In an increasingly complex and uncertain global economy, the role of a risk manager has evolved from a niche function to a critical pillar of any successful organization. These professionals are the strategic guardians who identify, analyze, and mitigate potential threats to a company's success. This vital role comes with significant responsibility and, consequently, a highly competitive compensation package. For those considering this career path, the salary for risk management professionals is robust, with a typical range in the United States falling between $95,000 and $150,000, and senior leaders earning well over $200,000 annually.

This article provides a data-driven look into the salaries you can expect in the field of risk management, the key factors that influence your pay, and the promising future of this dynamic career.

What Does a Risk Manager Do?

Before diving into the numbers, it's essential to understand the scope of the role. A risk manager is responsible for protecting an organization's assets, reputation, and earning capacity. They are forward-thinkers who anticipate potential problems and design strategies to prevent or minimize their impact.

Key responsibilities include:

- Identifying Risks: Pinpointing potential threats across various categories, including financial (market, credit), operational (processes, systems), strategic (competition, market shifts), and compliance (laws, regulations).

- Analyzing and Quantifying Risks: Assessing the likelihood and potential impact of each identified risk using both qualitative and quantitative methods.

- Developing Mitigation Strategies: Creating and implementing plans, policies, and procedures to manage and reduce risk exposure. This can involve risk avoidance, reduction, transfer (e.g., insurance), or acceptance.

- Monitoring and Reporting: Continuously tracking the organization's risk profile and reporting key findings and recommendations to senior management and the board of directors.

Average Risk Management Salary

The compensation for risk management professionals is attractive, reflecting the high-level analytical skills and strategic thinking required. While salaries vary, we can establish a strong baseline using data from leading authoritative sources.

- According to Salary.com, as of early 2024, the median annual salary for a Risk Manager in the United States is approximately $125,560. The typical range falls between $110,340 and $143,190, but this can vary significantly based on the factors discussed below.

- Payscale reports a median salary of around $98,000, with an entry-level Risk Analyst starting near $65,000 and a senior-level Chief Risk Officer (CRO) commanding a salary upwards of $175,000, not including substantial bonuses.

- Glassdoor lists the average total pay (including base salary, bonuses, and other compensation) for a Risk Manager at approximately $134,000 per year.

It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups risk managers under the broader category of "Financial Managers." For this group, the median annual wage was $139,790 in May 2022, indicating the strong earning potential within the financial sector of risk management.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of factors. Understanding these variables is key to maximizing your earning potential.

### Level of Education

A strong educational foundation is the launching point for a career in risk management. A bachelor's degree in finance, business, economics, or a related field is typically the minimum requirement. However, advanced degrees and certifications can significantly increase your salary.

- Master's Degree: An MBA or a specialized Master's in Risk Management, Finance, or Financial Engineering can provide a substantial salary bump and open doors to more senior positions.

- Professional Certifications: Earning globally recognized certifications demonstrates expertise and a commitment to the profession. Key certifications that boost earning potential include:

- Financial Risk Manager (FRM): Offered by GARP, this is the gold standard for financial risk professionals.

- Professional Risk Manager (PRM): A highly respected designation from PRMIA.

- Certified in Risk and Information Systems Control (CRISC): Crucial for those specializing in IT and cybersecurity risk.

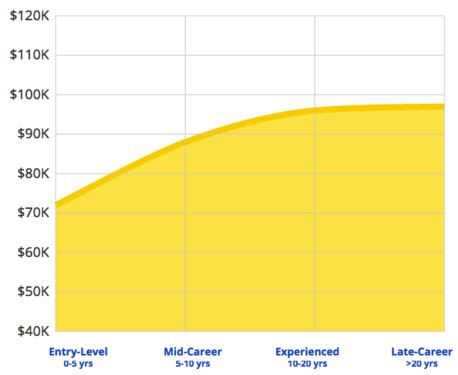

### Years of Experience

Experience is one of the most significant drivers of salary growth in risk management. The career path offers a clear progression with corresponding increases in compensation.

- Entry-Level (0-2 years): Professionals often start as a Risk Analyst. In this role, salaries typically range from $65,000 to $85,000 as they learn the fundamentals and support senior team members.

- Mid-Level (3-8 years): As a Risk Manager, professionals take on more autonomy and manage specific risk categories or projects. This is where salaries align with the national medians, typically $95,000 to $130,000.

- Senior-Level (8-15+ years): A Senior Risk Manager or Director of Risk will oversee entire risk programs or teams. Compensation at this level often ranges from $130,000 to $180,000+.

- Executive-Level: The Chief Risk Officer (CRO) is a C-suite executive responsible for the entire enterprise risk management (ERM) framework. Their compensation package, including base salary, bonuses, and stock options, can easily exceed $250,000 at large corporations.

### Geographic Location

Where you work matters. Salaries are often higher in major metropolitan areas and financial hubs to account for a higher cost of living and greater demand for talent. According to data from salary aggregators, cities like New York, San Francisco, Boston, and Chicago consistently offer higher-than-average salaries for risk management roles. Conversely, salaries may be lower in smaller cities and rural areas.

### Company Type

The industry and size of your employer play a crucial role in determining your salary.

- Industry: The highest salaries are typically found in the financial services sector, including investment banking, asset management, and commercial banking. Other high-paying industries include insurance, energy, and technology.

- Company Size: Large, multinational corporations generally offer higher base salaries, more comprehensive benefits, and larger bonus potential compared to smaller businesses or non-profits due to the scale and complexity of their risk exposure.

### Area of Specialization

As the field of risk management has broadened, several specializations have emerged, some of which are in higher demand and command premium salaries.

- Financial Risk: This traditional area, covering market, credit, and liquidity risk, remains highly lucrative, especially for those with strong quantitative skills.

- Cybersecurity Risk: With the rise of digital threats, professionals who can bridge the gap between IT security and business risk are in extremely high demand and can command top-tier salaries.

- Operational Risk: Focuses on risks arising from internal processes, people, and systems. This has become increasingly important in manufacturing, logistics, and healthcare.

- Compliance Risk: Experts who help organizations navigate the complex web of local and international regulations are essential and well-compensated.

Job Outlook

The future for risk management professionals is incredibly bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Managers (the category including risk managers) will grow by 16% from 2022 to 2032. This growth rate is much faster than the average for all occupations.

This high demand is driven by several factors, including stricter financial regulations, increasing globalization of business, the growing threat of cyberattacks, and the need for strategic planning in a volatile economic climate. Companies recognize that effective risk management is not just a defensive measure but a competitive advantage, solidifying the job security and career growth prospects for skilled professionals.

Conclusion

A career in risk management offers a rare combination of intellectual challenge, strategic importance, and significant financial reward. While the national average salary provides a strong baseline, your ultimate earning potential is in your hands. By pursuing advanced education and certifications, gaining diverse experience, and specializing in a high-demand area, you can build a highly lucrative and stable career. For anyone with a strategic mindset and an analytical approach to problem-solving, the field of risk management is a path worth exploring.