For ambitious technologists at the intersection of computer science and high finance, few names command as much respect or spark as much curiosity as Goldman Sachs. It represents a unique ecosystem where the sharpest minds in engineering build the platforms that power global markets, manage trillions of dollars in assets, and redefine the future of money. But alongside the prestige and the intellectual challenge lies a more pragmatic question that every aspiring engineer must ask: What is the real earning potential? What does a Goldman Sachs software engineer salary truly look like?

This guide is designed to be your definitive resource, pulling back the curtain on one of the most sought-after and lucrative careers in technology. We will move beyond simple averages to provide a granular, in-depth analysis of compensation, career trajectory, and what it takes to succeed. We'll break down the numbers, exploring how factors like experience, location, and specialization can dramatically impact your total compensation, which often soars well into the multi-six-figure range.

As a career analyst who has guided countless engineers through the complex landscape of tech compensation, I've seen firsthand the life-changing potential of securing a role at a top-tier institution. I once mentored a brilliant young graduate who was torn between a comfortable offer at a well-known tech company and the daunting "Superday" interview process at Goldman Sachs. She chose the harder path, and the combination of intellectual rigor and financial reward she found not only accelerated her career by years but also gave her the resources to fund her own fintech startup later on. Her story underscores a critical truth: this career is not just a job, but a powerful launchpad.

This article will provide you with the data-driven insights and strategic advice you need to navigate this path. Whether you are a student planning your future, a mid-career engineer considering a pivot, or simply curious about the pinnacle of fintech careers, this comprehensive guide will equip you with the knowledge to understand and pursue a Goldman Sachs software engineer salary.

### Table of Contents

- [What Does a Goldman Sachs Software Engineer Do?](#what-do-they-do)

- [Goldman Sachs Software Engineer Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion](#conclusion)

What Does a Goldman Sachs Software Engineer Do?

To understand the salary, you must first understand the immense value and responsibility of the role. A software engineer at Goldman Sachs is far more than a simple "coder." They are the architects and builders of a vast, complex, and mission-critical technological nervous system that underpins one of the world's most powerful financial institutions. The code they write doesn't just display a webpage; it executes billions of dollars in trades in microseconds, calculates risk across global portfolios, safeguards sensitive client data against sophisticated cyber threats, and delivers innovative banking services to millions of customers.

The Engineering Division at Goldman Sachs is considered a core pillar of the firm, on par with its trading and investment banking divisions. This "engineering-first" culture means software engineers are not a support function; they are a revenue-generating and risk-mitigating force. They are deeply integrated with the business, working alongside traders, quantitative analysts ("quants"), and investment bankers to solve complex financial problems with technological solutions.

Core Responsibilities and Typical Projects:

- Developing High-Performance Trading Systems: Building and maintaining the electronic platforms for equities, fixed income, currencies, and commodities (FICC) trading. This involves a relentless focus on low latency, high throughput, and extreme reliability, where every nanosecond counts.

- Creating Risk Management and Analytics Platforms: Engineering sophisticated systems that model, measure, and manage market, credit, and operational risk across the firm's entire balance sheet. These platforms run complex simulations to stress-test portfolios against various economic scenarios.

- Building Client-Facing Digital Products: Working on consumer and institutional platforms like Marcus by Goldman Sachs (digital consumer banking) or Marquee (a digital storefront providing clients with access to GS's proprietary data, analytics, and execution services).

- Ensuring Regulatory Compliance: Designing and implementing software that ensures the firm adheres to a complex web of global financial regulations, automating reporting and monitoring for authorities like the SEC and FINRA.

- Modernizing Core Infrastructure: Migrating legacy systems to the cloud (AWS, GCP), building out robust data pipelines, and enhancing cybersecurity defenses to protect the firm's assets and reputation.

### A Day in the Life of a Goldman Sachs Software Engineer (Associate Level)

To make this more concrete, let's imagine a typical day for "Alex," an Associate-level engineer working on the Marquee platform in the New York office.

