Welcome to the definitive guide on the fund accountant salary and career path. If you are a detail-oriented individual with a passion for numbers and an interest in the intricate engine room of the investment world, you've likely considered a career in fund accounting. It's a role that demands precision, resilience, and a deep understanding of financial markets. But what does that translate to in terms of compensation? How does a fund accountant's salary evolve over a career, and what factors can you control to maximize your earning potential?

This article will pull back the curtain on one of the most vital yet often overlooked roles in the financial services industry. We will explore not just the numbers, but the narrative behind them. You'll gain a comprehensive understanding of what a fund accountant salary looks like at every stage, from your first day as an analyst to a senior leadership position. We’ll delve into the factors that can add tens of thousands of dollars to your annual income, from geographic location to industry specialization.

Early in my own career as a professional development analyst, I worked closely with a team of fund accountants at a large asset management firm during a period of extreme market volatility. I was floored by their calm and methodical approach amidst the chaos. Their work wasn't just about balancing ledgers; it was about creating the single source of truth that every portfolio manager, investor, and regulator relied upon. This experience taught me that fund accounting is the bedrock of trust in the investment industry, and those who excel in it are compensated accordingly.

This guide is designed to be your roadmap. Whether you're a student weighing your options, a recent graduate preparing for your first interview, or a seasoned professional looking to pivot or advance, you will find the data, insights, and actionable advice you need to navigate this rewarding career.

### Table of Contents

- [What Does a Fund Accountant Do?](#what-is-a-fund-accountant)

- [Average Fund Accountant Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence a Fund Accountant's Salary](#key-factors)

- [Job Outlook and Career Growth for Fund Accountants](#job-outlook)

- [How to Become a Fund Accountant: A Step-by-Step Guide](#how-to-get-started)

- [Conclusion: Is a Career in Fund Accounting Right for You?](#conclusion)

What Does a Fund Accountant Do? An In-Depth Overview

Before we can accurately dissect a fund accountant's salary, we must first understand the depth and breadth of their responsibilities. A fund accountant is a specialized accounting professional responsible for maintaining the financial records and calculating the value of an investment fund. These funds can range from mutual funds and exchange-traded funds (ETFs) accessible to the public, to highly complex and private hedge funds, private equity funds, or real estate investment trusts (REITs).

Their primary and most critical responsibility is the calculation of the Net Asset Value (NAV). The NAV represents the value of a single share of a fund and is the price at which investors buy (subscribe) or sell (redeem) their shares. An accurate and timely NAV is non-negotiable; it is the cornerstone of the fund's operations and integrity. An error in the NAV can have significant financial and reputational consequences for the fund manager and its investors.

Beyond the NAV, their work is a meticulous blend of daily, weekly, and monthly tasks that ensure the fund's financial health and regulatory compliance.

Core Responsibilities and Daily Tasks:

- Trade Processing and Settlement: Recording all buying and selling of securities (stocks, bonds, derivatives, etc.) and ensuring these trades have settled correctly.

- Cash and Position Reconciliation: Daily reconciliation of the fund's cash accounts and investment positions with its custodians, brokers, and prime brokers. This involves identifying and resolving any discrepancies.

- Income and Expense Accrual: Accurately booking all fund income (dividends, interest) and accruing all fund expenses (management fees, administrative fees, professional fees).

- Corporate Actions Processing: Accounting for events like stock splits, mergers, spin-offs, and dividends that affect the value of the securities held in the fund.

- Financial Reporting: Preparing and assisting in the audit of the fund's financial statements (Statement of Assets and Liabilities, Statement of Operations, etc.) on a quarterly, semi-annual, and annual basis.

- Investor and Regulatory Compliance: Ensuring all accounting and reporting practices comply with regulatory standards (e.g., SEC regulations in the U.S.) and the fund's own prospectus.

- Capital Activity: For private funds (like hedge funds or private equity), this includes processing investor subscriptions and redemptions, calculating capital calls, and managing distributions.

---

#### A Day in the Life of a Fund Accountant

To make this role more tangible, let's walk through a typical day for "Sarah," a mid-level fund accountant working at a fund administrator that services hedge fund clients.

- 8:30 AM: Sarah arrives and immediately pulls the prior day's trading activity and broker reports for her assigned funds. She begins the initial cash and position reconciliation, flagging any immediate breaks or discrepancies.

