The glittering skyline of Manhattan isn't just a collection of buildings; it's a global symbol of ambition, power, and wealth. At the heart of this financial ecosystem lies the world of investment banking—a profession legendary for its grueling hours, high-stakes deals, and, most famously, its extraordinary compensation. For aspiring financiers, landing a job at a Wall Street bank is the pinnacle of achievement, a direct entry into a world where multi-million-dollar deals are commonplace and the rewards for success are astronomical. But what does it truly take to get there, and what is the reality behind the coveted investment banker salary in New York?

This guide is designed to be your definitive resource, cutting through the mystique to provide a data-driven, comprehensive look at this demanding yet potentially lucrative career path. We will dissect the compensation structures, explore the factors that can multiply your earnings, and lay out the strategic roadmap you need to follow to break into this exclusive industry. The figures are indeed staggering; it's not uncommon for a 22-year-old first-year analyst in New York City to earn an all-in compensation package approaching a quarter of a million dollars. As experience grows, those numbers can quickly escalate into the seven-figure range.

As a career analyst, I once mentored a brilliant economics student who was agonizing over two job offers: a prestigious and stable role at a major tech company and a high-octane investment banking analyst position in New York. Watching them weigh the guaranteed work-life balance against the explosive career trajectory and compensation of banking drove home a critical point: understanding the full picture—the salary, the bonus, the lifestyle, and the "exit opportunities"—is paramount. This guide aims to provide you with that complete picture, empowering you to make an informed and strategic decision about your future.

### Table of Contents

- [What Does an Investment Banker in New York Do?](#what-they-do)

- [Average Investment Banker Salary New York: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence an Investment Banker's Salary](#key-factors)

- [Job Outlook and Career Growth for Investment Bankers](#job-outlook)

- [How to Become an Investment Banker in New York](#how-to-start)

- [Conclusion: Is a New York Investment Banking Career Right for You?](#conclusion)

What Does an Investment Banker in New York Do?

Before we dive into the numbers, it's crucial to understand what an investment banker actually *does*. The role is far more than just "working in finance." At its core, investment banking is a specialized advisory service for corporations, governments, and other large institutions. Bankers act as financial intermediaries, helping their clients grow and manage their capital.

The functions of an investment bank are typically split into two main areas:

1. Capital Raising (Underwriting): When a company wants to raise money, it often turns to an investment bank. This can take several forms:

- Initial Public Offering (IPO): A bank guides a private company through the complex process of selling shares to the public for the first time, helping them with valuation, regulatory filings (like the S-1), and marketing the shares to institutional investors.

- Debt Issuance: A bank helps a company or government issue bonds or other debt instruments to raise funds for projects, operations, or refinancing existing debt.

2. Advisory Services (Mergers & Acquisitions - M&A): This is perhaps the most well-known aspect of investment banking.

- Sell-Side M&A: A company hires a bank to help them find a buyer and manage the sale process to achieve the highest possible price and best terms.

- Buy-Side M&A: A company hires a bank to help them identify and acquire another company, conducting due diligence and structuring the deal.

Junior investment bankers, primarily Analysts (undergraduates) and Associates (post-MBAs), are the engine room of the bank. They are responsible for the analytical work that underpins every deal and client pitch.

Typical Daily Tasks and Projects Include:

- Financial Modeling: Building complex financial models in Microsoft Excel to forecast a company's performance, value a business (using methods like Discounted Cash Flow or DCF), or analyze the impact of a potential merger (M&A model) or leveraged buyout (LBO model).

- Valuation Analysis: Performing detailed valuations using various methodologies, including Comparable Company Analysis ("Comps"), Precedent Transaction Analysis, and DCF analysis.

- Creating Pitch Books: Developing extensive presentations in Microsoft PowerPoint that the senior bankers use to pitch ideas to current or potential clients. These "decks" can be hundreds of pages long and require meticulous attention to detail.

