A management position at a prestigious "Big Four" firm like PricewaterhouseCoopers (PwC) represents a significant milestone in a professional's career. It signifies expertise, leadership, and a commitment to excellence. But beyond the prestige, a key question for aspiring and current professionals is: What is the compensation?

Securing a role as a Manager at PwC not only puts you on a path toward senior leadership but also comes with a substantial financial reward. A PwC Manager's salary reflects the high level of skill and responsibility required, with typical base salaries ranging from $130,000 to over $180,000 annually, augmented by significant performance-based bonuses.

This guide will break down the salary you can expect as a PwC Manager, the key factors that influence your earnings, and the overall career outlook.

What Does a PwC Manager Do?

A Manager at PwC is a pivotal role, bridging the gap between senior leadership (Senior Managers, Directors, Partners) and the junior staff executing the day-to-day work (Associates and Senior Associates). While responsibilities vary by service line—Assurance, Tax, or Advisory—the core functions remain consistent:

- Project and Engagement Management: They are the primary owners of client engagements, responsible for planning, budgeting, executing, and delivering high-quality work on time.

- Team Leadership: Managers lead teams of associates, providing guidance, coaching, and performance feedback. They are responsible for the professional development of their team members.

- Client Relationship Management: They serve as a key point of contact for clients, building trust and ensuring that client needs are met and expectations are exceeded.

- Technical Expertise: Whether in auditing financial statements, structuring a complex tax deal, or advising on a business transformation, managers are expected to have deep technical knowledge in their specific field.

Average PwC Manager Salary

Analyzing salary data requires looking at multiple sources to form a complete picture. It's crucial to distinguish between base salary and total compensation, which includes bonuses and other incentives.

Based on an aggregation of recent data from authoritative sources, the average base salary for a Manager at PwC in the United States falls between $145,000 and $155,000 per year.

- Salary.com reports a median base salary for a consulting manager in the industry to be around $152,490, with a typical range falling between $134,890 and $173,790.

- Glassdoor data, compiled from user-submitted reports, places the average PwC Manager salary at approximately $148,000 in base pay. When factoring in bonuses and profit-sharing, the "total pay" estimate often rises to the $160,000 - $175,000 range.

The typical salary range for a PwC Manager can be quite broad, starting around $130,000 for a newly promoted manager in a lower-cost-of-living area and exceeding $180,000 for an experienced manager in a high-demand specialization and location.

Key Factors That Influence Salary

Your specific salary as a PwC Manager isn't a single number; it's determined by a combination of critical factors. Understanding these will help you maximize your earning potential.

### Years of Experience

Within the "Manager" title itself, there is a progression. A first-year Manager (M1) will earn less than a third-year Manager (M3) who is on the cusp of a promotion to Senior Manager. Firms like PwC typically have a structured compensation model that includes annual raises and performance-based adjustments, meaning your salary grows steadily as you gain more experience and demonstrate greater impact in the role. The typical path to Manager involves 2-3 years as an Associate and 2-3 years as a Senior Associate, meaning most new managers have 4-6 years of prior experience.

### Geographic Location

Location is one of the most significant drivers of salary variance. To account for the vast differences in the cost of living, PwC adjusts its compensation bands by market. A Manager in a high-cost-of-living (HCOL) area like New York City, San Francisco, or Boston can expect to earn a 15-25% premium over a colleague in a lower-cost-of-living (LCOL) city like Tampa, Kansas City, or Phoenix. While the take-home pay is higher in HCOL cities, it's designed to offset higher expenses for housing, transportation, and taxes.

### Area of Specialization

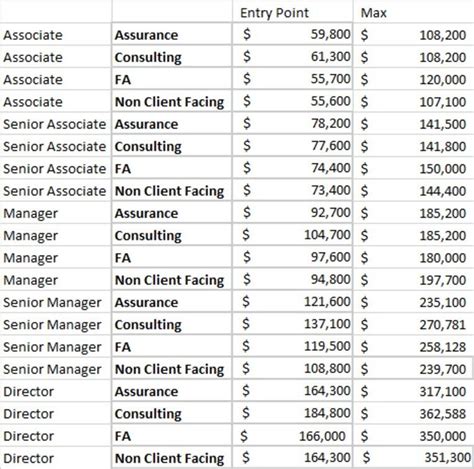

PwC's business is divided into distinct lines of service, and compensation often varies between them.

- Assurance (Audit): This is PwC's foundational practice. Salaries are highly competitive and form the benchmark for many professional services roles. A Certified Public Accountant (CPA) license is virtually required and essential for advancement.

- Tax: Compensation for Tax Managers is generally on par with or slightly higher than Assurance, especially for those with in-demand specializations like international tax, M&A tax, or transfer pricing.

- Advisory (Consulting): This is typically the highest-paying service line. Advisory managers who specialize in areas like deals, strategy consulting, cybersecurity, or cloud transformation often command the highest salaries within the firm. The work is project-based and directly tied to high-stakes client business problems, leading to premium compensation.

### Level of Education and Certifications

A bachelor's degree in accounting, finance, or a related field is the minimum requirement. However, advanced credentials significantly enhance earning potential.

- CPA License: For Assurance and Tax professionals, the CPA is a non-negotiable credential for reaching the Manager level and is a prerequisite for signing audit opinions.

- Master's Degree: A Master of Business Administration (MBA) is particularly valuable for those entering or advancing within the Advisory practice. Similarly, a Master of Accounting (MAcc) or Master of Taxation (MTax) can provide a competitive edge.

- Other Certifications: Credentials like the Chartered Financial Analyst (CFA), Certified Information Systems Auditor (CISA), or Project Management Professional (PMP) can also lead to higher pay, especially in specialized advisory roles.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "PwC Manager" as a distinct profession, we can look at its core components to assess the career outlook. The data is highly encouraging.

For roles in Assurance and Tax, the BLS projects that employment for Accountants and Auditors will grow by 4% from 2022 to 2032, which is about as fast as the average for all occupations. The increasing complexity of financial regulations and globalization ensures a steady demand for skilled accounting professionals.

For roles in Advisory, the outlook is even stronger. The BLS projects that employment for Management Analysts (the closest proxy for consultants) will grow by 10% from 2022 to 2032, which is much faster than the average. This growth is driven by a constant need for organizations to improve efficiency and navigate a rapidly changing business landscape.

Working at a market leader like PwC places you at the forefront of these stable and growing professions.

Conclusion

A career as a Manager at PwC is both professionally challenging and financially rewarding. With an average base salary comfortably in the six figures and a total compensation package that often exceeds $160,000, it stands as a testament to the value of the role.

For those aspiring to this position, the key takeaways are clear:

- Build a Strong Foundation: Excel in your early career as an Associate and Senior Associate.

- Specialize Wisely: Your choice of service line (Assurance, Tax, or Advisory) will significantly impact your long-term earning potential.

- Invest in Credentials: A CPA is essential for accounting tracks, while an MBA or other certifications can unlock doors in consulting.

- Be Strategic About Location: Understand the trade-offs between higher salaries and the cost of living in major metropolitan markets.

Ultimately, the path to a PwC Manager role is a marathon, not a sprint. It requires dedication and continuous learning, but the destination offers an exceptional platform for a successful and lucrative career in the world of professional services.