Unlocking Your Earning Potential: A Deep Dive into Forensic Accountant Salaries

In the world of finance, some roles are about building wealth, while others are about protecting it. Forensic accounting falls squarely in the latter, offering a thrilling career for those with an investigative mindset and a sharp eye for numbers. But beyond the intellectual challenge of being a "financial detective," is it a financially rewarding career?

The answer is a resounding yes. A career in forensic accounting is not only in high demand but also offers a lucrative salary that can grow substantially with experience, certifications, and specialization. While entry-level positions are competitive, senior forensic accountants with specialized expertise can command salaries well into the six figures, often exceeding $150,000 annually.

This guide will break down what you can expect to earn as a forensic accountant, the key factors that drive your salary, and the bright future of this compelling profession.

What Does a Forensic Accountant Do?

Before diving into the numbers, it’s important to understand the role. A forensic accountant is essentially a hybrid of an accountant and a private investigator. They apply their accounting skills to investigate fraud, financial crimes, and other legal disputes. Their primary responsibility is to analyze complex financial information and communicate their findings in a clear, concise manner, often in a courtroom as an expert witness.

Key responsibilities include:

- Investigating suspected fraud, embezzlement, and other white-collar crimes.

- Conducting due diligence for mergers and acquisitions.

- Calculating economic damages in legal disputes.

- Tracing hidden assets in divorce cases or bankruptcy proceedings.

- Providing litigation support and serving as an expert witness in court.

Average Forensic Accountant Salary

Forensic accounting is a specialized field, and compensation reflects this. While salaries vary widely based on the factors we'll explore below, we can establish a solid baseline by looking at data from leading salary aggregators.

According to Salary.com, the median salary for a Forensic Accountant in the United States is approximately $85,570 as of late 2023. The typical salary range falls between $77,930 and $94,400.

However, this is just a snapshot. Other sources provide a broader view:

- Payscale reports an average salary of around $74,000, but shows that top earners can reach upwards of $124,000.

- Glassdoor lists a higher national average of $93,500, which likely includes bonuses and other forms of compensation.

The key takeaway is that a starting salary in the $70,000s is common, with a clear and achievable path to earning over $100,000 as you gain experience and expertise.

Key Factors That Influence Salary

Your salary as a forensic accountant isn’t a single, fixed number. It’s a dynamic figure influenced by a combination of your qualifications, choices, and location. Understanding these factors is crucial to maximizing your earning potential.

###

Level of Education and Certifications

Your educational background and professional certifications are arguably the most significant drivers of your salary.

- Bachelor's Degree: A bachelor's in accounting or finance is the minimum requirement to enter the field.

- Master's Degree: A Master of Accountancy (MAcc) or an MBA with a concentration in finance or forensic accounting can provide a competitive edge and a higher starting salary.

- Certifications: This is where you can truly differentiate yourself and boost your earnings.

- Certified Public Accountant (CPA): While not exclusively for forensics, the CPA is a foundational credential that signals a high level of accounting proficiency and is highly valued by employers.

- Certified Fraud Examiner (CFE): This is the gold-standard certification for forensic accountants. According to the Association of Certified Fraud Examiners (ACFE) in their *2022 Compensation Guide for Anti-Fraud Professionals*, CFEs earn a 31% salary premium on average compared to their non-certified peers. This "CFE premium" is a direct testament to the value this specialized knowledge brings.

###

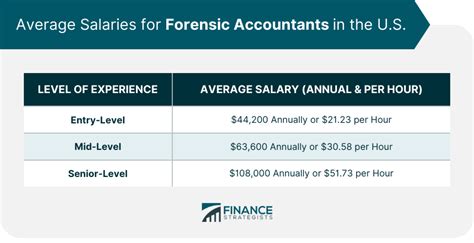

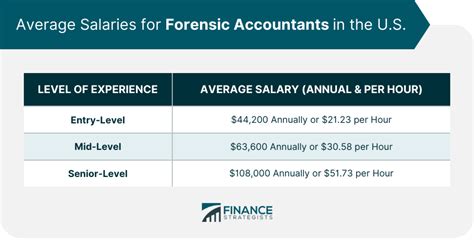

Years of Experience

Like most professions, experience pays. The career ladder for a forensic accountant has distinct rungs, each with a corresponding increase in responsibility and compensation.

