Understanding your employment classification is crucial for navigating your career and ensuring you are compensated fairly. A significant change is on the horizon for millions of U.S. workers with the U.S. Department of Labor's new rule adjusting the minimum salary threshold for exempt employees. This change, which takes full effect in 2025, will make more employees eligible for overtime pay and significantly impact how employers structure their workforce and compensation plans.

This guide will break down the new salary requirements, explain what it means to be an "exempt" employee, and analyze the key factors that influence compensation beyond this legal minimum.

What Does It Mean to Be an Exempt Employee?

The term "exempt employee" comes from the Fair Labor Standards Act (FLSA), a federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards.

- Non-Exempt Employees are covered by the FLSA and are entitled to both minimum wage and overtime pay (at a rate of 1.5 times their regular hourly rate) for any hours worked over 40 in a workweek.

- Exempt Employees are not entitled to overtime pay. To be classified as exempt, an employee must meet three specific tests:

1. Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Duties Test: The employee’s primary job duties must involve executive, administrative, or professional (EAP) tasks as defined by the Department of Labor. This is a complex test that looks at the actual responsibilities of the role, not just the job title.

3. Salary Level Test: The employee must be paid a salary that meets or exceeds a specific minimum threshold. This is the test being updated for 2024 and 2025.

If an employee fails to meet *any* of these three tests, they are considered non-exempt and are eligible for overtime pay.

The Minimum Salary Threshold for Exempt Employees: 2024 & 2025

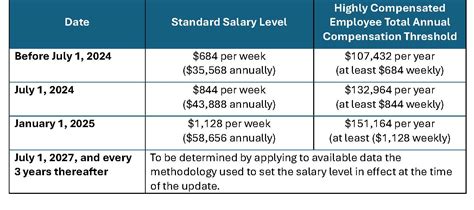

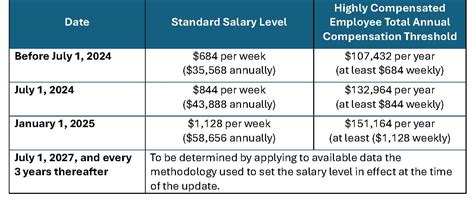

The core of the recent changes revolves around the "Salary Level Test." The U.S. Department of Labor has announced a phased increase to this minimum salary threshold. Staying informed about these dates and figures is critical for both employees and employers.

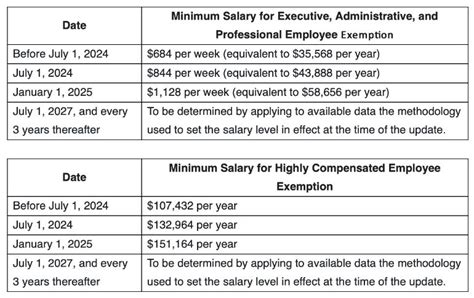

According to the U.S. Department of Labor's Final Rule issued in April 2024, the new minimum salary thresholds are as follows:

- Effective July 1, 2024: The minimum salary for exempt executive, administrative, and professional (EAP) employees will increase from $35,568 per year ($684 per week) to $43,888 per year ($844 per week).

- Effective January 1, 2025: The threshold will increase again to $58,656 per year ($1,128 per week).

Additionally, the threshold for Highly Compensated Employees (HCEs), who are subject to a more streamlined duties test, is also increasing:

- Effective July 1, 2024: The HCE total annual compensation threshold will rise to $132,964 per year.

- Effective January 1, 2025: The HCE threshold will rise again to $151,164 per year.

These federal figures represent the absolute minimum. As we will explore, your state or specific circumstances may dictate an even higher salary.

Key Factors That Influence Salary Beyond the Minimum

While the FLSA sets the legal floor, an employee's actual salary is determined by a combination of factors. The minimum threshold is a compliance benchmark, not a reflection of market value for professional roles.

### Geographic Location

The federal minimum is just that—a minimum. Many states and even some cities have their own, often higher, salary thresholds for exempt employees. Employers must comply with whichever law (federal, state, or local) is more favorable to the employee.

