Introduction

In the intricate, high-stakes world of healthcare, there are clinicians who save lives and administrators who manage operations. But who ensures the financial viability that allows the entire system to function? Who are the financial detectives scrutinizing every dollar, from patient registration to final payment, ensuring the organization remains healthy and capable of providing care? This is the domain of the Revenue Cycle Analyst—a critical, data-driven role that serves as the financial heartbeat of a healthcare provider.

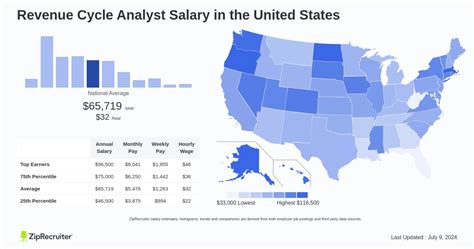

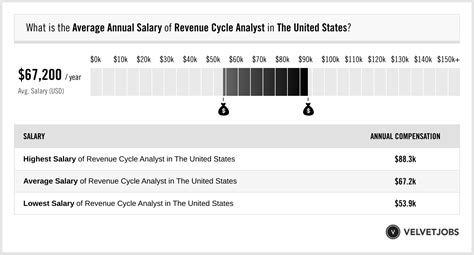

If you are analytical, detail-oriented, and seeking a career that blends finance, data analysis, and healthcare, you’ve landed in the right place. The role of a Revenue Cycle Analyst is not just a job; it’s a rewarding career path with significant growth potential and a compelling salary package. Nationally, a Revenue Cycle Analyst salary typically ranges from $55,000 for entry-level positions to over $90,000 for experienced professionals, with top earners in high-demand areas commanding well over six figures.

I once worked on a consulting project for a large regional hospital that was losing millions annually due to unexplained claim denials. It wasn't until a sharp junior analyst dug into the data and found a single, recurring coding error for a common procedure that the tide began to turn. Her discovery directly led to a process change that recovered over $2 million in the first year alone, showcasing the immense, tangible impact this role can have.

This guide is designed to be your definitive resource for understanding every facet of a career as a Revenue Cycle Analyst. We will dissect salary expectations, explore the factors that can maximize your earning potential, and provide a clear, actionable roadmap to help you launch and advance in this dynamic field.

### Table of Contents

- [What Does a Revenue Cycle Analyst Do?](#what-does-a-revenue-cycle-analyst-do)

- [Average Revenue Cycle Analyst Salary: A Deep Dive](#average-revenue-cycle-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Revenue Cycle Analyst Do?

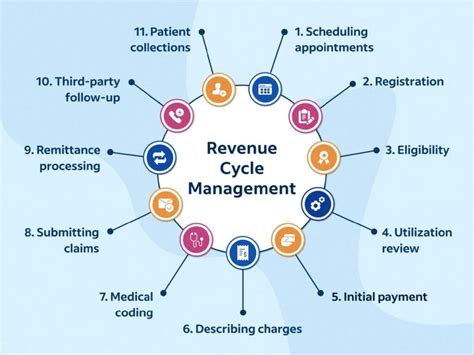

At its core, a Revenue Cycle Analyst is a financial problem-solver within the healthcare industry. Their primary objective is to optimize the Revenue Cycle Management (RCM) process. The revenue cycle is the entire lifespan of a patient account from creation to payment. It begins the moment a patient schedules an appointment and ends only when the provider has been fully reimbursed for the services rendered. This is a complex, multi-stage journey fraught with potential errors, delays, and denials.

The analyst’s job is to use data to identify bottlenecks, inefficiencies, and revenue leakage within this cycle and then recommend and implement solutions. They are the bridge between clinical operations, billing departments, and executive leadership, translating complex data into actionable financial strategy.

Core Responsibilities and Daily Tasks:

An analyst's work is a blend of routine monitoring and project-based problem-solving. Key responsibilities include:

- Data Analysis and Reporting: The heart of the role. Analysts extract, manipulate, and analyze large datasets from Electronic Health Record (EHR) systems (like Epic, Cerner, or Allscripts) and billing software. They create dashboards and reports on Key Performance Indicators (KPIs) such as:

- Denial Rate: The percentage of claims rejected by insurance payers.

- Days in Accounts Receivable (A/R): The average number of days it takes to collect payment.

- Clean Claim Rate: The percentage of claims accepted on the first submission.

- Cash Collection Rate: The percentage of expected revenue that is successfully collected.

