Ever wonder who navigates the labyrinthine corridors of the U.S. tax code for multinational corporations, high-net-worth individuals, and complex business ventures? Who stands between a client and the formidable power of the IRS? That is the domain of the tax lawyer, a highly specialized, intellectually demanding, and exceptionally rewarding legal profession. If you are drawn to a career that combines intricate problem-solving with high-stakes strategy and offers significant financial rewards, understanding the landscape of a tax lawyer's salary is your first critical step.

This is a field where expertise is directly and handsomely compensated. While salaries can vary widely, it's a profession where a six-figure income is the standard, not the exception. An entry-level tax associate at a major firm might start well above $200,000, while experienced partners can earn salaries that reach into the seven figures. I once advised a small, family-owned manufacturing business that was on the verge of collapse due to a crippling tax assessment. Their newly hired tax lawyer not only resolved the dispute but also restructured their operations, saving them millions in future liabilities and preserving dozens of jobs—a powerful reminder that this career is about much more than just numbers on a page; it's about securing futures.

This comprehensive guide will illuminate every facet of a tax lawyer's compensation, career trajectory, and the steps required to enter this elite field. We will delve into authoritative data to give you a clear and realistic picture of your potential earnings and long-term growth.

### Table of Contents

- [What Does a Tax Lawyer Do?](#what-does-a-tax-lawyer-do)

- [Average Tax Lawyer Salary: A Deep Dive](#average-tax-lawyer-salary-a-deep-dive)

- [Key Factors That Influence a Tax Lawyer's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Become a Tax Lawyer: Your Step-by-Step Guide](#how-to-get-started)

- [Is a Career as a Tax Lawyer Right for You?](#conclusion)

What Does a Tax Lawyer Do?

At its core, a tax lawyer is a legal advisor who specializes in the complex and constantly evolving body of statutes, regulations, and case law that constitute tax law. They are not merely accountants who file tax returns; they are strategists, negotiators, and advocates who help clients structure their affairs to minimize tax liability legally and ethically, and who represent them in disputes with tax authorities like the Internal Revenue Service (IRS) or state revenue departments.

Their responsibilities are broad and require a unique blend of legal acumen, financial literacy, and strategic thinking. Unlike many other legal fields that are primarily retrospective (dealing with events that have already occurred), tax law is often prospective, focusing on planning and structuring future transactions to achieve the most favorable tax outcomes.

Core Responsibilities and Typical Projects:

- Tax Planning and Advisory: This is a cornerstone of the practice. Tax lawyers advise corporations on the tax implications of mergers and acquisitions (M&A), structure real estate deals, guide international business operations to avoid double taxation, and help wealthy individuals with estate and gift tax planning.

- Tax Controversy and Litigation: When disputes arise, tax lawyers are on the front lines. They represent clients during IRS audits, appeal administrative decisions, and, if necessary, litigate cases in U.S. Tax Court, federal district courts, or the Court of Federal Claims.

- Compliance: While accountants handle the mechanics of filing returns, tax lawyers often oversee the process for complex entities, ensuring that all positions taken on the return are legally defensible and properly documented.

- Transactional Support: In any major business deal—a corporate merger, a private equity acquisition, a major financing round—a tax lawyer is a critical member of the deal team. They are responsible for structuring the transaction in the most tax-efficient manner possible, which can save the parties involved millions or even billions of dollars.

- Specialized Areas: They may focus on niche areas such as state and local tax (SALT), employee benefits (ERISA), tax-exempt organizations, or renewable energy tax credits.

### A Day in the Life of a Mid-Level Tax Associate

To make this tangible, let's walk through a typical day for "Alex," a fourth-year tax associate at a large law firm in a major city.

- 8:30 AM - 9:30 AM: Morning Review and Team Sync. Alex arrives, grabs coffee, and reviews overnight emails from international clients and senior partners. There's a query from the M&A team about the tax treatment of certain assets in a pending deal. Alex spends 30 minutes on a quick video call with the M&A partner and a tax partner to map out the research strategy for the day.

- 9:30 AM - 12:30 PM: Deep-Dive Research and Memo Drafting. The core of the morning is spent on the M&A query. Alex logs into specialized legal research databases like Westlaw and Bloomberg Tax. The task is to analyze a specific section of the Internal Revenue Code, its corresponding Treasury Regulations, and relevant case law to determine if a proposed transaction structure is legally sound. The goal is to produce a detailed memorandum outlining the risks and benefits.

