The title "Vice President" at a firm like J.P. Morgan Chase conjures images of immense responsibility, high-stakes decisions, and, of course, a substantial level of compensation. For ambitious professionals in the world of finance, reaching this milestone is a significant career achievement, a testament to years of dedication, analytical rigor, and relentless drive. But what does the journey to this role truly entail? And more pointedly, what is the reality behind the J.P. Morgan Vice President salary? Is the legendary compensation package worth the notoriously demanding lifestyle?

This guide is designed to be your definitive resource, pulling back the curtain on one of the most sought-after positions in global finance. We will move beyond mere numbers to provide a granular, 360-degree view of the VP role at J.P. Morgan. We'll dissect the complete compensation structure, explore the myriad factors that can dramatically influence your earnings, map out the career trajectory, and provide an actionable blueprint for aspiring VPs. The salary is undoubtedly a major draw, with total compensation packages often soaring deep into the six-figure range, frequently between $350,000 and $550,000+ annually.

I recall mentoring a young, brilliant Associate a few years back who was on the cusp of his VP promotion. The most significant shift wasn't just his impending pay rise, but the change in his perspective; he was transitioning from an executer of tasks to an owner of outcomes, a leader of teams, and a trusted advisor to clients. This guide aims to illuminate that complete picture—the role, the rewards, and the resolve required to succeed.

### Table of Contents

- [What Does a J.P. Morgan Vice President Actually Do?](#what-does-a-jp-morgan-vice-president-actually-do)

- [Average J.P. Morgan Vice President Salary: A Deep Dive](#average-jp-morgan-vice-president-salary-a-deep-dive)

- [Key Factors That Influence a VP's Salary](#key-factors-that-influence-a-vps-salary)

- [Job Outlook and Career Growth for a Finance VP](#job-outlook-and-career-growth-for-a-finance-vp)

- [How to Become a Vice President at J.P. Morgan](#how-to-become-a-vice-president-at-jp-morgan)

- [Is the J.P. Morgan VP Path Right for You?](#is-the-jp-morgan-vp-path-right-for-you)

What Does a J.P. Morgan Vice President Actually Do?

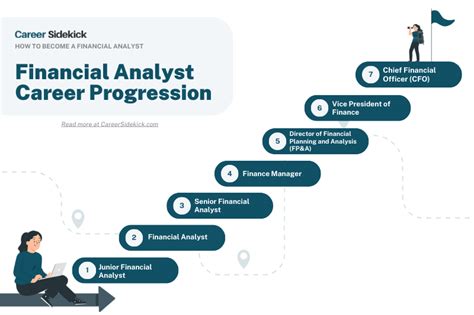

Before diving into the numbers, it's crucial to understand a key piece of Wall Street nomenclature: the title of "Vice President" in an investment bank is not equivalent to a VP role in a typical corporation. In the hierarchical structure of a firm like J.P. Morgan, the VP is a mid-level professional, not a senior executive. The typical investment banking career ladder looks like this:

1. Analyst (Typically 2-3 years, post-undergraduate)

2. Associate (Typically 3-4 years, post-MBA or promoted from Analyst)

3. Vice President (VP) (Typically 3-4 years, promoted from Associate)

4. Executive Director (ED) / Senior Vice President (SVP)

5. Managing Director (MD)

A Vice President at J.P. Morgan is therefore a seasoned professional who has successfully navigated the demanding Analyst and Associate years. They are the engine of deal execution and the primary day-to-day project manager. Their role is a critical bridge between the junior team (Analysts and Associates) who perform the granular modeling and research, and the senior bankers (EDs and MDs) who focus on originating deals and managing high-level client relationships.

Core Responsibilities Include:

- Project and Deal Management: The VP is the quarterback for live transactions, whether it's a merger and acquisition (M&A) deal, an initial public offering (IPO), or a debt financing. They are responsible for ensuring every stage of the deal process runs smoothly, from due diligence to closing.

- Client Interaction: While MDs own the primary client relationship, VPs have significant client contact. They are often the main point of communication for day-to-day matters, presenting analyses, and walking clients through financial models and deal structures.

- Mentorship and Team Leadership: A huge part of the VP's role is managing and training the Associates and Analysts on their deal teams. They review financial models, check pitch books for accuracy and narrative flow, and are responsible for the professional development of their junior bankers.

