For professionals and students with a passion for mathematics, statistics, and computer science, the role of a quantitative researcher—often called a "quant"—represents a pinnacle of intellectual challenge and financial reward. This demanding career path attracts top-tier talent for a reason: the compensation is among the highest in any industry. While salaries can start well into six figures, the total compensation for experienced quants at elite firms can soar into the millions.

This article provides a data-driven breakdown of what you can expect to earn as a quantitative researcher, the key factors that dictate your salary, and the promising outlook for this prestigious profession.

What Does a Quantitative Researcher Do?

Before diving into the numbers, it's essential to understand the role. Quantitative researchers are the architects of modern financial markets and data-driven industries. They use advanced mathematical models, statistical analysis, and programming skills to identify and capitalize on patterns, anomalies, and opportunities.

In finance, their primary goal is to develop and implement trading strategies. Their responsibilities typically include:

- Developing Models: Creating complex mathematical models to predict market movements.

- Backtesting Strategies: Using historical data to test the viability and profitability of a trading idea.

- Programming & Implementation: Writing the code that executes trading strategies, often in languages like Python, C++, or R.

- Data Analysis: Sifting through massive datasets (market data, alternative data, etc.) to find exploitable signals.

While most associated with finance, quants also work in tech, insurance, and other data-heavy fields, applying similar skills to problems like ad optimization, risk management, and supply chain logistics.

Average Quantitative Researcher Salary

The compensation for a quantitative researcher is highly variable but consistently impressive. It's crucial to distinguish between base salary and total compensation, as performance-based bonuses often constitute a significant portion—sometimes multiples—of the base pay, especially in finance.

According to data from salary aggregator Glassdoor, the estimated total pay for a Quantitative Researcher in the United States is around $216,000 per year, with an average base salary of approximately $155,000 per year (as of late 2023).

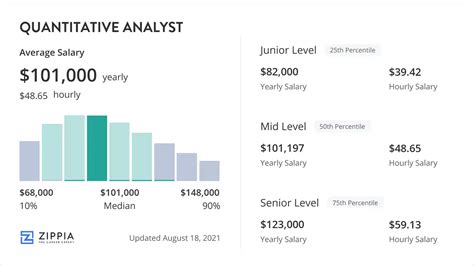

Salary ranges can be broken down by experience level:

- Entry-Level (0-2 years): A quantitative researcher with a Master's or PhD degree but little professional experience can expect a base salary between $120,000 and $175,000. Total compensation, including a signing bonus and a first-year performance bonus, can push this figure well over $200,000.

- Mid-Career (3-8 years): With a proven track record, a mid-career quant can command a base salary from $175,000 to $250,000. Their performance bonus becomes a much larger factor, often bringing total compensation into the $300,000 to $700,000 range, depending on the firm and individual performance.

- Senior/Principal (8+ years): Senior quants who lead teams or manage significant trading strategies can earn base salaries exceeding $250,000 to $350,000+. Their total compensation is heavily tied to the profitability of their strategies (their "P&L" or Profit and Loss), and it's not uncommon for top performers at hedge funds to earn $1 million or more annually.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a direct category for "Quantitative Researcher." The closest proxy is "Operations Research Analysts," which the BLS reports had a median pay of $85,720 per year in May 2022. This lower figure reflects a broader range of industries, including government and manufacturing, and does not capture the extreme top-end salaries found specifically in finance and tech hubs.

Key Factors That Influence Salary

Your earning potential as a quant is not a single number but a range determined by several critical factors.

###

Level of Education

Education is a primary gatekeeper for this field. While exceptional candidates can break in with a Bachelor's, advanced degrees are the norm and directly impact starting salary.

- Ph.D.: A doctorate in a quantitative field (e.g., Physics, Mathematics, Statistics, Computer Science, Engineering) is the gold standard. Ph.D. holders are sought for their deep theoretical knowledge and rigorous research experience. They command the highest starting salaries and are often fast-tracked for roles involving novel strategy development.

