It’s 7:00 PM on a Tuesday. The office is quiet, the sky outside is dark, and you’re still at your desk, polishing a presentation for tomorrow’s big meeting. You’re a salaried professional, proud of your work and dedicated to your role. But as the hours creep by, a persistent question nags at the back of your mind: *Should I be getting paid for this extra time?* It’s one of the most common and confusing questions in the modern workplace. You receive a fixed salary, a testament to your professional standing, but does that mean your employer has a claim to an unlimited number of your hours?

The answer, like so many things in the world of employment law, is complex: it depends. For millions of salaried workers across the United States, the line between a standard workweek and uncompensated extra hours is blurry, governed by a dense set of federal and state regulations. Understanding these rules isn’t just about compliance; it's about knowing your worth, protecting your time, and ensuring you are compensated fairly for your contributions. The difference between being eligible for overtime and not can mean thousands of dollars in your pocket each year and a healthier work-life balance.

I once coached a mid-level marketing manager who regularly worked 50-60 hour weeks, convinced it was just "part of the salaried deal." After we analyzed her actual day-to-day duties against federal guidelines, it became clear she was misclassified and was owed a significant amount in back overtime pay. This experience cemented for me that knowledge of these rules is not an HR-only affair; it is a fundamental tool for career self-advocacy.

This comprehensive guide is designed to demystify the rules surrounding salaried overtime pay. We will dissect the federal laws, explore the critical factors that determine your eligibility, and provide you with a clear, actionable roadmap to understand your specific situation.

### Table of Contents

- [What Does Being a "Salaried Employee" Truly Mean?](#what-does-being-a-salaried-employee-truly-mean)

- [The Core Question: A Deep Dive into Salaried Overtime Eligibility](#the-core-question-a-deep-dive-into-salaried-overtime-eligibility)

- [Key Factors That Determine Your Overtime Eligibility](#key-factors-that-determine-your-overtime-eligibility)

- [The Future of Salaried Work: Trends in Compensation and Employee Rights](#the-future-of-salaried-work-trends-in-compensation-and-employee-rights)

- [How to Determine Your Status and Take Action: A Step-by-Step Guide](#how-to-determine-your-status-and-take-action-a-step-by-step-guide)

- [Conclusion: Empowering Yourself with Knowledge](#conclusion-empowering-yourself-with-knowledge)

What Does Being a "Salaried Employee" Truly Mean?

Before we can tackle the overtime question, we must first establish a crystal-clear understanding of what it means to be "on salary." The term is often used casually to signify a professional, white-collar job, but in the context of employment law, it has a very specific definition that sets the stage for everything that follows.

At its core, being a salaried employee means you receive a predetermined, fixed amount of compensation for each pay period (weekly, bi-weekly, monthly), regardless of the exact number of hours you work within that period. If you earn $60,000 a year, you receive the same paycheck whether you work 35 hours one week or 50 hours the next. This contrasts sharply with an hourly employee, who is paid a set rate for each hour worked. For them, the math is simple: more hours worked equals a larger paycheck.

The concept of a salary is intended to compensate an employee for the overall value they bring to a position and for getting a job done, rather than for the time it takes to do it. This structure is typically reserved for roles where the output is more important than the input, and where work can't always be neatly contained within a 9-to-5 schedule.

However, a critical misunderstanding many employees have is believing that "salaried" automatically means "ineligible for overtime." This is a myth. Simply receiving a salary does not, by itself, exempt you from overtime protections. The legal framework that governs overtime pay, the Fair Labor Standards Act (FLSA), looks at more than just how you are paid; it scrutinizes the nature of your job and your level of pay to determine your status.

### A "Day in the Life" Comparison: Salaried vs. Hourly

To make this distinction more tangible, let's consider two roles at the same fictional company, "Innovate Corp."

Meet Alex, the Hourly Administrative Assistant:

- 8:55 AM: Alex clocks in using the company's timekeeping software.

- 9:00 AM - 12:00 PM: Alex answers phones, sorts mail, schedules appointments, and manages the office supply inventory. Every task is part of a structured day.

- 12:00 PM - 1:00 PM: Alex clocks out for a mandatory, unpaid one-hour lunch break.

- 1:00 PM - 5:00 PM: Alex continues with data entry and prepares for the next day.

- 5:01 PM: Alex clocks out. If their manager asks them to stay until 6:00 PM to help prepare for an emergency meeting, Alex will be paid for that extra hour at their regular hourly rate. If Alex works more than 40 hours in the week, they will receive time-and-a-half for the additional hours.

Meet Ben, the Salaried Marketing Manager:

- 8:45 AM: Ben arrives and starts reviewing campaign performance data from overnight. He doesn't clock in.

