Introduction

For millions of entrepreneurs, consultants, and small business owners, forming an S Corporation is a pivotal moment. It’s a declaration of legitimacy, a strategic move for growth, and most notably, a powerful tool for optimizing taxes. But with this power comes a critical responsibility that is often misunderstood and fraught with peril: paying yourself a "reasonable salary." This isn't a job title, but a crucial IRS requirement that sits at the very heart of the S corp advantage. Get it right, and you unlock significant tax savings. Get it wrong, and you could face daunting audits, back taxes, and penalties.

The concept of a "reasonable salary" can feel nebulously complex, leaving many business owners asking, "How much should I actually pay myself?" The answer isn't a single number. Instead, it’s a carefully calculated figure based on your unique role, skills, experience, and market realities. While a nationwide analysis shows that the salary an S corp owner pays themselves can range from $40,000 to over $200,000 annually, the "reasonable" part is what truly matters. This guide is designed to demystify that process entirely.

I've spent years advising professionals on career and financial strategy, and I once worked with a brilliant graphic designer who had just formed her S corp. She was taking minimal salary and massive distributions, thinking she’d brilliantly outsmarted the tax system. A year later, an IRS inquiry letter arrived, turning her world of creative freedom into a nightmare of financial anxiety and paperwork. Her story underscores a vital lesson: understanding and documenting your reasonable salary isn't just about compliance; it's about building a sustainable, stress-free foundation for your business.

This article will serve as your definitive roadmap. We will dissect the IRS’s expectations, provide you with the tools and data to perform your own salary analysis, and walk you through a step-by-step process for setting and justifying your compensation with confidence.

### Table of Contents

- [Understanding the 'Reasonable Salary' Requirement for an S Corp](#understanding-the-reasonable-salary-requirement-for-an-s-corp)

- [How to Determine Your Reasonable Salary: A Deep Dive](#how-to-determine-your-reasonable-salary-a-deep-dive)

- [Key Factors That Influence Your Reasonable Salary](#key-factors-that-influence-your-reasonable-salary)

- [The Outlook for S Corp Owners and Business Growth](#the-outlook-for-s-corp-owners-and-business-growth)

- [How to Set and Document Your S Corp Salary: A Step-by-Step Guide](#how-to-set-and-document-your-s-corp-salary-a-step-by-step-guide)

- [Conclusion: Building Your Business on a Foundation of Confidence](#conclusion-building-your-business-on-a-foundation-of-confidence)

Understanding the 'Reasonable Salary' Requirement for an S Corp

Before we can determine what a reasonable salary *is*, we must first understand *why* it exists. Unlike a traditional job title, "reasonable salary for s corp" is a tax compliance concept. At its core, it's a rule established by the Internal Revenue Service (IRS) to prevent a specific type of tax avoidance.

An S Corporation is a "pass-through" entity. This means the company's profits and losses are "passed through" to the owners' personal tax returns, avoiding the double taxation that C Corporations face (where the company pays corporate tax, and shareholders pay tax on dividends). The key benefit for an S corp owner lies in how their income is categorized. It's split into two types:

1. W-2 Salary: This is the official wage the owner pays themselves as an employee of their own company. This income is subject to FICA taxes (Social Security and Medicare), which currently total 15.3% (split between employee and employer, but since you're both, you pay it all).

2. Shareholder Distributions: This is the remaining profit paid out to the owner. Crucially, distributions are *not* subject to self-employment (FICA) taxes.

Herein lies the temptation. An owner might want to pay themselves a very low salary (e.g., $10,000/year) and take the rest of their company's profit (e.g., $150,000) as distributions, thereby avoiding 15.3% in FICA taxes on that large sum. The IRS is well aware of this strategy. To counteract it, they mandate that any S corp owner who provides more than minor services to their company must pay themselves a "reasonable compensation"—a salary—*before* taking any distributions. This reasonable salary must reflect the fair market value of the services the owner provides to the business.