- 10:00 AM: The market is open. Sarah monitors any incoming corporate actions for the day and liaises with the custodian bank to ensure they are processed correctly in the accounting system. She receives a query from a portfolio manager about a specific dividend payment, researches it, and provides a clear explanation.

- 12:00 PM (Lunch): A brief break, often at her desk, especially on a busy day.

- 1:00 PM: Focus shifts to income and expense processing. She accrues management and performance fees based on the fund's documents and books any interest income from bond holdings.

- 3:00 PM: The most critical part of the day begins: the preliminary NAV calculation. She runs the accounting system's valuation reports, ensuring all securities are priced correctly using approved pricing sources.

- 4:30 PM: Sarah performs a "NAV review," a self-check process where she analyzes the day-over-day price movement of the fund. Any significant swing (e.g., more than 1%) requires a detailed explanation. She identifies a price change in a derivative position, investigates the underlying factors, and documents her findings.

- 5:30 PM: After her review is complete, she submits the preliminary NAV to her manager for a final sign-off. The manager asks for clarification on one expense item, which Sarah provides.

- 6:00 PM: The final NAV is approved and disseminated to the client and relevant parties. Sarah files her reconciliation proofs and review checklists, then takes a moment to plan for the next day. During month-end or quarter-end, her day might extend much later to handle financial statement preparation and reporting.

---

This example illustrates that the role is far more than simple bookkeeping. It is an analytical, problem-solving position that requires immense attention to detail and the ability to work under tight, daily deadlines.

Average Fund Accountant Salary: A Deep Dive

Now, let's get to the core of the query: the numbers. The salary for a fund accountant is not a single figure but a wide spectrum influenced by a multitude of factors we will explore in the next section. However, by synthesizing data from leading compensation and labor market sources, we can establish a clear and reliable baseline.

It's important to note that "salary" in the financial services industry often refers to base salary, which is only one component of total compensation. Bonuses, in particular, can significantly augment annual earnings, especially at senior levels and in certain types of firms.

#### National Averages and Typical Ranges

To provide a comprehensive picture, we'll look at data from several authoritative sources.

> According to Salary.com, as of late 2023, the median base salary for a Fund Accountant I (entry-level) in the United States is $66,301, with a typical range falling between $60,501 and $72,701. For a Fund Accountant II (mid-career), the median rises to $77,401, with a range of $70,501 to $85,001. A Senior Fund Accountant (Fund Accountant III) sees a median of $92,601, typically ranging from $84,201 to $101,901.

> Payscale.com reports a slightly broader average base salary for the generic "Fund Accountant" title at approximately $71,500 per year. Their data shows a range from roughly $55,000 for the 10th percentile to over $98,000 for the 90th percentile, excluding bonuses.

> Glassdoor, which incorporates user-submitted data and often reflects total compensation (base + additional pay), places the average fund accountant salary higher, at an estimated total pay of $85,348 per year in the United States, with a likely range of $70,000 to $105,000.

Synthesizing this data, a reasonable expectation for a fund accountant's base salary in the U.S. is:

- Entry-Level: $60,000 - $75,000

- Mid-Career: $75,000 - $95,000

- Senior/Lead: $95,000 - $125,000+

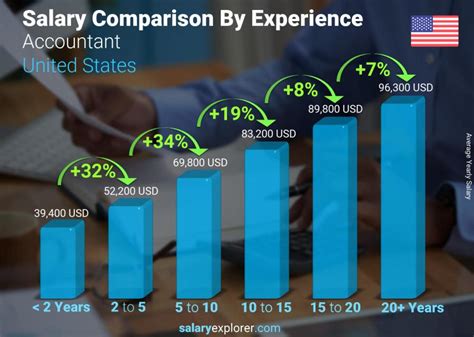

#### Salary Progression by Experience Level

Career and salary progression in fund accounting is relatively structured and predictable, especially in larger organizations. As you gain experience, you take on more complex funds, review the work of junior staff, and handle more client-facing responsibilities, all of which command higher pay.