- 9:00 AM - 1:00 PM: Ben attends a strategy meeting, brainstorms a new project with his team, and then spends two hours writing creative briefs. His work is project-based and driven by deadlines, not a set list of hourly tasks.

- 1:00 PM - 1:30 PM: Ben eats a quick lunch at his desk while responding to urgent emails.

- 1:30 PM - 6:30 PM: Ben has a one-on-one with a direct report, takes a client call that runs long, and then stays late to finalize a budget proposal due the next morning.

- 6:31 PM: Ben heads home. He doesn't receive extra pay for the extra hours worked today. His salary is intended to cover all the work required to achieve his marketing goals.

As we'll see, Ben's ineligibility for overtime isn't just because he's salaried. It's because his role likely meets specific duties and salary level tests that classify him as an "exempt" employee. Alex, whose role does not meet those tests, is "non-exempt" and therefore protected by overtime laws, even if the company decided to pay her a fixed weekly salary. This distinction between exempt and non-exempt is the single most important concept you need to understand.

The Core Question: A Deep Dive into Salaried Overtime Eligibility

We've arrived at the heart of the matter. The definitive answer to "do you get overtime pay on salary?" is governed by the Fair Labor Standards Act (FLSA), a federal law established in 1938 that sets standards for minimum wage, overtime pay, recordkeeping, and youth employment.

The FLSA mandates that most employees in the U.S. must be paid overtime at a rate of at least one and one-half times their regular rate of pay for all hours worked over 40 in a workweek.

However, the FLSA also creates exemptions from this requirement for certain types of employees. These individuals are considered "exempt" from overtime rules. Employees who are not exempt are called "non-exempt," and they are entitled to overtime pay, regardless of whether they are paid on a salary or hourly basis.

Therefore, the real question is not "Am I salaried?" but "Am I an exempt or non-exempt employee?"

To be classified as exempt, an employee must generally meet three specific tests as defined by the U.S. Department of Labor (DOL):

1. The Salary Basis Test: The employee must be paid on a salary basis, meaning they receive a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee's salary must meet a minimum specified amount. This threshold is periodically updated by the DOL.

3. The Duties Test: The employee's primary job duties must involve the kind of work associated with exempt executive, administrative, professional, computer, or outside sales employees.

Crucially, an employee must meet *all three* of these tests to be considered exempt. If even one test is not met, the employee is non-exempt and must be paid overtime for hours worked over 40 in a week.

Let's break down the two main classifications.

### What is a Non-Exempt Employee?

A non-exempt employee is anyone who does not meet the specific criteria for exemption under the FLSA. This is the default status for most workers.

- Who they are: Non-exempt employees are typically those in roles that are non-managerial and involve performing routine, non-discretionary tasks. This includes many administrative assistants, paralegals (in some cases), call center representatives, clerical workers, maintenance staff, and technicians.

- How they are protected: They are legally entitled to overtime pay at time-and-a-half for any hours worked beyond 40 in a workweek.

- The Salaried Non-Exempt Employee: This is where much of the confusion lies. A company can choose to pay a non-exempt employee a salary for simplicity. For example, a company might pay a receptionist a salary of $800 per week, which covers a 40-hour workweek. However, if that receptionist works 45 hours one week, they are still legally entitled to overtime pay for those extra 5 hours. Their regular hourly rate would be calculated ($800 / 40 hours = $20/hour), and their overtime rate would be $30/hour. They would be owed an additional $150 for that week.

### What is an Exempt Employee?

An exempt employee is someone who meets all three tests (Salary Basis, Salary Level, and Duties) and is therefore *not* entitled to overtime pay under the FLSA.

- Who they are: These roles typically involve significant independent judgment, decision-making authority, and specialized knowledge. They are often managers, executives, doctors, lawyers, architects, software engineers, and senior-level administrative staff whose work is directly related to the management or general business operations of the company.

- How they are compensated: They receive their fixed salary regardless of the hours worked. This salary is meant to compensate them for completing their job duties, even if it requires more than 40 hours in a week. They are "exempt" from the overtime rules.

Think of it like a legal checklist. For an employer to legally classify you as exempt and not pay you overtime, they must be able to check all three boxes:

1. Are you paid on a salary basis? (✓/X)

2. Does your salary meet the current federal and state minimum threshold? (✓/X)

3. Do your primary job duties fit into one of the specific "exempt" categories (Executive, Administrative, Professional, etc.)? (✓/X)

If the answer to all three is "yes," you are likely an exempt employee. If the answer to any one of them is "no," you are likely non-exempt and entitled to overtime. In the next section, we will explore each of these tests in exhaustive detail, as this is where the nuances truly lie.