- Denial Management and Root Cause Analysis: When a claim is denied, the analyst doesn't just see a failed transaction; they see a puzzle to solve. They investigate *why* claims are being denied (e.g., incorrect patient information, invalid medical codes, lack of prior authorization) and work with relevant departments to fix the systemic issue.

- Process Improvement: Based on their analysis, they recommend changes to workflows. This could involve retraining front-desk staff on insurance verification, working with clinicians to improve documentation, or collaborating with the IT department to automate a manual billing task.

- Payer Contract Analysis: They may analyze payment trends from different insurance companies (payers) to ensure the provider is being reimbursed according to the terms of their contracts.

- Compliance and Regulation: Analysts must stay current with a labyrinth of healthcare regulations, including HIPAA, and the ever-changing coding and billing rules from government payers like Medicare and Medicaid.

### A "Day in the Life" of a Revenue Cycle Analyst

To make this tangible, let's follow a mid-level analyst named Alex at a multi-specialty clinic:

- 9:00 AM - 10:30 AM: Morning Dashboard Review. Alex starts the day by reviewing the RCM performance dashboards. They notice that the denial rate for the cardiology department has spiked by 5% over the past week. They flag this for deeper investigation. They also review the overall Days in A/R, noting it's holding steady at a healthy 38 days.

- 10:30 AM - 12:00 PM: Deep Dive into Cardiology Denials. Alex runs a query in the data warehouse to pull all denied cardiology claims from the last 14 days. They sort the data by denial reason and discover that 70% of the denials share the same code: "Service Not Medically Necessary."

- 12:00 PM - 1:00 PM: Lunch & Learn. Alex attends a voluntary webinar hosted by the Healthcare Financial Management Association (HFMA) on upcoming changes to Medicare reimbursement for telehealth services.

- 1:00 PM - 3:00 PM: Collaborative Problem-Solving. Alex schedules a quick meeting with the lead biller for cardiology and the department's practice manager. They present their findings. The practice manager suspects a new, junior physician might be documenting their notes in a way that doesn't adequately support the billing codes. They agree to review the physician's recent charts together.

- 3:00 PM - 4:30 PM: Ad-Hoc Reporting & System Maintenance. The CFO requests a report on cash collection trends for a new orthopedic service line. Alex pulls the data, creates a few visualizations in Tableau, and sends a summary email. They then spend time working with IT to test a new rule in the billing system designed to automatically catch registration errors before a claim is submitted.

- 4:30 PM - 5:00 PM: Planning & Wrap-Up. Alex documents their findings on the cardiology denial issue and outlines next steps, including a plan to provide targeted training for the new physician. They update their project tracker and plan their priorities for the next day.

This example illustrates how the role is far from monotonous. It requires a dynamic skill set, including technical analysis, critical thinking, and interpersonal communication to drive meaningful financial improvements.

Average Revenue Cycle Analyst Salary: A Deep Dive

Understanding the earning potential is a primary motivator for anyone considering a new career. The Revenue Cycle Analyst role offers a competitive salary that grows substantially with experience and expertise. Compensation is not just a single number; it's a combination of base salary, potential bonuses, and benefits, all of which we will explore here.

National Average and Salary Range

Across the United States, the salary for a Revenue Cycle Analyst shows a consistent and promising range. According to leading salary aggregators, the data as of late 2023 and early 2024 paints a clear picture:

- Salary.com: Reports the median national salary for a Revenue Cycle Analyst I (entry-level) is $61,168, with a typical range falling between $54,809 and $68,367. For a more experienced Revenue Cycle Analyst III, the median jumps to $81,595, with a range of $72,669 to $91,424.

- Payscale: Shows a slightly broader range, with the average base salary listed at approximately $59,000 per year. The full range spans from around $45,000 for the 10th percentile (likely entry-level roles in low-cost areas) to over $79,000 for the 90th percentile (senior-level talent).

- Glassdoor: Based on user-submitted data, reports a total pay average of $67,419 per year in the United States, with a likely base pay range of $53,000 to $77,000.

Key Takeaway: A reasonable expectation for a qualified candidate is a starting salary in the $55,000 to $65,000 range, with the potential to reach the $80,000 to $95,000+ bracket as a senior individual contributor, before moving into management.

Salary by Experience Level

Your value—and therefore your salary—increases directly with your proven ability to impact the bottom line. Experience allows you to move from simply reporting data to interpreting it, predicting trends, and leading strategic initiatives.

