A career as a hedge fund analyst is one of the most sought-after, challenging, and financially rewarding paths in the modern financial industry. Known for its high-stakes environment and intellectual rigor, this role offers unparalleled earning potential. While entry-level base salaries often start well into the six figures, the real story lies in the performance-based bonuses, which can push total compensation packages to astounding levels, often ranging from $250,000 to over $500,000 even within the first few years.

If you're considering this demanding career, understanding the compensation structure is crucial. This guide will break down what a hedge fund analyst earns, the key factors that dictate your salary, and what the future holds for this elite profession.

What Does a Hedge Fund Analyst Do?

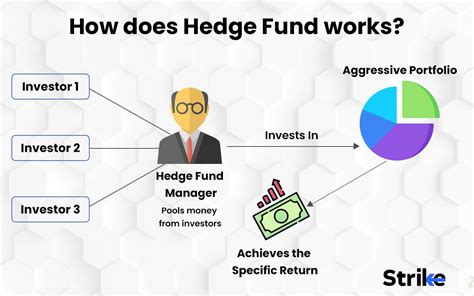

Before diving into the numbers, it's essential to understand the role. A hedge fund analyst is the engine of the investment process. Their primary job is to conduct deep, exhaustive research to identify investment opportunities that will generate "alpha," or returns that outperform the market.

Core responsibilities include:

- Financial Modeling: Building complex models to forecast a company's future performance and determine its valuation.

- Due Diligence: Performing in-depth research on companies, industries, and macroeconomic trends. This includes reading financial reports, speaking with industry experts, and meeting with company management.

- Generating Investment Theses: Synthesizing research into a compelling "buy" or "sell" recommendation (a pitch) to be presented to the Portfolio Manager.

- Portfolio Monitoring: Continuously tracking existing investments and market conditions to react to new information.

The hours are long and the pressure is intense, but the work is incredibly dynamic and intellectually stimulating.

Average Hedge Fund Analyst Salary

The compensation for a hedge fund analyst is famously composed of two main parts: a base salary and a performance bonus. The bonus is the variable and most significant component, directly tied to both individual and fund performance.

According to data from Salary.com, the median base salary for a Hedge Fund Analyst in the United States is approximately $116,300 as of early 2024. However, this figure only tells a fraction of the story.

When including bonuses and other incentives, the numbers climb dramatically. Glassdoor reports a likely total pay range of $150,000 to $350,000 per year, with an average total compensation of around $215,000.

Here’s a typical breakdown by experience level (Total Compensation):

- Entry-Level Analyst (0-2 years): $150,000 - $300,000

- Mid-Level Analyst (3-5 years): $300,000 - $700,000+

- Senior Analyst / Junior Portfolio Manager (5+ years): $500,000 - $2,000,000+

It's clear that while the base salary is competitive, the bonus structure creates the potential for exponential income growth based on successful performance.

Key Factors That Influence Salary

Your specific salary as a hedge fund analyst isn't set in stone. It is influenced by a combination of critical factors.

### Level of Education

A bachelor's degree in Finance, Economics, Accounting, or a related quantitative field is the minimum requirement. However, the prestige of your institution matters significantly. Graduates from "target schools" (e.g., Ivy League universities, Stanford, MIT, University of Chicago) often command higher starting salaries due to their rigorous academic programs, elite alumni networks, and direct recruitment pipelines to top funds.

An advanced degree, such as an MBA from a top-tier business school or a Master's in Financial Engineering (MFE), can significantly increase earning potential and open doors to more senior roles or specialized quantitative funds.

### Years of Experience

Experience is arguably the single most important factor in compensation growth. As analysts prove their ability to generate profitable ideas, their value to the fund—and their bonus potential—skyrockets.

- Pre-MBA Analyst (0-3 years): Focuses on building models and conducting primary research. Bonuses are substantial but smaller than senior roles.

- Post-MBA / Senior Analyst (3-7 years): Gains more autonomy, manages larger and more complex research projects, and has a stronger voice in investment decisions. Bonuses can easily exceed base salary several times over.

- Portfolio Manager (PM): After many successful years, an analyst may be promoted to Portfolio Manager, where they are responsible for the overall investment strategy and P&L (Profit and Loss). At this level, compensation is directly tied to the fund's performance and can run into the millions or tens of millions of dollars.

### Geographic Location

Finance is a geographically concentrated industry. Salaries for hedge fund analysts are highest in major financial hubs where the majority of funds are based. The competition for talent in these cities drives compensation upward.

Top-paying locations in the U.S. include:

- New York, NY: The undisputed center of the hedge fund world.

- Greenwich & Stamford, CT: A major hub for many large, established funds.

- Boston, MA: A strong center for asset management and numerous hedge funds.

- Chicago, IL: A key hub, particularly for quantitative and derivatives trading.

- San Francisco, CA: A growing hub, especially for funds specializing in technology.

Salaries in these cities are often 15-30% higher than in other parts of the country to account for competition and a higher cost of living.

### Company Type

Not all hedge funds are created equal. The size, strategy, and performance of the fund are massive determinants of pay.

- Assets Under Management (AUM): A large, multi-billion-dollar "mega-fund" (e.g., Citadel, Bridgewater, Millennium) has a much larger capital and revenue base to pay its analysts than a small, start-up fund with under $500 million in AUM.

- Fund Performance: Most funds operate on a "2 and 20" fee structure (a 2% management fee on assets and a 20% performance fee on profits). In a good year, the performance fee pool is massive, leading to enormous bonuses. In a down year, bonuses can be significantly smaller or even non-existent.

- Fund Strategy: Specialized funds may pay a premium for specific expertise. For example, quantitative (or "quant") funds that rely on complex algorithms and high-frequency trading heavily recruit analysts with advanced degrees in computer science, mathematics, and physics, and often pay a premium for these skills.

### Area of Specialization

The industry or sector you cover can also impact your value. Analysts with deep, specialized knowledge in high-growth or complex sectors are extremely valuable. In-demand specializations currently include:

- Technology, Media, and Telecom (TMT)

- Healthcare and Biotechnology

- Energy and Renewables

- Distressed Debt and Special Situations

Expertise in these areas can make you a more attractive candidate and lead to higher compensation offers.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Hedge Fund Analyst" as a distinct profession. However, it provides data for the broader category of "Financial and Investment Analysts."

The BLS projects that employment for this group will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by the increasing complexity of financial products and the need for in-depth analysis.

While the overall field is growing, it is crucial to understand that competition for top-tier hedge fund roles is exceptionally fierce. These positions represent a small and elite fraction of the total financial analyst jobs available. The industry is also cyclical; hiring can expand rapidly during bull markets and contract during economic downturns.

Conclusion

A career as a hedge fund analyst offers one of the most compelling compensation packages in any industry. While the journey is demanding, requiring elite academic credentials, an intense work ethic, and superior analytical skills, the rewards are commensurate with the challenges.

For prospective professionals, the key takeaways are:

- Total compensation is king: Look beyond the base salary to the performance bonus, which is the primary driver of earnings.

- Performance pays: Your ability to generate profitable ideas directly impacts your income.

- Experience, prestige, and location matter: Your background, where you work, and the type of fund you work for will significantly shape your career and earning trajectory.

For those with a deep passion for the markets and the drive to succeed at the highest level, the path of a hedge fund analyst remains an unparalleled opportunity for both intellectual and financial fulfillment.