Key Factors That Determine Your Overtime Eligibility

Understanding whether you are exempt or non-exempt requires a forensic examination of your compensation and, more importantly, your actual job responsibilities. An employer cannot simply give you an impressive-sounding title like "Project Coordinator" or "Lead Technician" and declare you exempt. The U.S. Department of Labor (DOL) and the courts look past titles and job descriptions to the reality of your day-to-day work. This section provides an in-depth analysis of the factors that truly matter.

###

The Salary Threshold Test: The First Hurdle

This is the most straightforward test. To qualify for exemption, you must be paid a salary that meets or exceeds the minimum level set by the FLSA. This threshold is a critical gatekeeper; if your salary falls below this amount, you are automatically non-exempt and eligible for overtime, *regardless of your job duties*.

As of July 1, 2024, the U.S. Department of Labor has implemented a new rule significantly increasing this threshold.

- Standard Salary Level: The minimum salary threshold for the executive, administrative, and professional exemptions is $844 per week, which equates to $43,888 per year.

- Upcoming Increase: This threshold is scheduled to increase again on January 1, 2025, to $1,128 per week, or $58,656 per year.

Source: U.S. Department of Labor, "Final Rule: Restoring and Extending Overtime Protections."

What this means for you: If you are a salaried employee and your annual salary is less than $43,888 (or $58,656 starting in 2025), you are non-exempt. You must be paid overtime for any hours you work over 40 in a week. This rule change in 2024 reclassified millions of U.S. workers from exempt to non-exempt, making them newly eligible for overtime pay.

#### The Highly Compensated Employee (HCE) Test

The FLSA also includes a separate, more streamlined test for highly paid employees. To qualify as an HCE, an employee must:

1. Receive a total annual compensation that meets a higher threshold. As of July 1, 2024, this amount is $132,964 per year. This will increase to $151,164 per year on January 1, 2025.

2. Routinely perform at least one of the duties of an exempt executive, administrative, or professional employee.

This test is easier to meet on the duties side but requires a much higher salary.

###

The Duties Test (In-Depth): What Do You *Actually* Do?

This is the most complex and frequently misapplied part of the exemption analysis. Your "primary duty" is defined as the principal, main, major, or most important duty that you perform. It's not about which task takes up the most time, but which is the most critical to your role.

The FLSA outlines several categories of exempt duties. You must fit into at least one of these to be classified as exempt.

#### 1. The Executive Exemption

This exemption applies to managers. To qualify, an employee must:

- Have a primary duty of managing the enterprise or a customarily recognized department or subdivision.

- Customarily and regularly direct the work of at least two or more other full-time employees (or their equivalent).

- Have the authority to hire or fire other employees, or their suggestions and recommendations as to the hiring, firing, advancement, promotion, or any other change of status of other employees are given particular weight.

Example: The manager of a retail store who supervises six cashiers and has the authority to create schedules, discipline employees, and recommend them for promotion is likely an exempt executive.

Common Misapplication: An employee given the title "Shift Supervisor" who primarily performs the same work as their subordinates (e.g., making coffee, serving customers) and lacks true hiring/firing authority would likely *not* qualify for this exemption.

#### 2. The Administrative Exemption

This is one of the most broadly interpreted and often misclassified exemptions. It is not for clerical or secretarial work. To qualify, an employee must:

- Have a primary duty of performing office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers.

- Have a primary duty that includes the exercise of discretion and independent judgment with respect to matters of significance.

"Discretion and independent judgment" means you must be able to compare and evaluate possible courses of conduct and act or make a decision after considering the various possibilities. It implies that you have authority to make an independent choice, free from immediate direction or supervision.

Examples: An HR manager who develops company policies, a financial analyst who provides guidance on investments, a marketing specialist who plans and executes advertising campaigns, or an executive assistant to a high-level executive who manages their schedule and correspondence with significant autonomy.

Common Misapplication: An accounts payable clerk who simply enters data according to a set of pre-established rules, or a marketing assistant who only implements campaigns planned by others without making significant decisions, would likely *not* qualify. They are following procedures, not exercising independent judgment on matters of significance.

#### 3. The Professional Exemption

This exemption is split into two types: Learned Professionals and Creative Professionals.

- Learned Professional: To qualify, an employee must:

- Have a primary duty of performing work requiring knowledge of an advanced type in a field of science or learning.

- This knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction (e.g., a college degree or more).

- Classic Examples: Doctors, lawyers, dentists, registered nurses, architects, engineers, accountants, teachers, scientists.