### A "Day in the Life" of an S Corp Owner's Financial Decisions

To make this tangible, let's imagine a day for "Alex," a solo IT consultant who runs her business as an S Corp.

Morning (9:00 AM - 12:00 PM): The Work

Alex spends her morning deep in client work. She’s migrating a client's server infrastructure to the cloud, a complex project requiring specialized skills in AWS, network security, and database management. She is acting as a Senior Cloud Architect.

Afternoon (1:00 PM - 3:00 PM): The Business Operations

After lunch, Alex switches hats. She sends out invoices, follows up on late payments, updates her project management software, and responds to three new potential client inquiries. Here, she's acting as a Project Manager and an Accounts Receivable Clerk.

Late Afternoon (3:00 PM - 5:00 PM): The CEO Role

Alex spends the last two hours on business development. She researches potential new service offerings, updates her website with a new case study, and has a networking call with a potential strategic partner. This is the work of a CEO or Business Development Manager.

At the end of the month, when it's time to run payroll, Alex can't just pay herself a random low number. She must look at the value of the hats she wore—Senior Cloud Architect, Project Manager, CEO—and determine a salary that an outside company would realistically pay someone to perform those duties. This figure is her "reasonable salary." Only after that salary is paid via payroll (with taxes withheld) can she take the remaining profit from her successful month as a tax-advantaged distribution.

How to Determine Your Reasonable Salary: A Deep Dive

Determining your reasonable salary isn't a guessing game; it's a research project. The goal is to arrive at a defensible figure that you could justify to the IRS if ever questioned. The IRS itself doesn't provide a magic formula or a calculator. Instead, it expects you to use the same methods any business would use to set compensation for a new hire. This involves gathering objective, third-party data based on the actual work you perform.

There are three primary methods for calculating your reasonable salary, which should ideally be used in conjunction to build the strongest case.

### Method 1: The Comparable Market Research Approach

This is the most common and widely accepted method. You research what other companies are paying employees in similar roles, with similar experience, in your geographic area. The key is to be honest and specific about the job you do. You're not just a "business owner"; you are a Marketing Director, a Lead Software Engineer, a Financial Advisor, or a combination of roles.

Step-by-Step Market Research:

1. Define Your Role(s): As seen with Alex, you likely wear multiple hats. List them out. Identify your primary value-driving role (e.g., Senior Graphic Designer) and your secondary roles (e.g., Bookkeeper, Sales Manager).

2. Allocate Time: Estimate the percentage of your time you spend on each role. For example: 70% as a Senior Graphic Designer, 20% on sales, and 10% on administration.

3. Gather Salary Data: Use authoritative sources to find salary data for these roles in your specific location.

Authoritative Data Sources:

- U.S. Bureau of Labor Statistics (BLS): The BLS Occupational Outlook Handbook (OOH) is the gold standard for unbiased national and state-level data. It provides median pay, job descriptions, and educational requirements.

- Reputable Salary Aggregators: Websites like Salary.com, Payscale, and Glassdoor offer more granular data, often allowing you to filter by city, years of experience, and company size. They are excellent for finding a realistic range.

- Industry-Specific Surveys: Professional associations (e.g., the American Institute of Architects) often publish their own salary surveys, which can be highly specific and authoritative for your field.

- Recruiting Firm Reports: Staffing and recruiting firms like Robert Half publish annual salary guides that are packed with valuable, up-to-date market data for various industries (Finance, Tech, Marketing, etc.).

Example Calculation:

Let's say you're a web developer in Denver, CO, running your S-corp.

- Primary Role (80%): Senior Web Developer

- Secondary Role (20%): Project Manager

Your research yields the following data for Denver:

| Data Source | Senior Web Developer (Denver) | Project Manager (IT) (Denver) |

| :--- | :--- | :--- |

| BLS (National Median) | ~$78,300 (Web Developers) | ~$95,370 (Computer & IS Managers) |

| Salary.com | $110,000 - $135,000 | $115,000 - $140,000 |

| Glassdoor | Average Base: $125,000 | Average Base: $122,000 |

| Payscale | Average: $105,000 | Average: $98,000 |

You'd then calculate a weighted average. Using the mid-range Glassdoor figures for simplicity:

- ($125,000 * 0.80) + ($122,000 * 0.20) = $100,000 + $24,400 = $124,400

In this scenario, a reasonable salary would likely fall in the $115,000 to $130,000 range. Setting your salary at $125,000 would be a highly defensible position, supported by robust market data.

