So, you’re drawn to the world of quantitative finance. You’re intrigued by the intersection of complex mathematics, cutting-edge technology, and the high-stakes thrill of financial markets. You've heard whispers of astronomical salaries and intellectually stimulating work that shapes the global economy. The question is: what does the financial reality of this elite career path truly look like? How does a quantitative analyst salary progression unfold from the first day on the job to the pinnacle of the profession?

This is not just a job; it’s a vocation for the intellectually relentless. The compensation reflects that, with entry-level total packages often starting well into the six figures and top-tier professionals earning seven figures annually. It’s a field where your direct contribution—your "alpha"—is measurable and rewarded accordingly. I once had the privilege of interviewing a director at a major hedge fund who had a PhD in astrophysics. He told me, "In academia, I was modeling the universe. Here, I'm modeling a universe of risk and opportunity. The math is just as beautiful, but the feedback loop is immediate, and the impact is tangible." That conversation perfectly encapsulated the unique allure of the quant career: a place where abstract brilliance creates concrete, and often immense, value.

This guide is designed to be your definitive resource on quant salary progression. We will dissect every component of a quant's compensation, explore the factors that can dramatically increase your earnings, and lay out a clear roadmap for how to enter and thrive in this demanding yet exceptionally rewarding field.

### Table of Contents

- [What Does a Quantitative Analyst (Quant) Do?](#what-is-a-quant)

- [Average Quantitative Analyst Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence Quant Salary](#key-factors)

- [Job Outlook and Career Growth for Quants](#job-outlook)

- [How to Become a Quantitative Analyst](#how-to-start)

- [Conclusion: Is a Quant Career Right for You?](#conclusion)

What Does a Quantitative Analyst (Quant) Do?

Before we dive into the numbers, it's crucial to understand what a Quantitative Analyst—colloquially known as a "quant"—actually does. In essence, a quant is a specialist who applies mathematical and statistical methods to financial and risk management problems. They are the architects of the complex models and algorithms that drive modern finance. Think of them as the bridge between theoretical mathematics and practical, profitable application in the markets.

The role of a quant is not monolithic; it varies significantly depending on whether they work on the "buy-side" (hedge funds, asset management firms) or the "sell-side" (investment banks).

- Buy-Side Quants: These quants are focused on generating profit for the firm's own capital. They develop and implement proprietary trading strategies. Their work is directly tied to the firm's performance (PnL or Profit and Loss). This is where you'll find "alpha-seeking" quants who research new signals and build models to predict market movements.

- Sell-Side Quants: These quants typically work at investment banks. Their primary role is to develop models for pricing and hedging complex financial derivatives that the bank sells to clients (the buy-side). They also focus on creating models for risk management and electronic market-making to provide liquidity to the market.

Core Responsibilities and Daily Tasks:

A quant's day is a blend of intense research, programming, and collaboration. Common tasks include:

- Mathematical Modeling: Designing and developing sophisticated mathematical models for pricing securities (especially derivatives), evaluating risk, or predicting market trends. This involves heavy use of stochastic calculus, probability theory, and statistical analysis.

- Strategy Development and Backtesting: Creating new trading strategies based on market inefficiencies or patterns. A significant amount of time is spent "backtesting" these strategies against historical data to see how they would have performed.

- Programming and Implementation: Translating mathematical models and trading strategies into robust, efficient code, typically using languages like Python, C++, R, or KDB+/q. This code must be fast, accurate, and reliable, especially in high-frequency trading environments.

- Data Analysis and Research: Sifting through massive datasets (market data, alternative data like satellite imagery or credit card transactions) to find predictive signals. This often involves techniques from machine learning and artificial intelligence.

- Risk Management: Building models to quantify and manage the various risks a firm is exposed to, including market risk, credit risk, and operational risk.

### A Day in the Life of a Buy-Side Quant Researcher

To make this more concrete, let's walk through a hypothetical day for a mid-level quant researcher at a hedge fund in New York City.