- Financial Modeling and Valuation Oversight: While they may not build complex models from scratch as frequently as an Analyst, they must have absolute mastery of them. They direct the modeling process and are ultimately responsible for the integrity and accuracy of the valuation analyses (e.g., Discounted Cash Flow (DCF), LBO models, comparable company analysis).

- Marketing and Pitching: VPs play a significant role in creating the "pitch books" used to win new business. They help shape the narrative, refine the analysis, and often participate in the presentations to prospective clients.

### A "Day in the Life" of a J.P. Morgan Investment Banking VP

- 7:00 AM: Wake up, immediately check emails and market news (Bloomberg, Wall Street Journal) for any overnight developments affecting active deals or clients.

- 8:30 AM: Arrive at the office. Huddle with the deal team (Associates and Analysts) to set the priorities for the day. Review the junior team's overnight work on an LBO model for a potential private equity buyout.

- 10:00 AM: Join a conference call with a client's CFO and legal counsel to discuss the timeline and key workstreams for an upcoming IPO. The VP leads most of the discussion, fielding detailed questions on valuation and market timing.

- 12:30 PM: Grab a quick lunch at their desk while reviewing a draft of a Confidential Information Memorandum (CIM) for a sell-side M&A project.

- 2:00 PM: The Managing Director on the deal pulls the VP into their office for a strategy session. They discuss negotiation tactics and potential buyers for the sell-side mandate.

- 4:00 PM: Spend two hours working directly with an Associate to refine a complex merger model. The VP's role here is to pressure-test assumptions and ensure the output is defensible and tells a compelling story.

- 6:30 PM: Participate in an internal committee meeting to get a new deal approved. The VP presents the financial overview and rationale for the transaction.

- 8:00 PM: The "second shift" begins. The VP reviews the latest turn of a pitch book for a meeting the next morning, providing detailed comments and edits for the Analyst to incorporate.

- 10:00 PM (or later): Final check of emails and a last call with the junior team to ensure they are on track before heading home. This cycle can be even more intense during live deals.

Average J.P. Morgan Vice President Salary: A Deep Dive

The compensation for a J.P. Morgan Vice President is a powerful combination of a strong base salary and a significant, performance-driven bonus. This structure is designed to attract and retain top talent in a fiercely competitive industry. It's important to analyze compensation not as a single number, but as a package.

According to data compiled from various authoritative sources, the total compensation for a J.P. Morgan VP in a major financial hub like New York City typically falls within a specific range, which grows with seniority within the VP band.

- Authoritative Data: Reputable sources like Glassdoor, Salary.com, and particularly the industry-specific site Levels.fyi provide granular, user-reported data. As of late 2023 and early 2024, data points to the following ranges for an Investment Banking VP at J.P. Morgan in New York:

- Base Salary: Typically ranges from $250,000 to $275,000 per year. J.P. Morgan, along with other bulge bracket banks, has been standardizing these base salaries in recent years.

- Annual Bonus: This is the highly variable component and can range from $100,000 to $300,000+. This bonus is paid out in the first quarter of the following year (e.g., a 2023 bonus is paid in Q1 2024).

- Total All-In Compensation: This places the typical annual earnings for a J.P. Morgan VP between $350,000 and $575,000. First-year VPs will be at the lower end of this spectrum, while experienced third- or fourth-year VPs will be at the higher end.

Salary.com corroborates this, reporting that a "Vice President of Investment Banking" in the United States has a median base salary around $240,000, with total compensation packages often exceeding $450,000 when bonuses and other incentives are included.

### Compensation Breakdown: Base, Bonus, and Benefits

The salary figure alone doesn't tell the whole story. The total remuneration package is what truly defines a VP's earnings.

| Compensation Component | Typical Range (for NYC/London VP) | Description |

| :--- | :--- | :--- |

| Base Salary | $250,000 - $275,000 | The fixed, bi-weekly or monthly paycheck. Provides stability and is the foundation of the compensation package. |

| Performance Bonus | $100,000 - $300,000+ | The variable "at-risk" portion. Determined by a combination of individual performance, deal team/group performance, and overall firm profitability. Paid annually. |

| Sign-on Bonus | Varies ($20,000 - $50,000+) | Typically offered to VPs hired laterally from other firms or, in some cases, top MBA graduates. |

| Retirement Savings | 401(k) with company match | J.P. Morgan offers a competitive 401(k) plan, often matching a percentage of employee contributions (e.g., 5%). |

| Health & Wellness | Comprehensive medical, dental, vision | Top-tier benefits are standard, including robust health insurance plans and wellness programs. |

| Other Perks | Deferred compensation, subsidized gym, relocation assistance | For senior VPs, a portion of the bonus may be in deferred stock or cash, vesting over several years. |

### Salary Progression by Experience Level

The VP title itself has its own internal ladder, and compensation grows accordingly.

