Exploring Your Earning Potential: A Deep Dive into a Chase Bank Relationship Banker Salary

For those with a knack for building relationships and a passion for finance, a career as a Relationship Banker at a top-tier institution like JPMorgan Chase can be a rewarding and lucrative path. This role serves as an excellent launchpad into the wider world of financial services, offering a blend of customer service, sales, and financial guidance. But what can you realistically expect to earn?

This article provides a data-driven look at a Relationship Banker's salary at Chase Bank, exploring not just the average numbers but also the critical factors that can significantly impact your total compensation. With a typical total pay range spanning from $50,000 to over $85,000 annually, understanding these variables is key to maximizing your earning potential.

What Does a Relationship Banker at Chase Bank Do?

Before diving into the numbers, it's essential to understand the role. A Relationship Banker at Chase is the primary point of contact for bank customers, moving beyond the transactional duties of a traditional teller. Their mission is to build and deepen long-term relationships with clients.

Key responsibilities include:

- Proactive Client Engagement: Understanding a client's life events and financial goals (e.g., buying a home, saving for college, starting a business).

- Needs-Based Selling: Recommending and opening appropriate products and services, such as checking and savings accounts, credit cards, and personal loans.

- Problem Resolution: Assisting clients with complex account issues and providing high-level customer service.

- Digital Integration: Educating clients on using Chase's digital banking tools, including the mobile app and online portal.

- Referral Generation: Identifying clients who could benefit from specialized services and referring them to partners like Financial Advisors, Mortgage Bankers, or Business Relationship Managers.

In essence, you are a trusted advisor, helping individuals and families navigate their financial journey with Chase's suite of solutions.

Average Relationship Banker Salary at Chase Bank

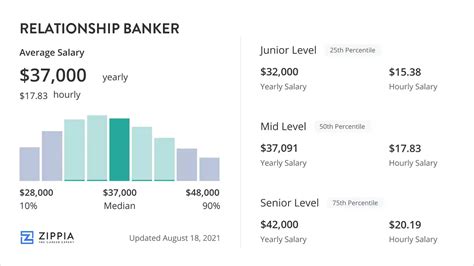

While salaries vary, we can establish a strong baseline using data from leading salary aggregators. It's important to distinguish between base salary and total compensation, which includes bonuses and commissions.

According to recent data:

- Glassdoor reports that the estimated total pay for a Relationship Banker at JPMorgan Chase is between $62,000 and $88,000 per year, with an estimated average base salary of around $56,000 per year. This total pay figure includes potential additional compensation like cash bonuses, commissions, and profit sharing.

- Payscale indicates an average base salary of approximately $52,000 per year for a Relationship Banker at Chase, with a reported range typically falling between $44,000 and $65,000 for the base alone. Bonuses can add several thousand dollars to this figure.

- Salary.com places the median salary for a "Relationship Banker I" (an entry-to-intermediate level role) in the broader market around $46,500, but this can climb significantly with experience and a strong performance record, especially at a large institution like Chase.

Considering these sources, a fair expectation for a Relationship Banker at Chase is a base salary in the $50,000 to $60,000 range, with total compensation reaching $65,000 to $85,000+ based on performance-driven incentives.

Key Factors That Influence Salary

Your salary is not a single, static number. Several key factors determine your specific compensation package.

### Level of Education

While a bachelor’s degree is often preferred, it's not always a strict requirement for a Relationship Banker role. However, a degree in a relevant field like Finance, Business Administration, or Economics can make you a more competitive candidate and may provide a slight edge in starting salary negotiations. More importantly, a bachelor's degree is often a prerequisite for advancing into higher-paying roles within the bank, such as Financial Advisor or Branch Manager.

### Years of Experience

Experience is one of the most significant drivers of salary growth. A proven track record demonstrates your ability to build a client portfolio, meet sales goals, and handle complex financial conversations.

- Entry-Level (0-2 years): Professionals in this bracket can expect a salary at the lower end of the range. The focus is on learning the products, building client-facing skills, and establishing a performance history.

- Mid-Career (3-5 years): With several years of experience, Relationship Bankers can command a higher base salary and are often more effective at earning commissions, pushing their total compensation toward the industry average and beyond.

- Senior/Lead (5+ years): Senior Relationship Bankers or those in a "Relationship Banker II/III" role not only earn at the top of the pay scale but may also take on mentorship responsibilities, qualifying them for leadership-based bonuses.

### Geographic Location

Where you work matters immensely. Chase, like most large corporations, adjusts its pay scales based on the local cost of living and market competition.

- High Cost-of-Living (HCOL) Areas: In major metropolitan centers like New York City, San Francisco, Los Angeles, and Boston, you can expect significantly higher base salaries to offset the high cost of housing and living expenses.

- Medium-to-Low Cost-of-Living (LCOL) Areas: In smaller cities or more rural regions, the base salary will likely be closer to the lower end of the national average, though the purchasing power may be equivalent or even greater than in an HCOL area.

### Bank Prestige and Size

Working for a global financial leader like JPMorgan Chase comes with distinct advantages over smaller, regional banks or credit unions. While a community bank might offer a strong sense of local connection, a powerhouse like Chase typically provides:

- Competitive Base Salaries: To attract top talent in a competitive market.

- Structured Bonus and Commission Plans: Clearly defined metrics for earning additional income.

- Comprehensive Benefits: Robust healthcare, retirement plans (like a 401(k) with a company match), and paid time off that add significant value to the total compensation package.

- Unmatched Career Mobility: A structured path for advancement within a vast organization.

### Performance, Commissions, and Specializations

This is where you have the most direct control over your income. A significant portion of a Relationship Banker's earnings can come from variable pay tied to performance. This is typically based on meeting and exceeding quarterly or annual goals for:

- New Account Openings

- Loan and Credit Card Origination

- Client Asset Growth

- Successful Referrals to other business lines (investments, mortgages, etc.)

Furthermore, specializing can increase your value. For example, a banker who develops an expertise in small business accounts or who is selected for the Chase Private Client team (serving high-net-worth individuals) will have access to higher compensation tiers and bonus potential.

Job Outlook

The career outlook for financial professionals remains positive. While automation and digital banking are changing the nature of in-person banking, they are also freeing up Relationship Bankers to focus on what they do best: building relationships and providing complex, personalized advice that algorithms cannot replicate.

According to the U.S. Bureau of Labor Statistics (BLS), employment for Personal Financial Advisors—a common next step for successful Relationship Bankers—is projected to grow 13% from 2022 to 2032, much faster than the average for all occupations. The BLS notes that as the population ages and life expectancies rise, demand for financial planning services will continue to increase. The Relationship Banker role is a critical entry point into this growing field.

Conclusion

A career as a Relationship Banker at Chase Bank offers a competitive salary and a clear path for professional growth. While a base salary in the $50,000 to $60,000 range is a reasonable starting point, your ultimate earning potential is in your hands.

For those considering this path, the key takeaways are:

- Total Compensation is Key: Look beyond the base salary to the significant income potential from bonuses and commissions.

- Performance Pays: Your ability to meet client needs and achieve sales goals will directly impact your take-home pay.

- Location Matters: Expect your salary to be adjusted based on your local market.

- This is a Launchpad: The skills, experience, and network you build as a Relationship Banker can open doors to highly lucrative roles across the financial services industry.

By focusing on developing your skills, delivering exceptional client service, and strategically leveraging your experience, you can build a successful and financially rewarding career at Chase Bank.