- Due Diligence: Investigating every aspect of a company involved in a transaction—its financials, customers, contracts, and market position—to identify potential risks and liabilities.

- Administrative and Process Management: Tracking potential buyers, managing data rooms (secure online repositories of documents), and coordinating with lawyers, accountants, and the client.

### A "Day in the Life" of a First-Year Analyst in NYC

To make this tangible, here’s a realistic (and intense) look at a typical weekday for a junior banker working on a live deal:

- 9:00 AM: Arrive at the office in Midtown or the Financial District. Grab coffee and immediately check emails for overnight requests from your Vice President (VP) or from the client in a different time zone.

- 9:30 AM - 1:00 PM: Your VP has left comments on the valuation section of a pitch book due this evening. You spend the morning updating the financial model with new data, re-running the valuation outputs, and ensuring every number in the PowerPoint slides aligns perfectly with your Excel model.

- 1:00 PM - 2:00 PM: Lunch is ordered via a service like Seamless and eaten at your desk while you listen in on a deal team call with the client, taking notes on new action items.

- 2:00 PM - 7:00 PM: The "grind." You are tasked with creating a new analysis on potential synergistic savings in a merger. This requires deep research and building a new model from scratch. The deadline is tomorrow morning. You are in constant communication with your Associate to review your work.

- 7:00 PM - 8:30 PM: Dinner is ordered and expensed by the bank, again eaten at your desk. You might take a 20-minute break to catch up on news or chat with fellow analysts.

- 8:30 PM - 1:30 AM: Your VP sends their final feedback on the pitch book. You spend the next several hours making "turns"—implementing all the edits, which can range from minor formatting changes to re-doing entire analyses. You triple-check every page for typos, alignment issues, and numerical errors before sending the final version to the team.

- 1:30 AM: If you're lucky, you can expense a car service (like Uber or a black car) to take you home. You'll get a few hours of sleep before doing it all over again.

This grueling schedule is the trade-off for the exceptional compensation and career opportunities, which we will now explore in detail.

Average Investment Banker Salary New York: A Deep Dive

The compensation structure in investment banking is unique because the bonus component often equals or significantly exceeds the base salary, especially as one becomes more senior. New York City, as the undisputed capital of the US finance industry, commands the highest salaries in the nation for this profession.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Investment Banker." The closest analogues are "Financial Analysts" and "Securities, Commodities, and Financial Services Sales Agents." While the BLS reports a median pay of $96,220 per year for Financial Analysts nationally (as of May 2022), this figure is not representative of front-office investment banking roles in a major hub like NYC. It includes a much broader range of corporate finance and analyst roles across the country with different pay scales.

For a true picture, we must turn to industry-specific data aggregators and reports that survey bankers directly. Reputable sources like Wall Street Oasis (WSO), Glassdoor, and specialized compensation reports provide a much more accurate view.

### Investment Banking Compensation: Base Salary + Bonus

The total compensation, or "all-in comp," is a combination of a base salary and a year-end performance bonus.

- Base Salary: This is your predictable, fixed income paid bi-weekly or monthly. In recent years, intense competition for talent has driven base salaries for junior bankers significantly higher.

- Bonus: This is the variable, discretionary component paid out once a year (typically in January or February). It is determined by three main factors: your individual performance, the performance of your group (e.g., the Healthcare M&A group), and the overall performance of the bank.

