For ambitious professionals in the finance industry, achieving the title of Executive Director (ED) at a powerhouse institution like JPMorgan Chase (JPMC) represents a significant career milestone. This prestigious role not only signifies a high level of expertise and responsibility but also comes with a compensation package that places it among the top echelons of corporate earners.

An Executive Director at JPMC can expect a total compensation package that often ranges from $400,000 to over $700,000 annually, with top performers in high-demand divisions potentially exceeding this figure. This article will break down the components of this salary, the factors that influence it, and the career outlook for professionals aspiring to this level.

What Does a JPMC Executive Director Do?

Before diving into the numbers, it's crucial to understand the role. Within the corporate hierarchy of investment banks like JPMorgan Chase, the title of "Executive Director" is not a board-level position. Instead, it sits between Vice President (VP) and Managing Director (MD), making it roughly equivalent to a Senior Vice President in other industries.

An Executive Director is a seasoned professional responsible for driving business, managing client relationships, and executing complex projects. Their daily responsibilities often include:

- Leading deal teams on mergers, acquisitions, or capital raises.

- Managing a portfolio of key clients and generating new business.

- Overseeing and mentoring junior staff, including Associates and Vice Presidents.

- Contributing to the strategic direction of their specific group or division.

- Assuming significant responsibility for the profitability and risk management of their projects.

It is a demanding, high-stakes role that requires a deep blend of technical skill, market knowledge, and leadership ability.

Average JPMC Executive Director Salary

Compensation for a JPMC Executive Director is a combination of a substantial base salary and a significant performance-based bonus. It's essential to look at total compensation to understand the full earning potential.

Based on recent data from authoritative sources, here is a typical breakdown:

- Average Base Salary: According to data from Glassdoor and Salary.com, the average base salary for a JPMC Executive Director typically falls between $220,000 and $275,000 per year.

- Performance Bonus & Stock Awards: The variable component is what truly elevates the compensation. This can range dramatically from $150,000 to over $450,000 annually, paid in a mix of cash and restricted stock units (RSUs).

- Total Average Compensation: Combining these elements, the average total compensation for an Executive Director at JPMorgan Chase lands in the $450,000 to $650,000 range. Data from Levels.fyi, which specializes in compensation for tech and finance, often shows top-tier EDs in competitive divisions reaching total packages well over $700,000.

*Sources: Salary.com, Glassdoor, and Levels.fyi (Data retrieved in late 2023/early 2024).*

Key Factors That Influence Salary

Not all Executive Directors earn the same. Compensation can vary significantly based on several key factors.

### Years of Experience

Experience is paramount. The ED title is typically awarded to professionals with 10-15 years of experience who have progressed through the ranks from Analyst, Associate, and Vice President. An ED in their first year in the role will be at the lower end of the pay scale, while a senior ED with a proven track record of generating significant revenue and nearing a promotion to Managing Director will command a salary at the highest end of the spectrum.

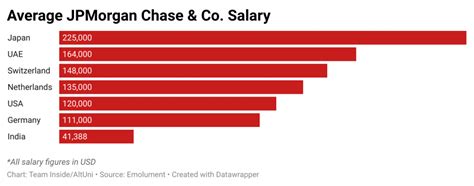

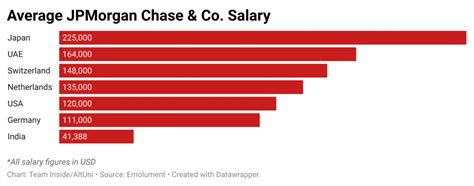

### Geographic Location

Where you work matters immensely in finance. Major financial hubs offer the highest compensation due to a higher cost of living and greater competition for top talent.

- Top-Tier Locations (New York, London, Hong Kong): Executive Directors in these global financial centers receive the highest salaries and bonuses.

- Second-Tier Locations (Chicago, Houston, San Francisco): While still very high, compensation in these cities may be slightly lower than in the top-tier hubs.

- Support & Operations Centers (Columbus, OH; Plano, TX; Wilmington, DE): EDs in corporate functions or technology roles based in these locations will generally have a lower base salary and bonus structure compared to their front-office counterparts in New York.

### Area of Specialization

The division within JPMC where an Executive Director works is one of the most significant drivers of salary.

- Investment Banking (M&A, Capital Markets): This is traditionally one of the highest-paying divisions due to its direct role in generating massive firm revenue.

- Sales & Trading: Top-performing traders and salespeople can also earn immense bonuses tied directly to their P&L (Profit and Loss).

- Asset & Wealth Management: Compensation is strong and often linked to assets under management (AUM) and performance fees.

- Corporate & Support Functions (Technology, Risk, Compliance, HR): While still highly paid, Executive Directors in these areas typically have a lower variable bonus component compared to front-office, revenue-generating roles. However, a specialized ED in a field like AI or Cybersecurity can still command a premium package.

### Level of Education

By the time a professional reaches the Executive Director level, their performance and experience far outweigh their educational background. However, education is a critical gateway. The vast majority of JPMC EDs hold at least a bachelor's degree in finance, economics, or a related field from a top university. Furthermore, a significant portion, particularly in Investment Banking, hold a Master of Business Administration (MBA) from an elite business school, which often serves as an accelerator to the VP and ED ranks.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for the specific title of "JPMC Executive Director," it provides excellent insight into the broader category of Financial Managers.

According to the BLS Occupational Outlook Handbook, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is "much faster than the average for all occupations." The BLS attributes this strong growth to the increasing complexity of the global financial environment and the need for skilled managers to help businesses navigate it.

This robust industry outlook suggests that demand for experienced, high-performing financial professionals like those at the Executive Director level will remain strong, supporting the continued high compensation for these roles.

Conclusion

The role of an Executive Director at JPMorgan Chase is a demanding but exceptionally rewarding career goal. It represents the culmination of years of hard work, strategic thinking, and consistent high performance.

Key Takeaways:

- Focus on Total Compensation: The base salary is only part of the story; performance-based bonuses and stock awards make up a significant portion of the package, often pushing total pay above $500,000.

- Performance is King: Your individual and team performance, particularly in revenue-generating divisions, is the single biggest driver of your bonus.

- Location and Division Matter: Where you work and what you do within the bank will create significant variations in your earning potential.

- The Path is a Marathon: Reaching the ED level is a long-term journey that requires dedication and a commitment to continuous learning and leadership development.

For those aspiring to a career in high finance, the JPMC Executive Director salary serves as a powerful benchmark for what is possible with talent, persistence, and a strategic career path.