- 12:30 PM - 1:30 PM: Client Lunch. Alex joins a partner for lunch with an in-house counsel from a major corporate client. The conversation is part relationship-building, part informal brainstorming about the tax implications of the client's planned expansion into Europe.

- 1:30 PM - 4:00 PM: Transactional Work. The afternoon shifts to a different matter. Alex is tasked with reviewing the tax representations and covenants in a hundred-page credit agreement for a financing deal. This requires meticulous attention to detail to ensure the client is protected from unforeseen tax liabilities. Alex redlines the document and drafts a summary of proposed changes for the deal team.

- 4:00 PM - 5:30 PM: Tax Controversy Case. Alex switches gears again to a tax controversy case. A client is under an IRS audit. Alex participates in a conference call with the IRS revenue agent, a senior partner, and the client's CFO to negotiate the scope of the information being requested by the government.

- 5:30 PM - 7:00 PM: Finishing Touches and Billing. The last part of the day is spent finalizing the research memo from the morning, responding to less urgent emails, and meticulously recording billable hours for each task performed throughout the day. Alex then briefly plans the priorities for the next day before heading home.

This example illustrates the intellectual variety, high level of responsibility, and demanding nature of the work.

Average Tax Lawyer Salary: A Deep Dive

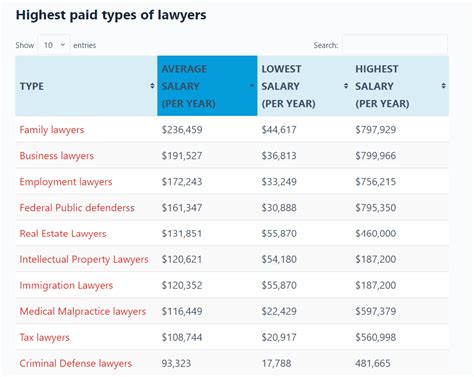

The compensation for a tax lawyer is among the highest in the legal profession, reflecting the specialized knowledge required and the immense value they can create for clients. While the U.S. Bureau of Labor Statistics (BLS) provides general data for all lawyers, we must turn to more specialized sources to understand the nuances of tax law compensation.

The BLS reports the median annual wage for all lawyers was $145,760 as of May 2023. However, this figure blends all specialties and geographic locations, from public defenders to corporate lawyers. Tax lawyers, particularly those in the private sector, typically earn significantly more.

According to data from Salary.com updated in 2024, the median salary for a Tax Attorney in the United States is $182,301. The typical salary range falls between $158,501 and $209,101. It's important to note that this represents base salary and does not include the substantial bonuses that are common in this field.

Glassdoor reports a slightly different figure, with the average total pay (base plus additional compensation like bonuses) for a Tax Attorney in the US being around $191,000 per year as of early 2024. This highlights the importance of considering total compensation, not just the base salary figure.

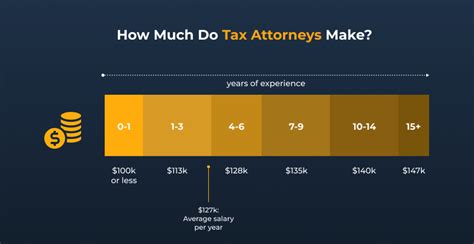

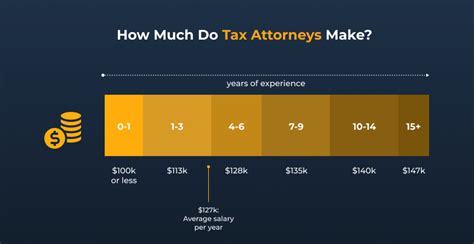

### Salary by Experience Level

Salary progression in tax law is steep and rapid, especially in the first decade of practice. Here’s a breakdown of typical earnings based on years of experience, drawing from a composite of industry data.

| Experience Level | Years of Experience | Typical Base Salary Range | Typical Total Compensation (with Bonus) | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level Associate | 0-2 Years | $150,000 - $225,000 | $170,000 - $245,000+ | Primarily in "BigLaw" firms, following the Cravath scale. Lower in smaller firms/government. |

| Mid-Level Associate | 3-5 Years | $225,000 - $350,000 | $260,000 - $400,000+ | Gaining significant responsibility. Often the point where specialization deepens. |

| Senior Associate / Counsel | 6-9 Years | $350,000 - $450,000 | $400,000 - $550,000+ | Operating with more autonomy, managing junior associates, and developing client relationships. |

