Article at a Glance

This in-depth guide provides a comprehensive analysis of a tax consultant salary, exploring every factor that influences earning potential. From entry-level roles to senior partnership positions, we'll break down the compensation packages, in-demand skills, and strategic career moves you need to maximize your income in this lucrative and intellectually stimulating field. Whether you're a student contemplating your future or a professional considering a career change, this is your definitive resource for understanding the financial landscape of tax consulting.

Table of Contents

- [What Does a Tax Consultant Do?](#what-does-a-tax-consultant-do)

- [Average Tax Consultant Salary: A Deep Dive](#average-tax-consultant-salary-a-deep-dive)

- [Key Factors That Influence a Tax Consultant Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Tax Consultants](#job-outlook-and-career-growth)

- [How to Become a Tax Consultant: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career in Tax Consulting Right for You?](#conclusion)

---

Introduction

Have you ever looked at a complex business transaction, a major life event like selling a home, or the labyrinthine structure of a multinational corporation and wondered, "How on earth do they handle the taxes for that?" If that question sparks curiosity rather than fear, you may have the mindset of a successful tax consultant. This is a career that goes far beyond simply filling out forms; it’s about strategic problem-solving, intricate analysis, and providing immense value to individuals and businesses navigating the ever-shifting landscape of tax law. The financial rewards for this expertise can be substantial, with the average tax consultant salary comfortably in the high five figures and top earners commanding well over $200,000 annually.

This isn't just a job; it's a profession built on a foundation of trust and intellectual rigor. Early in my advisory career, I worked with a multi-generational family business on the verge of a major expansion. They were brilliant at their craft but were about to make a structural decision that would have incurred a crippling, and entirely avoidable, tax liability a few years down the line. By restructuring their plan, we not only saved them a fortune but secured the company's legacy for the next generation. That experience solidified for me the profound impact a knowledgeable and proactive tax consultant can have—they are not just accountants; they are financial guardians and strategic partners.

This guide is designed to be your compass for navigating this compelling career path. We will dissect the tax consultant salary from every conceivable angle, exploring the factors that can dramatically increase your earning potential. We will look at the day-to-day realities of the job, the projected career outlook, and a clear, actionable roadmap for how you can get started. By the end, you will have a deep, authoritative understanding of what it takes to thrive—and be highly compensated—as a tax consultant.

---

What Does a Tax Consultant Do?

A common misconception is that a tax consultant is simply a high-level tax preparer who works year-round. While tax preparation (compliance) is a component of the job, it represents only a fraction of the role's true scope. At its core, a tax consultant is a strategic financial advisor specializing in tax law and its implications. Their primary goal is to help clients—ranging from individuals and small businesses to Fortune 500 corporations—minimize their tax liability legally and efficiently while ensuring full compliance with all relevant laws and regulations.

They operate at the intersection of law, finance, and business strategy. They don't just look at what happened last year; they look forward, helping clients structure transactions, investments, and business operations in the most tax-advantaged way possible.

### Core Responsibilities and Daily Tasks

The work of a tax consultant is varied and project-based, shifting in intensity and focus throughout the year. Key responsibilities include:

- Tax Planning & Strategy: This is the most value-driven aspect of the role. Consultants analyze a client's financial situation and business goals to develop long-term strategies for minimizing tax burdens. This could involve advising on the tax implications of a merger, suggesting optimal business entity structures (e.g., S-Corp vs. LLC), or planning for international expansion.

- Tax Compliance: This involves the preparation and review of complex tax returns for corporations, partnerships, high-net-worth individuals, and trusts. While entry-level staff may handle more of the initial preparation, senior consultants are responsible for reviewing for accuracy, strategy, and risk.

- Tax Research: Tax codes are notoriously complex and constantly changing. A significant portion of a consultant's time is spent researching and interpreting intricate sections of the Internal Revenue Code (IRC), state and local statutes, and international tax treaties to answer specific client questions or support a tax position.

- Audit Representation: When a client is audited by the IRS or a state tax authority, the tax consultant often acts as their primary representative. They defend the client's tax positions, provide documentation, and negotiate with tax agents.

