Welcome to the definitive guide on one of the most pivotal roles in the professional services world: the Senior Associate at PricewaterhouseCoopers (PwC). If you're an ambitious professional aiming for a career at a Big Four firm, or you're already an Associate looking toward your next promotion, you’ve likely asked the critical question: "What is a Senior Associate PwC salary, and what does it take to get there?"

This article goes beyond simple numbers. We will dissect the compensation, explore the multifaceted role itself, and lay out a comprehensive roadmap for achieving this prestigious position. A career as a PwC Senior Associate is more than a job; it's a launchpad for leadership, offering unparalleled experience, a powerful network, and a compensation package that reflects the high-stakes work you'll be doing. The national average total compensation for this role often lands between $90,000 and $130,000, but as you'll soon discover, this figure is just the starting point.

I once mentored a bright, young accountant who felt stuck as a second-year Associate. She was performing well but couldn't see the path to the "Senior" title and the accompanying salary bump. By breaking down the specific skills, performance metrics, and networking strategies—the very same ones we'll cover here—she was able to position herself for a top-tier performance review and secure her promotion ahead of schedule. Her success underscores a vital truth: understanding the mechanics of your career path is just as important as doing the work itself.

This guide is designed to give you that understanding. We will provide the data, context, and actionable advice you need to not only comprehend a PwC Senior Associate's salary but to actively pursue and maximize it.

### Table of Contents

- [What Does a PwC Senior Associate Do?](#what-does-a-pwc-senior-associate-do)

- [PwC Senior Associate Salary: A Deep Dive](#pwc-senior-associate-salary-a-deep-dive)

- [Key Factors That Influence a PwC Senior Associate's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for a PwC Senior Associate](#job-outlook-and-career-growth)

- [How to Become a PwC Senior Associate](#how-to-get-started-in-this-career)

- [Is a PwC Senior Associate Career Worth It?](#conclusion)

What Does a PwC Senior Associate Do?

A Senior Associate at PwC is not an entry-level position; it's the first significant step into a management track within the firm. Typically achieved after two to three years of experience as an Associate, the "Senior" title signifies a mastery of technical fundamentals and a growing capacity for leadership, project management, and direct client interaction.

While the core function is to execute high-quality work for clients, the *nature* of that work varies dramatically depending on the Line of Service (LoS).

Core Responsibilities Across All Lines of Service:

- Project Execution and Oversight: Seniors are the on-the-ground leaders of an engagement. They take the strategy set by Managers and Partners and break it down into actionable tasks for Associates.

- Supervising and Coaching Junior Staff: A significant part of the role involves reviewing the work of Associates (first and second-years), providing feedback, and coaching them on technical skills and firm methodologies.

- Direct Client Contact: Unlike Associates who may have limited client interaction, Seniors are often the primary day-to-day contact for the client's team. They handle status updates, request information (PBC lists in audit), and resolve minor issues.

- Risk Management: They are responsible for identifying potential risks in an engagement—be it an accounting irregularity, a tax compliance issue, or a project delay—and escalating them to the Manager.

To make this tangible, let's break down the role by PwC's main service lines:

- Assurance (Audit): An Audit Senior Associate is the quarterback of the audit team. They plan the audit, assign sections (e.g., Cash, Accounts Receivable, Inventory) to Associates, perform complex testing on high-risk areas, and draft the financial statements and audit reports. They live and breathe accounting standards like GAAP and IFRS.

- Tax: A Tax Senior Associate might specialize in corporate tax compliance, international tax, M&A tax, or transfer pricing. Their work involves preparing and reviewing complex tax returns, researching intricate tax law, and developing tax planning strategies for clients.

- Advisory (Consulting and Deals): This is the most diverse line of service.

- In Deals/Transaction Services, a Senior Associate might perform financial due diligence (FDD) on a target company for a private equity client, build financial models, or assist with post-merger integration.

- In Consulting, they could be doing anything from implementing a new cloud ERP system (like Workday or Salesforce), developing a cybersecurity strategy, or helping a client with a major business transformation. The work is project-based, and the skills required are often highly specialized.