### Method 2: The Multiple Factors Approach (The IRS's View)

The IRS itself outlines a series of factors that courts have used to determine if compensation is reasonable. Your research from Method 1 will feed directly into justifying your salary based on these factors. We will explore these factors in exhaustive detail in the next section, but they include:

- Your training and experience.

- Your duties and responsibilities.

- The time and effort you devote to the business.

- Compensation amounts paid by similar businesses for similar services.

- The use of a compensation formula and its consistent application.

Keeping detailed records of how your situation aligns with these factors is crucial for audit-proofing your salary decision.

### Method 3: The Source of Income Approach

This is a more conceptual check. Ask yourself: "What is the true source of my company's income?"

- Is it primarily from my personal services? If you are a consultant, designer, writer, or lawyer, your clients are paying for *you* and your expertise. In this case, a much larger portion of the company's net income should be allocated to your salary.

- Is it from the work of other employees or significant capital/equipment? If you own a construction company with a crew of 10 and expensive machinery, the income is generated by the combination of your management, your employees' labor, and your capital assets. In this case, your reasonable salary would be for your management role, and a larger portion of the profit could be considered a return on your capital investment (taken as a distribution).

This approach helps you gut-check your calculation. If 95% of your business's value comes directly from your brain and hands, a salary that accounts for only 20% of the profits is a major red flag for the IRS.

By combining market data, an analysis of the official IRS factors, and a conceptual understanding of your business's revenue sources, you move from guesswork to a data-driven, defensible compensation strategy.

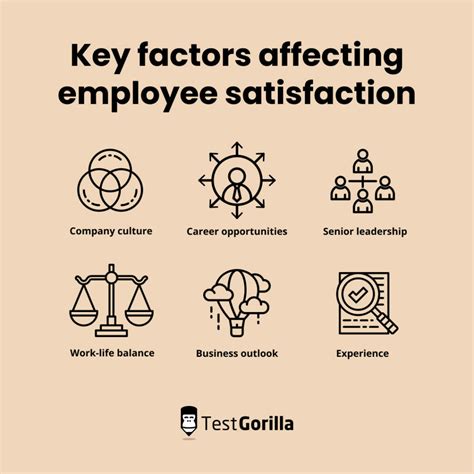

Key Factors That Influence Your Reasonable Salary

This section is the heart of your justification. When the IRS assesses whether your salary is "reasonable," they are not looking for a specific number. They are looking at the *process and logic* you used to arrive at that number. Each of the following factors should be considered and, ideally, documented in your internal company records. We will explore each one in detail, providing concrete examples and data points.

###

Level of Education & Specialized Training

Your formal education, professional certifications, and specialized training directly increase your market value. A third-party hiring manager would pay more for a candidate with advanced credentials, and you should compensate yourself accordingly.

- Impact of Degrees: An S corp owner with a Master's degree or Ph.D. in their field can justify a significantly higher salary than someone with a Bachelor's or Associate's degree. For example, according to the U.S. Bureau of Labor Statistics (BLS), professionals with a master's degree earn a median of nearly 18% more than those with only a bachelor's degree.

- Certifications: Industry-standard certifications are tangible proof of expertise.

- Example (IT): An IT consultant with a Certified Information Systems Security Professional (CISSP) certification can command a premium salary. Salary.com data for 2023 shows that IT professionals holding a CISSP can see a salary bump of 5-10% or more compared to non-certified peers. If the base salary for a Cybersecurity Analyst in your city is $100,000, your CISSP could justify a reasonable salary of $110,000 or more.