- High-Cost-of-Living States: States like California and New York have long maintained salary thresholds significantly higher than the federal level. For example, in 2024, California's minimum salary for exempt employees is $66,560 per year, already exceeding the upcoming 2025 federal level.

- Washington State: Washington also has a tiered system that will surpass the new federal threshold.

- Key Takeaway: Always check your state and local labor department websites for the most accurate salary requirements in your area. An employer in Los Angeles, for instance, must adhere to California's rule, not the lower federal one.

### Years of Experience

Experience is a primary driver of salary growth. While an entry-level professional might earn a salary close to the new exempt threshold, a seasoned veteran in the same role will command a much higher figure.

- Entry-Level (0-2 years): Salaries are typically lowest as the professional is still learning and developing core competencies.

- Mid-Career (3-8 years): With a proven track record, professionals can expect significant salary increases and more complex responsibilities.

- Senior/Lead (8+ years): Senior professionals and managers who lead teams or projects are valued for their strategic insight and expertise, placing their salaries well above the exempt minimum. Data from aggregators like Payscale and Salary.com consistently show a strong positive correlation between years of experience and total compensation across all professional fields.

### Level of Education

Education can directly impact both an employee's eligibility for exemption and their earning potential. The "learned professional" exemption, for instance, specifically applies to roles requiring knowledge of an advanced type (e.g., law, medicine, engineering, accounting) customarily acquired by a prolonged course of specialized intellectual instruction.

- Bachelor's Degree: This is often the baseline for many professional, exempt-level roles.

- Master's Degree/MBA: Advanced degrees often lead to higher starting salaries and faster career progression, especially in fields like finance, technology, and management consulting.

- Doctorate/Professional Degree (Ph.D., J.D., M.D.): These terminal degrees are required for the highest-paying professions, placing their holders far outside the range where the minimum salary threshold is a primary concern.

### Company Type

The size, industry, and financial health of a company heavily influence its compensation strategy.

- Industry: A software engineer at a major tech firm will have a starting salary that dwarfs the exempt minimum. Conversely, a manager at a non-profit or a small retail business may have a salary that requires closer scrutiny against the new thresholds.

- Company Size: Large, multinational corporations often have standardized, highly competitive salary bands that are well above federal and state minimums. Startups and small businesses may offer lower base salaries but supplement them with equity or other performance-based incentives.

- For-Profit vs. Non-Profit: Non-profit organizations typically have tighter budgets and may have more positions with salaries near the exempt threshold, making the 2025 update particularly impactful for this sector.

### Area of Specialization

Within any given field, specialization pays. A generalist HR manager will earn a solid salary, but an HR manager specializing in compensation and benefits analysis or labor relations for a large corporation will often earn more. According to Glassdoor data, roles in high-demand specializations like artificial intelligence, cybersecurity, and data science command premium salaries, rendering the exempt minimum a formality for those professionals.

Looking Ahead: The Future of Exempt Salary Thresholds

The 2024/2025 updates are not the end of the story. The Department of Labor's new rule includes a provision to automatically update the salary thresholds every three years, starting July 1, 2027. These future updates will be tied to current wage data to ensure the thresholds remain effective and do not erode over time due to inflation.

This signals a shift towards a more dynamic system of federal oversight. Professionals and employers should anticipate these regular adjustments as a new feature of the compliance landscape.

Conclusion

The new federal minimum salary for exempt employees marks a significant and overdue update to U.S. labor law. For professionals, it's a critical moment to understand your rights and assess your compensation.

Key Takeaways:

1. Know the Numbers: The federal minimum salary to be exempt from overtime will be $43,888/year on July 1, 2024, and $58,656/year on January 1, 2025.

2. State Law Prevails: If your state or city has a higher minimum salary threshold, your employer must follow it.

3. It’s Not Just About Salary: To be truly exempt, your job responsibilities must pass the "duties test." A high salary alone is not enough.

4. The Threshold is a Floor, Not a Ceiling: Your market value, driven by experience, education, location, and specialization, is what determines your ultimate earning potential.

For those considering a professional career path, these changes underscore the importance of fair pay and the legal protections that support it. By staying informed, you can better advocate for yourself and ensure your compensation reflects not only the legal minimum but also your true professional worth.