- 8:30 AM: Alex arrives, grabs coffee, and reviews overnight system health dashboards and any alerts from the European and Asian trading sessions.

- 9:00 AM: The team's daily stand-up meeting. Alex gives a quick update on their current project: developing a new API endpoint that will allow institutional clients to access real-time risk analytics for their options portfolios.

- 9:15 AM: "Heads-down" coding session. Alex implements the business logic for the new API in Java, writing clean, well-documented code and paying close attention to performance and security protocols.

- 11:00 AM: Code review. Alex reviews a pull request from a junior analyst on the team, providing constructive feedback on their implementation of a data caching layer to improve API response times.

- 12:00 PM: Meeting with a quantitative strategist and a product manager. They discuss the mathematical model behind the risk calculation for the new API, ensuring Alex's code correctly implements the financial logic. This direct collaboration with the "business side" is a daily reality.

- 1:00 PM: Lunch with the team.

- 2:00 PM: Writing unit and integration tests for the new API. At Goldman Sachs, testing is non-negotiable. The cost of a bug in a production financial system can be astronomical.

- 4:00 PM: Attends a "Tech Talk" presented by a senior Vice President on using machine learning to detect anomalous trading patterns. Continuous learning is a core part of the culture.

- 5:00 PM: Alex deploys their tested code to a staging environment and runs a final battery of tests before scheduling it for the next production release window. They check in their code, update the project ticket, and plan their tasks for the next day.

- 5:30 PM: Alex wraps up for the day, often with a sense of accomplishment from having solved a tangible, high-impact problem.

This blend of deep technical work, cross-functional collaboration, and direct business impact is what defines the role and justifies the premium compensation associated with it.

Goldman Sachs Software Engineer Salary: A Deep Dive

The compensation for a Goldman Sachs software engineer is highly competitive and structured to attract and retain top talent from both technology and finance. It's crucial to understand that "salary" is just one part of the equation. Total Compensation (TC) is the key metric, which is a combination of base salary, an annual performance-based bonus, and sometimes stock awards.

For the most accurate, up-to-date figures, we reference data from industry-leading salary aggregators like Levels.fyi, which provides crowd-sourced, verified compensation data from professionals within these companies, as well as Glassdoor and Payscale. It is important to note that these figures are estimates and can fluctuate based on market conditions, firm performance, and individual performance.

### Compensation Structure by Career Level

Goldman Sachs, like most large corporations, structures its roles and compensation in distinct levels or tiers. In the Engineering division, these levels typically follow the firm-wide hierarchy.

- Analyst (Entry-Level): This is the designation for new graduates or those with 0-3 years of experience. They focus on learning the systems, contributing to well-defined projects, and mastering the firm's development practices.

- Associate (Mid-Level): After 2-4 years, an Analyst is typically promoted to Associate. Associates take on more ownership, lead smaller features or components, and begin to mentor Analysts.

- Vice President (VP - Senior/Lead): This is a senior technical or team lead position, typically for engineers with 5-10+ years of experience. VPs are responsible for the architecture and delivery of major projects, leading teams, and interfacing with senior business stakeholders. This is a pivotal, long-term career level for many.

- Managing Director (MD - Leadership): This is a senior leadership role, equivalent to a Director or Principal Engineer at a tech company. MDs are responsible for entire technology platforms, large organizations, and setting technical strategy for a business line. Compensation at this level is highly variable and performance-driven.

Here is a breakdown of the typical Total Compensation ranges for software engineers at Goldman Sachs in a high-cost-of-living area like New York City, based on 2023-2024 data.

| Level | Typical Years of Experience | Base Salary Range | Annual Bonus Range | Estimated Total Compensation (TC) |

| :--- | :--- | :--- | :--- | :--- |

| Analyst | 0 - 3 | $110,000 - $150,000 | $20,000 - $50,000 | $130,000 - $200,000 |

| Associate | 3 - 6 | $150,000 - $200,000 | $40,000 - $100,000+ | $190,000 - $300,000+ |

| Vice President (VP) | 6 - 12+ | $200,000 - $275,000 | $80,000 - $250,000+ | $280,000 - $525,000+ |

| Managing Director (MD) | 12+ | $300,000 - $500,000+ | Highly Variable ($200k - $1M+) | $500,000 - $1,500,000+ |

*Sources: Levels.fyi, Glassdoor, industry reports (2023-2024 data for NYC/Jersey City locations). Figures are estimates and can vary significantly.*

### Deconstructing the Compensation Package

Understanding the components is key to appreciating the full earning potential.