Here’s a typical salary progression you can expect throughout your career:

| Career Stage | Years of Experience | Typical Salary Range (Annual) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level Analyst | 0-2 Years | $55,000 - $68,000 | Data entry, running pre-built reports, basic claim follow-up, identifying low-level denial reasons, proficiency in Excel. |

| Mid-Career Analyst | 2-5 Years | $65,000 - $80,000 | Performing root cause analysis, developing new reports, managing small projects, training junior staff, advanced Excel, basic SQL, EHR proficiency. |

| Senior Analyst | 5-10 Years | $78,000 - $95,000+ | Leading complex projects, presenting to leadership, mentoring the team, payer contract analysis, advanced SQL, data visualization (Tableau/Power BI). |

| Lead Analyst / Supervisor| 8+ Years | $85,000 - $110,000+ | Supervising a team of analysts, setting departmental goals, managing vendor relationships, strategic process improvement, expert-level analytics. |

| Manager / Director | 10+ Years | $100,000 - $150,000+ | Full oversight of the RCM department, budget management, strategic planning with C-suite executives, policy development, extensive leadership experience. |

*Note: These are national averages. As we'll discuss in the next section, these figures can be significantly higher in major metropolitan areas and for individuals with specialized technical skills.*

Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the financial puzzle. Total compensation includes other valuable components that can add thousands of dollars to your annual earnings.

- Bonuses: This is a common component, especially in larger health systems and for-profit entities. Bonuses are typically tied to performance metrics. An analyst might receive an annual bonus based on:

- Team/Department Performance: Achieving a target reduction in the overall denial rate or Days in A/R.

- Individual Performance: Successfully leading a project that recovers a specific amount of lost revenue.

- Company Profitability: A general bonus paid to all employees based on the organization's financial success.

- *Expected Range:* Annual bonuses can range from 3% to 15% of the base salary, depending on the role, company, and performance.

- Profit Sharing: While less common in non-profit hospitals, some for-profit healthcare companies and consulting firms offer profit-sharing plans, where a portion of the company's profits is distributed among employees.

- Benefits Package: Never underestimate the value of a strong benefits package. This is a significant part of your compensation. Key elements include:

- Health Insurance: Comprehensive medical, dental, and vision plans. A good plan can save you thousands of dollars in out-of-pocket costs per year.

- Retirement Savings: A 401(k) or 403(b) plan with a company match is essentially free money. A common match is 50% of your contribution up to 6% of your salary. Maximizing this is crucial for long-term wealth.

- Paid Time Off (PTO): A generous PTO policy (vacation, sick days, personal days) is a valuable quality-of-life benefit.

- Professional Development: Many employers will pay for industry certifications (like the CRCR), conference attendance, or even contribute to a master's degree program, representing thousands of dollars in investment in your career.

When evaluating a job offer, it's essential to look at the total compensation package. A job with a slightly lower base salary but a fantastic bonus structure and a generous 401(k) match could be more lucrative in the long run than a job with a higher base but weaker benefits.

Key Factors That Influence Salary

While national averages provide a useful benchmark, your personal salary as a Revenue Cycle Analyst will be determined by a specific set of factors. Understanding these levers is the key to maximizing your earning potential throughout your career. This section provides an in-depth analysis of the six primary drivers of your salary.

### 1. Level of Education and Certifications

Your educational background and professional credentials are the foundation of your career and play a significant role in your starting salary and long-term growth trajectory.

- Bachelor's Degree (The Standard): A bachelor's degree is the standard entry requirement for most Revenue Cycle Analyst positions. The most relevant and desirable fields of study include:

- Healthcare Administration (HCA): Provides a direct understanding of the healthcare ecosystem, regulations, and operational management.

- Finance or Accounting: Equips you with a strong foundation in financial principles, spreadsheet modeling, and quantitative analysis.

- Business Administration: Offers a well-rounded view of operations, management, and strategy.

- Health Information Management (HIM): Focuses on data management, medical coding, and compliance, which are all highly relevant.

- *Salary Impact:* Having a degree in one of these fields makes you a more competitive candidate and generally places you at the midpoint or higher of the entry-level salary band.

- Master's Degree (The Accelerator): For those with ambitions for leadership, a master's degree can be a powerful accelerator. While not required for an analyst role, it becomes almost essential for Manager, Director, and VP-level positions.

- Master of Healthcare Administration (MHA): The gold standard for healthcare leadership roles.

- Master of Business Administration (MBA): Highly valued for strategic, financial, and operational leadership, especially with a concentration in finance or data analytics.

