A career as a Financial Consultant at a prestigious firm like Fidelity Investments represents a pinnacle for many in the financial services industry. It’s a role that combines deep market knowledge with a genuine passion for helping people secure their financial future. But beyond the professional satisfaction, what is the earning potential?

For those considering this rewarding path, the compensation is a significant factor. A Fidelity Financial Consultant's salary is a compelling blend of a stable base and a high-potential variable component, with top performers earning well into six figures. Total compensation can range from approximately $80,000 for entry-level positions to over $250,000 annually for experienced, high-achieving consultants.

This article will break down the salary structure, the factors that influence your earnings, and the bright future this career holds.

What Does a Fidelity Financial Consultant Do?

Before diving into the numbers, it's essential to understand the role. A Fidelity Financial Consultant is a licensed financial professional who works directly with clients to help them achieve their financial goals. They are the face of Fidelity to individual investors, providing guidance, building relationships, and managing client assets.

Key responsibilities include:

- Financial Planning: Assessing a client's complete financial picture—including income, assets, and goals—to create a comprehensive financial plan.

- Investment Management: Recommending and managing a portfolio of investment products, such as mutual funds, ETFs, stocks, and bonds, that align with the client's risk tolerance and objectives.

- Client Relationship Building: Serving as a trusted advisor, conducting regular reviews, and providing ongoing support to build long-term, multi-generational relationships.

- Retirement and Goal-Based Planning: Specializing in complex areas like retirement income strategies, college savings, and estate planning.

Average Fidelity Financial Consultant Salary

The compensation for a Fidelity Financial Consultant is typically structured with a base salary and variable pay (bonuses, commissions, or profit sharing). This structure rewards both stability and performance.

While salaries vary, we can establish a strong baseline using data from authoritative sources:

- Total Compensation: According to Glassdoor, the estimated total pay for a Financial Consultant at Fidelity in the United States is approximately $159,000 per year, with a likely range between $117,000 and $218,000. This figure includes an average base salary of around $72,000 and significant additional pay (bonuses and commission) averaging $87,000.

- Base Salary Range: Payscale corroborates this structure, reporting a base salary range of $51,000 to $124,000, with bonuses potentially reaching upwards of $86,000.

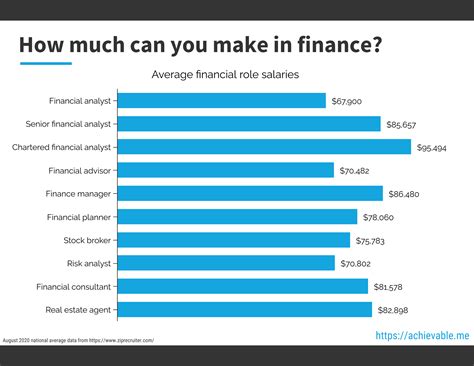

For context, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for all Personal Financial Advisors was $99,580 in May 2023. Fidelity's compensation structure is competitive and often exceeds the national median, especially when accounting for variable pay.

Key Factors That Influence Salary

Your specific salary as a Fidelity Financial Consultant is not a single number but a dynamic figure influenced by several key factors. Understanding these drivers is crucial to maximizing your earning potential.

### Level of Education

A bachelor's degree in finance, economics, accounting, or a related business field is the standard entry requirement. While an advanced degree like a Master of Business Administration (MBA) can lead to a higher starting salary and more senior roles, professional certifications are often more impactful. The most respected certifications include:

- Certified Financial Planner (CFP®): This is the gold standard in the industry. Earning a CFP designation demonstrates expertise in financial planning, ethics, and professionalism, often leading to significantly higher compensation and greater client trust.

- Chartered Financial Analyst (CFA®): This globally recognized designation signifies a deep expertise in investment analysis and portfolio management, and is highly valued for roles dealing with complex investment strategies.

### Years of Experience

Experience is arguably the most significant driver of income in this role, as it directly correlates with the size of your client portfolio (Assets Under Management, or AUM) and your proven ability to generate results.

- Entry-Level (0-3 Years): Consultants in their early years are typically focused on building their client base and learning the firm's processes. Base salaries are solid, but variable pay is in its growth phase. Total compensation might fall in the $80,000 to $120,000 range.

- Mid-Career (4-9 Years): With a proven track record and a substantial book of business, mid-career consultants see their variable pay become a much larger portion of their total compensation. Earnings can climb to the $150,000 to $220,000 range and beyond.

- Senior-Level (10+ Years): Senior consultants often manage portfolios for high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients. Their expertise and extensive relationships place them at the top of the earnings scale, with total compensation often exceeding $250,000.

### Geographic Location

Where you work matters. Financial consultant salaries are higher in major metropolitan areas with a high cost of living and a greater concentration of wealth. According to Salary.com, a financial advisor in New York City or San Francisco can expect to earn 20-30% more than the national average. Working in a major financial hub like Boston (Fidelity's headquarters), New York, or Chicago will typically offer a higher salary base and access to more affluent clients, boosting bonus potential.

### Company Type

Working for a large, established firm like Fidelity offers distinct advantages over smaller, independent firms or bank-based advisory roles. Fidelity provides:

- Strong Brand Recognition: A trusted name that makes it easier to attract and retain clients.

- In-House Client Stream: Fidelity has a massive existing customer base, providing a steady flow of warm leads to its consultants.

- Robust Resources: Access to world-class research, technology platforms, and marketing support.

These factors create a stable and high-potential environment, allowing consultants to focus on advising rather than prospecting, which directly contributes to higher, more consistent earnings.

### Area of Specialization

Developing a niche can make you an invaluable asset and a higher earner. Consultants who specialize in high-demand areas can command premium compensation because their expertise allows them to solve more complex client problems. Key specializations include:

- Retirement Income Planning: A core strength of Fidelity, this area is in constant demand due to an aging population.

- High-Net-Worth (HNW) Wealth Management: Catering to clients with substantial assets requires sophisticated knowledge of tax-efficient strategies, estate planning, and alternative investments.

- Business Owners: Advising entrepreneurs on succession planning, corporate retirement plans (401(k)s), and managing personal wealth tied to their business.

Job Outlook

The future for financial consultants is exceptionally bright. According to the U.S. Bureau of Labor Statistics, employment for personal financial advisors is projected to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is fueled by several factors:

- The large Baby Boomer population is entering retirement, requiring expert guidance on managing their savings.

- Increased life expectancies mean retirement funds must last longer.

- The decline of traditional pension plans has shifted the responsibility of retirement saving onto individuals, increasing the need for professional financial advice.

Conclusion

A career as a Fidelity Financial Consultant is more than just a job; it's a pathway to significant personal and financial growth. While the base salary provides a stable foundation, the real earning potential lies in the performance-based compensation that rewards expertise, dedication, and the ability to build lasting client relationships.

For ambitious individuals with a passion for finance and a commitment to helping others, this career path offers a clear and prosperous future. By focusing on continuous learning, obtaining key certifications like the CFP®, and building a strong track record, you can position yourself for a highly rewarding career at the forefront of the financial services industry.