1. Base Salary: This is the fixed, reliable portion of your paycheck. It is competitive with top tech firms and provides a high degree of financial stability. As you can see from the table, the base salary grows steadily with each promotion.

2. Annual Bonus: This is the most significant differentiator between finance and traditional tech compensation. The bonus is highly variable and is determined by three main factors:

- Firm Performance: How well Goldman Sachs did as a whole during the year. In a bull market with high profits, the bonus pool is larger for everyone.

- Division/Team Performance: How your specific business unit and team performed against its goals.

- Individual Performance: Your personal contribution, impact, and annual performance review. High-performers can receive bonuses that are 50-100% (or more) of their base salary, especially at the VP and MD levels. This direct link between performance and reward is a hallmark of Wall Street culture.

3. Stock & Other Incentives: While historically the bonus was all cash, in recent years, a portion of the bonus for more senior employees (typically VP and above) may be paid in Restricted Stock Units (RSUs). This helps with long-term retention. Unlike FAANG companies where stock can be the largest component of compensation, at Goldman, the cash bonus often remains the dominant variable component.

4. Benefits & Perks: Beyond direct compensation, Goldman Sachs offers a world-class benefits package that represents significant value. This includes:

- Retirement Savings: A robust 401(k) plan with a generous company match.

- Healthcare: Comprehensive medical, dental, and vision insurance for employees and their families.

- Wellness Programs: On-site fitness centers (in some locations), mental health resources, and wellness stipends.

- Parental Leave: Generous leave policies for new parents.

- Other Perks: Commuter benefits, employee discounts, and access to firm-sponsored events and networks.

This comprehensive and performance-driven compensation structure is designed to attract individuals who are motivated by high stakes and high rewards, creating a powerful incentive to deliver exceptional results.

Key Factors That Influence a Goldman Sachs Software Engineer Salary

While the level (Analyst, Associate, VP) is the primary determinant of your salary band, several other factors create significant variance within those bands. Mastering these levers can add tens or even hundreds of thousands of dollars to your earnings over the course of your career. As a career analyst, I advise clients to think of their career as a portfolio of skills and attributes; strengthening each one increases its overall value.

### ### Level of Education

Your educational background is the foundation upon which your career is built.

- Bachelor's Degree (BS): A Bachelor of Science in Computer Science, Computer Engineering, or a related STEM field (like Mathematics or Physics with a strong programming component) is the standard entry requirement. Top-tier universities with strong engineering programs are heavily recruited, but exceptional candidates from any accredited university can succeed. For an entry-level Analyst role, the specific university is less important than demonstrated skill in data structures, algorithms, and programming projects.

- Master's Degree (MS): A Master's degree in Computer Science or a specialized field can provide a competitive edge. It may allow a candidate to enter at a higher salary point within the Analyst band or, with relevant prior experience, even be considered for an Associate role. A Master's in a niche, high-demand area like Machine Learning, Cybersecurity, or Quantitative Finance is particularly valuable.

- Ph.D.: A doctorate is typically sought for highly specialized roles, particularly within the Quantitative Strategist ("Strats") groups. Strats are a hybrid of researcher, quantitative analyst, and software engineer. A Ph.D. in Physics, Applied Mathematics, or Computer Science (specializing in an area like ML or distributed systems) can lead directly to these elite, highly compensated roles that often start at the Associate or even VP level, with compensation packages to match.

