For those navigating the demanding yet rewarding landscape of high finance, reaching the level of Managing Director (MD) at a prestigious firm like Goldman Sachs represents a career pinnacle. It's a role synonymous with leadership, influence, and, of course, significant financial compensation. While the path is arduous, the potential rewards are immense, with total compensation packages often soaring well into the seven-figure range.

This article provides a data-driven breakdown of what a Managing Director at Goldman Sachs earns, the key factors that shape their pay, and the professional outlook for those aspiring to reach this elite level.

What Does a Goldman Sachs MD Do?

Before diving into the numbers, it's crucial to understand the role. A Managing Director at Goldman Sachs is not just a senior employee; they are a leader and a primary driver of the firm's business. The "MD" title is a formal designation conferred upon a select group of high-performing individuals, typically after 10-15+ years of exceptional performance.

Their responsibilities transcend day-to-day execution and focus on:

- Business Development (Rainmaking): Originating new business, whether it's sourcing major M&A deals, securing underwriting mandates, or attracting significant assets from institutional clients.

- Client Relationship Management: Acting as the senior point of contact for the firm's most important clients, providing strategic advice and building long-term partnerships.

- Team and Divisional Leadership: Managing large teams of Vice Presidents, Associates, and Analysts, setting strategic direction, and mentoring the next generation of talent.

- Risk Management: Upholding the firm's standards and making critical decisions that can have a firm-wide impact.

In essence, an MD is a senior partner responsible for generating revenue and shaping the future of their division.

Average Goldman Sachs MD Salary

When discussing compensation at this level, it is essential to distinguish between base salary and total compensation. The base salary provides a stable, predictable income, but the majority of an MD's earnings come from their annual bonus, which is highly variable.

- Average Base Salary: According to data from salary aggregators, the base salary for a Managing Director at Goldman Sachs typically falls within the $500,000 to $750,000 range. Glassdoor reports an average base pay of around $514,000 per year, but this can climb higher for more tenured MDs.

- Annual Bonus & Total Compensation: The bonus is the critical component. It is tied directly to individual performance (deals closed, revenue generated), divisional performance, and the overall profitability of the firm in a given year. In a strong year, an MD's bonus can be 1x to 3x their base salary, or even higher.

- Estimated Total Compensation: Consequently, the total compensation for a first-year or junior MD often starts in the $800,000 to $1.5 million range. For more senior, high-performing MDs in revenue-generating divisions, total annual compensation of $2 million to $5 million is common, with superstar "rainmakers" capable of earning substantially more in exceptional years. Reports from industry sources like eFinancialCareers consistently place typical MD total compensation in the low seven figures.

*(Sources: Glassdoor, eFinancialCareers Compensation Reports, 2023-2024)*

Key Factors That Influence Salary

Compensation for a Goldman Sachs MD is not a monolith. Several factors create a wide variance in pay from one MD to another.

###

Years of Experience

Experience is the most significant determinant of compensation. An MD is not an entry-level position; it is the culmination of a long and successful career path (Analyst -> Associate -> Vice President -> MD). Even within the MD rank, there is a hierarchy. A newly promoted, first-year MD will earn considerably less than a 10-year veteran MD who runs a major group and has a deep book of client relationships. Seniority brings greater responsibility, a larger client portfolio, and, therefore, higher pay.

###

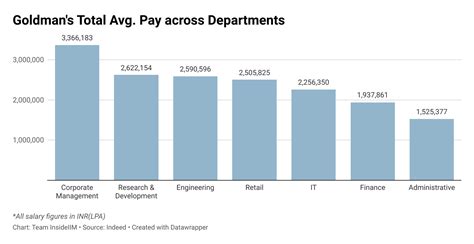

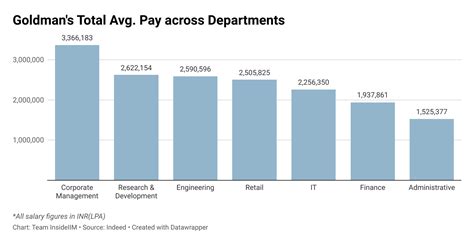

Area of Specialization

Where an MD works within the firm dramatically impacts their earning potential. Compensation is directly linked to revenue generation.

