A career in private equity (PE) is often considered one of the most prestigious and financially rewarding paths in the world of finance. For ambitious individuals with a sharp analytical mind and a tireless work ethic, the role of a Private Equity Analyst offers unparalleled experience and a compensation package to match. But what does that salary actually look like?

While headlines often focus on multi-million dollar partner paydays, the journey begins at the analyst level. Here, total compensation can often soar well into the six-figure range even for entry-level professionals, making it one of the most lucrative starting points for a young career. This article will break down the components of a private equity analyst salary, the key factors that influence your earnings, and what you can expect from this demanding yet rewarding career.

What Does a Private Equity Analyst Do?

Before we dive into the numbers, it's essential to understand the role. A Private Equity Analyst is the engine room of a PE firm. These professionals are financial detectives and strategic architects, tasked with identifying, evaluating, and executing potential investments. Their day-to-day responsibilities are intense and varied, including:

- Financial Modeling: Building complex financial models to forecast a target company's future performance and determine its valuation.

- Due Diligence: Conducting exhaustive research on potential investment opportunities, scrutinizing everything from market positioning and competitive landscape to financial statements and operational efficiency.

- Industry Analysis: Monitoring market trends and identifying promising sectors for investment.

- Creating Presentations: Developing detailed investment memorandums and presentations for the firm's investment committee.

- Supporting Portfolio Companies: Assisting senior team members in monitoring the performance of companies the firm has already acquired.

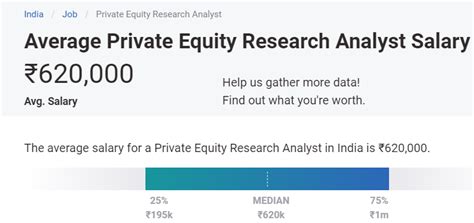

Average Private Equity Analyst Salary

Discussing PE compensation requires looking beyond a simple base salary. The compensation structure is typically divided into two main components: a base salary and a significant performance-based bonus.

According to the latest data from reputable sources like Glassdoor and Salary.com, the average base salary for a first-year Private Equity Analyst in the United States typically falls between $100,000 and $140,000 annually.

However, the base salary is only part of the story. The annual bonus is where the role’s earning potential truly shines. This bonus is tied to both individual and firm performance and can range from 50% to over 100% of the base salary.

Therefore, the total compensation for an entry-level analyst (often called a pre-MBA analyst) can realistically range from $150,000 to over $250,000 in their first year. As analysts gain experience and move to the Associate level, total compensation packages of $300,000 to $450,000 are common.

Key Factors That Influence Salary

Your specific salary within these ranges will depend on a combination of critical factors. Understanding these drivers is key to maximizing your earning potential.

###

Level of Education

A strong academic background is non-negotiable in private equity. A bachelor's degree in Finance, Economics, Accounting, or a related quantitative field from a top-tier university is the standard entry requirement. While a master's degree is not always necessary for an initial analyst position, an MBA from a highly-ranked business school is the traditional path to advancing to the post-MBA Associate role, which comes with a significant jump in both base salary and bonus potential. Furthermore, earning a professional designation like the Chartered Financial Analyst (CFA) charter can enhance a candidate's credibility and earning power.

###

Years of Experience

Private equity compensation scales dramatically with experience. The career path has a clear and steep compensation ladder.

- Analyst (0-3 Years): This is the entry point, typically for professionals with 1-2 years of prior experience in investment banking or management consulting. Total compensation is in the $150,000 - $250,000+ range.

- Associate (2-5+ Years): After a few years as an analyst or by entering post-MBA, professionals become Associates. Total compensation sees a significant increase, often ranging from $300,000 to $450,000.

- Senior Roles (Vice President, Principal, Managing Director): At these levels, compensation structures become more complex and lucrative. Base salaries and bonuses continue to grow, but a third component, "carried interest," is introduced. This is a share of the fund's profits, which can lead to seven or eight-figure paydays over the life of a successful fund.

###

Geographic Location

As with most high-finance roles, location plays a major role. The world's financial centers command the highest salaries due to the concentration of top firms and intense competition for talent.

- Top-Tier Hubs: New York City is the epicenter of private equity and offers the highest compensation packages. Other major hubs like San Francisco, Boston, and Chicago also offer salaries at the top end of the scale.

- Secondary Markets: Cities like Charlotte, Dallas, and Los Angeles have growing PE scenes and offer competitive salaries, which can be especially attractive when factoring in a lower cost of living.

###

Company Type

The size and type of the private equity firm are arguably the most significant drivers of compensation. This is typically measured by Assets Under Management (AUM).

- Mega-Funds ($20B+ AUM): Firms like Blackstone, KKR, and The Carlyle Group manage enormous pools of capital. They execute the largest deals and, consequently, pay the highest compensation at all levels.

- Upper Middle-Market & Middle-Market Funds ($1B - $20B AUM): This is the largest segment of the PE industry. These firms offer highly competitive compensation, often just a slight step down from mega-funds, and can provide excellent experience.

- Lower Middle-Market & Boutique Funds (<$1B AUM): Smaller funds may offer slightly lower base salaries and bonuses. However, they can provide incredible hands-on experience, greater responsibility early on, and potentially a better work-life balance.

###

Area of Specialization

The industry sector a fund focuses on can also impact pay. Funds specializing in high-growth, complex sectors often need analysts with specific expertise and may pay a premium for it. Currently, specialists in Technology, Software/SaaS, and Healthcare/Biotech are in high demand and can command top-tier compensation. While generalist or traditional industry funds (e.g., consumer, industrials) still pay exceptionally well, having expertise in a "hot" sector can give your earnings an extra edge.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for the broader category of "Financial Analysts" will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to the increasing complexity of financial products and the need for in-depth analysis.

While the BLS provides a positive outlook for financial analysis in general, it's crucial to note that private equity is a small and extremely competitive subset of this field. The number of analyst positions at elite firms is limited, and the competition for each spot is fierce. However, for those who successfully break in, the career trajectory and security are excellent, as skilled capital allocators are always in demand.

Conclusion

A career as a private equity analyst is undeniably demanding, but it offers one of the most compelling compensation packages available to young professionals.

Key Takeaways:

- Think Total Compensation: Your earnings are a combination of a strong base salary and a significant annual bonus, with total first-year packages often exceeding $150,000.

- Experience is King: Your salary will grow substantially as you advance from Analyst to Associate and beyond, with the introduction of carried interest creating immense long-term wealth potential.

- Firm Size and Location Matter: Aiming for a mega-fund in a major financial hub like New York City will yield the highest possible salary.

- The Path is Competitive but Rewarding: While breaking into the industry is challenging, the financial rewards, professional development, and career outlook are second to none.

For those with the ambition, analytical prowess, and dedication, a career as a private equity analyst is not just a job—it's an opportunity to operate at the pinnacle of the financial world and build a truly remarkable future.