- *Salary Impact:* An MHA or MBA can increase starting salary potential by 10-20% and is often a prerequisite for roles paying $120,000+. It signals a commitment to the field and a readiness for strategic responsibility.

- Professional Certifications (The Differentiator): Certifications are one of the fastest and most effective ways to increase your value and salary. They validate your specific expertise in revenue cycle functions.

- Certified Revenue Cycle Representative (CRCR): Offered by the Healthcare Financial Management Association (HFMA), this is the premier foundational certification. It demonstrates proficiency in the key aspects of the revenue cycle. *Salary Impact:* Obtaining a CRCR can add $3,000 - $7,000 to your annual salary and makes your resume stand out significantly, especially early in your career. Many employers list it as "preferred" and will often pay for you to obtain it.

- Certified Specialist Physician-Based Coding (CSPC™): Offered by the AAPC, this and similar coding certifications (like CPC®) are extremely valuable for analysts specializing in the professional fee/physician side of billing.

- Certified Revenue Cycle Executive (CRCE): The senior-level certification from HFMA, designed for managers and executives. *Salary Impact:* This is a hallmark of an industry leader and is associated with six-figure salaries and director-level positions.

### 2. Years of Experience

This is perhaps the most straightforward and powerful determinant of your salary. As outlined in the previous section, your pay grows in distinct tiers as you move from executing tasks to owning outcomes and finally to driving strategy.

- 0-2 Years (Entry-Level): Focus is on learning the systems, processes, and terminology. You are primarily an executor, running reports and identifying issues as directed.

- 2-5 Years (Mid-Career): You now have a solid understanding and can work more independently. You're not just identifying problems; you're performing the root cause analysis and proposing solutions. Your salary growth here is rapid as you prove your value.

- 5-10+ Years (Senior/Lead): You are a subject matter expert. You handle the most complex analytical challenges, mentor junior analysts, and interact with departmental leadership. You may lead high-impact projects, like implementing a new denial management software or analyzing the financial feasibility of a new service line. An analyst with 8 years of experience, deep system knowledge, and a track record of successful projects can command a salary approaching or exceeding $100,000 in many markets.

### 3. Geographic Location

Where you work has a dramatic impact on your paycheck. Salaries are adjusted based on the local cost of living and the concentration of large, high-paying employers (typically major academic medical centers and large hospital networks).

High-Paying Metropolitan Areas:

Cities with a high cost of living and a dense healthcare market consistently offer the highest salaries.

- San Francisco Bay Area, CA: Analyst salaries can be 25-40% above the national average. A senior analyst here could easily earn $110,000 - $130,000.

- New York City, NY: Similar to the Bay Area, with salaries 20-35% higher than average.

- Boston, MA: Home to numerous world-class hospitals and biotech companies, salaries are typically 15-25% above average.

- Washington, D.C.: A strong market with many large health systems and government-related health jobs, offering salaries 10-20% above average.

- Seattle, WA: A growing tech and healthcare hub with competitive salaries often 15-25% above the norm.

Mid-Tier & Lower-Paying Areas:

Salaries in smaller cities and rural areas are lower, but the cost of living is also significantly less. A $60,000 salary in Des Moines, Iowa, might offer a similar or better quality of life than an $85,000 salary in San Francisco.

- *Example:* According to Salary.com, the median salary for a Revenue Cycle Analyst II in San Jose, CA, is $89,936, while the same role in Birmingham, AL, is $68,898. That's a 30% difference, which largely reflects the vast difference in housing and living costs.

The Rise of Remote Work: The pandemic has accelerated the trend of remote work in this field. This creates new opportunities. You might be able to work for a company based in a high-paying city while living in a lower-cost area. However, be aware that many companies are now adopting location-based pay bands, adjusting your salary based on your physical location, even for remote roles.

### 4. Company Type and Size

The type of organization you work for is a major salary driver.

- Large Academic Medical Centers & Hospital Systems: (e.g., Mass General Brigham, Mayo Clinic, Cleveland Clinic). These are often the top payers. They have vast, complex revenue cycles, large budgets, and a high demand for skilled analysts to manage millions, or even billions, in revenue. Salaries here are typically at the higher end of the spectrum.

- For-Profit Health Systems: (e.g., HCA Healthcare, Tenet Healthcare). These organizations are intensely focused on the bottom line and are willing to pay competitively for analysts who can directly improve profitability and shareholder value. Bonus structures are often more aggressive.

- Physician Groups and Specialty Clinics: These can be large or small. A large, multi-specialty physician group might have pay comparable to a mid-sized hospital. A small, single-specialty practice will likely offer lower salaries but may provide a broader range of responsibilities and a better work-life balance.