- Creative Professional: To qualify, an employee must:

- Have a primary duty of performing work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.

- Classic Examples: Musicians, composers, actors, painters, writers, journalists (in some cases), graphic artists who are creating original designs rather than modifying existing ones.

Common Misapplication: A paralegal who performs legal research under the close supervision of an attorney may not qualify as a learned professional if their role doesn't require the same level of advanced knowledge and discretion. Similarly, a graphic artist who is simply resizing logos according to a style guide is likely not a creative professional.

#### 4. The Computer Employee Exemption

This is a specific exemption for high-level computer professionals. To qualify, an employee must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field and must have a primary duty consisting of:

- The application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software, or system functional specifications.

- The design, development, documentation, analysis, creation, testing, or modification of computer systems or programs.

- The design, documentation, testing, creation, or modification of computer programs related to machine operating systems.

Important Note: This exemption does not apply to employees engaged in the manufacture or repair of computer hardware, nor does it apply to help-desk staff who provide support but are not involved in systems-level design or programming.

#### 5. The Outside Sales Exemption

To qualify for the outside sales exemption, an employee must:

- Have a primary duty of making sales or obtaining orders or contracts for services.

- Be customarily and regularly engaged *away from* the employer's place or places of business.

This exemption has no salary requirement. An outside salesperson can be exempt regardless of how little they earn. "Inside sales" roles (those conducted from an office via phone or email) do not qualify for this specific exemption and must meet one of the other exemption tests.

###

Geographic Location: The Power of State and Local Law

The FLSA sets the floor, not the ceiling. Many states and even some cities have enacted their own wage and hour laws that are more protective of employees than federal law. When state and federal laws conflict, the employer must follow the law that is more generous to the employee.

Several states have higher salary thresholds for exemption than the federal level.

- California: As of 2024, the minimum salary for exempt employees in California is $66,560 per year, which is significantly higher than the federal threshold. California also has very strict definitions for the duties tests.

- New York: New York State has different salary thresholds depending on the county. In New York City, Westchester, and Long Island, the 2024 threshold for executive and administrative exemptions is $1,200 per week ($62,400 annually). The rest of the state has a lower threshold, but it's still often higher than the federal minimum.

- Washington: The state's 2024 salary threshold is tied to its minimum wage and is approximately $67,724.80 per year for all businesses.

Source: Official state Department of Labor websites (e.g., California Department of Industrial Relations, New York State Department of Labor).

It is absolutely critical to check your specific state and city labor laws, as they may grant you overtime rights even if you are considered exempt under federal rules.

###

Company Policy, Contracts, and "Comp Time"

Even if an employee is legally classified as exempt, a company can choose to offer additional compensation for extra hours worked. This is a matter of company policy or individual employment contracts, not legal obligation.

- Overtime for the Exempt: Some companies, particularly in competitive industries, may pay their exempt employees "straight time" for all hours worked over 40 or offer a bonus structure tied to project hours. This is a benefit, not a right.

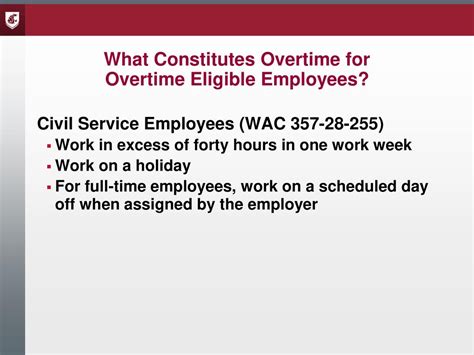

- Compensatory Time ("Comp Time"): Private-sector employers cannot legally offer non-exempt employees comp time (e.g., an hour off next week for an hour of overtime worked this week) in lieu of overtime pay. Overtime must be paid in cash. For exempt employees, an informal comp time arrangement may be offered, but it's not legally mandated. Public sector (government) employers have different rules and can often provide comp time.

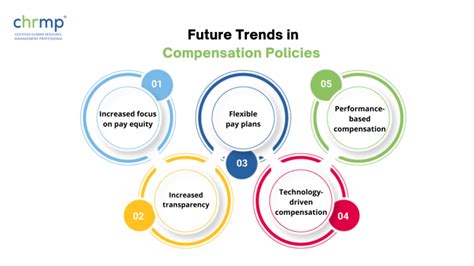

The Future of Salaried Work: Trends in Compensation and Employee Rights

The landscape of salaried work is not static. It's continually being shaped by new legislation, technological advancements, and evolving workplace philosophies. For any salaried professional, staying aware of these trends is key to understanding your career trajectory and advocating for fair compensation. The job outlook isn't just about job growth; it's about the quality and structure of the jobs themselves.