- Specialized Advisory: Many consultants develop deep expertise in niche areas like international tax, state and local tax (SALT), M&A tax due diligence, transfer pricing, or R&D tax credits.

A Day in the Life of a Senior Tax Consultant

To make this role more tangible, here’s a snapshot of a typical Tuesday for a senior consultant at a mid-sized accounting firm:

- 9:00 AM - 10:00 AM: Client Call. Discuss the tax implications of a proposed acquisition with the CFO of a tech client. Outline the due diligence process and key risk areas.

- 10:00 AM - 12:30 PM: Research & Memo Drafting. Dive into research on a complex international tax issue related to the client call. Begin drafting a technical memo outlining findings and strategic recommendations for the partner's review.

- 12:30 PM - 1:30 PM: Lunch & Team Huddle. Grab a quick lunch while leading a virtual huddle with junior staff. Assign compliance review tasks and answer questions about a new piece of tax legislation.

- 1:30 PM - 3:30 PM: Review Work. Review a complex partnership tax return (Form 1065) prepared by a junior associate. Identify several opportunities for optimization and provide detailed review notes.

- 3:30 PM - 4:30 PM: Business Development. Call a prospective client to discuss their needs and how the firm's services can provide value. Prepare a proposal for a new engagement.

- 4:30 PM - 5:30 PM: Continuing Professional Education (CPE). Attend a webinar on recent developments in state and local tax laws to stay current and maintain professional licensure.

---

Average Tax Consultant Salary: A Deep Dive

The compensation for a tax consultant is a reflection of the high level of specialized knowledge, analytical skill, and responsibility the role demands. While salaries can vary widely based on the factors we'll explore in the next section, we can establish a strong baseline using data from reputable sources.

It's important to note that a "Tax Consultant" can fall under various titles in salary surveys, including Tax Advisor, Tax Senior, or Tax Manager. For the most accurate picture, we'll synthesize data from several sources.

### National Average and Salary Ranges

According to recent 2024 data, the financial outlook for tax consultants in the United States is robust.

- Salary.com reports that the median tax consultant salary in the U.S. is $124,360, with the typical range falling between $111,260 and $139,390.

- Payscale.com shows a slightly broader range, with an average base salary of approximately $83,000, but this figure includes a wider spectrum of roles, including more junior tax associates. Their data shows that top earners can push past $150,000 on base salary alone.

- Glassdoor, which incorporates user-submitted data, places the total pay for a Tax Consultant at an average of $113,674 per year in the United States, with a likely range between $87,000 and $149,000.

Synthesizing this data, a realistic expectation for a qualified tax consultant is a base salary in the $90,000 to $140,000 range, with the median hovering around $115,000 - $125,000. However, this is just the base salary. Total compensation, which includes bonuses and other benefits, tells a much more complete story.

### Compensation by Experience Level

Salary progression in tax consulting is predictable and steep, rewarding the accumulation of experience and expertise. Here’s a typical trajectory:

| Experience Level | Years of Experience | Typical Salary Range (Base) | Key Responsibilities & Titles |

| ------------------- | ------------------- | ------------------------------- | ------------------------------------------------------------ |

| Entry-Level | 0-2 Years | $65,000 - $85,000 | Tax Associate, Tax Staff. Focus on compliance (tax return preparation), basic research, and supporting senior staff. |

| Mid-Career | 3-7 Years | $85,000 - $130,000 | Senior Tax Consultant, Tax Senior. Manages smaller engagements, reviews work of junior staff, handles more complex compliance, and begins client interaction. |

| Senior/Lead | 8-15 Years | $130,000 - $180,000+ | Tax Manager, Senior Tax Manager. Manages client relationships, oversees teams, develops tax strategies, and participates in business development. |

| Expert/Principal| 15+ Years | $180,000 - $300,000+ | Tax Director, Partner. Sets firm strategy, brings in major clients, handles the most complex advisory work, and has P&L responsibility. |

*Source: Data compiled and synthesized from Salary.com, Glassdoor, and Robert Half Salary Guides.*

### A Look Beyond the Base Salary: Total Compensation

A tax consultant's base salary is only one piece of the puzzle. Total compensation can be significantly higher, especially in public accounting firms and corporate roles.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to individual performance, team/department performance, and the overall profitability of the firm. For a Senior Consultant or Manager, a bonus can easily range from 10% to 30% of their base salary. In a very profitable year, these can be even higher.