| Partner (Non-Equity) | 8+ Years | $400,000 - $700,000 | $500,000 - $850,000+ | Salaried partner with a significant bonus. A step towards equity partnership. |

| Partner (Equity) | 10+ Years | N/A (Draw + Profits) | $800,000 - $3,000,000+ | Receives a share of the firm's profits. Earnings can vary dramatically based on firm profitability. |

| In-House Tax Counsel | 5+ Years | $180,000 - $300,000+ | $220,000 - $400,000+ (plus stock) | At a large corporation. VP or Director of Tax can earn significantly more. |

| Government Attorney (IRS/DOJ)| 0-10+ Years | $75,000 - $180,000+ | $75,000 - $180,000+ | Follows the federal GS pay scale. Lower ceiling but excellent benefits and work-life balance. |

*(Sources: Data compiled and synthesized from reports by Salary.com, Glassdoor, Payscale, and NALP (National Association for Law Placement) reports on law firm salaries.)*

### Beyond the Base Salary: Understanding Total Compensation

A tax lawyer's paycheck is more than just their base salary. Total compensation is a critical concept, especially in private practice.

- Bonuses: These are often substantial and are typically tied to a combination of firm profitability, individual performance, and the number of billable hours worked. For associates at major law firms, year-end bonuses can range from $20,000 for first-year associates to over $115,000 for senior associates, often paid on a lockstep scale.

- Profit Sharing: This is the primary compensation method for equity partners at law firms. They receive a "draw" (a regular payment like a salary) throughout the year, with the bulk of their compensation coming from their share of the firm's profits at year-end. This is why partner compensation can fluctuate significantly year-to-year.

- Billable Hour Targets: While not direct compensation, meeting or exceeding a firm's billable hour requirement (often 1,800-2,000+ hours per year) is a prerequisite for bonus eligibility and career advancement.

- Stock Options and Equity: For in-house tax lawyers at publicly traded companies or late-stage startups, compensation packages often include restricted stock units (RSUs) or stock options, which can add substantial long-term value to their earnings.

- Benefits: Top-tier employers offer comprehensive benefits packages, including premium health, dental, and vision insurance; generous 401(k) matching or other retirement plans; paid parental leave; and budgets for continuing legal education (CLE) and professional development, such as covering the cost of an LL.M. degree.

Key Factors That Influence a Tax Lawyer's Salary

While the averages provide a baseline, your actual earning potential as a tax lawyer will be determined by a combination of powerful factors. Understanding these levers is key to maximizing your income and career growth.

### ### Level of Education: The J.D. and the All-Important LL.M.

Your educational background is the foundation of your career and a primary determinant of your starting salary and long-term prospects.

- Juris Doctor (J.D.): This is the mandatory, non-negotiable degree for practicing law in the United States. The reputation and ranking of the law school you attend can significantly impact your initial job opportunities. Graduates from top-tier (T-14) law schools are more likely to secure interviews and offers from the highest-paying "BigLaw" firms, immediately placing them in the top salary bracket for entry-level lawyers.

- Master of Laws in Taxation (LL.M.): For tax law, the LL.M. is a game-changer. It is a one-year, post-J.D. specialized degree that provides a deep, intensive education in tax law. While not strictly required, it is considered the gold standard in the field and is often a de facto requirement for elite positions at top law firms, boutique tax firms, and high-level in-house roles. Holding an LL.M. from a top program (like NYU, Georgetown, or Florida) signals a high level of expertise and commitment to the specialty. This can lead to:

- Higher Starting Salaries: An LL.M. graduate may command a higher starting salary or be placed a year ahead on the associate salary scale compared to a J.D.-only graduate.

- Expanded Job Opportunities: It opens doors that might otherwise be closed, particularly for graduates whose J.D. is not from a top-ranked school.

- Faster Advancement: The specialized knowledge gained allows a lawyer to contribute at a higher level more quickly, leading to faster promotions.

- Dual Degrees (J.D./CPA, J.D./MBA): While less common than the LL.M., holding a Certified Public Accountant (CPA) license or an MBA alongside a J.D. can be extremely valuable. A J.D./CPA is particularly powerful in roles that blur the line between legal advice and accounting, such as in Big Four accounting firms or in estate planning. A J.D./MBA can be advantageous for tax lawyers focusing on M&A and corporate transactions, as it demonstrates a deeper understanding of the business and financial drivers behind the deals.

### ### Years of Experience: The Path from Associate to Partner

As the salary table above demonstrates, experience is arguably the single most powerful driver of salary growth in the legal profession. This is not just about time served; it's about the accumulation of expertise, client relationships, and a track record of success.

