Introduction

Have you ever envisioned a career where your income is a direct reflection of your effort and your impact? A path where you’re not just earning a living, but building a business and helping individuals and families achieve their most profound life goals—securing their children's education, enjoying a dignified retirement, and creating a lasting legacy. This is the promise of a career as a Financial Representative, particularly at a storied institution like Northwestern Mutual. But with great potential comes great questions, chief among them: "What can I realistically expect to earn?"

The compensation for a Financial Representative is one of the most misunderstood aspects of the profession. Unlike a traditional salaried job, it’s a dynamic, performance-driven figure. While salary aggregators might report a wide range, from a starting stipend of $45,000 to a seasoned professional's earnings well over $250,000 annually, the true story lies in the details. It's a journey of building a client base from the ground up, where initial years require immense grit and later years can yield extraordinary financial and personal rewards.

I remember speaking with a friend who left a stable corporate job to join this field. The first two years were, in his words, "the hardest thing I've ever done." He faced rejection daily and his income was a fraction of his old salary. But he was driven by a powerful moment when he helped a young widow navigate her finances after her husband's unexpected passing, ensuring she and her children were secure. Today, he runs a thriving practice, and he measures his success not just by his income, but by the number of lives he has positively impacted. His story encapsulates the essence of this career: it's an entrepreneurial venture of the highest order, demanding resilience but offering unparalleled rewards.

This comprehensive guide will demystify the financial representative northwestern mutual salary and the career path itself. We will dissect the compensation structure, explore the critical factors that dictate your earning potential, and provide a clear, actionable roadmap for anyone considering this challenging but potentially life-changing profession.

### Table of Contents

- [What Does a Financial Representative at Northwestern Mutual Do?](#what-does-a-financial-representative-at-northwestern-mutual-do)

- [Average Financial Representative Northwestern Mutual Salary: A Deep Dive](#average-financial-representative-northwestern-mutual-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Financial Representative at Northwestern Mutual Do?

To understand the salary, you must first understand the role. A Financial Representative at Northwestern Mutual is far more than a salesperson; they are a licensed professional, an entrepreneur, and a long-term financial planner for their clients. Their primary mission is to help clients identify their financial goals and then develop and implement a strategy to achieve them. This is accomplished through a comprehensive planning process that addresses risk management (insurance) and wealth accumulation (investments).

The role is fundamentally entrepreneurial. While Northwestern Mutual provides a powerful brand, extensive training, and a robust platform of products and services, each representative is responsible for building their own book of business. This means they are the CEO of their own practice within the larger company framework.

Core Responsibilities Include:

- Prospecting and Client Acquisition: This is the lifeblood of the business, especially in the early years. It involves actively seeking out potential clients through networking, referrals, social media (like LinkedIn), community involvement, and other marketing efforts.

- Needs Analysis: Conducting in-depth meetings with clients to understand their complete financial picture. This isn't just about numbers; it's about understanding their values, fears, dreams, and life objectives. This is known as "fact-finding."

- Financial Planning: Using the information gathered, the representative analyzes the client's situation and develops a personalized financial plan. This plan might address retirement funding, education savings, investment management, estate planning, and business succession.

- Providing Solutions: Recommending and implementing specific financial products and services to execute the plan. At Northwestern Mutual, this typically involves a mix of life insurance, disability income insurance, long-term care insurance, annuities, and investment products through their wealth management company.

- Client Servicing and Reviews: The relationship doesn't end after a sale. A key part of the job is conducting regular reviews with clients to track their progress, adjust the plan as life circumstances change (marriage, new child, career change), and provide ongoing guidance and support.

- Continuous Learning: The financial world is constantly evolving. Representatives must stay current on market trends, tax laws, new products, and advanced planning strategies through ongoing education and pursuing professional designations.

### A Day in the Life

No two days are exactly alike, but a typical day for a developing representative might look like this:

- 8:00 AM - 9:00 AM: Arrive at the office. Review the day's schedule, respond to urgent client emails, and prepare for upcoming meetings. This time might also be spent in a team huddle or training session.

- 9:00 AM - 12:00 PM: "Power Hours" for Prospecting. This is dedicated, focused time for outreach. It could involve making phone calls to set appointments, sending personalized LinkedIn messages, following up on referrals, or attending a local business networking event. This is often the most challenging, yet most critical, part of the day for a new representative.