- Example (Finance): A financial advisor operating their own S corp who holds the Certified Financial Planner (CFP) designation has a higher market value than one without. This designation is a strong justification for a higher salary.

- Example (Marketing): A marketing consultant with certifications in Google Ads and Analytics or who is a HubSpot Certified Partner can justify a higher rate and salary because these skills are in high demand and demonstrably linked to revenue generation.

Actionable Advice: Make a list of all your degrees, certifications, and significant training courses. For each, research the typical salary premium associated with it in your profession. This creates a powerful piece of documentation.

###

Years of Experience

Experience is one of the most significant determinants of compensation. You must benchmark your salary against professionals with a similar level of experience. Classify yourself honestly into one of the following tiers.

- Entry-Level (0-3 years): If you've recently started your professional career and your S corp is one of your first ventures, your reasonable salary should align with entry-level or junior positions in your field. It would be difficult to justify a six-figure salary if your peers with 2 years of experience are making $60,000.

- Mid-Career (4-10 years): You have a proven track record of success, require less supervision, and can handle complex projects independently. Your salary should reflect this.

- Senior/Expert (10+ years): You are a leader in your field. You may have a history of managing teams, directing major projects, and developing strategy. Your reasonable salary should align with senior, principal, or director-level roles.

Salary Growth Trajectory Example: Software Developer

Let's look at how experience impacts the salary for a Software Developer, using a blend of data from the BLS and Payscale for a more nuanced view.

| Experience Level | Typical Title | Approximate Salary Range (National Average) | Justification |

| :--- | :--- | :--- | :--- |

| 0-3 Years | Junior Developer | $65,000 - $90,000 | Focuses on coding specific modules, bug fixes, and learning the codebase. Requires significant mentorship. |

| 4-10 Years | Mid-Level/Senior Developer | $95,000 - $140,000 | Can lead small projects, design system components, and mentor junior developers. Works independently. |

| 10+ Years | Principal/Lead Engineer | $145,000 - $200,000+ | Responsible for system architecture, technical strategy, setting standards, and guiding the entire engineering function. |

An S corp owner with 15 years of software development experience who is the sole technical expert in their company should be setting their reasonable salary in the "Principal/Lead" range, not the "Junior" range.

###

Geographic Location

Where your business operates has a massive impact on salary expectations. Cost of living and local market demand for your skills create huge salary variances across the country. A $100,000 salary might be high for a role in rural Mississippi but low for the exact same role in San Francisco.

High-Paying vs. Low-Paying Metropolitan Areas:

Using data from the BLS Metropolitan Area Occupational Employment and Wage Statistics, we can see clear disparities.

Example: Marketing Manager (BLS Occupational Code 11-2021)

| Metropolitan Area | Annual Mean Wage (May 2022 Data) | Justification |

| :--- | :--- | :--- |

| San Jose-Sunnyvale-Santa Clara, CA | $233,180 | High concentration of tech companies, intense competition for talent, and extremely high cost of living. |

| New York-Newark-Jersey City, NY-NJ-PA | $211,410 | Major hub for advertising, finance, and media, driving up demand and salaries. High cost of living. |

| Dallas-Fort Worth-Arlington, TX | $166,440 | Strong and growing business hub with a more moderate cost of living than coastal cities, but still competitive. |

| Omaha-Council Bluffs, NE-IA | $140,110 | Solid Midwestern business center with a lower cost of living, resulting in more moderate salary levels. |

| Huntsville, AL | $125,570 | Lower cost of living and different industry mix leading to different salary benchmarks. |

*(Source: BLS Occupational Employment and Wage Statistics, Marketing Managers, May 2022)*

Actionable Advice: Your salary research *must* be geographically specific. Use the location filters on Salary.com and Glassdoor. If you live in a high-cost-of-living area (HCOL), you have a solid justification for a higher reasonable salary. Conversely, if you try to justify a San Francisco-level salary while operating out of a small town in the Midwest, the IRS may question it.

