Are you drawn to the fast-paced world of finance but equally motivated by the desire to help people achieve their dreams? Do you possess a unique blend of analytical acumen and interpersonal skill? If so, a career as a Financial Services Representative (FSR) might be the perfect fit, offering a rewarding path that combines financial strategy with tangible human impact. This role serves as the crucial bridge between complex financial products and the everyday individuals and families who need them to secure their futures. It’s a career defined by trust, guidance, and the potential for significant financial and personal growth.

The compensation for this critical work is compelling. While a financial services representative salary can vary widely based on numerous factors, the overall earning potential is strong. Entry-level professionals can expect to start in the range of $45,000 to $55,000, but with experience, specialization, and performance-based incentives, that figure can quickly climb. Seasoned representatives, especially those who transition into advisory roles, often earn well into the six figures. I remember my first serious meeting about my own finances; I was a recent graduate, completely overwhelmed by terms like "mutual funds" and "retirement accounts." The representative I met with didn't just sell me a product; she took the time to educate me, simplifying complex ideas and empowering me to make my first informed financial decision. That experience crystalized for me the immense value of this profession—it's not just about transactions; it's about transformations.

This comprehensive guide is designed to be your definitive resource for understanding everything about a Financial Services Representative's career and salary. We will dissect compensation structures, explore the factors that can maximize your earnings, analyze the long-term job outlook, and provide a step-by-step roadmap to get you started.

### Table of Contents

- [What Does a Financial Services Representative Do?](#what-do-they-do)

- [Average Financial Services Representative Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-start)

- [Conclusion: Is This Career Right for You?](#conclusion)

What Does a Financial Services Representative Do?

A Financial Services Representative is a frontline professional who works directly with clients at banks, credit unions, investment firms, and insurance companies. They are the face of the institution, responsible for understanding a client's financial situation and guiding them toward the products and services that best meet their needs. This role is a hybrid of customer service, sales, and financial guidance, demanding a high degree of product knowledge, regulatory awareness, and communication skill.

At its core, the FSR's mission is to build and maintain strong client relationships. They are the initial point of contact for individuals looking to open a checking or savings account, apply for a loan, invest for retirement, or purchase insurance. Their guidance helps people navigate major life events, from buying a first home and saving for a child's education to planning for a comfortable retirement.

Core Responsibilities and Daily Tasks:

The day-to-day activities of an FSR can be dynamic and varied, but they generally revolve around these key functions:

- Client Consultation: Meeting with new and existing clients to discuss their financial objectives, risk tolerance, and current financial health.

- Account Management: Assisting clients with opening, managing, and closing various types of accounts, including checking, savings, money market, and certificates of deposit (CDs).

- Product Education: Clearly explaining the features, benefits, and risks associated with a wide range of financial products, such as mutual funds, annuities, life insurance, credit cards, and personal or auto loans.

- Transaction Processing: Handling routine transactions like deposits, withdrawals, and transfers, ensuring accuracy and compliance with bank policies.

- Needs Analysis and Sales: Identifying opportunities to "deepen" the client relationship by proactively offering additional products or services that align with their discovered needs. This is a crucial sales component of the role.

- Referrals: Recognizing when a client's needs exceed their own expertise or licensing (e.g., complex wealth management, estate planning) and referring them to a specialized colleague, such as a Financial Advisor or Mortgage Specialist.

- Compliance and Paperwork: Meticulously completing and filing all necessary documentation, adhering to strict industry regulations like Know Your Customer (KYC), Anti-Money Laundering (AML), and FINRA rules.

- Problem Resolution: Acting as a primary resource for clients experiencing issues with their accounts or services, troubleshooting problems effectively and ensuring client satisfaction.

### A "Day in the Life" of a Financial Services Representative

To make this more concrete, let's imagine a typical Tuesday for "Alex," an FSR at a regional bank branch:

- 8:45 AM: Alex arrives, logs into the system, and reviews the day's appointments and any urgent client emails. He checks the morning's market summary to be informed for client conversations.

- 9:15 AM: The branch opens. Alex's first appointment is with a young couple looking to consolidate debt and start a savings plan for a down payment on a house. He reviews their budget, explains the benefits of a high-yield savings account, and discusses options for a personal loan.

- 11:00 AM: An elderly client comes in, confused about a letter regarding her IRA. Alex patiently walks her through the Required Minimum Distribution (RMD) rules, calculates the amount she needs to withdraw, and processes the transaction for her.

- 12:30 PM: Lunch break.

- 1:30 PM: Alex has a scheduled call with a small business owner who needs to set up payroll services and a business checking account. He gathers the necessary information and paperwork to begin the process.

- 3:00 PM: The branch manager holds a brief team huddle to discuss a new mortgage promotion. They review the product details and sales targets for the month.