- Investment Banking Division (IBD): MDs specializing in Mergers & Acquisitions (M&A) or capital markets underwriting are classic "rainmakers." Their compensation is closely tied to the fees generated from the deals they originate and execute. This is often one of the highest-paying areas.

- Sales & Trading (Global Markets): Compensation for MDs in this division is heavily influenced by the P&L (Profit and Loss) of their trading book or sales team. High-performing traders in volatile markets can see enormous bonuses, though the risk and variability are also higher.

- Asset & Wealth Management: MDs here are compensated based on factors like Assets Under Management (AUM) and performance fees. Securing and growing large institutional or high-net-worth client accounts is the key to higher earnings.

- Internal & Support Divisions: MDs in functions like Risk, Compliance, Technology, or Legal are vital to the firm but are considered cost centers, not revenue centers. While they are still compensated exceptionally well, their total pay is generally lower than their counterparts in client-facing, revenue-generating roles.

###

Geographic Location

The global financial hubs command the highest salaries due to intense competition for talent and a higher cost of living. According to Salary.com, financial manager salaries in New York City and San Francisco are significantly higher than the national average. An MD in New York, London, or Hong Kong will almost certainly earn more than an MD in a regional office like Salt Lake City or Dallas, even if they hold similar responsibilities.

###

Level of Education

By the time a professional reaches the MD level, their performance and track record far outweigh their specific academic credentials. However, the educational path serves as a crucial foundation. The vast majority of MDs hold a bachelor's degree from a top-tier "target" university. Many also hold a Master of Business Administration (MBA) from an elite program (e.g., Harvard, Wharton, Stanford). An MBA can accelerate the path to the senior ranks by providing advanced financial skills, leadership training, and a powerful professional network, but it is not a strict prerequisite for promotion.

###

Company Type

While this article focuses on Goldman Sachs, it's useful to see where the firm sits in the competitive landscape. As a top Bulge Bracket bank, Goldman Sachs's compensation structure is among the highest in the industry. However, Elite Boutique investment banks (e.g., Evercore, Lazard) sometimes offer even higher total compensation in good years, as their pay structures can be more directly tied to the revenue an individual banker generates.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Managers will grow by 16% from 2022 to 2032, a rate that is much faster than the average for all occupations. This indicates a strong and sustained demand for skilled financial professionals.

However, it's important to be realistic. This overall industry growth does not mean the path to an MD role is easy. Competition for positions at elite firms like Goldman Sachs is incredibly fierce and is often cyclical, depending on the health of the global economy, interest rates, and M&A market activity. Only a very small percentage of analysts who start at the firm will ultimately achieve the title of Managing Director.

*(Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers)*

Conclusion

Reaching the level of Managing Director at Goldman Sachs is a marathon, not a sprint. It requires over a decade of relentless dedication, top-tier performance, and exceptional leadership ability. For those who achieve it, the rewards are commensurate with the effort.

Here are the key takeaways:

- Focus on Total Compensation: Base salary is only a fraction of the story; the annual bonus is the primary driver of an MD's earnings.

- Expect Seven Figures: A typical total compensation package for an MD at Goldman Sachs ranges from $1 million to several million dollars annually.

- Performance is Paramount: Your pay is directly tied to your performance, your division's success, and the firm's overall profitability.

- It's a Long-Term Goal: This role is the culmination of a 10-15+ year career journey through the demanding ranks of investment banking.

For aspiring finance professionals, the role of an MD should be seen as a North Star—a challenging and distant, but ultimately achievable, goal that represents the zenith of a career in finance.