For those with a meticulous eye for detail, a passion for helping others, and a desire to be at the heart of one of life's biggest financial decisions, a career as a Loan Officer Assistant (LOA) can be an incredibly rewarding starting point. It’s a role that combines administrative prowess with deep industry knowledge, serving as the essential backbone to a successful mortgage lending team. But beyond the satisfaction of helping families secure their dream homes, a critical question remains: what can you expect to earn?

The financial potential of this career is often underestimated. While it's an entry-to-mid-level position, the loan officer assistant salary is competitive, with a national average typically falling between $45,000 and $65,000 per year, and top earners with significant experience and in-demand skills commanding well over $80,000, especially when factoring in bonuses. This article will serve as your definitive guide, moving far beyond simple averages to explore every facet of compensation, career growth, and what it takes to succeed.

I remember when my wife and I bought our first home. Our Loan Officer (LO) was the charismatic face of the operation, but it was his assistant, a woman named Sarah, who was our true guide. She was the one who patiently walked us through the mountain of paperwork, called to remind us of deadlines, and calmly explained why the underwriter needed yet another bank statement. Without her organizational genius and reassuring presence, the process would have been ten times more stressful. She was the unsung hero of our home-buying journey, and her role exemplifies the critical importance—and value—of a great LOA.

This guide is designed for aspiring LOAs, current professionals looking to maximize their earnings, and anyone curious about this vital role in the financial services industry. We will dissect every factor that influences your paycheck and map out the road to a long and prosperous career.

### Table of Contents

- [What Does a Loan Officer Assistant Do?](#what-is-an-loa)

- [Average Loan Officer Assistant Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-start)

- [Conclusion: Is This the Right Career for You?](#conclusion)

What Does a Loan Officer Assistant Do?

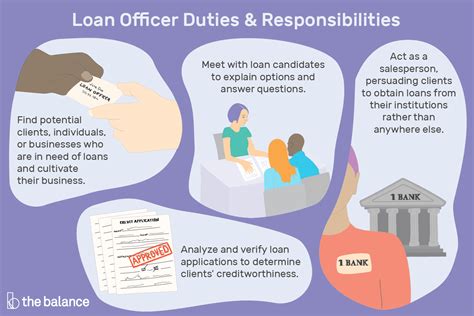

A Loan Officer Assistant, often called an LOA or a Mortgage Loan Assistant, is the operational powerhouse behind a Loan Officer (LO) or a team of LOs. While the Loan Officer is primarily focused on client acquisition, building relationships, and advising on loan products, the LOA is the master of execution. They manage the loan pipeline from application to closing, ensuring every step is completed accurately, efficiently, and in compliance with strict industry regulations.

Think of the LO as the architect who designs the blueprint for a client's mortgage, and the LOA as the project manager who ensures the foundation is solid, the materials are ordered, and the construction stays on schedule. Their work is a blend of administrative tasks, client communication, and detailed para-professional financial work.

Core Responsibilities and Daily Tasks:

The day-to-day duties of an LOA are varied and demanding, requiring exceptional organizational skills and the ability to multitask under pressure. Key responsibilities include:

- Loan Application Support: Assisting the LO in taking and preparing new loan applications, ensuring all initial information in the 1003 (Uniform Residential Loan Application) is accurate.

- Document Collection and Management: This is a cornerstone of the role. LOAs are responsible for requesting, collecting, and organizing a vast array of documents from borrowers, such as pay stubs, W-2s, tax returns, bank statements, and letters of explanation. They must meticulously review these for completeness and accuracy.

- Pipeline Management: LOAs maintain and update the LO's pipeline of loans in progress. They track key milestones, deadlines, and communication logs, often using specialized Customer Relationship Management (CRM) or Loan Origination Software (LOS).

- Client Communication: Acting as a primary point of contact for borrowers, the LOA provides status updates, answers questions about the process, and clarifies requests for information. This requires a high degree of professionalism and empathy.

- Third-Party Coordination: The mortgage process involves many players. The LOA liaises with real estate agents, appraisers, title companies, escrow officers, and insurance agents to coordinate necessary services and paperwork.

