financial engineer must look far beyond the base salary and analyze the entire potential compensation package, as the variable component often outweighs the fixed salary.

Key Factors That Influence Financial Engineer Salary

While the national averages provide a baseline, a financial engineer's actual salary is a complex equation with many variables. Mastering and optimizing these factors is the key to maximizing your earning potential throughout your career. This is the most critical section for understanding how to move from a "good" salary to an "elite" one.

### 1. Level of Education: The Price of Admission

In this field, education is not just a checkbox; it's the foundation of your credibility and capability. The type and prestige of your degree have a direct and significant impact on your starting salary and career trajectory.

- Bachelor's Degree: A bachelor's degree in a quantitative field (e.g., Mathematics, Statistics, Physics, Computer Science, Engineering, Economics) is the absolute minimum requirement. However, it's increasingly difficult to land a top-tier financial engineering role with only an undergraduate degree unless it's from a top-tier university (like MIT or Caltech) combined with exceptional internship experience.

- Master's Degree (The Gold Standard): A specialized master's degree is the most common and effective entry point into the profession. The top programs are Master's in Financial Engineering (MFE), Master of Science in Quantitative Finance (MSQF), or a Master's in Computational Finance (MSCF).

- Impact: Graduating from a top-10 MFE program (e.g., Carnegie Mellon, Baruch, UC Berkeley, NYU, Columbia) is a powerful signal to employers. These programs have dedicated career services and deep industry connections. Placement reports from these programs often show average starting total compensation packages of $150,000 to $200,000+ for new graduates.

- Ph.D. (The Specialist's Path): A Ph.D. in a highly quantitative field like Physics, Mathematics, or Computer Science is highly valued for the most research-intensive roles, often called "strat" or "research quant" positions. These roles involve developing entirely new mathematical models from scratch, rather than implementing existing ones. Ph.D.s can command the highest starting salaries, often exceeding $200,000+ in total compensation, especially if their research is directly applicable to finance (e.g., stochastic processes, machine learning).

- Professional Certifications:

- Chartered Financial Analyst (CFA): While more geared towards portfolio management and investment analysis, the CFA charter is respected and demonstrates a commitment to financial ethics and a broad understanding of the investment landscape. It can be a valuable addition, particularly in asset management roles.

- Financial Risk Manager (FRM): This is a highly relevant certification offered by the Global Association of Risk Professionals (GARP). Earning the FRM designation is a powerful signal of expertise in risk management methodologies and is extremely valuable for quants specializing in risk analysis, where it can directly lead to higher salaries and promotions.

### 2. Years of Experience: The Proven Track Record

Experience is the single most powerful driver of salary growth in this field. As you move from a junior analyst to a senior leader, your value shifts from your ability to execute tasks to your ability to generate profit and manage risk on a large scale.

- 0-2 Years (Analyst): At this stage, you are an investment. Your salary ($120k - $200k) is for your potential. You'll spend your time learning the firm's systems, supporting senior quants, cleaning data, and running analysis. The focus is on absorbing knowledge and proving your technical competence and work ethic.

- 3-6 Years (Associate): You've proven your worth. You are now a reliable producer, entrusted with owning projects, developing components of larger models, and directly supporting a trading desk. Your compensation jumps significantly ($200k - $400k) because you are now a net contributor to the firm's bottom line.

- 7-12 Years (Vice President - VP): You are no longer just a modeler; you are a leader and a strategist. As a VP, you might lead a small team of analysts, be responsible for the entire modeling suite for a specific financial product, or be the lead quant for a trading pod. Your decisions have a direct and measurable impact on P&L. Compensation reflects this with a heavy bonus component, pushing total pay into the $400k - $750k+ range. Your reputation begins to build across the industry.

- 12+ Years (Director/Managing Director - MD): You are now part of the firm's leadership. You manage large teams, set the strategic direction for entire departments, face off with major clients, and are responsible for millions or even billions of dollars in revenue or risk. Your compensation ($750k - $5M+) is a direct reflection of your business impact. At this level, you are a franchise player whose departure would be a significant blow to the firm.