- Certifications: While a degree is paramount, professional certifications can demonstrate specific expertise. A certification like AWS Certified Solutions Architect or Certified Information Systems Security Professional (CISSP) won't replace a degree but can bolster a resume, especially for roles in cloud engineering or cybersecurity, potentially leading to a higher offer within your salary band.

### ### Years of Experience

This is the most straightforward factor impacting salary. Compensation grows in distinct steps as you progress through the firm's hierarchy.

- Entry-Level (Analyst, 0-3 Years): At this stage, your salary reflects your potential. Compensation is focused on a strong base salary to attract top graduate talent. The goal is to learn and prove your capabilities. Total Compensation: $130,000 - $200,000.

- Mid-Career (Associate, 3-6 Years): This is where compensation begins to accelerate significantly. As an Associate, you have proven your value and are now a reliable, independent contributor. Your bonus becomes a much larger and more variable portion of your TC, directly reflecting your increased impact on projects and team success. Total Compensation: $190,000 - $300,000+.

- Senior/Lead (Vice President, 6-12+ Years): Becoming a VP is a major career milestone. At this level, you are not just an engineer; you are a technical leader. Your compensation structure shifts to heavily reward leadership, project delivery, and business impact. The bonus potential is substantial, and this is where top performers truly begin to separate themselves, with TC regularly exceeding $400,000 or $500,000. Total Compensation: $280,000 - $525,000+.

- Leadership (Managing Director, 12+ Years): An MD's compensation is almost entirely performance-based. They are judged on the overall success and profitability of their entire division or platform. The base salary is high, but it is dwarfed by a bonus that is tied directly to the P&L (Profit and Loss) of their business area. Total Compensation: $500,000 - $1,500,000+.

### ### Geographic Location

Goldman Sachs is a global firm, and compensation is adjusted based on the cost of living and local market rates for talent. This is a critical factor.

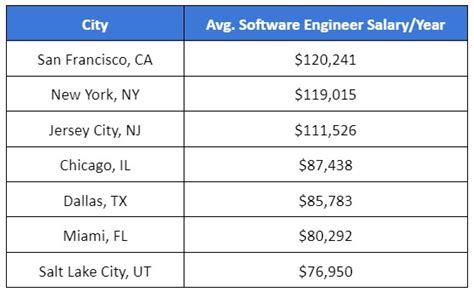

- Tier 1: High Cost of Living (HCOL) Hubs (e.g., New York City, Jersey City, London): These are the firm's primary financial centers and command the highest salaries. The figures presented in the deep dive table are representative of these locations. The intense competition for talent from other banks and tech firms drives compensation to its peak.

- Tier 2: Major Tech Hubs (e.g., Dallas, Salt Lake City): Goldman Sachs has been strategically growing its presence in these "high-value" locations. While the absolute base salary and bonus figures may be 10-20% lower than in NYC, the significantly lower cost of living means the effective purchasing power can be comparable or even higher. For example, a $300,000 TC in Dallas may provide a better quality of life than a $350,000 TC in Manhattan.

- Tier 3: Global Centers (e.g., Bengaluru, Warsaw): These locations are crucial to the firm's global technology strategy. Compensation is highly competitive for the local market but will be different in absolute U.S. dollar terms compared to U.S. locations. However, engineers in these offices work on the same critical global systems and have significant career growth potential within the firm.

### ### Company Type & Size (A Comparative Analysis)

To truly understand the Goldman Sachs software engineer salary, it's useful to compare it to other potential employers.

| Employer Type | Typical Compensation Structure | Culture & Environment |

| :--- | :--- | :--- |

| Goldman Sachs (Investment Bank) | High Base Salary + Very High, Variable Cash Bonus | High-pressure, results-driven, formal, deep integration with finance. Work is tied directly to markets and P&L. |

| FAANG (e.g., Google, Meta) | High Base Salary + High, Predictable Stock (RSU) Grants + Modest Cash Bonus | Tech-first, engineering-led, often more relaxed culture. Focus on product development for billions of users. |

| Fintech Unicorn (e.g., Stripe, Brex) | Competitive Base Salary + High-Growth Stock Options (High Risk/Reward) | Fast-paced, high-ownership, less structured. Success is tied to the startup's growth trajectory. |

| Traditional Corporation (Non-Tech) | Moderate Base Salary + Small Bonus | Slower-paced, better work-life balance, technology is often a cost center rather than a core business driver. |

An engineer choosing Goldman Sachs is often optimizing for high cash compensation and the unique challenge of solving financial problems, whereas an engineer choosing Google may be optimizing for stock growth and a more product-focused, tech-centric culture.

