Are you navigating a job offer or trying to understand your current pay structure? You've likely encountered terms like "exempt" and "non-exempt." While they may seem like simple payroll jargon, understanding them—especially the "salary non-exempt" classification—is crucial for protecting your rights and maximizing your income. This classification doesn't define a specific job, but rather a method of payment that offers a stable salary *plus* the potential for significant overtime earnings.

This guide will demystify the salary non-exempt meaning, explain how it impacts your total compensation, and explore the factors that determine your earning potential within this common and important pay structure.

What Does "Salary Non-Exempt" Actually Mean?

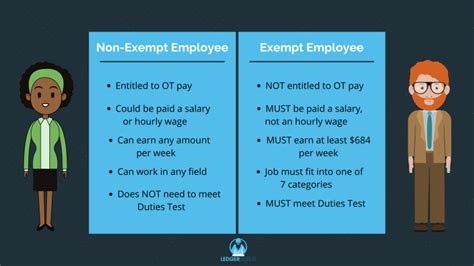

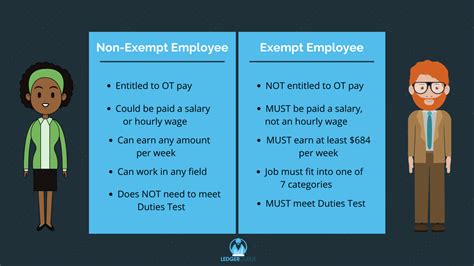

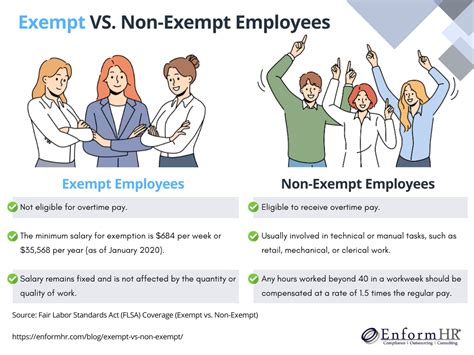

At its core, "salary non-exempt" is a pay classification under the U.S. Fair Labor Standards Act (FLSA). It's a hybrid model that combines the stability of a fixed salary with the overtime protections typically associated with hourly work. Let's break it down:

- Salary: You receive a fixed, predetermined amount of money each pay period, regardless of the exact number of hours you work (up to 40 hours per week). This provides predictable income.

- Non-Exempt: This is the key part. It means you are *not exempt* from the FLSA's overtime rules. Your employer is legally required to pay you overtime, typically at a rate of 1.5 times your "regular rate of pay," for all hours worked over 40 in a single workweek.

This classification is distinct from other common pay structures:

| Classification | Pay Structure | Overtime Eligibility | Commonly For... |

| :--- | :--- | :--- | :--- |

| Salary Non-Exempt | Fixed base salary per pay period. | Yes. Entitled to overtime pay for hours worked over 40 in a workweek. | Administrative staff, paralegals, inside sales, some IT support roles, coordinators. |

| Salary Exempt | Fixed base salary per pay period. | No. Not eligible for overtime pay, regardless of hours worked. | Executives, senior managers, many professional roles (doctors, lawyers), outside sales. |

| Hourly Non-Exempt | Paid a set rate for each hour worked. | Yes. Entitled to overtime pay for hours worked over 40 in a workweek. | Retail associates, food service workers, manufacturing line workers, tradespeople. |

To be classified as "exempt" from overtime, an employee must generally meet all three of the following "tests" as defined by the Department of Labor:

1. Salary Basis Test: Be paid on a salary basis.

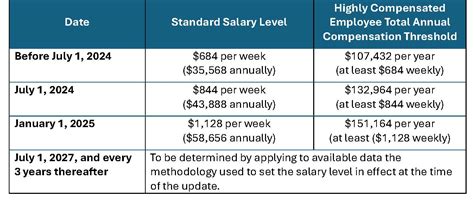

2. Salary Level Test: Earn a salary above a specific threshold ($684 per week or $35,568 per year as of 2024).

3. Duties Test: Primarily perform job duties that are considered executive, administrative, or professional in nature.

If an employee is paid a salary but does *not* meet the duties test, they are classified as salary non-exempt.

How "Salary Non-Exempt" Impacts Your Total Earnings

This is where the classification becomes powerful. While it doesn't represent a specific job title, it dictates how your total compensation is calculated. Your earnings are not just your salary; they are your base salary + any overtime worked.

Consider this scenario: An IT Support Specialist has a base salary of $60,000 per year.

- Regular Rate of Pay Calculation: $60,000 / 52 weeks = $1,153.85 per week. $1,153.85 / 40 hours = $28.85 per hour (this is their "regular rate" for overtime calculation).

- Overtime Rate: $28.85 x 1.5 = $43.28 per hour.