- 3:30 PM: A walk-in client, a recent college graduate, wants to open his first investment account. Since Alex holds a Series 6 and 63 license, he can discuss mutual funds. He conducts a risk tolerance questionnaire and helps the client invest a small amount into a diversified, low-cost index fund.

- 4:45 PM: As the branch nears closing, Alex finalizes his paperwork for the day, ensuring all applications are complete and compliant. He follows up with the young couple from the morning via email, sending them the resources he promised.

- 5:15 PM: Alex logs off, having helped several people take a meaningful step forward on their financial journey.

This example illustrates the blend of scheduled appointments, spontaneous client needs, administrative duties, and continuous learning that defines the FSR role.

Average Financial Services Representative Salary: A Deep Dive

Understanding the earning potential is a critical step in evaluating any career path. A financial services representative salary is not a single, static number; it's a dynamic figure composed of a base salary plus variable compensation, which grows significantly with experience, performance, and specialization.

Let's break down the numbers from authoritative sources to build a clear picture of what you can expect to earn.

National Averages and Salary Ranges

According to the most recent data, the compensation for FSRs shows a healthy range, reflecting the diverse responsibilities and environments in which they work.

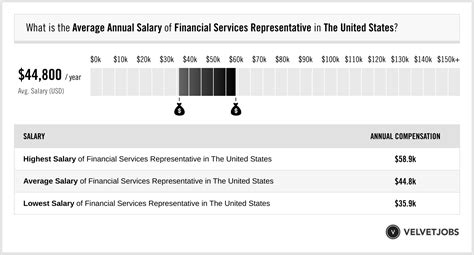

- Salary.com: As of late 2023, Salary.com reports that the median annual salary for a Financial Services Representative I (entry-level) in the United States is $44,198. The typical range falls between $39,637 and $49,438. For a more experienced Financial Services Representative II, the median salary increases to $50,230.

- Glassdoor: This platform, which aggregates self-reported user data, shows a slightly higher figure. As of December 2023, the estimated total pay for a Financial Services Representative is $67,610 per year in the United States, with an average salary of $52,001 per year. The "total pay" figure includes additional compensation like cash bonuses, commission, and profit sharing, which Glassdoor estimates at an average of $15,609 per year.

- Payscale: Payscale.com provides a similar perspective, reporting an average base salary of $48,784 per year. Their data shows a base salary range from $37,000 to $70,000, with bonuses potentially adding another $1,000 to $15,000 annually.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups FSRs under the broader category of "Securities, Commodities, and Financial Services Sales Agents." For this group, the median annual wage was $67,900 as of May 2022. It's important to note that this category includes more specialized and higher-earning roles like stockbrokers, so the median is higher than what a typical bank-based FSR might start at. However, it accurately reflects the earning potential as an FSR gains licenses and experience. The BLS data shows a vast range, with the lowest 10 percent earning less than $38,590 and the highest 10 percent earning more than $206,160.

Salary by Experience Level

Your salary will grow in direct correlation with your experience, skill set, and the trust you build with clients. Here’s a breakdown of what to expect at different stages of your career.

| Experience Level | Typical Years of Experience | Typical Base Salary Range (Annual) | Key Responsibilities & Capabilities |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $42,000 - $55,000 | Learning products, processing basic transactions, opening standard accounts, focusing on customer service, studying for licenses (SIE, Series 6/7). |

| Mid-Career | 3-8 Years | $55,000 - $75,000 | Holds key licenses (Series 7, 63, 66), manages a portfolio of clients, handles more complex products (annuities, managed accounts), meets consistent sales goals, begins mentoring junior staff. |

| Senior / Lead | 8+ Years | $75,000 - $100,000+ | Manages high-net-worth client relationships, may hold advanced certifications (CFP®), acts as a subject matter expert, often transitions to a specialized role like Private Banker, Financial Advisor, or Branch Manager. |

*Note: These ranges are for base salary and do not include the significant impact of bonuses and commissions, which can add 10-40% or more to total compensation, especially in mid-career and senior roles.*

Breaking Down the Compensation Package

To fully grasp the earning potential, you must look beyond the base salary. The total compensation package for an FSR is a multifaceted structure.

1. Base Salary: This is the fixed, predictable portion of your pay. It provides a stable income floor and is typically determined by your experience, location, and the size of your employer.

2. Commission: In many roles, especially at broker-dealers and insurance companies, a significant portion of income is commission-based. This means you earn a percentage of the revenue generated from the products you sell (e.g., a percentage of an investment's expense ratio or a commission on an insurance policy). This directly rewards high performance.

3. Bonuses: Bonuses are typically paid quarterly or annually and are tied to meeting specific individual, branch, or company-wide goals. These goals can be based on:

- Sales Volume: The total dollar amount of loans, investments, or insurance products sold.