### ### Area of Specialization

Not all software engineering roles at Goldman Sachs are created equal in terms of compensation. Your specialization within the firm can have a massive impact.

- Quantitative Strategists ("Strats"): This is arguably the most lucrative engineering role. Strats work on the front lines with traders to develop pricing models, trading algorithms, and risk management strategies. These roles often require advanced degrees (Master's or PhD) and a deep understanding of mathematics and financial products. Their compensation is directly tied to the profitability of the trading desks they support, leading to some of the highest bonuses in the firm.

- Low-Latency/High-Frequency Trading (HFT) Engineers: These engineers, often using C++, work on the absolute cutting edge of performance. They build the infrastructure where every microsecond of latency can mean millions of dollars. This is a highly specialized and highly compensated field.

- Cybersecurity Engineers: With financial institutions being a prime target for cyberattacks, top-tier cybersecurity talent is in extremely high demand. Engineers who specialize in threat detection, penetration testing, and secure infrastructure design command a premium salary.

- Cloud & Platform Engineers: As Goldman continues its migration to the public cloud and builds out its own internal developer platforms, engineers with deep expertise in AWS, GCP, Kubernetes, and large-scale distributed systems are critical and well-compensated.

- Client-Facing Application Engineers (e.g., Marcus): Engineers building products for external clients have a direct impact on revenue and customer satisfaction. While perhaps not as high-paying as Strats, these roles are crucial and offer competitive salaries combined with the satisfaction of building tangible products.

### ### In-Demand Skills

Beyond your title, a specific set of high-value skills will make you a more attractive candidate and a higher-performing employee, leading directly to better compensation.

- Core Programming Languages: Fluency in Java is essential, as it's the workhorse for many of the firm's large-scale backend systems. Python is critical for data analysis, scripting, and machine learning, particularly in Strats and data science roles. C++ is the language of choice for performance-critical applications like HFT.

- Data Structures & Algorithms: This is the non-negotiable price of entry. A deep, practical understanding of hashmaps, trees, graphs, sorting algorithms, and complexity analysis is required to pass the rigorous technical interviews.

- Systems Design: For mid-level and senior roles, the ability to design scalable, resilient, and secure distributed systems is paramount. This involves understanding concepts like microservices, message queues, databases (SQL and NoSQL), caching, and API design.

- Financial Domain Knowledge: This is the great differentiator. An engineer who understands what an option, a swap, or a credit default risk is can communicate more effectively with business stakeholders and build better products. You are not expected to be an expert on day one, but demonstrating intellectual curiosity and a willingness to learn the business is key to long-term success and higher pay.

- Cloud Technologies: Expertise in a major cloud provider, especially Amazon Web Services (AWS), is increasingly vital. Knowledge of services like EC2, S3, RDS, and Lambda is highly valuable.

- Database and Big Data Technologies: Experience with both relational databases (SQL) and modern data technologies like Spark, Kafka, and NoSQL databases is essential for handling the immense volumes of data the firm processes daily.

By strategically developing these factors, an engineer can navigate their career at Goldman Sachs from a strong starting salary to a truly exceptional level of total compensation.

Job Outlook and Career Growth

When considering a long-term career path, salary is only one part of the picture. The stability and growth potential of the profession are equally important. For software engineers, particularly those in the dynamic fintech sector, the future is exceptionally bright.

### ### Strong Projected Growth

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative data on job outlooks. In its latest Occupational Outlook Handbook, the BLS projects that employment for Software Developers, Quality Assurance Analysts, and Testers is