- Master's Degree: A Master's in Financial Engineering (MFE), Quantitative Finance, Data Science, or a related field is a very common and effective entry point into the industry.

- Bachelor's Degree: A Bachelor's degree from a top-tier university with a major in a quantitative discipline can be sufficient for entry-level roles, particularly in programming-heavy or quant trading assistant positions.

###

Years of Experience

Experience is paramount. As a quant builds a track record of creating profitable or impactful models, their value and compensation skyrocket. The most significant jumps in compensation come from performance bonuses, which grow exponentially as a researcher proves their ability to generate revenue for the firm. An experienced quant with a transferable "P&L" is one of the most sought-after professionals in the financial world.

###

Geographic Location

Where you work matters immensely. Salaries are significantly higher in major financial and tech hubs to account for the concentration of top firms and the high cost of living.

- Top Tier Cities: New York City and Chicago are the traditional epicenters of quantitative finance in the U.S. and command the highest salaries. The San Francisco Bay Area is another top location, driven by tech firms and quantitative hedge funds.

- Other Hubs: Cities like Boston, Austin, and Houston also have growing quant communities and offer competitive, albeit slightly lower, compensation packages.

###

Company Type

The type of company you work for is arguably the single biggest determinant of your total compensation.

- Elite Hedge Funds and Proprietary Trading Firms (e.g., Jane Street, Citadel, Renaissance Technologies, Two Sigma): These firms offer the highest potential compensation. Their bonus structures are directly tied to the firm's and the individual's profitability, leading to multi-million dollar paydays for top performers.

- Investment Banks (e.g., Goldman Sachs, JPMorgan Chase): Large banks have extensive quantitative research teams for derivatives pricing, risk management, and algorithmic trading. Compensation is excellent but generally more structured and with lower bonus potential than at top hedge funds.

- Big Tech Companies (e.g., Google, Meta, Amazon): Quants in tech work on problems like programmatic advertising, search algorithms, and logistics. Compensation is highly competitive, often featuring large stock grants, though cash bonuses may be smaller than in finance.

- Asset Management Firms and Consulting: These roles also require quantitative skills but typically offer lower compensation packages compared to the high-stakes world of proprietary trading.

###

Area of Specialization

Within the quant world, some specializations are more lucrative than others. Roles that are closer to direct revenue generation tend to pay more.

- High-Frequency Trading (HFT) and Statistical Arbitrage: These roles are at the cutting edge of strategy development and can be extremely profitable, leading to very high bonuses.

- Machine Learning / AI: As AI becomes more integral to finding signals in noisy data, specialists in this area are in incredibly high demand.

- Derivatives Pricing and Risk Management: While sometimes seen as a more traditional area, these roles are fundamentally critical to the operation of large financial institutions and are compensated accordingly.

Job Outlook

The future for quantitative researchers is exceptionally bright. The increasing computerization of markets and the explosion of available data mean that demand for individuals who can translate complex data into actionable insights has never been higher.

The BLS projects that employment for Operations Research Analysts will grow 23 percent from 2022 to 2032, which is "much faster than the average for all occupations." Similarly, related fields like Data Scientists and Market Research Analysts are also projected to see much-faster-than-average growth. This signals a sustained, long-term demand for quantitative talent across multiple industries.

Conclusion

The path to becoming a quantitative researcher is rigorous, demanding advanced education, exceptional analytical ability, and a relentless drive to solve complex problems. However, the rewards are commensurate with the challenge.

For aspiring quants, the key takeaways are:

- Aim High on Education: An advanced degree in a quantitative discipline is your entry ticket.

- Focus on Impact: Your long-term earnings are directly tied to the value and profitability you create.

- Choose Your Employer Wisely: The type of firm you join will be the biggest driver of your total compensation.

- Never Stop Learning: This field evolves rapidly, and staying on top of new techniques in machine learning, statistics, and programming is essential for career longevity and growth.

For those with the right blend of skills and ambition, a career as a quantitative researcher is one of the most intellectually stimulating and financially rewarding paths available in the modern economy.