- Junior Associate (Years 1-3): Focus is on learning the ropes. You'll spend most of your time on research, drafting memos, and performing due diligence. You work under the close supervision of senior lawyers. Salary growth is typically lockstep in BigLaw, meaning everyone in your class year gets the same base salary.

- Mid-Level Associate (Years 4-6): You begin to take on more responsibility, managing smaller aspects of a deal or case, having direct client contact, and supervising junior associates. Your value to the firm increases dramatically, and this is reflected in significant salary jumps.

- Senior Associate/Counsel (Years 7-9+): You are now a senior specialist. You may be leading deal teams, serving as the primary point of contact for clients, and beginning to develop your own book of business. At this stage, some lawyers may transition to a non-partner track role like "Counsel" or "Special Counsel," which offers high pay and responsibility without the business-development pressures of partnership.

- Partner: This is the pinnacle of the law firm hierarchy.

- Non-Equity Partner: A salaried position with a significant bonus. It's a promotion that recognizes seniority and expertise, but without an ownership stake.

- Equity Partner: You "buy-in" to the firm and become an owner. Your compensation is a share of the firm's profits. This is where salaries can explode into the high six or seven figures, but it comes with immense pressure to generate revenue and manage the business of the firm.

### ### Geographic Location: The Coasts and the Heartland

Where you practice law has a massive impact on your salary. Major metropolitan areas with large financial centers have the highest concentration of high-paying BigLaw firms and corporate headquarters. However, these salaries must be weighed against a much higher cost of living.

Here is a comparative look at estimated median salaries for Tax Attorneys by major U.S. city, according to Salary.com data (2024):

| City | Estimated Median Base Salary | Comparison to National Median |

| :--- | :--- | :--- |

| New York, NY | $219,891 | ~20% higher |

| San Francisco, CA | $228,054 | ~25% higher |

| Washington, D.C. | $202,668 | ~11% higher |

| Chicago, IL | $191,802 | ~5% higher |

| Boston, MA | $205,394 | ~13% higher |

| Houston, TX | $183,939 | ~1% higher |

| Miami, FL | $173,004 | ~5% lower |

As the data shows, practicing in San Francisco or New York can lead to a salary that is 20-25% higher than the national median. Conversely, practicing in a smaller midwestern or southern city will likely result in a lower base salary, though the lower cost of living might mean greater purchasing power.

### ### Company Type & Size: BigLaw vs. Boutique vs. In-House

The type of organization you work for is a critical determinant of your salary, work-life balance, and career path.

- Large Law Firms ("BigLaw"): These are the Am Law 100/200 firms, typically with hundreds or thousands of lawyers across multiple offices. They pay the highest salaries, especially at the associate level, often following a lockstep compensation model known as the "Cravath Scale." The trade-off is immense pressure, extremely long hours, and a highly competitive "up-or-out" culture.

- Boutique Tax Firms: These are smaller, specialized firms that focus exclusively on tax law. They may not match BigLaw's starting salaries, but they offer exceptionally deep expertise. For partners, compensation can be just as high, if not higher, than at large firms, as they have lower overhead. The work is often highly sophisticated.

- In-House Corporate Legal Departments: Working as a tax lawyer for a company (e.g., Google, Procter & Gamble, ExxonMobil) offers a different path. The base salary might be slightly lower than at a top law firm, but the work-life balance is generally much better. Compensation often includes valuable stock options or RSUs, and you get to see the direct business impact of your legal advice.

- "Big Four" Accounting Firms: Firms like Deloitte, PwC, EY, and KPMG have large and respected tax law practices. They hire J.D.s and LL.M.s to work alongside their accountants. The compensation is competitive with law firms (though historically slightly lower at the top end), and the culture is distinct, blending legal and consulting work.

- Government: Working for the IRS (Office of Chief Counsel) or the Department of Justice (Tax Division) offers the lowest starting pay. However, the benefits are unparalleled. You receive some of the best, most practical tax training in the world, work on landmark cases, enjoy excellent job security, and have a genuine work-life balance with predictable hours and generous federal benefits. Many lawyers start in government for the training and then move to the private sector for much higher pay.

### ### Area of Specialization

Even within the niche of tax law, further specialization can impact your value and salary. High-demand, high-complexity areas often command a premium.

- International Tax: With the globalization of business, this is one of the most complex and lucrative specialties. Lawyers who can navigate cross-border transactions, transfer pricing, and the tax treaties between nations are in constant demand.