#### A Day in the Life: Audit Senior Associate (During Busy Season)

- 7:30 AM: Arrive at the client site. Grab coffee and set up your workstation. Quickly scan emails that came in overnight from the offshore team who reviewed workpapers while you were sleeping.

- 8:00 AM: Huddle with your two Associates. Outline the day's goals: "Jane, I need you to finish testing revenue samples. Tom, please follow up with the client's controller about that accounts payable aging report. I'll be working on the inventory valuation model."

- 10:00 AM: The client's controller emails you with a question about a complex leasing standard. You spend 45 minutes researching the specific guidance in the firm's technical library and drafting a clear, concise response.

- 12:00 PM: Quick team lunch. You use this time to check in with your Associates on a personal level and see how they're handling the busy season pressure.

- 1:00 PM: Jump on a call with your Manager to provide a status update. You flag a potential issue you've found in the inventory reserve calculation that might require more testing. The Manager agrees and asks you to scope out the extra work required.

- 3:00 PM: Review Jane's work on revenue testing. You find a few minor errors, which you explain to her patiently, showing her how to correct them and why it's important. This is a crucial coaching moment.

- 5:00 PM: The client finally sends over the data you need for the inventory analysis. You spend the next few hours working heads-down in Excel and the firm's proprietary data analytics software (like Alteryx or Power BI).

- 7:30 PM: You pack up, making sure to send a status update to your Manager and a to-do list for the offshore team. You grab dinner (paid for by the firm) on your way home, knowing you'll do it all again tomorrow.

This example highlights the blend of technical accounting, project management, and people skills that define the Senior Associate role.

PwC Senior Associate Salary: A Deep Dive

Now for the central question: How much does a PwC Senior Associate earn? The compensation structure at a Big Four firm is multifaceted, consisting of a base salary, an annual performance bonus, and a range of other benefits and perks.

It's crucial to understand that there isn't one single salary. Compensation is highly dependent on the factors we'll discuss in the next section, primarily geographic location and line of service.

#### National Average Salary and Range

Based on an aggregation of recent data from authoritative sources, the typical salary landscape for a PwC Senior Associate in the United States looks like this:

- Average Base Salary: $98,500 per year

- Typical Base Salary Range: $82,000 to $125,000 per year

- Average Total Compensation (Base + Bonus): $105,000 per year

- Typical Total Compensation Range: $90,000 to $140,000+ per year

Data Sources: These figures represent a synthesized average from data reported in early 2024 by platforms such as Glassdoor, Levels.fyi, Payscale, and anonymized user-submitted data on forums like Fishbowl and Reddit's /r/accounting.

- Glassdoor reports an average PwC Senior Associate salary of approximately $99,000 in base pay, with additional cash compensation (bonuses) averaging around $7,000.

- Levels.fyi, which is particularly strong for consulting and tech-adjacent roles within Advisory, often shows higher ranges, with total compensation packages for Senior Associates in high-cost-of-living areas frequently exceeding $130,000, especially in specialized consulting practices.

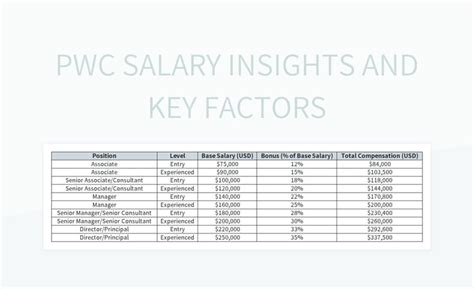

#### Salary by Experience Level: The PwC Career Progression

A Senior Associate is a single step in a long and lucrative career ladder. Understanding your place on this ladder provides crucial context for your salary expectations. The progression is fairly standardized, with promotions and salary increases tied to annual performance reviews.