- Pre-Underwriting File Review: Before a loan file is submitted to the underwriter for formal approval, a skilled LOA will perform a preliminary review. They check for red flags, ensure the file is structured logically, and verify that all necessary documentation is present, significantly increasing the chances of a smooth approval.

- Compliance and Disclosures: They assist in preparing and sending initial loan disclosures to borrowers in compliance with regulations like the TILA-RESPA Integrated Disclosure (TRID) rule, ensuring that all timing and content requirements are met.

### A Day in the Life of an LOA

To make this tangible, let's walk through a typical day for an LOA named Alex:

- 8:30 AM: Alex arrives, grabs coffee, and immediately logs into the Loan Origination Software (LOS), Encompass. He reviews his LO's entire pipeline, prioritizing files by their closing dates and underwriting deadlines. He flags three files that need urgent attention today.

- 9:00 AM: The first task is a new loan application that came in late yesterday. Alex reviews the initial file, creates a "needs list" of required documents for the borrower, and drafts a welcoming, informative email to send them.

- 10:15 AM: Alex calls a borrower whose file is scheduled for submission to underwriting tomorrow. He gently reminds them that their most recent pay stubs are still outstanding and explains why they are critical for the underwriter.

- 11:00 AM: He shifts focus to a file that just received conditional loan approval. Alex meticulously reviews the underwriter's conditions, which include sourcing a large deposit and providing a termite inspection report. He calls the borrower to explain the conditions clearly and contacts the real estate agent to coordinate the inspection.

- 1:00 PM: Lunch break.

- 2:00 PM: An appraiser's report comes in for another file. Alex opens it, verifies the value, and uploads it to the loan file in the LOS, notifying the LO and the processor.

- 3:30 PM: Alex spends an hour "scrubbing" a file for a new purchase. He organizes all the documents the borrower has submitted, checks that the income calculations are correct, and ensures the file tells a clear, logical story before sending it to the processing team. This proactive work prevents future headaches.

- 4:45 PM: Before logging off, Alex updates the CRM with notes from all his calls and activities, sets reminders for tomorrow's follow-ups, and sends a quick end-of-day summary to his Loan Officer.

This example highlights the dynamic and critical nature of the LOA role. It's not just paperwork; it's proactive problem-solving and relationship management.

Average Loan Officer Assistant Salary: A Deep Dive

Now, let's get to the core of the matter: compensation. The loan officer assistant salary is not a single, fixed number but rather a spectrum influenced by a multitude of factors we'll explore in the next section. However, by aggregating data from authoritative sources, we can establish a clear and reliable baseline.

It’s important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a distinct category for "Loan Officer Assistant." The role falls under the broader category of "Loan Interviewers and Clerks" (SOC Code 43-4131). According to the May 2023 BLS data, the median annual wage for this category was $48,770, with the lowest 10 percent earning less than $36,250 and the highest 10 percent earning more than $65,560.

While the BLS provides a solid foundation, salary aggregators that collect real-time, user-submitted data can offer a more nuanced picture that often includes bonuses and other compensation.

Here's a breakdown from leading salary platforms (data as of late 2023/early 2024):

- Salary.com: Reports the median U.S. salary for a Mortgage Loan Assistant I at $48,639, with a typical range falling between $43,491 and $54,677. This platform is known for using HR-reported data, which often reflects base salary more than total compensation.

- Payscale: Shows a slightly wider range, with an average base salary of approximately $49,000. Their data indicates a total pay spectrum (including bonuses and profit sharing) from $37,000 to $74,000.

- Glassdoor: Cites a total pay average of around $62,500 for a "Loan Officer Assistant," with a likely base salary range of $46,000 to $68,000. Glassdoor's "total pay" figure often includes bonuses, which are a significant part of LOA compensation.

- Indeed: Lists an average base salary of $51,135 per year based on thousands of user-submitted data points.