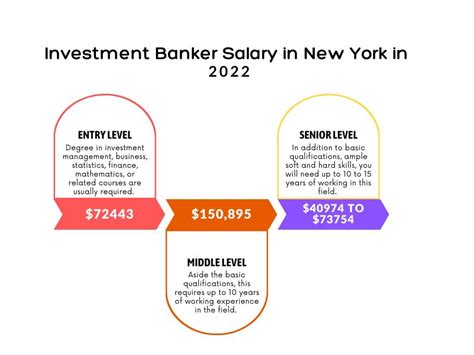

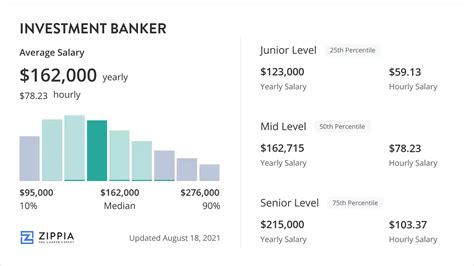

Here is a detailed breakdown of typical all-in compensation for investment bankers in New York City by seniority level.

#### New York City Investment Banking Compensation Brackets (2023-2024 Data)

| Level / Title | Years of Experience | Typical NYC Base Salary Range | Typical NYC Bonus Range | Typical NYC All-In Compensation |

| :--- | :--- | :--- | :--- | :--- |

| Analyst (1st Year) | 0 - 1 | $110,000 - $125,000 | $80,000 - $100,000 | $190,000 - $225,000 |

| Analyst (2nd Year) | 1 - 2 | $125,000 - $150,000 | $90,000 - $120,000 | $215,000 - $270,000 |

| Analyst (3rd Year) | 2 - 3 | $150,000 - $175,000 | $100,000 - $140,000 | $250,000 - $315,000 |

| Associate (1st Year) | 3 - 5 (Post-MBA) | $175,000 - $225,000 | $100,000 - $180,000 | $275,000 - $405,000 |

| Associate (3rd Year) | 5 - 7 | $225,000 - $250,000 | $150,000 - $250,000 | $375,000 - $500,000 |

| Vice President (VP) | 7 - 10 | $250,000 - $300,000 | $200,000 - $400,000+ | $450,000 - $700,000+ |

| Director / Principal | 10 - 15 | $300,000 - $400,000 | $400,000 - $800,000+ | $700,000 - $1,200,000+ |

| Managing Director (MD)| 15+ | $400,000 - $1,000,000+ | $500,000 - $5,000,000+ | $1,000,000 - $10,000,000+ |

*(Sources: Combined and triangulated data from Wall Street Oasis 2023 Compensation Report, Glassdoor, Salary.com, and recent industry reporting for 2024 projections. Ranges can vary significantly based on the factors discussed in the next section.)*

### Other Compensation Components and Benefits

Beyond the base and bonus, the total package is sweetened by several other valuable perks, particularly at the junior level.

- Signing Bonus: First-year Analysts and Associates almost always receive a one-time signing bonus upon accepting an offer. For Analysts, this is typically $10,000 - $15,000. For post-MBA Associates, it can be $50,000 - $75,000 or more to help cover school-related debt.

- Relocation Bonus: An additional bonus, often around $5,000 - $10,000, to assist with the high cost of moving to New York City.

- Stub Bonus: First-year analysts who start in the summer receive a pro-rated "stub" bonus after their first six months, with their first full bonus coming a year after that.

- Retirement Plans: Robust 401(k) plans with generous company matching policies.

- Health Insurance: Top-tier health, dental, and vision insurance plans with low premiums and deductibles.

- Lifestyle Perks: These are designed to make the long hours more bearable and are a significant, if non-cash, part of compensation. They include:

- A generous nightly meal stipend (e.g., $30-$40 per night).

- Free car service home (e.g., Uber or private car) for employees working past a certain hour (e.g., 9 or 10 PM).

- On-site gyms or subsidized gym memberships.

When all these components are considered, the total value of an entry-level offer is even higher than the "all-in" compensation figure suggests. This comprehensive and aggressive pay structure is designed to attract and retain the very top talent from universities around the world.

Key Factors That Influence an Investment Banker's Salary

While the table above provides a strong baseline, actual compensation can vary dramatically based on a number of critical factors. Two bankers with the same title at different firms or in different groups can have vastly different paydays. Understanding these nuances is key to maximizing your earning potential throughout your career.