- 7:30 AM: Arrive at the office. Grab a coffee and review overnight market movements in Asia and Europe. Check the performance of the strategies currently running in production. Did any of them behave unexpectedly?

- 8:00 AM: Morning research meeting. The team discusses a new research paper on using natural language processing (NLP) to analyze central bank statements. They brainstorm how this could be adapted into a new trading signal.

- 9:00 AM: Deep work session. The quant continues working on her main project: developing a new mid-frequency statistical arbitrage strategy for equities. This involves cleaning and processing a large tick-data dataset and then using Python with libraries like `Pandas`, `NumPy`, and `Statsmodels` to identify statistical relationships between stocks.

- 12:00 PM: Lunch, often eaten at the desk while reading financial news or industry blogs like Quantpedia or Wilmott. The market is most active, so it's a good time to observe any unusual patterns.

- 1:00 PM: Coding and backtesting. The quant has a preliminary version of her new strategy. She writes a backtesting script to simulate how it would have performed over the last five years of market data. The initial results are promising but show a large drawdown in 2020.

- 3:00 PM: Collaboration and debugging. She meets with a senior quant to review the backtest results. The senior suggests adding a new risk filter to the model to better handle periods of high volatility. They spend an hour debugging a tricky section of the C++ implementation used for the simulation engine to ensure its accuracy.

- 4:30 PM: The US market is closing. She runs a script to analyze the day's trading logs, looking for execution inefficiencies or data quality issues.

- 5:30 PM: Afternoon project. She shifts focus to a smaller task: improving the data-cleaning pipeline for an alternative dataset the firm recently purchased. This is less glamorous than strategy development but absolutely critical for the quality of all research.

- 6:30 PM - 7:00 PM: Wrap up. She commits her latest code to the firm's repository with detailed comments, documents her findings from the day's research, and outlines her plan for tomorrow. Before leaving, she takes one last look at the performance dashboard.

This "day in the life" illustrates the highly analytical, data-intensive, and problem-solving nature of the job. It’s a career for those who are passionate about uncovering hidden patterns and building systems to capitalize on them.

Average Quantitative Analyst Salary: A Deep Dive

Quantitative analyst compensation is legendary in the professional world, and for good reason. It’s one of the few career paths where a recent graduate with a specialized advanced degree can command a starting total compensation package approaching or even exceeding $200,000. However, the salary structure is far more complex than a simple monthly paycheck. It's crucial to understand the two main components: Base Salary and Performance Bonus.

- Base Salary: This is the fixed, guaranteed portion of your annual income. It is competitive and generally high to attract top talent, but it is often the smaller part of the total compensation, especially for experienced quants at top firms.

- Performance Bonus: This is the variable, and often much larger, portion of compensation. It's typically paid out once a year (in January or February) and is directly tied to a combination of individual performance, team performance, and the overall profitability of the firm. For quants on the buy-side, this bonus can be a direct percentage of the PnL their strategies generated. This is why quant compensation can reach astronomical levels—if your models make the firm hundreds of millions, your bonus can be in the millions.

### National Averages and Salary Progression

It's difficult to provide a single "average" salary due to the extreme variability. However, we can analyze data from authoritative sources to build a clear picture of the salary progression.

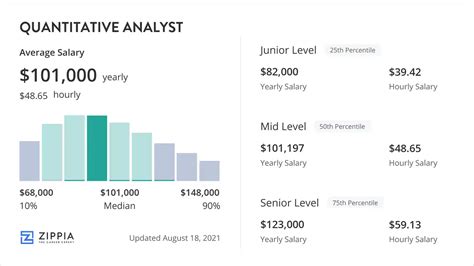

According to Salary.com, as of late 2023, the median base salary for a Quantitative Analyst in the United States is around $111,590, with a typical range falling between $96,590 and $128,190. However, this figure primarily reflects base salary and can be misleading as it often underrepresents the massive impact of bonuses, especially at top-tier firms.

Glassdoor reports a higher average base salary of $134,800 per year, with total compensation figures (including bonuses and stock) often reaching much higher. User-reported data on platforms like Wall Street Oasis and eFinancialCareers, which specialize in finance careers, provide a more realistic picture of total compensation.

