In the world of business, projects are the engines of growth and innovation. But for any project to succeed, it must be financially sound. This is where the project accountant comes in—a specialized professional who serves as the financial guardian of a project from inception to completion. If you have a knack for numbers and a strategic mindset, this career path offers not only stability but also significant earning potential.

So, what can you expect to earn as a project accountant? While the national average provides a solid baseline, your salary can vary significantly based on your experience, location, and expertise. In this guide, we'll break down the salary expectations for a project accountant in the United States, with a median salary often landing between $75,000 and $80,000 annually. Let's explore the factors that can help you maximize your income in this rewarding field.

What Does a Project Accountant Do?

Before diving into the numbers, it’s important to understand the role. A project accountant is a hybrid of a traditional accountant and a project manager. They don't just crunch numbers; they use financial data to ensure a project remains on schedule and within budget. Their insights directly influence key business decisions and project profitability.

Key responsibilities typically include:

- Developing and maintaining project budgets and forecasts.

- Tracking all project-related costs, including labor, materials, and subcontractor expenses.

- Managing project billing and invoicing, often using specialized formats like AIA billing in construction.

- Conducting variance analysis (comparing planned costs to actual costs) and reporting findings to project managers and stakeholders.

- Ensuring compliance with contracts and regulations.

- Closing out project accounts upon completion.

Average Project Accountant Salary

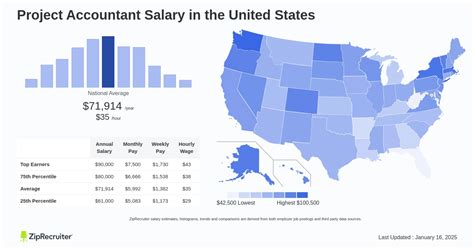

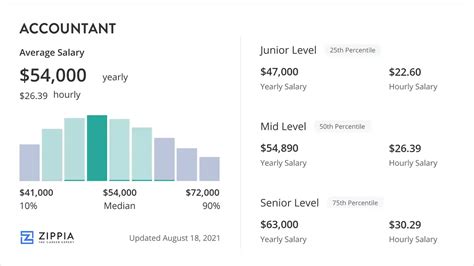

Across the United States, the salary for a project accountant is competitive and reflects the specialized skills required for the role. Based on current data, you can expect a healthy income that grows substantially with experience.

According to Salary.com, the median salary for a Project Accountant in the U.S. is approximately $78,401 as of early 2024, with a typical range falling between $68,801 and $90,101.

Other authoritative sources provide a similar picture:

- Payscale reports an average base salary of around $66,500, noting that this can rise significantly with the addition of bonuses and profit-sharing, which are common in project-based roles.

- Glassdoor estimates a total pay (base plus additional compensation) of about $76,000 per year.

It's also helpful to look at salary progression:

- Entry-Level (0-2 years): Typically earn between $55,000 and $68,000.

- Mid-Career (3-7 years): Can expect to earn between $68,000 and $85,000.

- Senior/Lead (8+ years): Often command salaries of $85,000 to $100,000+, especially when managing large-scale, complex projects.

Key Factors That Influence Salary

Your base salary is just the starting point. Several key factors can dramatically increase your earning potential. Understanding these levers is crucial for career planning.

### Level of Education

A solid educational foundation is non-negotiable. A bachelor's degree in accounting, finance, or a related business field is the standard entry requirement. However, advanced degrees and certifications can set you apart and unlock higher pay grades.

- Master's Degree: A Master of Business Administration (MBA) or a Master of Accountancy (MAcc) can provide a competitive edge, leading to higher starting salaries and faster advancement into management roles.

- Certifications: Professional certifications are a powerful salary booster.

- Certified Public Accountant (CPA): This is the gold standard in the accounting industry. Holding a CPA license demonstrates a high level of expertise and can add a 10-15% premium to your salary.

- Certified Management Accountant (CMA): Highly relevant for project accountants as it focuses on internal financial planning, analysis, and decision support.

- Project Management Professional (PMP): While not an accounting certification, a PMP demonstrates expertise in project management methodologies, making you a more valuable and versatile project team member.

### Years of Experience

Experience is perhaps the single most significant driver of salary growth. As you progress in your career, you move from executing tasks to providing strategic financial oversight, which commands a higher salary. A senior project accountant who can successfully manage a portfolio of multi-million dollar projects is an invaluable asset to any company.

### Geographic Location

Where you work matters. Salaries for project accountants vary significantly by state and city due to differences in cost of living and market demand. Metropolitan areas with a high concentration of construction, engineering, or tech companies tend to offer the highest salaries.

For example, a project accountant earning the national median of $78,000 might see that salary increase substantially in high-cost-of-living cities:

- San Jose, CA: ~ $98,000

- New York, NY: ~ $94,000

- Boston, MA: ~ $90,000

Conversely, salaries may be closer to or slightly below the national average in lower-cost-of-living areas.

### Company Type

The industry you work in and the size of your employer play a major role in your compensation package.

- Industry: Project accountants are in high demand in sectors with large, complex projects. Industries like construction, engineering, energy (oil & gas), IT/software development, and government contracting typically offer the highest salaries.

- Company Size: Large, multinational corporations often have more structured and generous compensation plans, including higher base salaries and better benefits, compared to small or mid-sized businesses.

### Area of Specialization

Developing expertise in a specific niche can make you a highly sought-after, and highly-paid, professional. Specializations often align with the industries mentioned above.

- Construction: Understanding complex billing structures (e.g., AIA G702/703), lien waivers, and job costing is a valuable skill set.

- Government Contracting: Knowledge of the Federal Acquisition Regulation (FAR) and Defense Contract Audit Agency (DCAA) compliance is a specialized and lucrative field.

- Technology/IT: Managing the finances of large-scale software implementations or infrastructure projects requires a unique understanding of capitalization rules for software development costs.

Job Outlook

The future for project accountants looks bright and stable. According to the U.S. Bureau of Labor Statistics (BLS), employment for all accountants and auditors is projected to grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

The BLS anticipates about 126,500 openings for accountants and auditors each year, on average, over the decade. This steady demand is driven by the consistent need for financial oversight in an increasingly complex global economy. As long as companies are investing in projects to grow and innovate, skilled project accountants will be essential to their success.

Conclusion

A career as a project accountant offers a dynamic, challenging, and financially rewarding path for detail-oriented professionals. With a median salary hovering in the high $70s and a clear path to earning over $100,000, it stands out as an attractive specialization within the accounting field.

To maximize your earning potential, focus on these key takeaways:

1. Build a Strong Foundation: A bachelor's degree is essential, but pursuing a CPA or other relevant certification is the fastest way to boost your credibility and salary.

2. Gain Diverse Experience: Seek out roles on larger, more complex projects to accelerate your skill development and career progression.

3. Be Strategic About Location and Industry: Target high-growth industries in major metropolitan areas to command top-tier compensation.

By combining financial acumen with project management principles, you can build a successful and lucrative career as the financial backbone of your company's most important initiatives.