- Profit Sharing: This is particularly common for those at the Manager level and above in public accounting partnerships. A portion of the firm's annual profits is distributed to eligible employees, directly tying their success to the firm's performance. This can be a substantial addition to income.

- Signing Bonuses: To attract top talent, especially experienced hires with a specialized skill set, firms often offer significant signing bonuses, which can range from $5,000 for a recent graduate to over $30,000 for a seasoned manager.

- Benefits and Perks: The value of a comprehensive benefits package cannot be overstated. Standard benefits include:

- Health Insurance: Medical, dental, and vision.

- Retirement Savings: 401(k) or 403(b) plans, often with a generous employer match.

- Paid Time Off (PTO): Typically generous to compensate for the intense hours during busy season.

- Professional Development: Firms almost always pay for CPA licensing fees, exam materials, and the extensive Continuing Professional Education (CPE) required to maintain licensure. This is a benefit worth thousands of dollars annually.

- Other Perks: Depending on the firm, this can include wellness stipends, parental leave, flexible work arrangements, and cell phone reimbursement.

When you factor in a 15% annual bonus, the median salary of $124,000 quickly becomes a total compensation package of over $142,000. For a Senior Manager earning $160,000, a 25% bonus and profit-sharing could push their total earnings well over the $200,000 mark.

---

Key Factors That Influence a Tax Consultant Salary

While we've established a national average, the actual tax consultant salary you can command is not a single number but a dynamic figure influenced by a powerful combination of factors. Mastering these elements is the key to unlocking the highest earning potential in the field. This section provides an exhaustive breakdown of the levers you can pull to increase your value and, consequently, your paycheck.

###

1. Level of Education and Professional Certifications

Your educational foundation is the launching pad for your career, but professional certifications are the rocket fuel.

- Bachelor's Degree: A bachelor's degree in Accounting is the gold standard and a virtual prerequisite for any reputable firm. Degrees in Finance, Economics, or even Pre-Law can also be viable entry points, provided you have completed the necessary accounting coursework required for certification.

- Master's Degree: While not always mandatory, a Master of Science in Taxation (MST) or a Master of Accountancy (MAcc) with a tax concentration is a significant differentiator. It signals a deep commitment to the field and provides advanced, specialized knowledge that can lead to a 5% to 15% higher starting salary. More importantly, it helps you meet the 150-credit-hour requirement for the CPA license in most states.

- Certified Public Accountant (CPA): This is the single most important credential for a tax professional in the United States. It is the premier license for accountants, signifying a high level of competence, ethical standards, and expertise. Earning your CPA license can lead to an immediate salary increase of $10,000 to $20,000 and is a non-negotiable requirement for advancement to Manager and Partner levels in any public accounting firm. Without it, your career and salary will hit a hard ceiling.

- Enrolled Agent (EA): An EA is a tax advisor who is a federally-authorized tax practitioner empowered by the U.S. Department of the Treasury. EAs have "unlimited practice rights," meaning they can represent any taxpayer before the IRS. While the CPA is broader, the EA is highly respected for its specific focus on taxation. It's an excellent credential, particularly for those focusing purely on tax and perhaps not wishing to pursue audit or other accounting functions. It provides a significant salary boost over an uncredentialed preparer but is generally seen as secondary to the CPA in the large firm environment.

- Juris Doctor (JD): A law degree, especially when combined with a CPA or an LL.M. (Master of Laws) in Taxation, places you at the very top of the profession. These "Tax Attorneys" handle the most complex issues, including tax litigation, high-stakes M&A structuring, and intricate estate planning. Their earning potential is the highest in the field, often starting well above what a traditional tax consultant makes and growing rapidly from there.

###

2. Years and Quality of Experience

Experience is the primary driver of salary growth. However, it's not just about the number of years, but the *quality* and *type* of experience gained.

- 0-2 Years (Associate): Salary: ~$65k - $85k. The focus is on learning the fundamentals of tax compliance—preparing individual (1040), corporate (1120), and partnership (1065) returns. You learn the software, the firm's processes, and basic research skills.