- VP - Year 1 (VP1): This is typically an individual just promoted from Associate.

- *Estimated Total Compensation:* $350,000 - $425,000

- VP - Year 2 (VP2): The VP is now more experienced, handling more complex aspects of deals and taking on more client-facing responsibilities.

- *Estimated Total Compensation:* $400,000 - $500,000

- VP - Year 3+ (Senior VP): This professional is on the cusp of a promotion to Executive Director. They are highly independent, may begin to source smaller deals, and are seen as a key leader within their group.

- *Estimated Total Compensation:* $475,000 - $575,000+

It is crucial to note that the bonus component is highly sensitive to market conditions. In a boom year with high deal flow, bonuses can be exceptional. Conversely, in a market downturn, bonuses can be significantly reduced, impacting total compensation dramatically.

Key Factors That Influence a VP's Salary

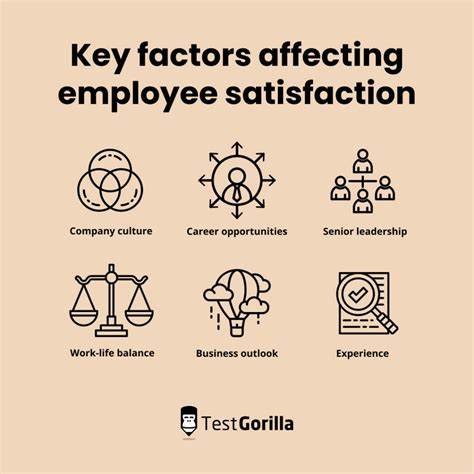

While the figures above provide a solid baseline, the actual take-home pay of a J.P. Morgan Vice President is influenced by a powerful confluence of factors. A professional who understands and strategically navigates these variables can significantly maximize their earning potential over the course of their career. This section delves deep into the seven most critical drivers of compensation.

### 1. Area of Specialization (Division within J.P. Morgan)

This is perhaps the most significant factor after location. J.P. Morgan is a vast, diversified financial institution, and a "Vice President" title exists across numerous divisions. Their compensation structures, however, are far from uniform.

- Investment Banking Division (IBD): This is the classic, high-powered division focused on M&A advisory, IPOs (Equity Capital Markets - ECM), and debt issuances (Debt Capital Markets - DCM). This division consistently commands the highest compensation packages. The direct link between their work and massive fee-generating events for the firm justifies the high base salaries and enormous bonus potential. The figures cited earlier ($350k - $575k+) are most representative of IBD VPs.

- Sales & Trading (S&T): VPs in this division work on the trading floor, facilitating the buying and selling of securities (stocks, bonds, currencies, commodities) for institutional clients. Their compensation is heavily tied to their "P&L" (Profit and Loss) or the revenue they generate. A successful Sales VP or Trader can earn on par with, or even exceed, their IBD counterparts, but the income is often more volatile and directly tied to market performance and individual production.

- Asset & Wealth Management (AWM): VPs in this area manage investments for high-net-worth individuals and institutions. Compensation is competitive but generally lower than in IBD. A significant portion of their earnings might be tied to Assets Under Management (AUM) and performance fees. A VP here might see a total compensation in the $250,000 to $400,000 range.

- Corporate & Commercial Banking: These VPs manage lending and other banking relationships with large corporations and middle-market companies. The work is less transaction-focused and more relationship-based than IBD. Compensation is strong but reflects the lower-margin nature of corporate lending compared to advisory work. Total compensation might range from $200,000 to $350,000.

- Technology & Operations (Corporate Functions): A VP in a technology or risk management role is a senior technologist or project manager, not a revenue-generator in the traditional sense. While highly valued and well-compensated, their salary structure resembles that of a senior tech professional more than a frontline banker. A VP of Software Engineering at J.P. Morgan could earn $200,000 to $350,000+, depending on their specific domain and impact.

### 2. Geographic Location

Where you sit physically has a massive impact on your paycheck, driven by cost of living, market size, and concentration of deal flow.

- Tier 1: New York City & London: These are the undisputed epicenters of global finance. J.P. Morgan's headquarters and largest offices are here, and the most significant deals are executed from these locations. They offer the highest salaries and bonus potential to attract the world's top talent and to compensate for an extremely high cost of living. The salary figures discussed in this guide are primarily anchored to these locations.