- 12:00 PM - 1:00 PM: Lunch, often with a potential client, a center of influence (like a CPA or attorney who can provide referrals), or a mentor.

- 1:00 PM - 5:00 PM: Client Meetings. This block is for face-to-face or virtual meetings. It could be an initial fact-finding meeting with a new prospect, a plan presentation meeting where recommendations are made, or a review meeting with an existing client.

- 5:00 PM - 6:30 PM: Plan Preparation and Administration. The day's meetings are over, but the work isn't. This time is dedicated to analyzing client data, building financial plans using specialized software, preparing for the next day's meetings, and completing application paperwork.

- Evening (Optional but Common): Many representatives hold one or two evening meetings per week to accommodate clients who can't meet during traditional business hours.

This schedule highlights the immense self-discipline required. The freedom to set your own schedule is a major perk, but it comes with the responsibility of being your own boss and holding yourself accountable for the activities that drive results.

Average Financial Representative Northwestern Mutual Salary: A Deep Dive

This is the section where we address the core question, but it requires a significant mindset shift from a traditional salary. For a Financial Representative at Northwestern Mutual, "salary" is better understood as "total compensation" or "earnings," as it's primarily composed of commissions, bonuses, and fees, not a fixed paycheck.

It's crucial to understand the commission-based nature of this role. While the company offers one of the industry's best training programs and often a financing plan (stipend or draw) to help new representatives get started, long-term success is dictated by performance. This creates an incredibly wide salary range and is the reason why this career isn't for everyone.

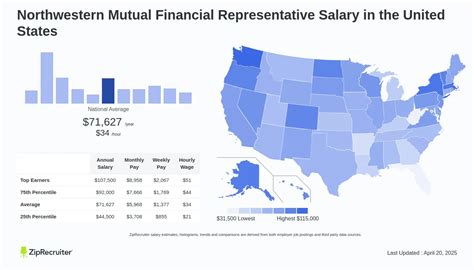

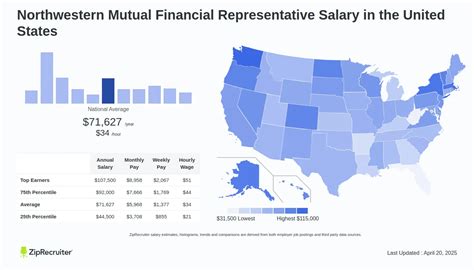

According to data aggregated by Salary.com, the typical total cash compensation for a Financial Representative at Northwestern Mutual in the United States ranges from $50,299 to $71,154, with an average of $57,688 (as of late 2023). However, this number can be misleading. It likely blends the lower-end stipends of new reps with the more moderate earnings of mid-level reps.

A more insightful look comes from Glassdoor, which reports a much wider "total pay" range. For a Northwestern Mutual Financial Representative, Glassdoor estimates the total pay to be between $59,000 and $164,000 per year, with a median of $95,500. This reflects the inclusion of commissions and bonuses and paints a more realistic picture of the potential for a successful representative. Top performers, those who have built a significant practice over 5-10+ years, can earn well in excess of $300,000 to $500,000+ annually.

### Compensation Structure by Experience Level

A more useful way to analyze earnings is to look at the typical progression. This is a journey, not a static number.

| Career Stage | Typical Timeframe | Typical Annual Earnings Range | Key Income Sources |

| :--- | :--- | :--- | :--- |

| New Representative | Years 1-2 | $40,000 - $80,000 | Stipend/Financing Plan, First-Year Commissions (FYCs) from new clients. |

| Developing Representative| Years 3-5 | $80,000 - $150,000 | Declining stipend (if any), strong FYCs, growing renewal commissions, initial asset-based fees. |

| Established Advisor | Years 5-10 | $150,000 - $300,000+ | Strong FYCs, significant renewal commissions, growing AUM fees, bonuses for production targets. |

| Senior/Wealth Mgmt. Advisor| Years 10+ | $300,000 - $1,000,000+ | Income is heavily weighted towards renewal commissions and fees on a large base of Assets Under Management (AUM), plus new business. |

*Note: These are illustrative estimates. Actual earnings depend entirely on individual effort, skill, market, and persistency of business. Many representatives do not make it past the first two years, while others exceed these figures.*

### Breakdown of Compensation Components

Understanding the different ways you get paid is essential.