- Entry-Level (0-3 Years): In this stage, you'll likely be a Staff or Associate Accountant. You'll support senior team members, conduct data analysis, and learn investigative techniques. Expect a salary in the $70,000 to $85,000 range.

- Mid-Career (4-9 Years): As a Senior Accountant, you'll manage your own cases, have direct client contact, and begin supervising junior staff. Your salary will typically climb into the $85,000 to $115,000 range.

- Senior/Manager-Level (10+ Years): With a decade or more of experience, you can move into roles like Manager, Director, or Partner. You'll be responsible for managing large teams, business development, and serving as a testifying expert witness. At this level, salaries regularly exceed $120,000, with top professionals earning $175,000 or more.

###

Geographic Location

Where you work matters. Salaries for forensic accountants are significantly higher in major metropolitan areas with a high cost of living and a concentration of large corporations and financial institutions.

According to data from Salary.com, cities like San Francisco, New York, Boston, and Washington D.C. offer salaries that can be 15-30% above the national average. Conversely, salaries in smaller cities and rural areas will typically be lower to reflect the local market and cost of living.

###

Company Type

The type of organization you work for has a major impact on your compensation structure and overall earnings.

- Public Accounting Firms: The "Big Four" (Deloitte, EY, PwC, KPMG) and other large national firms are major employers of forensic accountants. They offer competitive starting salaries, excellent training, and a clear career path, though the work can be demanding.

- Boutique Forensic Accounting Firms: These smaller, specialized firms often focus on specific niches like litigation support or insurance claims. While starting salaries might be comparable to larger firms, senior-level and partner compensation can be extremely high.

- Government Agencies: The FBI, SEC, IRS, and CIA all employ forensic accountants. While base salaries may be slightly lower than in the private sector, government roles offer outstanding job security, excellent benefits, and a strong pension plan.

- Corporate (In-house): Large corporations hire forensic accountants for their internal audit, compliance, and risk management departments. Compensation is often very competitive and includes corporate bonuses and stock options.

###

Area of Specialization

Within forensic accounting, certain specializations are more lucrative than others due to the level of expertise required and the stakes involved.

- Litigation Support and Expert Witnessing: This is often the highest-paying specialization. Testifying in high-stakes corporate lawsuits or criminal trials requires impeccable credibility and expertise, and these professionals command high hourly rates.

- Fraud Investigation: Investigating complex financial crimes for corporations or government agencies is a core function and is very well-compensated.

- Bankruptcy and Insolvency: These cases require deep financial analysis to trace assets and manage creditor claims.

- Insurance Claims: Forensic accountants in this area investigate business interruption claims and suspicious personal injury claims.

Job Outlook

The future for forensic accountants is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Accountants and Auditors" will grow by 4% from 2022 to 2032.

However, the demand for the specialized skills of a *forensic* accountant is expected to be even stronger. A tightening regulatory environment, the increasing complexity of a global economy, and the constant threat of digital and cyber-crime all fuel the need for professionals who can uncover financial misconduct. This sustained demand ensures strong job security and upward pressure on salaries for qualified individuals.

Conclusion

A career in forensic accounting is a pathway to a profession that is both intellectually stimulating and financially rewarding. While a solid six-figure salary is well within reach, it's not simply given—it's earned through a commitment to continuous learning and strategic career choices.

To maximize your earning potential, focus on these key takeaways:

1. Invest in Certifications: Earning your CPA and, especially, your CFE credential is the single most effective way to increase your salary.

2. Gain Diverse Experience: Move from supporting roles to leading investigations to build the expertise that employers pay a premium for.

3. Consider Specializing: Developing a niche in a high-demand area like litigation support can significantly elevate your professional standing and income.

For those with a passion for uncovering the truth hidden in the numbers, forensic accounting offers a clear and profitable career path with a dynamic future.