- Tier 2: Major International Hubs (Hong Kong, Singapore, San Francisco): These cities host major J.P. Morgan offices and handle significant regional or sector-specific (e.g., tech in SF) deal flow. Compensation is very strong, often approaching NYC/London levels, but can sometimes be slightly lower. Tax implications can also play a major role in take-home pay (e.g., lower income tax in Hong Kong/Singapore, high state tax in California).

- Tier 3: Major U.S. Regional Hubs (Chicago, Houston, Los Angeles): These cities have substantial J.P. Morgan presences, often with industry-specific focuses (e.g., Oil & Gas in Houston). Salaries and bonuses are robust but generally reflect a 10-20% discount compared to New York City to account for a lower cost of living. A VP in Chicago might expect a total package closer to the $300,000 - $450,000 range.

- Tier 4: Growth & Operations Centers (Salt Lake City, Dallas, Tampa, Columbus): J.P. Morgan has been strategically building out large "back-office" and "middle-office" hubs in these lower-cost cities. While VP titles exist here, they are more often in operations, technology, compliance, and support roles. The compensation is excellent for the local market but will be significantly lower than in frontline investment banking roles in Tier 1 cities.

### 3. Years of Experience (The VP Band)

As outlined previously, not all VPs are equal. The "VP band" typically lasts 3 to 4 years, and compensation ramps up significantly each year. This progression is based on the expectation that with each year, the VP becomes more autonomous, more skilled in managing clients and teams, and more valuable to the firm. A third-year VP (VP3) who has successfully executed multiple high-profile deals and is seen as a future leader will have a much larger bonus allocation than a first-year VP (VP1) who is still transitioning from the Associate role. This annual step-up is one of the most powerful internal drivers of salary growth.

### 4. Level of Education

By the time a professional reaches the VP level, their specific university matters less than their performance track record. However, their educational background was critical in securing the initial entry point into the hyper-competitive world of investment banking.

- Undergraduate Institution: The path to VP often begins with securing an Analyst role out of college. A degree from a "target school" (e.g., Ivy League universities, MIT, Stanford, NYU, Georgetown) or "semi-target school" (e.g., Michigan, UVA, Berkeley) provides a significant advantage due to established on-campus recruiting pipelines with J.P. Morgan.

- Master of Business Administration (MBA): The most common alternative path is to enter banking as an Associate after completing an MBA from a top-tier program (e.g., HBS, Wharton, Stanford GSB, Booth, Columbia). An MBA acts as a career accelerator, allowing someone from a different industry to pivot directly into the post-Analyst level. While the MBA itself doesn't guarantee a higher VP salary later on, it is often the very key that unlocks the door to the career path in the first place.

- Certifications (CFA, etc.): Holding the Chartered Financial Analyst (CFA) designation is highly respected, particularly in Asset Management, Equity Research, and Sales & Trading. While it may not lead to a direct, formulaic salary increase for an IBD VP, it signals a deep commitment to the profession and a mastery of financial analysis, which can be a positive factor during performance reviews and bonus discussions.

### 5. Company Type & Size (Comparative Analysis)

While our focus is J.P. Morgan, understanding how its compensation compares to competitors provides crucial context. J.P. Morgan is a "bulge bracket" bank—a large, full-service global institution.

- Bulge Bracket Banks (e.g., Goldman Sachs, Morgan Stanley): Compensation across these firms is highly competitive and generally standardized, especially for base salaries. A VP at Morgan Stanley will have a very similar pay structure to a VP at J.P. Morgan.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller firms specialize purely in advisory (mainly M&A). They often pay higher bonuses than bulge bracket banks in good years because they have lower overhead and don't have large, lower-margin divisions to support. It is not uncommon for a VP at an elite boutique to out-earn their J.P. Morgan counterpart, especially in a strong M&A market. The trade-off can be less brand recognition and fewer international opportunities.

- Middle-Market Banks (e.g., Baird, Houlihan Lokey, William Blair): These firms focus on deals for smaller to mid-sized companies. Compensation for VPs is very strong but generally a step below bulge bracket and elite boutique levels, reflecting the smaller deal sizes and fees.

### 6. In-Demand Skills

In today's evolving financial landscape, certain skills are prized above others and can directly influence a VP's bonus and career trajectory.

- Mastery of Financial Modeling and Valuation: This is table stakes. A VP must be an expert in DCF, LBO, M&A accretion/dilution models, and various valuation methodologies.

