A career at Goldman Sachs is often seen as the pinnacle of a young professional's ambition in the world of finance. It's a name synonymous with prestige, high-stakes deals, and, of course, significant financial rewards. For those eyeing a role as a Financial Analyst at this bulge-bracket investment bank, the most pressing question is often: "What can I actually expect to earn?"

The answer is compelling. An entry-level analyst at Goldman Sachs can expect a total compensation package that often lands well into the six figures, making it one of the most lucrative career paths for new graduates. This article provides a data-driven breakdown of a Goldman Sachs Financial Analyst's salary, the key factors that influence it, and what you need to know to navigate this competitive and rewarding career.

What Does a Financial Analyst at Goldman Sachs Do?

Before diving into the numbers, it's crucial to understand the role. A "Financial Analyst" at Goldman Sachs is typically an entry-level position for professionals with 0-3 years of experience, usually hired directly from undergraduate programs. While responsibilities vary by division (e.g., Investment Banking, Global Markets, Asset Management), the core duties are intense and intellectually demanding.

An analyst's day-to-day work often includes:

- Financial Modeling: Building complex spreadsheets to forecast a company's future performance, often in the context of a merger, acquisition, or initial public offering (IPO).

- Valuation Analysis: Using methodologies like Discounted Cash Flow (DCF), comparable company analysis, and precedent transaction analysis to determine the value of a business.

- Market Research: Compiling and analyzing data on industries, markets, and economic trends to support strategic decisions.

- Presentation Development: Creating "pitch books" and other presentation materials for senior bankers to present to clients.

- Deal Support: Assisting senior team members with all aspects of live transaction execution.

It's a high-pressure, fast-paced environment that serves as a powerful training ground for a long-term career in finance.

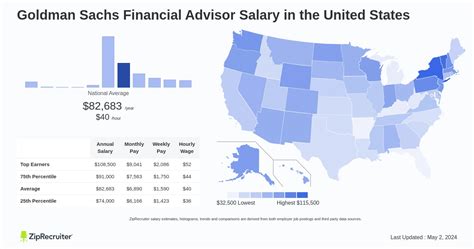

Average Goldman Sachs Financial Analyst Salary

Compensation in investment banking is a tale of two parts: a base salary and a performance-based bonus. It is essential to consider both to understand the full earnings picture.

According to the latest data from reputable salary aggregators, the compensation for a first-year Financial Analyst at Goldman Sachs in a major financial hub like New York City typically breaks down as follows:

- Average Base Salary: $110,000 per year. This figure is for first-year analysts and has become a standard starting point for most major investment banks.

- Performance Bonus: This is highly variable and depends on both the firm's overall performance and the individual's contribution. For a first-year analyst, this can range from $40,000 to over $90,000.

- Total Compensation: Combining these figures, a first-year Financial Analyst at Goldman Sachs can expect their total compensation to fall within the $150,000 to $200,000+ range.

*Sources: Salary data is compiled and cross-referenced from recent user-reported data on Glassdoor, Levels.fyi, and industry reports for 2023-2024 analyst classes.*

As analysts gain experience, their base salary sees modest increases, but their performance bonus potential grows significantly. A third-year analyst, for example, could see a bonus that approaches or even exceeds their base salary.

Key Factors That Influence Salary

While the headline numbers are impressive, several factors can significantly influence an analyst's earnings.

### Level of Education

A bachelor's degree is the standard requirement for an analyst role, typically in fields like finance, economics, accounting, or mathematics. While the specific undergraduate institution can impact hiring chances, it doesn't directly alter the standardized salary bands for analysts.

The major educational differentiator is a Master of Business Administration (MBA). Professionals who pursue an MBA from a top-tier business school can re-enter the investment banking world at the "Associate" level. This comes with a substantial pay increase. A first-year Associate at Goldman Sachs can expect a base salary in the range of $175,000 to $225,000, with a bonus that can push total compensation well over $300,000.

### Years of Experience

Experience is one of the most direct drivers of compensation growth at an investment bank. The career track is highly structured:

- Analyst (Years 1-3): As detailed above, total compensation starts strong and grows each year, primarily through larger bonuses.

- Associate (Post-MBA or Direct Promote): This represents a significant jump in both base salary and bonus potential.

- Vice President (VP) and beyond: At this level, compensation becomes even more heavily weighted towards performance bonuses and can easily reach the high six-figures and beyond.

### Geographic Location

Where you work matters. Goldman Sachs, like other global banks, adjusts its salaries based on the cost of living and market competition in different cities.

- Top-Tier Hubs (New York, San Francisco): These locations offer the highest salaries to attract talent in high-cost-of-living areas. The figures cited in this article primarily reflect these markets.

- Other Major Financial Centers (London, Chicago, Hong Kong): Compensation remains highly competitive but may be slightly lower than in New York.

- Growth Markets (Salt Lake City, Dallas): Goldman Sachs has expanded significantly in these lower-cost-of-living cities. While the salaries are lower than in NYC (e.g., a base salary might be 10-20% less), they are still extremely high relative to the local market, offering excellent purchasing power.

### Company Type

While this article focuses on Goldman Sachs, it's helpful to understand how its pay structure compares to the broader industry. Goldman Sachs is a "bulge bracket" bank, a category of the largest and most profitable global investment banks.

- Bulge Bracket & Elite Boutiques (e.g., Evercore, Centerview): These firms are at the top of the pay scale and often compete fiercely for the best talent, leading to very similar, if not identical, compensation packages.

- Middle-Market Banks: These firms, which handle smaller deals, offer very strong compensation but typically pay slightly less than the bulge bracket banks.

- Corporate Finance (In-House): A financial analyst working in the finance department of a Fortune 500 company (non-financial) will have a much lower salary and bonus structure but often a better work-life balance. According to the U.S. Bureau of Labor Statistics (BLS), the median pay for Financial Analysts across all industries was $99,890 per year in May 2023, which helps contextualize the premium paid by firms like Goldman Sachs.

### Area of Specialization

"Financial Analyst" is a broad title. Within Goldman Sachs, your division heavily impacts your work and bonus potential.

- Investment Banking Division (IBD): This is the classic, high-pressure division focused on M&A and capital raising. It is historically one of the highest-paying divisions, with very large year-end bonuses tied to deal flow.

- Global Markets (Sales & Trading): Compensation in this division is highly variable and tied directly to trading performance. An analyst on a highly profitable trading desk could earn an exceptional bonus.

- Asset & Wealth Management: Analysts here help manage investments for institutions and high-net-worth individuals. Compensation is excellent, though the bonus structure can be different and sometimes tied to assets under management (AUM).

Job Outlook

The demand for top-tier financial talent remains consistently strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for all financial analysts is projected to grow 8 percent from 2022 to 2032, which is faster than the average for all occupations.

However, competition for roles at elite firms like Goldman Sachs is incredibly fierce. While the overall field is growing, securing a position at the highest level requires exceptional academic performance, relevant internship experience, and sharp technical and interpersonal skills.

Conclusion

A career as a Financial Analyst at Goldman Sachs offers a path to extraordinary earning potential right from the start of your professional life. With a first-year total compensation package often ranging from $150,000 to over $200,000, the financial rewards are undeniable. This earning power grows substantially with experience, promotions, and strong performance, especially within the firm's prestigious Investment Banking and Global Markets divisions.

However, prospective candidates must understand the trade-offs. The role demands an immense commitment, long hours, and the ability to perform under extreme pressure. For those who possess the ambition, intellect, and resilience to thrive in this environment, a career at Goldman Sachs is not just a job—it's a launchpad to a powerful and financially rewarding future in the world of finance.