### The Ongoing Battle Over Overtime Rules

The most significant trend impacting salaried employees is the dynamic nature of the FLSA overtime regulations themselves. The salary threshold, in particular, has become a political football, with different presidential administrations pushing for higher or lower levels. The 2024 rule change, which significantly raised the salary threshold, represents a major shift toward expanding overtime eligibility.

- What to Expect: The DOL has built automatic updates into the 2024 rule, with the salary threshold set to be re-evaluated every three years based on current wage data. This means the number will likely continue to rise. Professionals who are currently exempt but earn close to the new $58,656 threshold (effective Jan 1, 2025) should monitor this closely. You may find yourself reclassified as non-exempt in the coming years.

- Future Challenges: These rule changes often face legal challenges from business groups, which can create uncertainty. Staying informed through resources like the DOL's Wage and Hour Division (WHD) website is crucial. According to the WHD, these updates are designed to ensure that the FLSA’s intended overtime protections are fully implemented and to prevent the erosion of overtime rights for middle-income workers.

### The Impact of Remote and Hybrid Work

The massive shift to remote and hybrid work models has introduced new complexities into the overtime equation, especially for salaried non-exempt employees.

- The Challenge of Tracking Hours: For non-exempt employees working from home, accurately tracking work hours is paramount. The lines between work and home life can blur, leading to "off-the-clock" work, such as answering emails late at night or taking calls during a lunch break. Employers are legally obligated to pay for all hours worked, even if they were not explicitly authorized. This has led to an increased adoption of sophisticated time-tracking software and stricter policies about after-hours communication.

- Implications for Exempt Workers: For exempt employees, remote work can exacerbate the tendency to work longer hours. Without the physical boundary of leaving an office, the workday can easily stretch to 10, 12, or more hours. This has fueled a growing conversation about work-life balance, "right to disconnect" laws (which are gaining traction in other countries), and the importance of setting clear expectations for exempt employee availability.

### The Push for Pay Transparency

A powerful movement toward pay transparency is reshaping how companies handle compensation. A growing number of states and cities (including Colorado, California, Washington, and New York City) now require employers to include salary ranges in their job postings.

- How This Affects You: This transparency gives you unprecedented leverage. When you can see the salary range for a role, you have a much better starting point for negotiation. It also helps you assess whether a potential role will fall above or below the FLSA salary threshold for exemption.

- Advancing in Your Field: As pay becomes more transparent, the focus shifts to justifying your position within that pay band. This is where upskilling and specialization become critical. Proving your value through quantifiable achievements, in-demand skills (like data analysis, AI proficiency, or specialized software knowledge), and leadership capabilities will be the primary way to advance to higher salary levels and, often, into genuinely exempt roles. According to a 2023 Payscale report, "organizations with high levels of pay transparency tend to have more engaged and satisfied employees." This trend empowers workers to better understand their market value and advocate for fair pay.

### How to Stay Relevant and Advance

In this evolving environment, proactive career management is more important than ever.

1. Become a Lifelong Learner: The duties that qualify for exemption (e.g., strategic planning, advanced analysis) are becoming more sophisticated. Invest in certifications, workshops, and courses related to your field. If you are in a role that is borderline non-exempt, acquiring skills that allow you to exercise more discretion and independent judgment can help you transition into a truly exempt, higher-level position.

2. Document Your Accomplishments: Don't just list your duties on your resume; quantify your impact. Instead of "Managed social media," write "Developed and executed a social media strategy that increased engagement by 40% and generated a 15% lift in qualified leads." This demonstrates the kind of "matters of significance" that are hallmarks of exempt administrative roles.

3. Understand Your Company's and Industry's Compensation Philosophy: Pay attention to how your company structures salaries, bonuses, and promotions. Are they a market leader in pay? Do they value work-life balance? Understanding this will help you align your career goals with the right opportunities, whether that's maximizing your overtime earnings as a non-exempt employee or climbing the ladder to a senior exempt role.

How to Determine Your Status and Take Action: A Step-by-Step Guide

Knowledge is power, but only when it leads to action. If you've read this far, you may be questioning your own classification. This section provides a practical, step-by-step guide to analyze your situation and determine the appropriate next steps. Approach this process calmly, professionally, and methodically.

### Step 1: Gather Your Documents and Review the Facts

Before you can draw any conclusions, you need to collect the evidence. Treat this like a personal audit.

- Find Your Official Job Description: Get a copy of the most recent version from your HR department. This is the company's official statement of your intended duties.

- Analyze Your Pay Stubs: Look at several recent pay stubs. Confirm that you are paid a fixed salary each pay period. Calculate your annual salary. Is it above or