- 3-7 Years (Senior): Salary: ~$85k - $130k. At this stage, you transition from "doer" to "reviewer." You are trusted with more complex returns, begin managing smaller client engagements, and start to develop a specialty. Your value increases as you become more efficient and can mentor junior staff. This is where the first major salary jump occurs.

- 8-15 Years (Manager/Senior Manager): Salary: ~$130k - $180k+. This is a critical pivot. Your value is no longer just in your technical skills, but in your ability to manage projects, lead teams, nurture client relationships, and identify new business opportunities. You are the primary point of contact for your clients and are responsible for the profitability of your engagements.

- 15+ Years (Director/Partner): Salary: ~$180k - $300k+. At this level, you are a leader of the business. Your compensation is heavily tied to the revenue you generate (your "book of business"). You are a renowned expert in your chosen specialty, a trusted advisor to C-suite executives, and you set the strategic direction for the tax practice.

###

3. Geographic Location

Where you work has a massive impact on your salary, largely driven by cost of living and the concentration of large corporate clients.

- Top-Tier Cities: Major metropolitan areas with significant financial and business hubs offer the highest salaries.

- New York, NY: +20% to +30% above national average.

- San Francisco Bay Area, CA (San Francisco, San Jose): +25% to +35% above national average.

- Boston, MA: +15% to +25% above national average.

- Washington, D.C.: +10% to +20% above national average.

- Chicago, IL: +5% to +15% above national average.

- Mid-Tier Cities: Large cities with strong economies also offer competitive salaries, though slightly less than the top tier. Examples include Dallas, Houston, Atlanta, Seattle, and Denver. Salaries here are often at or slightly above the national average.

- Lower-Cost Areas: In smaller cities and rural areas, salaries will be lower to reflect the reduced cost of living and a different client base. You might expect salaries to be 5% to 15% *below* the national average.

It's crucial to weigh the higher salary in a top-tier city against the drastically higher cost of living. A $150,000 salary in San Francisco may provide a similar or even lower quality of life than a $120,000 salary in Dallas.

###

4. Company Type and Size

The type of organization you work for is a defining factor in your day-to-day work, career trajectory, and compensation structure.

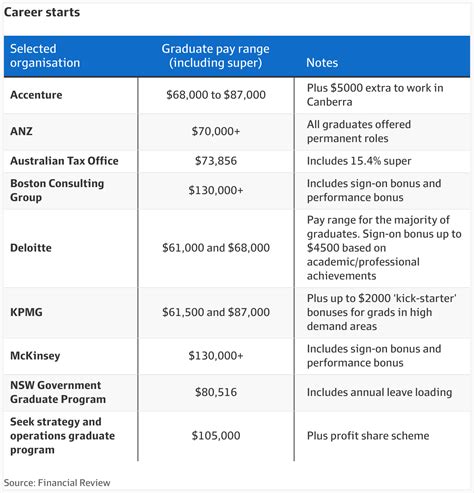

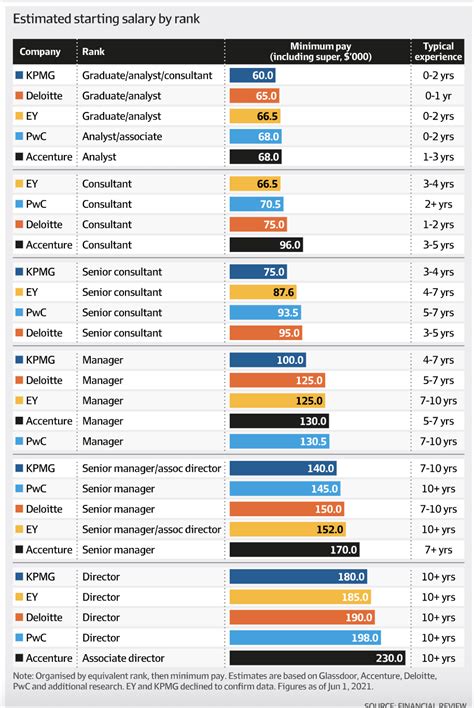

- The "Big Four" Accounting Firms (PwC, Deloitte, EY, KPMG): These global giants offer the most structured career paths and some of the highest starting salaries. They work with the largest multinational corporations on the most complex issues. The trade-off is a notoriously demanding work culture with long hours, especially during busy season. However, having a Big Four firm on your resume is a prestigious credential that opens doors for the rest of your career.