| Career Stage | Years of Experience | Typical Base Salary Range | Key Responsibilities & Role |

| :--- | :--- | :--- | :--- |

| Entry-Level Fund Accountant | 0-2 years | $60,000 - $75,000 | Daily reconciliations, trade processing, basic NAV calculations for simple funds, learning systems. |

| Mid-Career Fund Accountant | 3-5 years | $75,000 - $95,000 | Manages a portfolio of more complex funds, handles corporate actions, trains junior staff, preliminary NAV review. |

| Senior Fund Accountant | 5-8 years | $95,000 - $125,000 | Reviews work of junior/mid-level staff, handles most complex funds (derivatives, PE), main point of contact for audits, liaises directly with clients. |

| Fund Accounting Manager | 8-12+ years | $120,000 - $160,000+ | Manages a team of accountants, oversees a book of business, handles client relationships, resource allocation, and process improvement. |

| Director / Vice President | 12+ years | $150,000 - $250,000+ | Strategic oversight of the department, major client relationship management, business development, sets departmental policy and technology strategy. |

*Note: These are typical base salary ranges and can vary significantly based on the factors discussed in the next section.*

#### Deconstructing Total Compensation: Beyond the Base Salary

In finance, the base salary is just the beginning of the story. Total compensation is a more accurate measure of your annual earnings.

- Annual Bonus: This is the most significant variable.

- At Fund Administrators and Mutual Fund Companies: Bonuses are typically more modest, often ranging from 5% to 15% of base salary. They are tied to both individual and company performance.

- At Hedge Funds and Private Equity Firms: Bonuses are a much larger component of pay and can range from 20% to 100% (or more) of base salary, depending on the firm's performance for the year. This is where the earning potential truly skyrockets.

- Profit Sharing: Some firms offer a profit-sharing plan, where a portion of the company's profits is distributed to employees. This is common in smaller, privately-owned investment boutiques.

- Retirement Benefits: A 401(k) or 403(b) plan is standard. A key differentiator is the employer match. A generous match (e.g., 100% of your contribution up to 6% of your salary) is a significant and valuable part of your compensation package.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is expected. Premium plans with low deductibles add thousands of dollars in value annually. Other perks can include gym memberships, wellness stipends, and generous paid time off (PTO).

- Stock Options / Equity: While less common for pure accounting roles compared to investment or technology roles, some firms, especially smaller or pre-IPO companies, may offer equity as part of the compensation package. In private equity, senior professionals may receive "carried interest," which is a share of the fund's profits and can be extremely lucrative.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the value of the entire compensation and benefits package. A role with a $90,000 base salary and a 15% bonus is superior to a $95,000 base salary with no bonus potential.

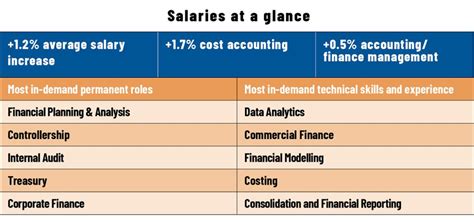

Key Factors That Influence a Fund Accountant's Salary

This is the most critical section for understanding and maximizing your earning potential. Two fund accountants with the same title and five years of experience can have vastly different salaries. The disparities are driven by a predictable set of factors. Understanding these levers is key to strategically guiding your career toward higher compensation.

1. Level of Education and Professional Certifications

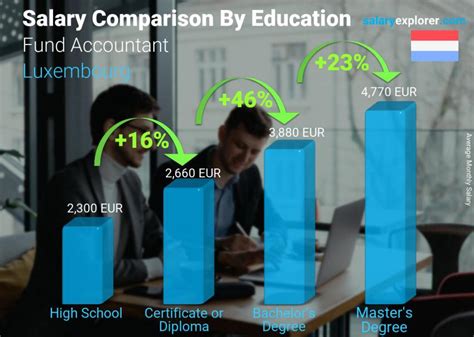

Your educational foundation sets the initial floor for your salary and can influence your entire career trajectory.

- Bachelor's Degree: A bachelor's degree in Accounting or Finance is the non-negotiable entry ticket. Degrees in Economics or Business Administration are also acceptable, provided they include a strong curriculum in accounting principles. Candidates with a high GPA (3.5+) from a well-regarded university often command a premium in their starting salary offers.

- Master's Degree: A Master of Accountancy (MAcc) or a Master of Science in Finance (MSF) can provide a competitive edge. It often fulfills the credit hour requirement for the CPA exam and can lead to a 5% to 15% higher starting salary. More importantly, it can accelerate your path to senior roles.