###

Company Type & Size

The type and scale of your business matter. The IRS considers the complexity and volume of your responsibilities.

- Company Size (Revenue & Employees): Managing a business with $2 million in annual revenue and five employees is objectively more complex than managing a solo operation with $150,000 in revenue. The owner of the larger business can justify a higher salary based on the increased scope of responsibility (payroll, HR, team management, larger financial risk).

- Startup vs. Established Business: In the very early days of a business (pre-revenue or low-revenue), it's considered reasonable to take a lower-than-market-rate salary, or even no salary, as long as you are also not taking distributions. However, once the company is profitable and able to pay, the salary should be adjusted upward to a reasonable market rate. You cannot perpetually underpay yourself once the money is there.

- Profitability: A highly profitable company is expected to pay its key employees (including the owner) more. If your S corp has a net profit of $500,000, setting your salary at $40,000 is a significant red flag. This signals a clear intent to avoid payroll taxes. Conversely, if the business only profited $70,000, a salary of $65,000 with a $5,000 distribution is perfectly reasonable.

###

Area of Specialization

Within any given profession, some specializations are more lucrative than others due to demand and required expertise. This nuance is critical for pinpointing your true market value.

- Example (Law): A general practice attorney will have a different reasonable salary than a highly specialized patent attorney who works with tech companies. Patent law requires a specific technical background and commands a premium.

- Example (Consulting): A general management consultant's market rate will differ from that of a cybersecurity consultant specializing in threat intelligence for financial institutions. The latter's niche skills and the high-stakes nature of their work justify a higher salary.

- Example (Marketing): A "Marketing Consultant" is broad. A consultant specializing in Marketing Automation for B2B SaaS companies has a very specific, high-demand skill set. Researching salaries for this niche will yield a more accurate and justifiable figure than looking at general marketing roles.

###

In-Demand Skills

Beyond formal titles and specializations, specific skills can dramatically increase your value. If you possess skills that are critical to your company's success and are in high demand in the market, they must be factored into your salary.

High-Value Skills List (Examples):

- Technical Skills: Artificial Intelligence/Machine Learning, Cloud Computing (AWS, Azure, GCP), Data Science and Analytics, Cybersecurity, Blockchain development.

- Business Skills: Financial Modeling, Advanced Sales and Negotiation (especially for high-ticket items), Digital Marketing (SEO/SEM, conversion rate optimization), Product Management, Capital Raising.

- Creative Skills: UI/UX Design for complex applications, Video Production and Motion Graphics, High-end Copywriting for specific industries (e.g., finance, healthcare).

If your S corp's primary service is AI consulting, your expertise in machine learning algorithms isn't just a "skill"—it's the core asset of the business. Your salary should reflect the high market rate for AI specialists. Documenting these specific skills and providing market data on their value is a key part of justifying your compensation.

The Outlook for S Corp Owners and Business Growth

Choosing the S corp structure and navigating the reasonable salary requirement is not just a short-term tax strategy; it's a long-term plan for professional and financial growth. The landscape for small businesses, freelancers, and independent consultants is more dynamic than ever, with trends pointing towards sustained opportunities for entrepreneurial success.

### The Rise of the Entrepreneurial Workforce

The traditional 9-to-5 career path is no longer the only route to success. Data consistently shows a strong and growing trend toward self-employment and small business formation. According to the U.S. Small Business Administration (SBA), small businesses are a vital engine of the economy, creating 1.5 million net new jobs annually in recent years. This cultural and economic shift means that more professionals than ever are becoming S corp owners, increasing the pool of resources, communities, and tools available to support them.

The outlook is particularly strong in knowledge-based industries. The U.S. Bureau of Labor Statistics (BLS) projects that management, professional, and related occupations are poised for significant growth. For instance:

- Management Occupations: Projected to grow 8% from 2021 to 2031, much faster than the average for all occupations, resulting in about 883,900 new jobs. Many of these roles will be filled by consultants and agency owners operating as S corps.