### Level of Education

Education is the primary gatekeeper for entry into investment banking. The prestige of your institution and your academic performance directly impact your access to interviews and, consequently, your starting salary.

- Undergraduate Degree (The Analyst Path): Investment banks heavily recruit from a select list of "target schools." These include Ivy League universities (Harvard, Princeton, UPenn's Wharton School), as well as other elite institutions like MIT, Stanford, University of Chicago, Duke, and NYU's Stern School of Business. Graduating from one of these schools significantly increases your chances of landing a top-paying job at a bulge bracket or elite boutique firm. Students from "semi-target" or "non-target" schools can still break in, but it requires significantly more networking and a flawless academic record. A high GPA (typically 3.7+) is a non-negotiable screening criterion for most top banks.

- Master of Business Administration (MBA) (The Associate Path): The MBA is the primary entry point for career switchers or those looking to re-brand themselves into investment banking. Similar to undergrad, the school's prestige is paramount. A degree from a top-tier MBA program (e.g., Harvard Business School, Stanford GSB, Wharton, Columbia, Chicago Booth) is the standard requirement for entering an Associate program at a major bank. The salary jump is significant: a pre-MBA professional might earn $100,000, but post-MBA, their starting all-in compensation as a banking Associate can triple to over $300,000.

- Certifications and Licenses:

- FINRA Licenses: After you are hired, your firm will sponsor you to take a series of licensing exams administered by the Financial Industry Regulatory Authority (FINRA). These include the Securities Industry Essentials (SIE), Series 79 (for investment banking), and Series 63 (state securities law). These are a requirement for the job but do not directly increase your salary; they are simply a license to operate.

- Chartered Financial Analyst (CFA): The CFA designation is a highly respected, graduate-level credential in the investment management world. While less common and required in pure investment banking (which is more transaction-focused), it can be a valuable differentiator. It signals a deep commitment to financial analysis and can be particularly useful for roles in Equity Research or for bankers who later want to transition to the "buy-side" (e.g., asset management). It won't necessarily result in an immediate pay bump but strengthens your overall professional profile.

### Years of Experience and Career Trajectory

Investment banking has one of the most structured and rapid career progression tracks in the corporate world. Your title and compensation are directly tied to your years of experience, with significant pay increases at each promotion point.

- Analyst (Years 0-3): As detailed, this is the entry-level. You are the "grinder," focused on execution, modeling, and presentation-making. The promotion from Analyst 1 to Analyst 2, and then to Analyst 3, comes with a substantial base salary and bonus increase each year. High-performing analysts are often offered a direct promotion to the Associate level without needing an MBA.

- Associate (Years 3-7): Post-MBA hires and promoted Analysts enter at this level. The role shifts slightly from pure execution to project management. Associates manage the analysts, review their work, and begin to have more direct contact with clients. Their bonus becomes a larger percentage of their total compensation, reflecting their increased responsibility.

- Vice President (VP) (Years 7-10): A VP is the primary project manager and the main point of contact for the client on a day-to-day basis. They are responsible for the overall execution of a deal, guiding the junior team, and ensuring the senior bankers are prepared for important meetings. Compensation at this level becomes highly variable and performance-driven. A strong VP at a top firm in a good year can easily clear $700,000+.

- Director / Principal (Years 10-15): This is a senior role that bridges the gap between VPs and Managing Directors. Directors are developing their own client relationships and beginning to source business for the firm, though they are still involved in deal execution.

- Managing Director (MD) (15+ Years): This is the top of the pyramid. MDs are rainmakers. Their primary job is to leverage their network and reputation to originate deals and bring in revenue for the bank. Their compensation is almost entirely tied to the business they generate. Base salaries may be in the $400k-$600k range, but their bonus, which can be millions of dollars, is a direct reflection of their success.

### Geographic Location

While this guide focuses on New York, it's the benchmark against which all other