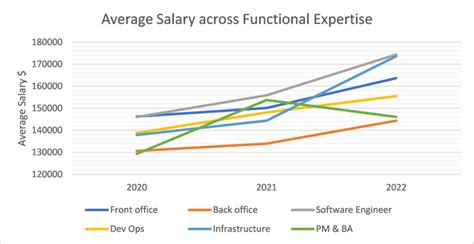

Here is a more representative breakdown of total compensation (Base + Bonus) by experience level, synthesized from industry reports and specialized salary aggregators. These figures are most representative of major financial hubs like New York and Chicago.

#### Quantitative Analyst Compensation by Experience Level (Total Compensation)

| Experience Level | Years of Experience | Typical Educational Background | Base Salary Range | Total Compensation Range | Notes |

| ----------------------- | ------------------- | --------------------------------- | ----------------------- | ---------------------------- | ----------------------------------------------------------------------------------------------------------------------------------------- |

| Entry-Level Quant | 0-2 Years | PhD or Master's in a STEM field | $125,000 - $175,000 | $175,000 - $350,000+ | PhDs typically command the higher end. Includes a significant sign-on bonus (often $50k-$100k). |

| Mid-Career Quant | 3-7 Years | PhD or Master's | $175,000 - $250,000 | $350,000 - $750,000+ | Now has a track record of PnL. Bonus is a significant multiplier of base salary. May begin to get a small share of the team's bonus pool. |

| Senior Quant | 8-15 Years | PhD or Master's | $250,000 - $350,000 | $750,000 - $2,000,000+ | Often leads a small team or manages a significant book of strategies. Compensation is heavily tied to the performance of their strategies/team. |

| Principal / Director | 15+ Years | PhD or Master's | $350,000 - $500,000+ | $2,000,000 - $10,000,000+ | Top-tier performers at elite funds. Compensation is almost entirely driven by PnL. May have a stake in the firm (partnership). |

*Sources: Synthesized from data on Glassdoor, Salary.com, eFinancialCareers, Selby Jennings reports, and Wall Street Oasis community data (2022-2023).*

### A Deeper Look at Compensation Components

Beyond base and bonus, the package includes several other valuable components:

- Sign-On Bonus: This is a one-time bonus paid upon joining a firm. For highly sought-after PhD graduates, this can range from $50,000 to $100,000 or more. It is used to offset bonuses the candidate may be forfeiting by leaving their previous firm and to make an offer more attractive.

- Stub Bonus: If you join mid-year, you'll often receive a pro-rated bonus for your first partial year at the firm.

- Deferred Compensation: A portion of a large bonus may be "deferred," meaning it is paid out over several years. This is often in the form of cash or stock and is contingent on the employee remaining with the firm, acting as "golden handcuffs."

- 401(k) and Retirement Plans: Most firms offer a 401(k) plan with a company match, which is an essential part of long-term wealth building.

- Health and Wellness Benefits: Top-tier firms provide comprehensive health, dental, and vision insurance with low premiums. Many also offer benefits like gym memberships, wellness stipends, and free meals, which add significant quality-of-life value.

- Relocation Packages: For candidates moving to a major financial hub, firms often provide generous relocation packages that can cover moving expenses, temporary housing, and other associated costs.

Understanding this complete picture is vital. A job offer with a slightly lower base salary but a historically higher bonus structure and a large sign-on bonus can be far more lucrative than an offer with a high base but a low variable component. The quantitative analyst salary progression is less about the base salary increase and more about the exponential growth of the performance-based bonus as one's impact on the firm's profitability grows.

Key Factors That Influence Quant Salary

While the average salary figures provide a baseline, a quant's actual earnings are subject to immense variation. Several key factors determine whether a quant's compensation is merely excellent or truly extraordinary. Mastering and optimizing these factors is the key to accelerating your salary progression.

### 1. Level of Education: The Entry Ticket

In the world of quantitative finance, your educational background is your foundational credential. It's the first filter recruiters use to identify suitable candidates. The hierarchy is quite clear, and it directly impacts starting salary and career trajectory.