Conclusion on Averages: A conservative estimate for the national median base salary is $49,000 - $52,000. However, when you factor in common performance-based bonuses, a more realistic total compensation average for an experienced LOA is closer to $55,000 - $65,000.

### Salary by Experience Level

Your earnings as an LOA will grow in lockstep with your experience, skill, and ability to contribute to the LO's success. More experienced assistants can handle more complex files with less supervision, directly increasing the LO's production capacity and, consequently, their own value.

Here is a typical salary progression, combining data from Payscale and industry observations:

| Experience Level | Years of Experience | Typical Base Salary Range | Typical Total Compensation Range (with Bonuses) | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level LOA | 0-2 Years | $40,000 - $48,000 | $42,000 - $55,000 | Basic document collection, data entry, scheduling, learning the loan process and software. |

| Mid-Career LOA | 3-7 Years | $48,000 - $60,000 | $55,000 - $75,000 | Full pipeline management, client communication, pre-underwriting file review, training new staff. |

| Senior/Lead LOA | 8+ Years | $60,000 - $75,000+ | $70,000 - $90,000+ | Managing complex files (jumbo, self-employed), overseeing a team of LOAs, acting as a Junior LO, strategic process improvement. |

### Understanding Total Compensation: Beyond the Base Salary

The base salary is only part of the story. The mortgage industry is heavily performance-driven, and LOA compensation packages often reflect this. Understanding these components is crucial when evaluating a job offer.

- Base Salary: This is your guaranteed, fixed annual pay. It provides stability and is the foundation of your compensation. It's typically higher at large banks and credit unions.

- Per-File Bonus: This is the most common form of variable pay for LOAs. You receive a set dollar amount for every loan that successfully closes. This bonus can range from $25 to $150+ per file, depending on the company's structure and the loan's complexity. A productive team closing 15 loans a month could generate an extra $750 - $2,250 in monthly bonus income for the LOA.

- Performance Bonuses: These can be monthly, quarterly, or annual bonuses tied to the LO's or the branch's overall production volume, customer satisfaction scores, or file quality metrics.

- Commission/Overrides: While less common for pure administrative LOAs, some "hybrid" roles that blur the line with Junior Loan Officer positions may earn a small percentage of the total commission on a loan, known as a basis point (BPS) override.

- Profit Sharing: Some smaller mortgage brokerages or teams offer a share of the profits to key employees at the end of the year, fostering a strong sense of teamwork and shared ownership.

- Standard Benefits: Don't discount the value of a comprehensive benefits package. This includes:

- Health Insurance: Medical, dental, and vision coverage.

- Retirement Savings: Access to a 401(k) plan, often with a company match.

- Paid Time Off (PTO): Vacation days, sick leave, and holidays.

- Professional Development: Reimbursement for licensing fees (like NMLS), certifications, and continuing education.

When comparing job offers, always calculate the Total Annual Compensation (Base Salary + Estimated Annual Bonuses) and weigh the quality of the benefits package. A job with a slightly lower base salary but a generous per-file bonus structure and a strong 401(k) match could be far more lucrative in the long run.

Key Factors That Influence Loan Officer Assistant Salary

Your earning potential is not set in stone. It is a dynamic figure shaped by your qualifications, where you work, and the specific value you bring to your team. Mastering these factors is the key to maximizing your income and accelerating your career growth. This section provides an in-depth analysis of the six primary drivers of a loan officer assistant salary.

### 1. Level of Education and Certification

While a four-year college degree is not always a strict requirement, it can significantly impact your starting salary and long-term trajectory.

- High School Diploma or GED: This is the minimum requirement for most entry-level LOA positions. Candidates at this level can expect to start at the lower end of the salary spectrum, typically in the $40,000 - $45,000 range. They will rely heavily on on-the-job training.

- Associate's Degree: An A.A. in business, finance, or a related field demonstrates a higher level of commitment and foundational knowledge. It can give you a competitive edge and may lead to a slightly higher starting salary.

- Bachelor's Degree: A B.A. or B.S. in Finance, Business Administration, Economics, or Communications is highly desirable. It signals to employers that you possess strong analytical, communication, and critical thinking skills. Graduates with a relevant bachelor's degree can often command starting salaries in the $48,000 - $55,000 range and may be fast-tracked for more advanced roles.

