For ambitious individuals with a passion for financial markets and a talent for deep, analytical thinking, a career as a hedge fund analyst represents one of the most challenging and financially rewarding paths in the world of finance. But what does that compensation truly look like? While the allure of seven-figure paydays is well-known, understanding the components and drivers of that salary is key.

An entry-level analyst can expect a total compensation package starting between $150,000 and $300,000, while experienced senior analysts at top-performing funds can earn well over $1,000,000 annually. This guide will break down the role, salary expectations, and the key factors that determine your earning potential in this elite field.

What Does a Hedge Fund Analyst Do?

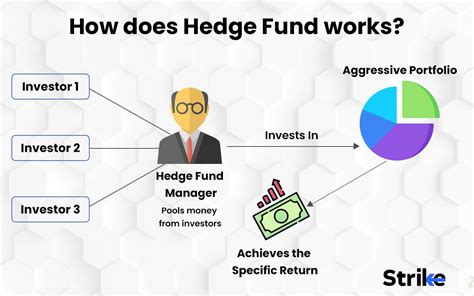

A hedge fund analyst is the intellectual engine of an investment fund. Their primary responsibility is to generate and research investment ideas that will produce high returns for the fund's investors. This is a demanding, high-stakes role that requires a unique blend of quantitative skill, qualitative judgment, and relentless curiosity.

Key responsibilities include:

- Financial Modeling and Valuation: Building complex financial models to forecast a company's future performance and determine its intrinsic value.

- In-depth Research (Due Diligence): Going beyond financial statements to understand a company's competitive advantages, management quality, industry trends, and potential risks. This can involve speaking with industry experts, customers, and even competitors.

- Generating Investment Theses: Synthesizing research into a coherent and persuasive investment idea (e.g., "buy this stock because the market misunderstands its growth potential," or "short this stock because its technology is obsolete").

- Portfolio Monitoring: Continuously tracking existing investments in the fund's portfolio and updating the investment thesis as new information becomes available.

- Communicating with Portfolio Managers: Pitching and defending investment ideas to the Portfolio Manager, who makes the final decision on buying or selling securities.

Average Hedge Fund Analyst Salary

Compensation in the hedge fund industry is famously structured around two components: a base salary and a performance-based bonus. The bonus is the most significant part of the total compensation and is directly tied to both individual and fund performance.

Here is a typical breakdown based on experience, synthesizing data from sources like Salary.com, Glassdoor, and specialized industry reports from firms like Page Executive.

- Entry-Level Analyst (0-3 Years): Typically hired after a 2-year program in investment banking or equity research.

- Base Salary: $110,000 - $175,000

- Bonus: 50% - 100% of base salary

- All-In Total Compensation: $170,000 - $350,000

- Mid-Level Analyst (3-5 Years): These professionals have a proven track record and take on more responsibility for idea generation.

- Base Salary: $175,000 - $250,000

- Bonus: 100% - 200%+ of base salary

- All-In Total Compensation: $350,000 - $750,000+

- Senior Analyst (5+ Years): A highly experienced analyst whose ideas significantly influence the fund's portfolio. Their compensation becomes heavily linked to the fund's profitability (P&L).

- Base Salary: $250,000 - $350,000+

- Bonus: Can be a multiple of base salary, often reaching into the high six-figures or millions in a good year.

- All-In Total Compensation: $750,000 - $2,000,000+

*Note: These figures can fluctuate significantly based on the factors discussed below.*

Key Factors That Influence Salary

Your compensation as a hedge fund analyst is not a single number but a variable dependent on several critical factors.

### Level of Education

While there is no single required degree, a strong educational background from a top-tier university is a common prerequisite.

- Undergraduate Degree: A bachelor's degree in a quantitative field like Finance, Economics, Statistics, or Computer Science from a "target school" (e.g., Ivy League, MIT, Stanford, UChicago) is the most common entry point. A high GPA (3.7+) is essential.

- Advanced Degrees: A Master of Business Administration (MBA) from a top program (e.g., Harvard, Wharton, Stanford) can be a pathway for career changers or for accelerating a move into a senior analyst role. For quantitative funds, a Ph.D. or Master's in a STEM field like Mathematics, Physics, or Computer Science is often required and commands a significant salary premium.

### Years of Experience

Experience is paramount. The traditional path involves gaining 2-3 years of intense analytical training in investment banking or private equity before moving to a hedge fund.

- Pre-MBA (Junior Analyst): At this stage, you are honing your modeling and research skills. Your bonus is significant but more standardized.

- Post-MBA (Mid-Level Analyst): You are expected to be a self-sufficient idea generator. Your compensation becomes more directly tied to the success of your investment recommendations.

- Senior Analyst: With deep industry expertise, you are a core part of the investment team. Your bonus is heavily tied to the fund's overall performance and your direct contribution to it, leading to exponential earning potential.

### Geographic Location

Where the fund is located plays a major role due to the concentration of talent, capital, and market activity. According to data from Glassdoor and Salary.com, compensation is highest in major financial hubs.

- New York, NY: The undisputed global center for hedge funds, commanding the highest salaries.

- Greenwich, CT & Stamford, CT: A major suburban hub for large, established hedge funds.

- Other Key Hubs: London, Hong Kong, San Francisco, and Chicago also offer competitive compensation packages, though often slightly below New York levels.

### Company Type

Not all hedge funds are created equal. The size and, most importantly, the performance of the fund are the ultimate determinants of pay.

- Assets Under Management (AUM): Larger funds (e.g., "mega-funds" with $10B+ in AUM) generally have larger compensation pools and can offer higher and more stable base salaries and bonuses.

- Fund Performance: This is the single most important factor. Hedge funds typically operate on a "2 and 20" fee structure (a 2% management fee on assets and a 20% performance fee on profits). The performance fee pool is what funds massive bonuses. A fund that has a phenomenal year will pay its analysts multiples of what a fund that had a flat or down year can afford.

### Area of Specialization

The fund's investment strategy dictates the skills required and, consequently, the pay.

- Long/Short Equity: The most common strategy, focused on stock picking.

- Global Macro: Focuses on large-scale economic trends, interest rates, and currency movements.

- Quantitative ("Quant"): Employs complex mathematical and statistical models to make investment decisions. Analysts with PhDs in hard sciences are highly sought after here and command some of the highest salaries in the industry.

- Credit & Distressed Debt: Focuses on corporate debt and companies undergoing bankruptcy or restructuring, requiring deep legal and financial expertise.

- Event-Driven: Centers on specific corporate events like mergers, acquisitions, or spinoffs.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track hedge fund analysts specifically but includes them in the broader category of "Financial and Investment Analysts." For this group, the BLS projects job growth of 8% from 2022 to 2032, which is much faster than the average for all occupations.

However, it is crucial to understand that the number of hedge fund analyst positions is extremely small and competition is extraordinarily intense. While the overall demand for financial analysis is growing, securing a seat at a top hedge fund remains one of the most competitive career goals in the world.

Conclusion

A career as a hedge fund analyst offers unparalleled intellectual challenges and some of the highest earning potential in the professional world. While the headline salary figures are impressive, it's vital to remember that compensation is anything but guaranteed.

Your earnings will be a direct reflection of:

- Performance: Your ability to generate profitable ideas for the fund.

- Experience: The depth of your analytical skills and industry knowledge.

- Pedigree: The strength of your educational and professional background.

For those with the intellectual horsepower, relentless work ethic, and unwavering passion for the markets, a career as a hedge fund analyst is one of the most financially and intellectually rewarding paths available.