- Consulting Firms: (e.g., Deloitte, PwC, Huron Consulting, Guidehouse). Working as an RCM consultant can be highly lucrative but is also very demanding. Consultants are hired to solve specific, high-stakes problems for healthcare providers. Salaries and bonuses can be significantly higher than industry roles, but expect longer hours and frequent travel.

- Healthcare Technology Vendors: (e.g., Epic, Cerner, athenahealth). These companies hire analysts for implementation, support, and product development roles. These positions often require a deep technical understanding of the software and can pay very well, blending the line between a traditional analyst and a tech role.

### 5. Area of Specialization

Within the RCM field, developing a specialization can make you a more valuable and higher-paid asset.

- Technical/Data Specialist: This is arguably the highest-paying path for an individual contributor. This analyst moves beyond Excel and becomes an expert in:

- SQL: Writing complex queries to pull data directly from databases.

- Data Visualization Tools: Creating sophisticated, interactive dashboards in Tableau or Power BI.

- EHR/RCM Software Configuration: Understanding the back-end logic of systems like Epic and being able to build rules and edit master files.

- *Salary Impact:* An analyst with strong SQL and Tableau skills can command a 15-25% salary premium over a peer who only uses Excel.

- Denial Management and Prevention Specialist: This analyst is a deep subject matter expert on payer rules and regulations. They are masters of root cause analysis and are responsible for strategic initiatives to prevent denials before they happen.

- Payer Contract and Reimbursement Specialist: This specialization involves analyzing complex payer contracts to model reimbursement, identify underpayments, and support contract negotiations. It requires a strong blend of financial modeling and analytical skills.

- Clinical Department Specialist: Some analysts specialize in the revenue cycle for a specific, high-complexity service line like Oncology, Cardiology, or Transplant. These areas have unique, intricate billing rules, and expertise is highly valued.

### 6. In-Demand Skills

Beyond your formal background, the specific, tangible skills you possess are what you leverage in your day-to-day work. Cultivating high-value skills is the most direct way to increase your performance and justify a higher salary.

- Advanced Microsoft Excel: Non-negotiable. This means going beyond basic formulas. You must master PivotTables, VLOOKUP/INDEX(MATCH), Power Query, and basic data modeling. This is the bedrock skill for 99% of analyst roles.

- SQL (Structured Query Language): The single most valuable technical skill for salary growth. It allows you to bypass pre-built reports and access raw data directly, enabling deeper and more customized analysis.

- EHR/EMR System Proficiency: Deep expertise in a major system, particularly Epic, is a massive advantage. Certifications in Epic modules like Resolute Hospital Billing (HB) or Professional Billing (PB) are extremely valuable and can lead to significant pay bumps.

- Data Visualization (Tableau, Power BI): The ability to turn spreadsheets of data into clear, compelling stories through visual dashboards is a highly sought-after skill. It allows you to communicate your findings effectively to non-technical stakeholders and executive leadership.

- Business Acumen and Communication: Technical skills are only half the equation. You must be able to understand the "why" behind the data, connect your analysis to business goals, and clearly articulate your findings and recommendations to clinicians, managers, and executives.

By strategically focusing on these six areas, you can actively steer your career towards higher compensation and greater professional opportunities.

Job Outlook and Career Growth

Choosing a career is not just about the starting salary; it’s about long-term stability, opportunities for advancement, and the potential for continued growth. The outlook for Revenue Cycle Analysts is exceptionally positive, driven by powerful, long-term trends in the U.S. healthcare industry.

Strong Job Growth Projections

While the U.S. Bureau of Labor Statistics (BLS) does not have a distinct category for "Revenue Cycle Analyst," we can look at closely related proxy occupations to gauge the demand. The data is overwhelmingly positive.

- Financial Analysts: The BLS projects employment for financial analysts to grow 8 percent from 2022 to 2032, much faster than the average for all occupations. The BLS attributes this to a growing range of financial products and the need for in-depth geographical expertise. A Revenue Cycle Analyst is, in essence, a specialized financial analyst for the healthcare sector, and this growth rate is a strong positive indicator.

- Medical and Health Services Managers: This category, which represents the leadership path for RCM professionals, is projected to grow by a staggering 28 percent from 2022 to 2032. This is one of the fastest growth rates of any occupation tracked by the BLS. The bureau states, "As the large baby-boom population ages and people remain active later in life, there should be