The Certification Game-Changer: NMLS Licensing

The most significant educational credential an LOA can obtain is a Mortgage Loan Originator (MLO) license through the Nationwide Multistate Licensing System & Registry (NMLS).

- What it is: The Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) requires individuals who "take a residential mortgage loan application" or "offer or negotiate terms of a residential mortgage loan" to be licensed.

- Why it Matters for LOAs: While a pure administrative LOA who doesn't discuss rates or terms with clients may not *need* a license, obtaining one is a massive value-add. A licensed LOA can legally step in for the LO to a much greater degree. They can discuss program options, quote interest rates, and take a full application from a client if the LO is unavailable.

- Salary Impact: This expanded capability makes a licensed LOA exponentially more valuable. Employers actively seek out and pay a premium for licensed assistants. An NMLS-licensed LOA can often command a base salary $5,000 to $15,000 higher than their unlicensed counterparts. Furthermore, it opens the door to higher per-file bonuses or even commission overrides, as they are directly contributing to origination activities. It is the single most effective way to boost your earnings and is a non-negotiable step toward becoming a Loan Officer.

### 2. Years of Experience

As highlighted in the table above, experience is a primary driver of salary growth. However, it's not just about the number of years; it's about the *quality* and *breadth* of that experience.

- Entry-Level (0-2 Years): The focus is on learning the fundamentals. Your value lies in your reliability, coachability, and attention to detail on basic tasks. Salary growth comes from proving you can master the core responsibilities quickly.

- Mid-Career (3-7 Years): You've moved beyond simply following checklists. You now understand the *why* behind the process. You can anticipate problems, manage a pipeline independently, and act as a trusted point of contact for clients and partners. Your salary increases because you are no longer just a support person; you are a proactive manager of the loan flow, freeing up significant time for your LO to generate new business. At this stage, you might earn in the $55,000 - $75,000 total compensation range.

- Senior/Lead LOA (8+ Years): You are a master of the craft. You can handle the most complex files—self-employed borrowers with intricate business structures, jumbo loans, or non-QM (non-qualified mortgage) products—with ease. You likely have your NMLS license and may even function as a "Junior LO," mentoring new team members, implementing process improvements, and managing a small team of other assistants. Your compensation reflects this expertise, often pushing into the $70,000 - $90,000+ range, heavily supplemented by performance bonuses tied to the team's top-tier production.

### 3. Geographic Location

Where you work has a dramatic impact on your salary, driven primarily by the cost of living and the competitiveness of the local real estate market. A higher salary in a high-cost-of-living city may not necessarily translate to more disposable income.

Here's a comparative look at estimated average LOA salaries in various U.S. metropolitan areas, juxtaposed with a cost-of-living index (where 100 is the national average):

| Metropolitan Area | Estimated Average Salary (Base) | Cost of Living Index | Market Dynamics |

| :--- | :--- | :--- | :--- |

| San Jose, CA | $65,000 - $75,000 | ~215 | Extremely high cost of living and a hyperactive, high-value real estate market demand top talent and pay a premium. |

| New York, NY | $60,000 - $70,000 | ~160 | A global financial hub with high salaries to offset a very high cost of living. |

| Boston, MA | $58,000 - $68,000 | ~150 | A competitive market with strong financial and tech sectors that drive up wages. |

| Denver, CO | $52,000 - $62,000 | ~115 | A booming real estate market with a slightly above-average cost of living, leading to competitive wages. |

| Dallas, TX | $48,000 - $58,000 | ~101 | A major business center with a robust housing market and a cost of living right around the national average. |

| Kansas City, MO | $44,000 - $52,000 | ~90 | A more affordable market where salaries are closer to the national median but purchasing power can be higher. |

| Jackson, MS | $40,000 - $48,000 | ~78 | Lower cost of living and less market competition generally result in salaries below the national average. |

Key Takeaway: Don't just look at the salary number. Always research the cost of living in a given area. A $65,000 salary in San Jose is very different from a $55,000 salary in Dallas. Furthermore, the rise of remote work has introduced new dynamics, with some national lenders offering standardized pay regardless of location, creating incredible opportunities for those in lower-cost areas.