- New Client Acquisition: The number of new households or accounts you bring to the firm.

- Client Satisfaction Scores: Measured through surveys and feedback.

- Referral Targets: The number of successful referrals you make to other departments (e.g., mortgage, wealth management).

4. Profit Sharing: Some firms offer profit-sharing plans, where a portion of the company's annual profits is distributed among employees. This aligns employee incentives with the overall success of the company.

5. Benefits and Perks: While not direct cash, a strong benefits package significantly impacts your overall financial well-being. This is an area where larger, established financial institutions often excel. Key benefits include:

- Health Insurance: Comprehensive medical, dental, and vision plans.

- Retirement Savings: A 401(k) plan, often with a generous employer match (e.g., matching 100% of your contribution up to 5-6% of your salary).

- Paid Time Off (PTO): Including vacation, sick days, and personal days.

- Tuition Reimbursement: Support for pursuing further education or advanced certifications.

- Licensing Support: Employers typically pay for the study materials and exam fees for required licenses like the Series 7 and 63.

When evaluating a job offer, it's crucial to consider this entire package. A role with a slightly lower base salary but a robust bonus structure and excellent benefits might be far more lucrative in the long run than one with a higher base but little else.

Key Factors That Influence Salary

The national average provides a useful benchmark, but your individual financial services representative salary will be determined by a specific set of factors. Understanding and strategically navigating these elements is the key to maximizing your earning potential throughout your career. This section, the most detailed in our guide, will explore each of these critical influencers.

Level of Education & Professional Certifications

While you can enter the field with a high school diploma, your educational background sets the foundation for your starting salary and long-term career trajectory.

- High School Diploma or GED: This is the minimum requirement for many entry-level FSR positions, particularly teller or personal banker roles at community banks. The starting salary will be at the lower end of the spectrum, likely in the $38,000 to $45,000 range. Career progression beyond this level often requires further education or exceptional on-the-job performance.

- Associate's Degree: An associate's degree in business, finance, or a related field can provide a competitive edge over candidates with only a high school diploma. It demonstrates a foundational knowledge and commitment to the field, potentially leading to a slightly higher starting salary and opening doors to roles at larger institutions.

- Bachelor's Degree: This is the preferred qualification for most FSR roles, especially at major national banks and investment firms. A degree in Finance, Economics, Business Administration, or Accounting is most relevant and highly valued. Graduates with a bachelor's degree can command higher starting salaries (often $50,000+) and are placed on a faster track for promotions and licensing opportunities. A bachelor's degree is also a prerequisite for many advanced certifications.

- Master's Degree (MBA, MS in Finance): While not necessary for an FSR role, a master's degree significantly accelerates career growth. Individuals with an MBA often bypass the traditional FSR track and enter more specialized roles in corporate finance, private banking, or wealth management, with starting salaries often in the $90,000 to $120,000+ range.

The Power of Professional Licenses and Certifications:

In finance, licenses aren't just a bonus; they are often a requirement to discuss or sell specific investment products, and they directly translate to higher earning power.

- Securities Industry Essentials (SIE) Exam: This is a foundational, co-requisite exam that tests basic securities industry knowledge. Passing it makes you more attractive to employers, as it shows initiative.

- FINRA Series 7 License (General Securities Representative): This is the gold standard. It allows you to sell a broad range of securities, including stocks, bonds, and mutual funds. Obtaining a Series 7 can lead to a significant salary jump and opens up a much wider range of commission-based opportunities. FSRs with a Series 7 are far more valuable to their firms.

- FINRA Series 6 License (Investment Company and Variable Contracts Representative): A more limited license that allows the sale of mutual funds, variable annuities, and unit investment trusts. It's a common starting point for FSRs at banks.

- Series 63, 65, and 66 Licenses: These are state-level securities licenses. The Series 63 (Uniform Securities Agent State Law Exam) is required to solicit orders for securities in a particular state. The Series 66 (Uniform Combined State Law Exam) combines the Series 63 and Series 65 (Uniform Investment Adviser Law Exam) and allows a representative to act as both a broker-dealer agent and an investment adviser representative. Holding these licenses is essential for providing fee-based advice and further boosts income.

- Certified Financial Planner (CFP®): This is the premier designation for financial planning professionals. While typically pursued after several years as an FSR or Financial Advisor, earning the CFP® marks you as a top-tier professional. It requires rigorous coursework, a comprehensive exam, experience, and adherence to a strict ethical code. Professionals with a CFP® designation often see their earnings increase by 15-25% or more and move into high-net-worth client management.

Years of Experience

Experience is perhaps the most significant determinant of salary growth. As you progress, you move from executing simple tasks to managing complex client relationships and generating substantial revenue for your firm.

