The allure of real estate development is powerful—it’s a career where you can literally shape the skylines of cities and build communities from the ground up. Beyond the satisfaction of creating tangible assets, it's a profession renowned for its significant financial potential. But what does a real estate developer *really* earn?

The answer is complex, with salaries influenced by a host of factors from location to specialization. While entry-level associates might start with a respectable salary, seasoned executives at top firms can earn seven-figure incomes through a combination of base pay, bonuses, and profit-sharing. This guide will break down the components of a real estate developer's salary, explore the key drivers of income, and provide a clear picture of your potential earnings in this dynamic field.

What Does a Real Estate Developer Do?

Before diving into the numbers, it's essential to understand the role. A real estate developer is the entrepreneur—or intrapreneur, if working within a larger company—who orchestrates the entire property development process. Think of them as the conductor of an orchestra, bringing together a diverse team of professionals to turn a vision into a reality.

Key responsibilities include:

- Site Acquisition: Identifying and purchasing land or properties with development potential.

- Market & Financial Analysis: Conducting due diligence to ensure a project is financially viable.

- Financing: Securing equity and debt to fund the project.

- Entitlements & Zoning: Navigating complex government approvals and zoning laws.

- Design & Construction Oversight: Managing architects, engineers, and construction managers.

- Leasing & Marketing: Developing and executing a strategy to sell or lease the finished property.

It's a high-stakes, high-reward role that requires a blend of financial acumen, negotiation skills, and project management expertise.

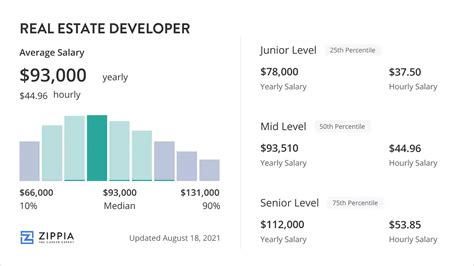

Average Real Estate Developer Salary

A real estate developer's compensation is often more than just a base salary; it typically includes a significant performance-based bonus or a share in the project's profits. This is a critical distinction when evaluating earnings.

- Average Base Salary: According to recent data from major salary aggregators, the average base salary for a Real Estate Development Manager in the United States typically falls between $115,000 and $130,000.

- Typical Total Compensation Range: When including bonuses and profit-sharing, the range expands dramatically.

- Salary.com reports a median salary of approximately $122,500, with a typical range falling between $96,000 and $152,000 for a mid-level Development Manager.

- Glassdoor lists an average base pay of $118,000, with "additional pay" (bonuses, etc.) averaging over $26,000, pushing the total average compensation closer to $144,000.

- Payscale notes that salaries can range from $75,000 for entry-level positions to over $175,000 for experienced senior developers, before considering the substantial impact of bonuses.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Real Estate Developer." The closest classification, "Property, Real Estate, and Community Association Managers," shows a median pay of $60,180 per year (May 2022). This category is much broader and includes roles with significantly different responsibilities and lower pay scales, so it should not be considered an accurate reflection of a developer's earnings.

Key Factors That Influence Salary

Your specific salary as a developer will be determined by a combination of personal qualifications and market forces. Here’s a breakdown of the most influential factors.

### Level of Education

While you can break into real estate development from various backgrounds, a relevant degree provides a significant advantage. Common undergraduate degrees include Finance, Business, Economics, Civil Engineering, and Urban Planning. However, to access top-tier salaries, many professionals pursue advanced degrees. An MBA with a concentration in Finance or Real Estate or a specialized Master's in Real Estate Development (MRED) from a reputable university can significantly increase earning potential and open doors to leadership roles at major firms. These programs provide advanced financial modeling skills, industry connections, and a deep understanding of market dynamics.

### Years of Experience

Experience is arguably the most critical factor in determining a developer's salary and bonus potential. The career path has a clear and lucrative progression:

- Entry-Level (0-3 Years): Roles like Development Analyst or Associate focus on financial modeling, market research, and supporting senior staff. Base salaries typically range from $75,000 to $95,000, with smaller, more structured bonuses.