1. Stipend/Financing Plan: To ease the transition, Northwestern Mutual often provides new representatives with a financing plan. This is not a "free salary." It's typically a subsidy or a draw against future commissions. It provides a baseline income stream while you build your client base, but it's temporary and designed to be replaced by commission income.

2. First-Year Commissions (FYCs): This is the primary driver of income in the early years. When a client purchases an insurance policy (like life or disability) or an annuity, the representative earns a large, upfront commission, often a significant percentage of the first year's premium. For investment products, there may be an upfront sales charge or fee.

3. Renewal Commissions: This is the key to building long-term, stable wealth. For many insurance products, the representative continues to earn a smaller commission in the years following the initial sale, as long as the client keeps the policy in force. A representative with a large book of persistent clients will have a substantial base of recurring, passive income each year before they even make a new sale.

4. Assets Under Management (AUM) Fees: As representatives become licensed to offer investment products through Northwestern Mutual Wealth Management Company, they can earn fees based on the total amount of client assets they manage. A typical fee might be around 1% of the assets per year. This becomes a major income source for senior advisors. An advisor managing $50 million in client assets could generate $500,000 in revenue from this source alone.

5. Bonuses and Awards: The company offers numerous bonuses for achieving specific production levels, growth targets, and persistency milestones (a measure of how many clients keep their policies). These can add tens of thousands of dollars to annual income for high-achievers.

6. Benefits: Successful representatives are eligible for a comprehensive benefits package, which is a significant differentiator. This includes health, life, and disability insurance, as well as access to a retirement plan (401(k)) and a pension plan—a rarity in a commission-based role. Eligibility and company contributions are often tied to production levels.

This multi-faceted structure shows that the career is about more than just one-time sales. It's about building a business that generates multiple, recurring streams of revenue over a long period.

Key Factors That Influence Salary

The vast difference between a representative earning $50,000 and one earning $500,000 is not luck. It is a result of several key factors that directly and powerfully influence compensation. Aspiring representatives must understand and actively manage these variables to maximize their earning potential.

###

Level of Education & Professional Certifications

While a specific degree is not always required, your educational background and commitment to ongoing learning play a significant role in your credibility and earning power.

- Bachelor's Degree: A bachelor's degree is the standard entry requirement for most reputable financial services firms, including Northwestern Mutual. While majors in Finance, Economics, or Business are common and provide a strong foundation, the company actively recruits from all majors. They prioritize traits like drive, coachability, and interpersonal skills over a specific academic background.

- Master of Business Administration (MBA): An MBA can provide a significant advantage, particularly if it's from a top-tier business school. It equips candidates with advanced financial knowledge, a powerful professional network, and enhanced credibility, especially when working with high-net-worth individuals and business owners. This can lead to a faster start and access to more sophisticated client cases earlier in one's career.

- Professional Certifications (The Game Changer): This is arguably more important than your initial degree for long-term earnings. Certifications demonstrate a commitment to the profession and a high level of expertise.

- CERTIFIED FINANCIAL PLANNER™ (CFP®): This is the gold standard in the financial planning industry. Earning the CFP® marks requires passing a rigorous exam, fulfilling experience requirements, and adhering to a strict code of ethics. According to the CFP Board, CFP® professionals report higher compensation levels than their non-certified peers. They are seen as comprehensive planners rather than just product salespeople, which builds immense trust and leads to more significant client relationships. An advisor with a CFP® designation can command higher fees and attract more affluent clients.

- Chartered Life Underwriter (CLU®): This designation signifies deep expertise in life insurance and estate planning. For a representative at a company with a strong insurance heritage like Northwestern Mutual, the CLU® is highly valuable and can lead to specializing in complex cases for wealthy families and business owners.

- Chartered Financial Consultant (ChFC®): Similar to the CFP®, the ChFC® covers a broad range of financial planning topics and is another highly respected credential.

- Securities Licenses: These are not optional; they are required to discuss or sell investment products. Key licenses include the SIE (Securities Industry Essentials), Series 7, and Series 66 (or Series 63 & 65). While obtaining these doesn't directly increase your "salary," it unlocks the ability to earn AUM fees and investment-related commissions, which are critical for reaching higher income levels.

###

Years of Experience: The J-Curve of Income

In a commission-based career, experience is the single most powerful determinant of income. The earnings trajectory doesn't follow a straight line; it follows a "J-curve."