### 4. Company Type and Size

The type of institution you work for will shape your work environment, culture, and compensation structure.

- Large National Banks & Credit Unions: (e.g., Wells Fargo, Bank of America, Navy Federal Credit Union)

- Pros: High stability, excellent benefits packages (top-tier health insurance, generous 401(k) matching), structured training programs, and clear career paths.

- Cons: Compensation may be more rigid, with a heavier reliance on base salary and less aggressive bonus structures. The work environment can be more corporate and bureaucratic.

- Independent Mortgage Brokerages: (Often smaller, local, or regional companies)

- Pros: Potentially much higher earning potential through aggressive per-file and performance bonuses. The culture is often more entrepreneurial, flexible, and fast-paced. You work closely with top-producing LOs and learn a great deal quickly.

- Cons: Less job security, benefits packages might be less robust, and there's often less formal training. Your income can be more volatile, tied directly to the ups and downs of the housing market.

- Direct Online Lenders: (e.g., Rocket Mortgage, Better.com)

- Pros: Tech-forward environment, often with excellent proprietary software. Can offer competitive salaries and strong bonus potential due to high volume. Many offer remote work opportunities.

- Cons: Can be a high-pressure, "call center" type of environment. The focus is on speed and volume, which may not suit everyone.

### 5. Area of Specialization

While most LOAs work in the residential mortgage space, specializing in certain types of loans can increase your value and pay.

- Government Loans (FHA/VA/USDA): These loans have unique and complex guidelines. An LOA who is an expert in VA eligibility or FHA underwriting requirements is a huge asset to their team and can command a higher salary.

- Jumbo & Super Jumbo Loans: These large loans for high-net-worth individuals have more stringent underwriting and documentation requirements. Expertise in this area is highly valued in affluent markets.

- Renovation Loans (FHA 203k, Fannie Mae HomeStyle): These are notoriously complex loans that involve coordinating with contractors and managing draws. An LOA who can successfully manage these files is rare and highly valuable.

- Commercial Lending: While a different field, some skills are transferable. Assistants in commercial lending, which deals with business properties, often require more advanced financial analysis skills and are compensated accordingly.

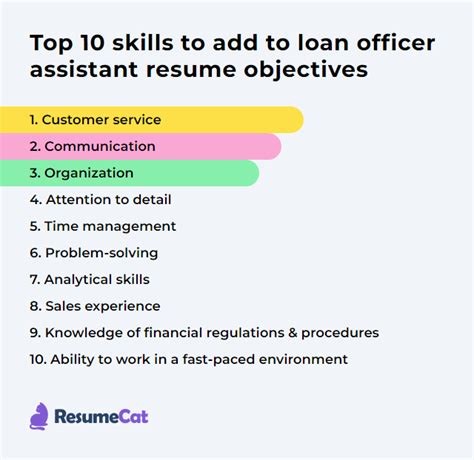

### 6. In-Demand Skills

Beyond your background, the specific, demonstrable skills you possess are what truly justify a top-tier salary. These are the skills to highlight on your resume and develop continuously.

Technical & Software Skills:

- Loan Origination Software (LOS) Proficiency: This is non-negotiable. Expertise in major platforms like Encompass by ICE Mortgage Technology (the industry leader), Calyx Point, or LendingQB is the most sought-after technical skill. Being a "power user" who knows the system inside and out is a massive advantage.

- CRM Software: Familiarity with systems like Salesforce, Jungo, or Total Expert for managing client communication and marketing automation.

- Automated Underwriting Systems (AUS): A solid understanding of how to read and interpret findings from Fannie Mae's Desktop Underwriter (DU) and Freddie Mac's Loan Product Advisor (LPA).

- Microsoft Office Suite: Advanced proficiency in Excel for creating spreadsheets and trackers