- Mid-Career (4-10 Years): As a Development Manager, you take on project-level responsibility, managing timelines, budgets, and teams. Base salaries often climb to $110,000 - $160,000, and bonus potential grows substantially as you become directly tied to project success.

- Senior/Executive (10+ Years): At the Director or Vice President level, you are responsible for sourcing deals, securing major financing, and setting the strategic vision. Base salaries often exceed $180,000 - $250,000+, but the majority of compensation comes from large bonuses and "carried interest"—a direct share of the project's profits, which can lead to seven-figure annual earnings.

### Geographic Location

Real estate is intrinsically local, and so are its salaries. Developers in major metropolitan areas with high property values and strong economic growth command the highest salaries.

- Top-Tier Markets: Cities like New York, San Francisco, Boston, and Los Angeles consistently offer the highest compensation due to the complexity and scale of projects and a high cost of living.

- Strong Secondary Markets: Rapidly growing cities like Austin, Denver, Nashville, and Seattle also offer highly competitive salaries as development activity booms.

- Regional Differences: Salaries in the Northeast and on the West Coast tend to be higher than in the South and Midwest, though this gap is closing in major Sun Belt cities.

### Company Type

The type of firm you work for has a profound impact on your compensation structure.

- Large National/Global Developers (e.g., Hines, Related Companies): These firms typically offer higher base salaries, structured bonus programs, and excellent benefits. The path is more corporate, but the financial stability is strong.

- Boutique or Regional Firms: These smaller, more localized companies may offer slightly lower base salaries but provide a greater opportunity for significant profit-sharing or equity in projects. The entrepreneurial upside can be immense.

- Corporate Real Estate: Working "in-house" for a large corporation (like Google or Target) or an institution (like a hospital system) to manage their real estate portfolio offers stability and competitive salaries, though often with less performance-based upside than a pure development firm.

- Entrepreneurial (Self-Employed): Starting your own development company presents the highest risk and the highest potential reward. Your income is tied directly to your ability to find and execute profitable deals.

### Area of Specialization

The type of asset you develop also matters. Some sectors are more complex or capital-intensive, requiring specialized expertise that commands higher pay.

- Multifamily Residential: A consistently strong sector, especially in urban areas.

- Industrial/Logistics: Currently one of the hottest sectors, driven by the growth of e-commerce. Expertise in developing large-scale warehouses and distribution centers is highly valued.

- Commercial Office: Development of Class A office towers in major business districts is complex and can be highly lucrative.

- Mixed-Use: Large, complex projects that combine retail, residential, and office space require a sophisticated skill set and often yield higher compensation for the development team.

Job Outlook

While the BLS doesn't track developers directly, the outlook for related professions signals continued health for the industry. The BLS projects that employment for Construction Managers will grow 5 percent from 2022 to 2032, faster than the average for all occupations.

The demand for real estate developers is fundamentally tied to economic and population growth. As long as cities expand, businesses need space, and people need places to live, there will be a need for skilled developers to lead these projects. Current trends, such as the housing shortage in many markets, the reshoring of manufacturing, and the redevelopment of aging urban centers, suggest a robust future for the profession.

Conclusion

A career as a real estate developer offers a unique opportunity to build a lasting legacy while achieving significant financial success. While the headline "average salary" provides a starting point, it's crucial to understand that your true earning potential is uncapped and directly linked to your performance.

For those considering this path, the key takeaways are:

- Think Total Compensation: Focus on the combination of base salary, bonus, and profit-sharing, as this is where the highest earnings are made.

- Experience is King: Your value and income will grow exponentially as you gain hands-on experience and build a track record of successful projects.

- Location Matters: Target major metropolitan areas or high-growth secondary markets to maximize your earning potential.

- Specialize and Network: Building expertise in a high-demand sector and cultivating a strong professional network are essential for long-term success.

For the ambitious, analytical, and resilient individual, a career in real estate development is not just a job—it's a pathway to becoming a primary driver of economic growth and community creation.