### 3. Geographic Location: The Power of the Hub

Where you work matters immensely. Financial engineering is a highly concentrated profession, and salaries are dramatically higher in the major global financial centers. The premium paid in these cities is not just a cost-of-living adjustment; it's a "hub premium" reflecting the density of talent, capital, and opportunity.

| City/Region | Average Base Salary Premium | Notes |

| ----------------------- | --------------------------- | ---------------------------------------------------------------------------------------------------------------- |

| New York City, NY | +20% to +35% vs. National Avg. | The undisputed global capital of finance. Highest concentration of investment banks, hedge funds, and opportunities. |

| San Francisco/Bay Area, CA | +15% to +30% vs. National Avg. | A major hub, especially for FinTech, venture capital, and quantitative asset management. Blends finance with tech. |

| Chicago, IL | +10% to +20% vs. National Avg. | A historic center for derivatives and options trading. Home to major exchanges (CME, CBOE) and prop trading firms. |

| Boston, MA | +5% to +15% vs. National Avg. | A major center for asset management and mutual funds. Strong quant presence at firms like Fidelity and Wellington. |

| Houston, TX / Dallas, TX | +0% to +10% vs. National Avg. | Growing hubs, particularly in energy trading and corporate finance. Lower cost of living can make salaries go further. |

| Other Major US Cities | -10% to +5% vs. National Avg. | Roles exist in cities like Charlotte, Philadelphia, and Los Angeles, but the density and peak salaries are lower. |

The Key Takeaway: Aspiring financial engineers should plan to start their careers in one of the major hubs (NYC, Chicago, SF) to maximize their initial earnings and access the best opportunities for growth.

### 4. Company Type & Size: Where You Work Defines What You Earn

The type of firm you work for is perhaps the most significant determinant of your salary structure and ultimate earning potential.

- Hedge Funds & Proprietary Trading Firms:

- Salary Structure: Moderate to high base salaries, but with an enormous emphasis on performance bonuses tied directly to P&L. This is the highest-risk, highest-reward environment.

- Earning Potential: The ceiling is virtually unlimited. Successful quants at top hedge funds (e.g., Renaissance Technologies, Citadel, Two Sigma) or prop shops (e.g., Jane Street, Hudson River Trading) can earn millions of dollars annually. The work is extremely demanding, with a high-pressure, "eat what you kill" culture.

- Investment Banks (Bulge Bracket & Elite Boutiques):

- Salary Structure: High base salaries and very structured, substantial annual bonuses. More hierarchical and predictable than hedge funds.

- Earning Potential: Excellent. VPs and MDs at firms like Goldman Sachs, J.P. Morgan, or Morgan Stanley routinely earn high six-figure to seven-figure compensation. Offers more stability and a clearer career path than many hedge funds.

- Asset Management Firms & Mutual Funds:

- Salary Structure: Good base salaries with solid, but typically less volatile, bonuses compared to investment banks or hedge funds.

- Earning Potential: Very strong, though the absolute peak is often lower than at top hedge funds. Roles here (e.g., at BlackRock, Vanguard, Fidelity) often offer a better work-life balance and focus on long-term investment strategies.

- FinTech Companies & Startups:

- Salary Structure: Can be highly variable. May offer a lower base salary but supplement it with significant equity (stock options).

- Earning Potential: The potential is massive if the company succeeds (e.g., an IPO or acquisition), but it carries significant risk. The equity could end up being worthless. These roles often appeal to those with an entrepreneurial spirit who want to build new products from the ground up.

- Corporate Treasury & Risk Management:

- Salary Structure: Good, stable base salaries with more modest bonuses.

- Earning Potential: Generally lower than in sell-side or buy-side finance roles. A large corporation (e.g., Apple, Microsoft, P&G) will hire financial engineers to manage currency risk, optimize cash flow, or model commodity price exposure. The work-life balance is typically the best of all these options.

### 5. Area of Specialization: The "Quant" Spectrum

"Financial Engineer" is a broad term. Within the field, different specializations command different salary levels, largely based on their proximity to revenue generation.

- Front Office Quants (Highest Paid): These quants work directly with traders and salespeople to create revenue.

- Roles: Quantitative Trader, Strats (Strategies),