- Professional Certifications (The Great Accelerator): This is arguably the most powerful educational factor you can control post-graduation.

- Certified Public Accountant (CPA): The CPA is the gold standard in the accounting world, and this holds true for fund accounting. Holding a CPA license is a signal of expertise, discipline, and ethical commitment. It is often a prerequisite for promotion to Manager-level positions and beyond. A CPA designation can easily add $10,000 to $20,000 or more to your annual salary compared to a non-certified peer with similar experience.

- Chartered Financial Analyst (CFA): While more common for portfolio managers and research analysts, the CFA charter is highly respected in fund accounting, especially for those who wish to transition to more analytical or client-facing roles. It demonstrates a deep understanding of investment instruments, valuation, and portfolio management. Completing even Level I or II of the CFA exam can differentiate your resume and boost your earnings.

- Other Certifications: Certifications like the Certified Management Accountant (CMA) or Certified Internal Auditor (CIA) are also valuable but are generally less impactful in the specific niche of fund accounting than the CPA.

2. Years and Quality of Experience

As shown in the salary progression table, experience is a primary driver of compensation. However, it's not just the number of years that matters, but the *quality* and *type* of experience gained.

- 0-2 Years (Foundation Building): The focus is on learning the fundamentals: NAV mechanics, reconciliation, and the core accounting system. Salary growth is steady but modest. The key is to absorb as much as possible and demonstrate reliability.

- 3-5 Years (Developing Expertise): At this stage, you should be moving beyond rote tasks. Your value increases as you begin to handle more complex funds (e.g., funds with derivatives, multi-currency classes, or private assets), train new hires, and take ownership of the preliminary review process. This is where you see the first significant salary jump.

- 5-8 Years (Senior/Lead Contributor): Senior accountants are the technical experts and problem-solvers. They are trusted to handle the most difficult funds, lead audit engagements, and interact confidently with clients and portfolio managers. Their experience in navigating complex corporate actions, valuation issues, and financial reporting standards justifies their six-figure base salaries.

- 8+ Years (Leadership and Strategy): Experience at this level transitions from "doing" to "managing" and "strategizing." Your value is in your ability to lead a team, manage client relationships, improve operational efficiency, and mitigate risk. Salaries at the Manager, Director, and VP levels reflect these significant leadership responsibilities. An experienced director who has successfully managed teams through market crises and system migrations is an invaluable asset.

3. Geographic Location

Where you work has a massive impact on your paycheck, primarily due to differences in the cost of living and the concentration of financial services firms. Major financial hubs offer the highest salaries but also come with the highest living expenses.

Here's a comparative look at how average fund accountant salaries (mid-career, ~5 years experience) can vary by location, based on a synthesis of market data:

| City/Region | Cost of Living Index (US Avg = 100) | Typical Mid-Career Base Salary | Commentary |

| :--- | :--- | :--- | :--- |

| New York, NY | ~220 | $100,000 - $130,000+ | The epicenter of hedge funds and investment banking. Highest salaries, especially on the buy-side. Extremely high cost of living. |

| San Francisco, CA | ~250 | $95,000 - $125,000 | Hub for venture capital, private equity, and tech-focused funds. Salaries are high to offset the nation's highest cost of living. |

| Boston, MA | ~150 | $90,000 - $115,000 | A major hub for mutual funds and asset management giants (e.g., Fidelity, State Street). Strong demand and competitive salaries. |

| Chicago, IL | ~105 | $80,000 - $100,000 | A significant financial center with a large presence of futures/options trading, asset managers, and fund administrators. Offers a great balance of high salary and reasonable cost of living. |

| Charlotte, NC | ~98 | $75,000 - $95,000 | A rapidly growing banking and finance hub. Salaries are competitive for the region, and the cost of living is attractive. |

| Dallas, TX | ~102 | $75,000 - $95,000 | Another growing financial center with many firms relocating for favorable business conditions. Strong demand and good salary-to-cost-of-living ratio. |

| Denver, CO | ~120 | $78,000 - $98,000 | A regional hub with a growing asset management scene. Salaries are strong, but the cost of living has risen significantly. |

| Lower Cost of Living Areas | < 90 | $65,000 - $85,000 | In cities like Kansas City, MO, or Omaha, NE (a surprising hub for some firms), salaries are lower but may offer greater purchasing power. |

The rise of remote work has slightly blurred these lines, but companies still tend to adjust salaries based on a "locality pay" model, even for remote employees.