- Years 1-2 (The Foundation): This is the bottom of the "J." Income is often at its lowest point. The representative is learning the business, building skills, and prospecting relentlessly with a high rate of rejection. Many individuals who are not suited for the entrepreneurial demands of the role will leave the business during this period. Income is almost entirely from first-year commissions and any company stipend.

- Years 3-5 (The Ramp-Up): This is the sharp upward slope of the "J." By this point, the representative has honed their process, built a solid base of a few hundred clients, and is becoming more efficient. Referrals begin to flow more consistently, reducing the need for cold prospecting. A meaningful stream of renewal commissions starts to build, providing a stable income floor. Annual earnings often cross the six-figure mark during this phase.

- Years 5-10 (The Professional Practice): The representative is now an established advisor. They have a mature practice with a large book of business generating significant renewal commissions and AUM fees. They may begin to specialize in a specific niche and are seen as an expert in their network. New business comes primarily from referrals and introductions from existing clients and centers of influence. Income becomes highly predictable and substantial.

- Years 10+ (The CEO): Top-performing senior advisors run a full-fledged enterprise. They may have a team of junior representatives, administrative staff, and specialists working for them. Their income is a powerful combination of renewals, AUM fees from a massive asset base, and new business from high-net-worth clients. They have achieved the entrepreneurial dream: a business that provides high income, autonomy, and impact.

###

Geographic Location

Where you build your practice matters. The cost of living and, more importantly, the concentration of wealth in a given area can significantly impact your ceiling.

- High-Paying Metropolitan Areas: Cities like New York, San Francisco, Los Angeles, Boston, and Chicago offer the highest earning potential. This is not because the commission rates are different, but because these areas have a high concentration of affluent individuals, families, and businesses with complex financial needs and the capital to implement comprehensive plans. A representative in Manhattan has more potential clients with multi-million dollar net worths within a 5-mile radius than a representative in a small rural town.

- Mid-Tier and Growing Cities: Locations like Austin, Denver, Seattle, and Charlotte offer a great balance. They have strong economies, a growing population of young professionals and families, and a lower (though rising) cost of living compared to the top-tier cities. These can be excellent places to build a practice.

- Lower-Paying Areas: Rural areas and states with lower average household incomes will naturally present a lower ceiling on potential earnings. While a representative can still build a very successful and respected practice, the average client size will likely be smaller, requiring a much larger volume of clients to achieve the same income as a peer in a major metro area.

According to the U.S. Bureau of Labor Statistics (BLS), for the broader category of "Personal Financial Advisors," the states with the highest annual mean wage are New York ($169,310), District of Columbia ($156,060), and Massachusetts ($144,380), highlighting the impact of major financial hubs.

###

Company Type & Size

While this article focuses on Northwestern Mutual, understanding the landscape is crucial. A financial representative's or advisor's compensation structure can vary dramatically depending on the type of firm they work for.

- Mutual Insurance Companies (e.g., Northwestern Mutual, MassMutual): These firms have a strong foundation in insurance products. Representatives are typically "captive agents" at the start, meaning they primarily sell the company's proprietary products. The model is highly entrepreneurial, with compensation driven by commissions and building a book of business. They offer extensive training and support for new entrants.

- Wirehouses (e.g., Morgan Stanley, Merrill Lynch): These are large, national brokerage firms. Advisors here often focus more on investment management for wealthy clients. They may start in a salaried development program and transition to a grid-based payout system, where they receive a percentage of the revenue they generate for the firm.

- Independent Broker-Dealers (e.g., LPL Financial, Ameriprise): These firms provide a platform for independent advisors to run their own businesses. Advisors have more freedom to choose from a wider array of products but receive less hands-on training and support than at a place like NM. Compensation is typically a higher payout percentage, but the advisor bears more of the business's overhead costs.

- Registered Investment Advisors (RIAs): These firms have a fiduciary duty to act in their clients' best interest. They are often fee-only, meaning they are compensated directly by clients (e.g., through AUM fees or flat planning fees) and do not earn commissions. This model is experiencing significant growth but is often a destination for experienced advisors rather than a starting point.

Working at a large, established company like Northwestern Mutual provides brand recognition, a structured training path, and a clear system for success, which can be invaluable for someone starting from scratch.

###

Area of Specialization (Niche)

Generalists can do well, but specialists often do better. As representatives gain experience, they can dramatically increase their income by developing a deep expertise in a specific niche. This allows them to market themselves more effectively, attract ideal clients, and solve more complex, high-value problems.