- Impact: If this specialist works 10 hours of overtime during a critical project week, they earn an additional $432.80 for that week. Over a year, consistent overtime can significantly boost their total annual income well beyond the initial $60,000.

Key Factors That Influence Your Salary

While "salary non-exempt" is a classification, the actual base salary you are offered is determined by the same market factors as any other job. Here’s how various elements impact your earning potential.

### Area of Specialization / Job Role

This is the single most significant factor. "Salary non-exempt" applies to a vast range of professions, from entry-level administrative roles to highly skilled technical positions. The value of your specific skills in the marketplace determines your base salary.

Here are some common salary non-exempt roles and their typical annual base salary ranges in the United States:

- Paralegal: $48,000 - $79,000 (Payscale, 2024)

- Executive Assistant: $55,000 - $90,000+ (Salary.com, 2024)

- IT Help Desk Specialist (Tier II): $52,000 - $75,000 (Glassdoor, 2024)

- Inside Sales Representative: $45,000 - $70,000 (base salary, often with added commission) (Glassdoor, 2024)

- Office Manager: $49,000 - $82,000 (Payscale, 2024)

### Geographic Location

Where you work matters immensely due to variations in cost of living and labor market demand. A non-exempt role in a major metropolitan area will almost always command a higher base salary than the same role in a rural community.

For example, according to Salary.com (2024), the median base salary for an Office Manager can vary significantly:

- New York, NY: $83,301

- Chicago, IL: $70,113

- Dallas, TX: $66,742

- Boise, ID: $61,586

### Years of Experience

Experience is a direct driver of salary. As you gain expertise, your value to an employer increases, leading to higher compensation.

- Entry-Level (0-2 years): You will typically earn at the lower end of the salary range for your role as you learn the fundamentals.

- Mid-Career (3-8 years): With a proven track record, you can command a salary in the mid-to-upper range and may take on more complex projects.

- Senior/Lead (8+ years): A senior non-exempt employee, like a Lead Paralegal or a Senior Executive Assistant, can earn at the very top of the pay scale for their profession due to their deep expertise and ability to mentor others.

### Level of Education

While experience often trumps education for many non-exempt roles, a relevant degree or certification can increase your starting salary and open doors to higher-paying positions. An Associate's or Bachelor's degree in business administration, for example, can give a candidate for an Executive Assistant role a competitive edge. Specialized certifications, like a CompTIA A+ for an IT specialist or a paralegal certificate, can directly translate to higher earning potential.

### Company Type and Industry

The size, profitability, and industry of your employer play a crucial role. A salary non-exempt role at a Fortune 500 tech or finance company will likely pay a higher base salary than the equivalent role at a small non-profit or local government agency. Industries with higher revenue margins, such as biotechnology, software development, and investment banking, tend to offer more competitive compensation packages for all employees, including their non-exempt staff.

Job Outlook for Common Non-Exempt Roles

Because "salary non-exempt" is a classification, there isn't a single job outlook. However, the outlook for many professions that fall under this category is stable and, in some cases, growing.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook (2022-2032 projections):

- Paralegals and Legal Assistants: Job growth is projected at 12%, much faster than the average for all occupations. The need for legal services continues to drive demand.

- Secretaries and Administrative Assistants: Overall employment is projected to decline, but the outlook for specialized roles like Executive Assistants remains strong as high-level executives continue to require skilled administrative support.

- Customer Service Representatives: Employment is projected to decline slightly, but with hundreds of thousands of openings projected each year (due to workers leaving the occupation), opportunities will remain plentiful.

- Computer Support Specialists: Job growth is projected at 5%, about as fast as average, driven by the ongoing need for IT support across all industries.

Conclusion: Embrace Your Classification

Understanding the "salary non-exempt meaning" is a critical piece of career literacy. It is not a job title but a powerful pay classification that provides both the stability of a salary and the financial benefit of overtime pay.

Key Takeaways:

- It's About Protection: The non-exempt status is designed to ensure you are fairly compensated for all the time you work.

- Your Earnings Can Exceed Your Salary: Overtime can be a significant component of your total compensation, especially during busy periods.

- Focus on Your Role and Skills: Your base salary is determined by your profession, experience, location, and industry. To increase your earnings, focus on building valuable skills and gaining experience in high-demand fields.

Whether you are an administrative professional, a paralegal, or an IT specialist, being classified as salary non-exempt is a positive standard that protects your work-life balance and rewards you for going the extra mile. By understanding how it works, you can better navigate your career path and ensure you are always paid what you are worth.

Sources:

- U.S. Department of Labor. (n.d.). *Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA)*.

- U.S. Bureau of Labor Statistics. (2023). *Occupational Outlook Handbook*.

- Glassdoor.com. (2024). *Salary Data*.

- Payscale.com. (2024). *Salary Data*.

- Salary.com. (2024). *Salary Wizard*.