- Mid-Tier and Regional Firms (e.g., BDO, Grant Thornton, RSM): These firms offer a compelling alternative. Salaries are very competitive with the Big Four, sometimes even matching them to attract talent. The client base is typically middle-market companies, which can provide a broader range of experience. Many professionals find the work-life balance to be slightly more manageable than at the Big Four.

- Boutique/Specialty Firms: These are smaller firms that focus on a specific niche, such as M&A tax, international tax for expats, or R&D tax credits. For a true expert in that niche, a boutique firm can offer the highest earning potential of all, as their value proposition is based on unparalleled expertise, not volume.

- Industry (In-House): This means leaving public accounting to work directly for a single company in their internal tax department (e.g., at Google, Ford, or Procter & Gamble). The transition from public to industry is a very common career path. Senior-level industry roles often offer a higher base salary, better bonuses, and a significantly improved work-life balance compared to a similar level in public accounting. However, the experience can be less varied as you are only working on one company's tax issues.

- Government (e.g., IRS, Treasury Department): Government roles offer unparalleled job security and excellent benefits. An IRS agent, for instance, gains deep insight into tax law enforcement. However, the salary potential is generally lower than in the private sector, with a much more defined and rigid pay scale (like the GS scale).

###

5. Area of Specialization

Just as doctors specialize, so do tax consultants. Generalists are valuable, but specialists command the highest fees and salaries. The most lucrative specializations are those that are highly complex, in high demand, and can save or make clients millions of dollars.

- Mergers & Acquisitions (M&A) Tax: Highest Earning Potential. M&A consultants perform tax due diligence on deals, structure transactions to be tax-efficient, and advise on post-merger integration. This is a high-pressure, high-stakes field directly tied to major corporate events.

- International Tax: Very High Earning Potential. This field deals with the tax implications of cross-border transactions, including transfer pricing (how multinational companies price goods and services between their own entities), foreign tax credits, and the interpretation of tax treaties. Globalization ensures this skill is always in demand.

- State and Local Tax (SALT): High Earning Potential. With 50 states having different tax regimes (and countless local jurisdictions), SALT is a minefield of complexity. Specialists help businesses manage their multi-state tax footprint, particularly with nexus (the connection that creates a tax obligation) and sales tax issues, which have become even more complex with the rise of e-commerce.

- Tax Technology (Tax Tech): Rapidly Growing Field. This specialization combines tax knowledge with technology skills. These consultants implement and manage tax software (like ONESOURCE or Corptax), automate tax processes, and use data analytics to identify tax planning opportunities. As firms embrace automation, this skill set is becoming invaluable.

- High-Net-Worth/Private Client Services: This involves providing comprehensive tax planning, estate planning, and compliance services for wealthy individuals and families. It requires strong client relationship skills in addition to technical expertise.

###

6. In-Demand Skills

Beyond your core knowledge, certain skills can make you a more effective and valuable consultant, directly impacting your salary and promotability.

- Data Analytics: The ability to use tools like Alteryx, Tableau, or Power BI to analyze large datasets is no longer a "nice to have"—it's becoming a core competency. You can identify trends, model the impact of tax strategies, and present data-driven insights to clients.

- Client Relationship Management & Business Development: As you become more senior, your ability to manage client expectations, build trust, and bring in new business becomes paramount. Strong communication, presentation, and negotiation skills are critical.

- Technological Proficiency: Deep expertise in tax preparation and research software (e.g., CCH Axcess, Thomson Reuters GoSystem Tax RS, BNA Tax Management) is assumed. The real value is in mastering emerging technologies.

- Legal and Regulatory Interpretation: The skill of reading dense legal text, interpreting its meaning, and applying it to a client's specific situation is the art of tax consulting. The better you are at this, the more valuable you become.

---

Job Outlook and Career Growth

Investing time and resources into a career path requires a clear understanding of its long-term viability. For tax consultants, the future looks not only stable but ripe with opportunity, though it is a future that will demand