| Career Level | Typical Years of Experience | Typical Base Salary Range (National Average) | Key Responsibilities |

| ------------------------ | --------------------------- | --------------------------------------------- | --------------------------------------------------------- |

| Associate (A1/A2) | 0-2 Years | $65,000 - $85,000 | Executing assigned tasks, learning firm methodology, testing |

| Senior Associate (S1-S3) | 2-5 Years | $82,000 - $125,000 | Supervising Associates, managing workstreams, client contact |

| Manager | 5-8 Years | $130,000 - $180,000 | Managing entire engagements, budgets, and client relationships |

| Senior Manager | 8-12 Years | $170,000 - $220,000+ | Managing multiple engagements, business development, mentoring |

| Director / Partner | 12+ Years | $250,000 - $1,000,000+ | Driving firm strategy, selling work, firm leadership |

*Source: Analysis of data from Glassdoor, Levels.fyi, and industry reports.*

As you can see, the promotion to Senior Associate represents a significant jump in both responsibility and compensation—often a 20-30% increase from a second-year Associate's salary. Within the Senior Associate level itself, there are typically three tiers (S1, S2, S3), each with a corresponding salary increase of 5-10% annually, performance permitting.

#### Deconstructing Total Compensation

Your paycheck is more than just your base salary. To get a complete picture, you must consider all components of compensation.

1. Base Salary: This is your fixed, bi-weekly or monthly pay. It forms the largest part of your compensation and is the number most influenced by your location, service line, and experience level.

2. Annual Performance Bonus: This is a variable component paid out once a year (typically in the fall). It is based on two main factors: the firm's overall financial performance and your individual performance rating.

- Performance Ratings: PwC uses a rating system. A top-rated ("high-performing") Senior Associate might receive a bonus of 10-15% of their base salary, while an average-rated one might receive 5-8%. A low-rated employee may receive no bonus.

- Typical Bonus Amount: For a Senior Associate, this can range from $4,000 to $15,000.

3. Signing & CPA Bonuses:

- CPA Bonus: To incentivize licensure, PwC offers a significant one-time bonus for passing the CPA exam, often $5,000. They also typically cover the cost of study materials and exam fees.

- Signing Bonus: While more common for campus hires and experienced hires at the Manager level and above, a signing bonus may be offered to a Senior Associate hired from a competitor, potentially ranging from $5,000 to $10,000.

4. Benefits and Perks (The "Hidden" Salary): The value of PwC's benefits package is substantial and should be factored into your total compensation analysis.

- Retirement: A 401(k) plan with a generous company match. For example, PwC may contribute 25% of your own contributions, up to 6% of your salary, and add a discretionary profit-sharing contribution on top of that, which can amount to several thousand dollars per year.

- Health & Wellness: Comprehensive medical, dental, and vision insurance. PwC also provides significant wellness subsidies (e.g., $1,000+ per year) that can be used for gym memberships, fitness classes, or mental health apps.

- Parental Leave: Industry-leading paid parental leave policies.

- Unlimited PTO: While the policy is "unlimited," in practice, usage is subject to engagement needs. However, it provides flexibility that fixed-accrual systems do not.

- Professional Development: The firm invests heavily in training, professional certifications (beyond the CPA), and continuing professional education (CPE).

When you add up the base salary, a potential bonus, the firm's 401(k) contributions, and the cash value of perks like the wellness subsidy, the "total rewards" package for a Senior Associate can easily be 15-20% higher than the base salary alone.

Key Factors That Influence a PwC Senior Associate's Salary

Your salary as a PwC Senior Associate is not a monolith. It's a dynamic figure determined by a complex interplay of variables. Understanding these factors is the key to negotiating your offer effectively, making strategic career choices, and maximizing your long-term earning potential. This section is the most critical for anyone serious about this career path.

### 1. Area of Specialization (Line of Service)

This is arguably the most significant factor influencing your salary *within* PwC. Not all service lines are created equal in terms of revenue generation and client billing rates, which directly translates to employee compensation.

- Assurance (Audit): This is the firm's traditional bedrock. While essential and prestigious, audit work is often seen as a commodity, leading to intense fee pressure from clients. As a result, Assurance salaries typically form the baseline for compensation at the firm.

- *Typical HCOL Senior Associate Base Salary (e.g., NYC):* $95,000 - $110,000

- Tax: Tax is slightly more specialized than audit. Niches like M&A Tax or International Tax can command higher fees and thus higher salaries than general compliance work. Compensation is generally on par with or slightly higher than Assurance.