- Bachelor's Degree: It is extremely rare for an undergraduate to land a front-office quant researcher role at a top hedge fund or investment bank directly. A bachelor's degree in a highly quantitative field (e.g., Mathematics, Computer Science, Physics, Statistics from a top-tier university like MIT, Stanford, or an Ivy League school) might be sufficient for a quant *developer* role or a position at a smaller, less-known firm. However, the salary potential will be on the lower end of the entry-level spectrum.

- Master's Degree: This is often considered the standard entry-level requirement. A Master's in Financial Engineering (MFE), Financial Mathematics, Statistics, or Computer Science is the most common path into the industry. Graduates from top MFE programs (like those at Carnegie Mellon, Baruch, NYU, or UC Berkeley) are aggressively recruited. A Master's degree holder can expect a starting total compensation package in the $175,000 to $275,000 range.

- Doctor of Philosophy (PhD): A PhD is the gold standard, particularly for quant researcher roles at elite hedge funds and proprietary trading firms. These firms are looking for individuals with deep, original research experience. They don't just want people who can apply known models; they want people who can *invent* new ones. PhDs in Physics, Mathematics, Statistics, and Computer Science are highly prized. A PhD signals exceptional analytical ability, persistence, and the capacity for independent research. Consequently, PhDs command the highest starting salaries, often with total first-year compensation packages reaching $300,000 to $450,000 or more, including substantial sign-on bonuses.

Certifications: While formal degrees are paramount, certifications like the Financial Risk Manager (FRM) or Chartered Financial Analyst (CFA) can be beneficial, particularly for roles in quant risk management or on the sell-side. They demonstrate a commitment to the finance domain but do not replace the need for a strong quantitative academic background.

### 2. Years of Experience: The Proven Track Record

Experience is the single most powerful driver of salary progression after education. The financial world is a meritocracy, and a quant's value is ultimately measured by their ability to generate profits (alpha) or manage risk effectively.

- 0-2 Years (Analyst/Associate): At this stage, you are learning the ropes. Your work involves implementing and testing models designed by senior quants, cleaning data, and supporting the team's infrastructure. Your compensation is high but is more of a reflection of your potential than your direct PnL contribution. Total compensation: $175k - $350k.

- 3-7 Years (Vice President/Mid-Level Quant): You have now developed a proven track record. You are expected to contribute original ideas, lead smaller research projects, and mentor junior quants. Your bonus becomes a much more significant portion of your total compensation and is more directly tied to the performance of the strategies you work on. Total compensation: $350k - $750k.

- 8-15 Years (Senior Quant/Director): You are now a leader. You may be responsible for a whole area of research (e.g., "volatility arbitrage" or "machine learning signals for equities"). You are responsible for a significant amount of the team's or firm's PnL. Your compensation is heavily skewed towards your bonus, which can be many multiples of your base salary. Total compensation: $750k - $2M+.

- 15+ Years (Managing Director/Principal): At this level, you are part of the firm's senior leadership. You may manage a large team of quants and traders, oversee a significant portion of the firm's capital, or be a "star" researcher whose name carries weight in the industry. Your compensation can be astronomical, often including a share of the firm's overall profits (partnership). Total compensation: $2M - $10M+.

### 3. Geographic Location: The Financial Hub Premium

Where you work matters immensely. Quant salaries are not uniform across the country or the world; they are heavily concentrated in major financial centers where the cost of living is high, and the competition for talent is fierce.

- Top Tier (New York City, Chicago): New York is the undisputed global center of finance, and quant salaries there are the highest. Chicago is a major hub for proprietary trading and derivatives, also commanding top-tier salaries. A mid-career quant in NYC might earn $600,000 in total compensation.

- Second Tier (London, Hong Kong, San Francisco/Bay Area): These are major international or tech-focused hubs with a strong demand for quants. Salaries are very competitive, though perhaps slightly lower than in NYC after adjusting for taxes and cost of living. A similar quant in London or the Bay Area might earn $500,000 - $550,000.