4. Company Type and Size

The type of firm you work for is perhaps the single largest determinant of your overall compensation, particularly the bonus component.

- Hedge Funds / Private Equity Firms (The "Buy-Side"): These firms offer the highest earning potential. They manage vast pools of capital and generate significant fees. Fund accountants working directly for these firms are seen as part of the core operational team.

- Salary: Base salaries are very competitive, often 10-20% higher than at administrators.

- Bonus: This is the key differentiator. Bonuses are directly tied to the fund's performance and can range from 30% to over 100% of base salary in a good year. The hours are long and the pressure is intense, but the rewards are substantial.

- Large Asset Managers (e.g., BlackRock, Vanguard, Fidelity): These are global giants that manage trillions of dollars, primarily in mutual funds and ETFs.

- Salary: They offer very competitive base salaries and excellent, structured career paths.

- Bonus: Bonuses are more predictable and modest than at hedge funds, typically in the 10-25% range. The major selling point is stability, exceptional benefits, and brand prestige.

- Fund Administrators (e.g., State Street, BNY Mellon, Citco): These are third-party service providers that handle the accounting and administration for hundreds or thousands of different funds. This is the most common employment path for fund accountants.

- Salary: Base salaries are solid and in line with the market averages cited earlier.

- Bonus: Bonuses are typically the most modest, often in the 5-15% range. These firms are excellent training grounds where you can get exposure to a wide variety of fund types and strategies. Many professionals start here and then move to a buy-side role.

- Big Four / Large Public Accounting Firms (e.g., PwC, Deloitte, EY, KPMG): These firms have dedicated asset management audit and advisory practices.

- Salary: Starting salaries are competitive, but may lag behind direct industry roles after a few years.

- Bonus: Similar to administrators, bonuses are in the 5-15% range. The primary benefit of starting here is the prestigious brand name on your resume and the rigorous audit training, which is a powerful springboard to high-level roles in the industry.

5. Area of Specialization

Within fund accounting, specialization in a complex or in-demand area can lead to a significant pay premium. Generalists are valuable, but specialists are rare and highly sought after.

- Private Equity Accounting: This is a highly specialized and lucrative niche. It involves managing illiquid assets, capital calls, complex distribution waterfalls, and investor reporting. Experience with systems like Investran or eFront is highly valuable. PE accountants often command a 15-25% salary premium over their mutual fund counterparts.

- Hedge Fund Accounting (Complex Strategies): Accounting for funds that use leverage, short selling, and complex derivatives (swaps, options, futures) requires a higher level of technical skill. Accountants who can navigate these instruments are prized, particularly at the funds themselves and at specialized administrators like Citco or SS&C GlobeOp.

- Real Estate / Infrastructure Fund Accounting: Similar to private equity, these funds deal with illiquid, hard-to-value assets. This requires specialized knowledge of property accounting, development draws, and fund structuring.

- Mutual Fund / '40 Act Fund Accounting: While the most common specialization, it is also the most standardized due to heavy SEC regulation. This can sometimes lead to slightly lower pay ceilings compared to the alternative investment space, but it offers greater stability and more predictable hours.

6. In-Demand Skills

Beyond your credentials, specific, demonstrable skills can make you a more valuable candidate and give you leverage in salary negotiations.

- Technical & Systems Skills:

- Advanced Microsoft Excel: This is table stakes. You must be a power user, proficient with VLOOKUP/INDEX-MATCH, PivotTables, and complex formulas. Knowledge of VBA (macros) and Power Query to automate tasks is a major plus.

- Database & Querying Skills (SQL): As data volumes grow, the ability to query databases directly using SQL to pull information or perform analysis is becoming an increasingly valuable skill, separating top-tier candidates from the pack.

- Proficiency in Fund Accounting Software: Deep experience in industry-standard platforms is a huge advantage. Key systems include Geneva, Investran, eFront, Advent APX/Axys, and Eagle STAR.

- Analytical Skills: The future of fund accounting is less about data entry and more about analysis. The ability to investigate a NAV variance, understand