- Computer and Information Technology Occupations: This field is expected to explode with 15% growth over the decade, adding approximately 682,800 new jobs. Freelance developers, cybersecurity experts, and IT consultants are prime candidates for the S corp structure.

- Marketing Professionals: As businesses of all sizes increase their digital footprint, the need for skilled marketing consultants continues to grow. The BLS projects a 10% growth for Marketing and Advertising Managers, well above the national average.

What this data signifies for you, the S corp owner, is that the demand for the expert services you provide is likely to remain strong or even increase. This sustained demand is the foundation upon which you can grow your business and, consequently, your reasonable salary.

### Emerging Trends and Future Challenges

To thrive as an S corp owner in the coming years, it's crucial to stay ahead of key trends and prepare for challenges:

1. The Gig Economy Matures: The "gig economy" is evolving from simple freelance tasks to high-value, project-based consulting. This "expert economy" favors seasoned professionals who can offer strategic guidance, creating more opportunities for high-earning S corp consultancies.

2. AI and Automation: Artificial intelligence will be both a tool and a competitive threat. Savvy S corp owners will leverage AI to automate administrative tasks (bookkeeping, scheduling, marketing), freeing them up to focus on high-value client work. They will also need to continuously upskill to ensure their services are not rendered obsolete by AI platforms.

3. Increased Regulatory Scrutiny: As the number of pass-through entities like S corps grows, so does the potential for IRS scrutiny. The IRS has received increased funding specifically to target tax gaps, and the reasonable salary issue is a known area of focus. This makes meticulous record-keeping and a well-justified salary more important than ever.

4. The Importance of a Personal Brand: In a crowded market, a strong personal brand is a key differentiator. S corp owners who invest in thought leadership—through writing, speaking, or social media—can command higher rates and attract better clients, directly supporting a higher reasonable salary.

### How to Stay Relevant and Grow Your Salary

Your reasonable salary is not static. It should evolve as your business and your own expertise grow.

- Annual Salary Review: Just like a traditional employee, you should conduct a formal salary review for yourself every single year. Re-run the market research, re-evaluate your roles and responsibilities, and adjust your salary up or down as dictated by the data and your company's profitability. Document this review.

- Continuous Learning: Invest in new skills and certifications. If you see a new technology or methodology gaining traction in your industry, be the first to master it. This directly translates to a higher market value.

- Scale Your Business: As you grow your revenue, you can justify a higher salary. This may involve raising your prices, taking on more clients, or even hiring employees. As your role shifts from just a "doer" to a "manager" or "CEO," your reasonable salary should increase to reflect that added complexity and responsibility.

The future for dedicated, well-informed S corp owners is bright. By embracing growth, adapting to new trends, and maintaining diligent compliance, you can ensure your business not only survives but thrives, providing you with both professional fulfillment and optimized financial rewards.

How to Set and Document Your S Corp Salary: A Step-by-Step Guide

Theory is important, but execution is everything. This section provides a practical, step-by-step playbook for setting your reasonable salary and creating the documentation necessary to defend it. Think of this as creating your "Reasonable Compensation Report" for your internal files.

### Step 1: Formally Define Your Role and Responsibilities

You cannot determine a salary for a job that hasn't been defined. Create a formal job description for yourself as if you were hiring an outside candidate for the role.

- Create a Document: Title it "Job Description: [Your Name], [Your Primary Title]" (e.g., "Job Description: Jane Doe, Lead Marketing Strategist").

- List Key Responsibilities: Be specific. Instead of "do marketing," write "Develop and execute multi-channel digital marketing campaigns, including SEO, PPC, and email marketing. Manage a budget of $X. Analyze campaign performance using Google Analytics and present monthly reports to key stakeholders."

- Detail All Roles: If you wear multiple hats, create sections for each. For instance:

- Lead Marketing Strategist (70%): [List of strategic duties]

- Sales Manager (20%): [List of business development duties]

- Office Administrator (10%): [List of administrative duties]

- Note Qualifications: List your experience, education, and certifications. "Requires 12+ years of experience in