- Emerging Hubs (Houston, Austin, Miami, Zurich): These cities have a growing finance or energy trading scene. While salaries are still very strong, they are generally lower than in the top-tier hubs. The same quant might earn $350,000 - $450,000 here, but the lower cost of living can make this financially attractive.

- Other Locations: Quant roles exist in other cities, often within the asset management arms of insurance companies or regional banks. Salaries here will be significantly lower, reflecting a lower cost of living and less intense competition.

| Location | Estimated Mid-Career Total Comp | Notes |

| ------------------- | ------------------------------- | ---------------------------------------------------------------- |

| New York, NY | $550,000 - $750,000+ | The global epicenter. Highest salaries and bonuses. |

| Chicago, IL | $500,000 - $700,000+ | Center for proprietary trading and options. Very high compensation. |

| San Francisco, CA | $450,000 - $650,000 | Hub for FinTech and quantitative asset management. |

| Houston, TX | $350,000 - $500,000 | Strong in energy trading and commodities. |

| Boston, MA | $350,000 - $500,000 | Major center for asset management firms. |

### 4. Company Type & Size: The Buy-Side vs. Sell-Side Divide

The type of firm you work for is perhaps the most significant determinant of your earning potential, even more so than experience in some cases.

- Hedge Funds and Proprietary Trading Firms (Buy-Side): This is the pinnacle of quant compensation. Firms like Renaissance Technologies, Jane Street, Citadel, D.E. Shaw, and Two Sigma are known for paying the absolute highest salaries. Their business model is to directly profit from their trading strategies, so a successful quant's value is clear and directly rewarded. Bonuses are a direct function of PnL and can be enormous.

- Investment Banks (Sell-Side): Firms like Goldman Sachs, J.P. Morgan, and Morgan Stanley employ large teams of quants. Their roles involve pricing derivatives, building risk models, and developing algorithms for market-making. While compensation is excellent, it is generally lower and less volatile than at top hedge funds. Bonuses are tied more to the bank's overall performance and the desk's revenue, rather than an individual's specific PnL. A senior quant here might earn in the high six figures or low seven figures, whereas a counterpart at a top hedge fund could earn multiples of that.

- Asset Management Firms: This category includes traditional mutual funds and investment managers like BlackRock, Vanguard, and Fidelity. They employ quants to develop systematic investment strategies (often called "quantitative equity" or "factor investing"). The pace is often less frantic than at a hedge fund, and the compensation, while very good, is generally lower and more stable, with a smaller bonus component.

- FinTech and Big Tech Companies: A growing number of quants are finding roles at companies like Stripe, Square, or even Google and Amazon. They work on problems like fraud detection, credit risk modeling, dynamic pricing, and forecasting. Compensation is competitive and often includes a significant stock/equity component, which can have massive upside but is different from the cash bonus structure of Wall Street.

### 5. Area of Specialization: Not All Quants Are Created Equal

Within the quant world, there are various specializations, and they have distinct compensation profiles.

- Quant Trader / Alpha Researcher: This is typically the highest-paid role. These quants are on the front line, developing and executing the strategies that make money. Their compensation has the highest beta to their own performance.

- Quant Developer: These quants build the high-performance infrastructure—the trading systems, backtesting engines, and data pipelines—that researchers use. They are experts in low-latency programming (C++) and systems architecture. Their compensation is extremely high, as they are a critical enabler of profitability, though slightly less variable than a researcher's.

- Machine Learning Quant: A newer and highly in-demand specialization. These quants apply techniques like deep learning, NLP, and reinforcement learning to financial data. Given the hype and potential of AI, they command a premium salary.

- Quant Risk Analyst: These quants build the models that measure and manage the firm's risk. It is a critical function, and they are well-compensated, but their pay is generally more stable and less stratospheric than that of alpha-generating quants.

- Model Validation Quant (MVQ): These quants act as an independent check on the models developed by the front office. They try to find flaws in the models before they can cause losses. It's a stable