- *Typical HCOL Senior Associate Base Salary:* $100,000 - $115,000

- Advisory (Consulting & Deals): This is where the highest salaries are found. Advisory work involves solving complex, high-stakes business problems, and clients are willing to pay a premium for this expertise.

- Deals / Transaction Services (FDD): Financial Due Diligence is a highly sought-after skill. The work is intense and deadline-driven, supporting M&A activity. Compensation is significantly higher than in Audit/Tax.

- *Typical HCOL Senior Associate Base Salary:* $110,000 - $130,000 (Bonuses are also much larger, often 15-25%).

- Strategy& (PwC's Strategy Consulting Arm): This is the elite tier of consulting within PwC. They compete with firms like McKinsey, BCG, and Bain. Salaries here are the highest in the firm and follow a separate, more aggressive compensation model. A Senior Associate equivalent could easily earn a base of $150,000+ with a substantial bonus.

- Tech / Cloud / Cybersecurity Consulting: With the boom in digital transformation, consultants who can implement platforms like Salesforce, Workday, or SAP, or advise on cybersecurity strategy, are in high demand. Their pay reflects this.

- *Typical HCOL Senior Associate Base Salary:* $115,000 - $140,000+

Why the difference? It comes down to billing rates. An Audit Senior Associate might be billed to the client at $200-$300 per hour. A Deals or Tech Consulting Senior Associate could be billed at $400-$600+ per hour. That difference in revenue generation flows directly to payroll.

### 2. Geographic Location

Cost of Living Adjustments (COLAs) are a primary driver of salary variance across the United States. PwC maintains different salary bands for cities based on the local market rate and cost of living.

Here's a comparative table to illustrate the dramatic impact of location on a Senior Associate's base salary (using Audit/Tax as a baseline):

| Tier | Representative Cities | Typical Base Salary Range | Rationale |

| ----------------------- | -------------------------- | ------------------------- | ------------------------------------------------------------------------------ |

| High Cost of Living (HCOL) | New York City, San Francisco, San Jose, Boston | $95,000 - $120,000+ | Extremely high housing, tax, and daily living costs demand a significant salary premium. |

| Mid-to-High Cost of Living (MCOL) | Chicago, Los Angeles, Washington D.C., Atlanta, Dallas | $88,000 - $105,000 | Competitive markets with moderate-to-high living costs. |

| Low Cost of Living (LCOL) | Kansas City, Charlotte, Tampa, Pittsburgh, St. Louis | $82,000 - $95,000 | Lower living costs allow the firm to offer more moderate, yet still competitive, salaries. |

*Source: Cross-referenced data from Levels.fyi and Glassdoor city-specific reports for 2023/2024.*

It is critical to note that a higher salary in an HCOL city does not always mean more disposable income. A $110,000 salary in Manhattan may feel tighter than a $90,000 salary in Charlotte after taxes and rent are paid. However, starting your career in an HCOL market can lead to a higher long-term salary trajectory, as future percentage-based raises will be off a larger base.

### 3. Level of Education and Professional Certifications

While a Bachelor's degree in Accounting, Finance, or a related field is the standard entry requirement, advanced credentials can significantly impact your salary and career velocity.

- Bachelor's vs. Master's Degree: For most roles, particularly in Assurance and Tax, a Master of Accountancy (MAcc) or Master of Taxation (MTax) is highly valued. It's often the most direct path to obtaining the 150 credit hours required for CPA licensure. While it may not provide a huge initial salary bump over a Bachelor's degree hire, it accelerates the path to the CPA, which *does* impact pay.

- The Power of the CPA: The Certified Public Accountant (CPA) license is the gold standard in the accounting world.

- Promotion Prerequisite: At PwC, you cannot be promoted to Manager in the Assurance or Tax lines of service without being a licensed CPA.

- Direct Financial Incentives: As mentioned, PwC offers a $5,000 bonus for passing the exam.