- 0-2 Years (Entry-Level): At this stage, you are learning the ropes. Your focus is on operational excellence, customer service, and product knowledge. Your salary is primarily base pay, with minimal bonuses. Typical Salary: $42,000 - $55,000.

- 3-8 Years (Mid-Career): You are now a fully licensed, proficient professional. You manage your own book of clients, consistently meet or exceed sales targets, and can handle more sophisticated client needs. Your compensation becomes a more even mix of base salary and variable pay (bonuses/commissions). Your expertise allows you to generate more revenue, which is reflected in your paycheck. Typical Salary: $55,000 - $75,000 (Base), with total compensation often reaching $85,000+.

- 8+ Years (Senior-Level): With nearly a decade of experience, you are an expert. You may manage the branch's most valuable clients, mentor a team of junior representatives, or specialize in a lucrative niche like business banking or retirement planning. Your reputation and network are strong assets. At this stage, variable compensation can often exceed base salary. Many in this bracket transition to Financial Advisor or Private Banker roles, where total compensation can easily surpass $150,000 - $200,000.

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and the concentration of financial activity in the region. Major financial hubs offer the highest salaries but also come with the highest living expenses.

| Metro Area Type | Example Cities | Typical Salary Range (Adjusted for Location) | Rationale |

| :--- | :--- | :--- | :--- |

| Top-Tier Financial Hubs | New York City, NY; San Francisco, CA; Boston, MA; Chicago, IL | $65,000 - $90,000+ (Base) | Extremely high cost of living, massive concentration of banks and investment firms, fierce competition for talent. |

| Major Economic Centers | Dallas, TX; Atlanta, GA; Charlotte, NC; Denver, CO | $50,000 - $70,000 (Base) | Strong economies and significant financial sectors, but a more moderate cost of living compared to top-tier hubs. |

| Mid-Sized Cities / Suburbs | Kansas City, MO; Phoenix, AZ; Columbus, OH; Orlando, FL | $45,000 - $60,000 (Base) | Solid job markets with a lower cost of living, offering a good balance of income and affordability. |

| Rural Areas / Small Towns | Various locations across the Midwest and South | $40,000 - $50,000 (Base) | Lower cost of living and less competition, but fewer opportunities at large national firms. Salaries are scaled to the local economy. |

*(Source: Salary data is synthesized from geographic filters on Payscale and Salary.com, 2023)*

A role in Manhattan may offer a base salary of $70,000, while the exact same role at the same company in Omaha, Nebraska, might offer $50,000. However, the lower cost of housing, transportation, and goods in Omaha could mean the $50,000 salary provides a higher quality of life.

Company Type & Size

The type of institution you work for dramatically shapes your role, culture, and compensation structure.

- Large National & Multinational Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These giants offer structured salary bands, clear career progression paths, and exceptional benefits packages. The compensation is often a blend of a solid base salary and achievable quarterly bonuses tied to well-defined metrics. They are excellent places to receive formal training and get licensed.

- Regional & Community Banks: These smaller institutions often foster a more tight-knit, community-focused culture. Base salaries may be slightly lower than at national banks, but they can offer a better work-life balance. Bonus structures might be more modest but are often tied to the overall success of the local branch.

- Credit Unions: As non-profit, member-owned organizations, credit unions prioritize member service over profit. This often translates to a culture with less high-pressure sales tactics. Salaries are competitive but may be slightly lower on average than for-profit banks. However, they are known for excellent benefits and high employee satisfaction.

- Brokerage Firms & Investment Companies (e.g., Fidelity, Charles Schwab, Vanguard): Roles here are often more specialized and investment-focused from day one. Compensation is heavily performance-driven, with a moderate base salary supplemented by significant potential for commissions and bonuses based on assets under management (AUM) and trading volume. This is where the highest earning potential often lies for sales-oriented individuals.

- Insurance Companies (e.g., Northwestern Mutual, New York Life): FSRs here focus on selling life insurance, disability insurance, and annuities. The compensation model is almost entirely commission-based. While this can be daunting, the upside is virtually unlimited for top performers. It requires strong entrepreneurial and sales skills.

Area of Specialization

As you gain experience, you can specialize in a particular niche. Specialization requires deeper knowledge and often serves more affluent clients, leading to higher compensation.

- Retail/Branch Banking: The generalist FSR. This is the foundation for most careers in the field.

- Business Banking: Serving the needs of small- to medium-sized businesses (SMBs), including business loans, lines of credit, and cash management services. This is a more complex and lucrative area.

- Mortgage & Lending: Specializing in helping clients secure home mortgages or other large loans. Compensation is often tied directly to loan origination volume.

- Retirement Planning: Focusing on IRAs, 401(k) rollovers, and creating long-term income strategies for clients approaching retirement. This requires a deep understanding of tax implications and investment products.