- Client Relationship Management: The ability to build trust, communicate complex ideas clearly, and manage client expectations is paramount. This skill becomes increasingly important as one moves from VP to ED.

- Negotiation and Persuasion: Whether negotiating a purchase price in an M&A deal or convincing a client of a particular strategic direction, the ability to persuade is a direct driver of success.

- Sector-Specific Expertise: A VP who develops a deep specialization in a hot sector like Technology (SaaS, FinTech), Healthcare (Biotech), or Renewable Energy becomes an invaluable asset and can command higher compensation.

- Leadership and Mentorship: A VP who is known for training and developing excellent Analysts and Associates is highly valued. Their ability to build a strong team is a key performance metric.

- Data Analysis and Technical Skills: Increasingly, familiarity with data analysis tools and even programming languages like Python for financial analysis can be a differentiator, allowing for more sophisticated insights and efficiency.

Job Outlook and Career Growth for a Finance VP

Securing a Vice President role at J.P. Morgan is not the end of the journey; it's a critical midpoint with a branching path of future opportunities. The career outlook for a talented finance professional at this level is exceptionally strong, though not without its challenges and evolving demands.

### The 10-Year Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not provide data specifically for "Investment Banking Vice Presidents," we can use related categories as a strong proxy. The outlook for Financial Managers, a category that includes senior roles in banking, is robust. The BLS projects a 16% growth in employment for Financial Managers from 2022 to 2032, which is "much faster than the average for all occupations."

- Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers.

- Key Drivers of Growth: The BLS cites the increasing complexity of the global financial environment, the need for expert cash management, and a growing range of financial products and services as primary drivers. As economies grow and companies continue to seek capital for expansion, M&A, and restructuring, the demand for skilled financial professionals to advise and execute these transactions will remain high.

For a role at J.P. Morgan, this translates to stable, long-term demand. While hiring may be cyclical—slowing during recessions and accelerating during economic booms—the fundamental need for elite banking talent is perennial.

### The Career Path Beyond Vice President

The VP role is a platform for promotion to the senior ranks of the bank. The next steps are:

1. Executive Director (ED) / Senior Vice President (SVP): After 3-4 years as a VP, a high-performing individual will be promoted to ED. This role involves greater autonomy, more significant client-facing responsibility, and the beginnings of business origination (sourcing deals). Compensation takes another significant leap, with total packages often moving into the $600,000 - $900,000+ range.

2. Managing Director (MD): This is the pinnacle of the investment banking career path. MDs are senior leaders primarily responsible for originating multi-million dollar deals, managing the firm's most important client relationships, and setting the strategy for their group. They are the firm's primary revenue generators. Compensation at this level is extraordinary, often $1,000,000+ annually, with a very large portion tied to performance.

### Exit Opportunities: The "Off-Ramp"

The skills, experience, and network gained as a J.P. Morgan VP create a wealth of lucrative "exit opportunities" outside of traditional banking. For many, the VP years are a strategic time to leverage their experience into a role with a better work-life balance or a different set of challenges.

- Private Equity (PE): This is the most coveted exit. PE firms hire experienced banking VPs to source, execute, and manage investments in private companies. The work is highly analytical and entrepreneurial, and the compensation potential (especially via "carried interest") can exceed that of banking.

- Hedge Funds: A VP with strong analytical and market-focused skills, particularly from S&T or Equity Research, can transition to a role as an analyst or portfolio manager at a hedge fund.

- Corporate Development: Large corporations have internal M&A teams, and they frequently hire banking VPs to lead their acquisition and strategy efforts. This offers a much better work-life balance while still involving high-stakes, transactional work.

- Venture Capital (VC): For VPs with a specialization in technology or healthcare, a move to a VC firm to invest in early-stage companies is a popular path.

- FinTech and Startups: Many VPs leverage their financial expertise to join high-growth FinTech companies in strategic finance or CFO-track roles.

### Emerging Trends and Future Challenges

To thrive and advance, a VP must stay ahead of the curve.

- Technological Disruption: Automation and AI are changing the nature of junior-level work. VPs of the future will need to be adept at leveraging technology and data analytics to provide deeper insights, not just manage manual processes.

- ESG and Sustainable Finance: There is a massive and growing demand for expertise in Environmental, Social, and Governance (ESG) investing and financing. VPs who build knowledge in this area will be exceptionally well-positioned.

- Regulatory Scrutiny: The financial industry remains under a microscope