- Implicit Salary Impact: Holding a CPA signals a high level of technical competence and professionalism, which factors into performance reviews and, consequently, into your annual raises and bonus allocations. It makes you a more valuable and versatile asset.

- Other High-Value Certifications:

- CFA (Chartered Financial Analyst): Extremely valuable in Deals, Transaction Services, and Valuation practices. Can add a significant premium to your salary.

- PMP (Project Management Professional): Highly regarded in the Consulting practice, demonstrating formal project management skills.

- CISA (Certified Information Systems Auditor): A key certification for IT Audit and Risk Assurance professionals, leading to higher pay in that niche.

- Specialized Tech Certifications: AWS/Azure/Google Cloud certifications, Salesforce certifications, or Cybersecurity certs (like CISSP) are almost mandatory for high pay in the tech consulting space.

### 4. Years of Experience (Within the "Senior" Role)

The "Senior Associate" title is not a single-year role. It typically spans two to three years, often designated as S1, S2, and S3. Your compensation grows as you progress through these years.

- First-Year Senior (S1): This is the newly promoted Senior. They are just beginning to take on supervisory responsibilities.

- *Example Salary (MCOL):* $88,000

- Second-Year Senior (S2): By now, the Senior is comfortable leading smaller engagements or significant sections of larger ones. They are a reliable go-to for the Manager.

- *Example Salary (MCOL):* $94,000 (assuming a 6-7% annual raise)

- Third-Year Senior (S3): This is the "Manager-in-waiting." They are often running engagements with minimal oversight and are actively developing the skills needed for the next level. This is a critical year for proving your readiness for promotion.

- *Example Salary (MCOL):* $101,000 (assuming another 6-7% annual raise)

Your annual performance rating heavily influences these raises. A top-performer might see a 10% raise, while a lower-performer might only get a 2-3% cost-of-living adjustment.

### 5. Company Type & Size (PwC vs. The World)

While this article focuses on PwC, a Senior Associate's salary is benchmarked against the broader market. Understanding this context is crucial, especially when considering career moves.

- PwC vs. Other Big Four (Deloitte, EY, KPMG): Compensation is generally very similar across the Big Four, often within a 5% variance for the same role, location, and service line. They are in a constant talent war and must remain competitive. Deloitte's consulting arm often pays a slight premium, pushing others to match.

- vs. Mid-Tier Firms (e.g., Grant Thornton, BDO, RSM): National and large regional firms typically pay slightly less than the Big Four, perhaps a 5-15% discount. They offer a different value proposition, often with better work-life balance, but their brand prestige and exit opportunities are generally not considered as strong.

- vs. "Industry" (Corporate Accounting/Finance Roles): This is the most common "exit opportunity." A Senior Associate leaving PwC for a "Senior Accountant" or "Financial Analyst" role at a Fortune 500 company can often expect a 15-25% salary increase. They trade the intense hours and "up-or-out" culture for better work-life balance and a higher base salary. However, bonus potential may be lower, and career progression can be slower.

### 6. In-Demand Skills

Beyond formal certifications, possessing specific, high-demand skills can make you a more valuable asset and lead to better project assignments, higher performance ratings, and ultimately, more pay.

- Technical Accounting & Finance Skills:

- Complex Financial Modeling: Essential for Deals, Valuation, and M&A tax.

- Knowledge of Niche Industries: Expertise in Financial Services, Energy, or Healthcare accounting is highly valued.

- SEC Reporting: Experience with 10-K and 10-Q filings is critical for public company audits.

- Data & Digital Skills:

- Data Analytics & Visualization: Proficiency in tools like Alteryx, Power BI, and Tableau is no longer a "nice-to-have"; it's a core competency. Seniors who can build automated workflows and create insightful dashboards are indispensable.

- ERP System Knowledge: Experience with SAP, Oracle, or Workday is a huge plus for both audit and consulting.

- Basic Coding/Scripting: Knowledge of Python or SQL for data manipulation is a major differentiator.

- Soft Skills (Power Skills):

- Advanced Project Management: The ability to manage timelines, budgets, and stakeholders effectively.

- Client Relationship Management: Building trust and rapport with clients, turning you into their trusted advisor.