- The Medical Market: Specializing in the unique financial needs of physicians, dentists, and surgeons. These professionals have high incomes but also high debt, complex cash flow, and specific disability insurance needs.

- Small Business Owners: Focusing on succession planning, key-person insurance, buy-sell agreements, and setting up employee retirement plans (like 401(k)s or SEP IRAs).

- Retirement Planning: Becoming an expert in income distribution strategies for pre-retirees and retirees, navigating Social Security, Medicare, and long-term care planning.

- Estate Planning: Working with affluent families and their attorneys to structure estates in a tax-efficient manner, ensuring a smooth transfer of wealth to the next generation using advanced life insurance strategies and trusts.

- Other Niches: This could include airline pilots, tech executives with stock options, professional athletes, or university faculty.

A specialized advisor becomes the go-to person in their chosen community, leading to a steady stream of high-quality referrals and the ability to command premium-level service.

###

In-Demand Skills

Your technical knowledge is the entry ticket, but your skills determine how far you go.

- Soft Skills (Crucial for Success):

- Prospecting & Networking: The ability to consistently meet new people and build relationships is non-negotiable, especially in the first five years.

- Communication & Empathy: You must be able to explain complex financial topics in simple terms and, more importantly, listen to understand a client's deepest goals and fears.

- Discipline & Grit: The resilience to face daily rejection and the self-discipline to execute on income-producing activities without a boss looking over your shoulder.

- Closing Skills: The ability to ethically and confidently guide a client to make a decision and take action on your recommendations.

- Hard Skills (That Increase Value):

- Comprehensive Financial Planning: The ability to integrate all aspects of a client's financial life—investments, insurance, tax, and estate planning—into one cohesive strategy.

- Business Acumen: Understanding how to read a balance sheet or a P&L statement is critical for working with business owner clients.

- Investment Analysis: A deep understanding of asset allocation, portfolio construction, risk management, and market dynamics.

- Tax Planning Knowledge: Knowing how different investment and insurance decisions impact a client's tax situation is a massive value-add.

Developing these skills through practice, mentorship, and continuous education is the most direct way to control your own income trajectory.

Job Outlook and Career Growth

For those with the entrepreneurial spirit and resilience to succeed, the long-term outlook for financial representatives and advisors is exceptionally bright. Several powerful demographic and economic trends are converging to create sustained demand for personalized financial advice.

According to the U.S. Bureau of Labor Statistics (BLS), employment of "Personal Financial Advisors" is projected to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations. This translates to about 31,200 new jobs opening up over the decade. This robust growth is fueled by several key factors:

- The Great Wealth Transfer and Retiring Baby Boomers: The baby boomer generation is entering or already in retirement. This massive demographic cohort needs professional guidance on how to turn their accumulated savings (in 401(k)s and IRAs) into a sustainable income stream that will last for the rest of their lives. They need help with Social Security maximization, pension decisions, and healthcare costs in retirement, creating immense demand for skilled advisors.

- Increasing Complexity of Financial Products: The proliferation of investment options, insurance products, and retirement vehicles has left many individuals feeling overwhelmed. A professional representative is needed to cut through the noise, simplify the choices, and help clients make informed decisions.

- Longer Lifespans: People are living longer than ever before, which means retirement savings need to last for 20, 30, or even 40 years. This longevity risk makes professional financial planning not just a luxury, but a necessity.

### Emerging Trends and Future Challenges

While the outlook is positive, the profession is not static. Advisors must adapt to new trends and challenges to remain relevant.

- The Rise of Robo-Advisors: Automated, algorithm-based investment platforms (robo-advisors) offer low-cost portfolio management. Some see this as a threat, but savvy advisors view it as an opportunity. Robo-advisors can't replicate the human element of financial advice. They can't provide behavioral coaching during a market downturn, understand the nuances of a client's family dynamics, or develop a complex estate plan. The future-proof advisor will focus on these high-value, holistic planning services that technology cannot replace. They may even leverage technology to handle simple portfolio management, freeing up their time for deeper client relationships.

- Focus on Holistic Wellness: The future of financial planning is moving beyond just investments. Clients are increasingly looking for advice that integrates their financial health with their overall life goals and well-being. Advisors who can act as a "financial life coach" will be in high demand.

- Regulatory Changes: The financial industry is highly regulated. Advisors must stay abreast