- Mergers & Acquisitions (M&A) Tax: As a key player on high-stakes corporate deal teams, M&A tax specialists who can structure multibillion-dollar deals for maximum tax efficiency are among the highest-paid lawyers.

- State and Local Tax (SALT): A burgeoning field as states become more aggressive in their tax policies, especially regarding e-commerce and remote work. Expertise in SALT is highly sought after by large corporations with a national footprint.

- Tax Controversy: Specialists who represent clients in major disputes against the IRS or other tax authorities command high fees due to the direct financial stakes involved.

- Estate Planning / Private Client Services: Advising high-net-worth individuals and families on transferring wealth through trusts and other vehicles is a consistently profitable and relationship-driven practice.

### ### In-Demand Skills

Beyond your degrees, specific skills can make you a more valuable and higher-paid tax lawyer.

- Technical Proficiency: Deep, demonstrable knowledge of the Internal Revenue Code and Treasury Regulations is the table stakes.

- Superior Research and Analytical Skills: The ability to dissect a complex problem, find the relevant statutes and case law, and synthesize it into a clear, defensible position is paramount.

- Exceptional Communication: You must be able to explain incredibly complex tax concepts clearly and concisely to non-specialists, including clients, executives, and other lawyers.

- Negotiation and Advocacy: Whether you are negotiating a deal point with opposing counsel or arguing a case before an IRS appeals officer, the ability to persuade is critical.

- Business Acumen: The best tax lawyers understand their client's business. They don't just give tax advice in a vacuum; they provide strategic counsel that aligns with the client's commercial goals.

Job Outlook and Career Growth

For those willing to undertake the rigorous educational and professional journey, the future is exceptionally bright. The demand for skilled tax lawyers is robust and expected to remain so for the foreseeable future.

The U.S. Bureau of Labor Statistics (BLS) projects that overall employment for lawyers will grow by 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS anticipates about 39,100 openings for lawyers each year, on average, over the decade.

While the BLS doesn't isolate data for tax lawyers, several powerful trends suggest that the demand for this specialty will be at the forefront of this growth:

1. Ever-Increasing Legal Complexity: The U.S. tax code is in a constant state of flux. Congress frequently passes new legislation (like the Inflation Reduction Act with its green energy credits or the Tax Cuts and Jobs Act) that creates new complexities and planning opportunities, driving demand for expert advice.

2. Globalization of Business: As more companies operate across borders, the need for international tax experts to manage issues like transfer pricing, foreign tax credits, and anti-deferral regimes (e.g., GILTI, Subpart F) will only grow.

3. Increased IRS Enforcement: Following recent funding increases, the IRS is ramping up its enforcement and audit activities, particularly focusing on large corporations, partnerships, and high-net-worth individuals. This directly translates into greater demand for tax controversy lawyers to defend clients.

4. Aging Demographics: The transfer of wealth from the baby boomer generation—often called the "great wealth transfer"—is creating unprecedented demand for sophisticated estate and gift tax planning.

5. The Rise of New Industries: Emerging areas like cryptocurrency and the digital economy present novel and unsettled tax questions, requiring highly specialized legal guidance.

### Emerging Trends and Future Challenges

The profession is not static. To thrive, a tax lawyer must stay ahead of key trends:

- Technology and AI: Artificial intelligence is beginning to automate basic legal research and document review. The future tax lawyer will need to leverage these tools to work more efficiently, focusing their efforts on high-level strategy, client counseling, and negotiation—tasks that AI cannot replicate.

- Data Analytics: The ability to analyze financial data to identify tax risks and opportunities will become an increasingly valuable skill, blending the roles of lawyer and financial strategist.

- Remote Work and Geographic Flexibility: The pandemic has shown that much legal work can be done remotely. While top firms are pushing for a return to the office, this trend may slightly de-emphasize the need to be in a high-cost city for certain roles, although major financial centers will always remain the epicenters of high-stakes transactional work.

### Advice for Advancement and Staying Relevant

- Never Stop Learning: The tax code changes. You must commit to a lifetime of learning through Continuing Legal Education (CLE), reading tax journals (like *Tax Notes*), and attending industry conferences.

- Build Your Network: Cultivate relationships with other lawyers, accountants, bankers, and clients. Your professional network is your most valuable asset for career advancement and business development.

- Develop a Niche: While a general tax background is essential, developing a deep spike of expertise in a high-demand area (like international tax or M&A) will make you invaluable.