When you hear the title "CEO of Verizon," you likely picture a world of high-stakes decisions, global influence, and, of course, a significant financial reward. The "Verizon CEO salary" is more than just a number; it's a benchmark representing the pinnacle of corporate achievement in one of the world's most critical industries. But what does that number truly represent? What is the journey to earning such a compensation package, and what does the role actually entail?

This guide is designed to be your definitive resource, whether you are an aspiring student dreaming of the C-suite, a mid-career professional seeking to understand executive-level opportunities, or simply curious about the mechanics of top-tier corporate leadership. We will dissect the Verizon CEO's compensation, but more importantly, we will use it as a case study to explore the broader career path of a top executive. We will delve into the salaries, skills, challenges, and long-term outlook for those who aspire to lead major corporations.

The average salary for a Top Executive in the United States, according to the U.S. Bureau of Labor Statistics, was $196,940 per year as of May 2023. However, this figure encompasses a vast range of roles. For a CEO of a Fortune 50 company like Verizon, total compensation can soar into the tens of millions of dollars, comprised of salary, bonuses, and extensive stock awards.

I once had the opportunity to sit in on a strategic off-site with a C-suite executive from a major technology firm. Watching them synthesize complex market data, navigate competing departmental interests, and articulate a clear, compelling vision for the next five years was a masterclass in leadership. It drove home the fact that a top executive's compensation isn't just for managing a company; it's for weathering uncertainty, inspiring thousands of employees, and ultimately creating billions in value for shareholders and society. That immense responsibility is the other side of the multi-million dollar coin.

This article will guide you through every facet of this demanding and rewarding career path.

### Table of Contents

- [What Does a Top Executive (like the Verizon CEO) Do?](#what-does-a-verizon-ceo-do)

- [Average Top Executive Salary: A Deep Dive](#average-verizon-ceo-salary-a-deep-dive)

- [Key Factors That Influence Executive Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Become a Top Executive](#how-to-get-started-in-this-career)

- [Conclusion: Is the Climb to the Top Worth It?](#conclusion)

What Does a Top Executive (like the Verizon CEO) Do?

While the salary commands headlines, the day-to-day reality of being a CEO for a company like Verizon is a relentless exercise in strategic leadership, communication, and decision-making under pressure. The role extends far beyond simply "being the boss." A top executive is the chief strategist, primary spokesperson, capital allocator, and ultimate arbiter for an organization with hundreds of thousands of employees and millions of customers.

The core responsibilities can be broken down into several key domains:

- Setting the Vision and Strategy: The CEO is responsible for defining the company's long-term direction. This involves answering fundamental questions: What markets should we be in? How will we compete and win? What are the major technological and market shifts we must prepare for (e.g., 6G, AI integration, satellite internet competition)? The CEO works with the board of directors and the executive team to formulate this strategy and ensure it is communicated effectively throughout the organization.

- Managing the Executive Leadership Team: A CEO does not run the company alone. They lead a team of C-suite executives (CFO, COO, CTO, etc.). A significant portion of the CEO's time is spent hiring, developing, and mentoring this team, ensuring they are aligned with the company's strategy and performing at the highest level.

- Capital Allocation: A company like Verizon has billions of dollars in capital to deploy each year. The CEO makes the final call on major investments: Should we spend billions to acquire more wireless spectrum? Should we invest heavily in expanding our fiber optic network? Should we acquire a smaller technology company? These decisions have decade-long consequences and are fundamental to the company's success.

- Being the Public Face of the Company: The CEO is the primary liaison between the company and its key stakeholders, including investors, customers, regulators, and the media. This involves presenting at investor conferences, participating in high-level government meetings, and acting as the company's chief advocate and brand ambassador.

- Ensuring Financial and Operational Performance: Ultimately, the CEO is accountable to the board of directors and shareholders for the company's performance. This means hitting financial targets (revenue, profit, cash flow) and ensuring the operational side of the business—the network, the customer service, the retail stores—runs efficiently and effectively.

### A "Day in the Life" of a Top Telecom CEO

To make this more concrete, here’s a hypothetical but realistic look at a day in the life:

- 5:30 AM - 7:00 AM: Wake up, review overnight market news from Europe and Asia, read internal performance dashboards, and exercise.

- 7:00 AM - 8:00 AM: Breakfast meeting with the Chief Technology Officer to discuss the progress of a critical 5G network upgrade.

- 8:00 AM - 10:00 AM: Lead the weekly C-Suite leadership meeting. Agenda items might include reviewing quarterly financial forecasts, debating a new marketing campaign for the consumer group, and addressing a recent cybersecurity threat.

- 10:00 AM - 11:30 AM: Call with three of the company's largest institutional investors to discuss the previous quarter's results and answer tough questions about future growth strategy.

- 11:30 AM - 12:30 PM: Media interview with a major financial news network to discuss the company's role in bridging the digital divide.

- 12:30 PM - 1:30 PM: Working lunch with the head of the Verizon Business Group to review a multi-billion dollar proposal for a new enterprise client.

- 1:30 PM - 3:00 PM: Strategic planning session focused on competitive threats from cable and satellite internet providers.

- 3:00 PM - 4:00 PM: Pre-briefing with the government relations team for an upcoming meeting with FCC commissioners in Washington D.C.

- 4:00 PM - 5:30 PM: Host a virtual "town hall" for 10,000 employees, sharing strategic updates and taking live Q&A.

- 5:30 PM - 7:00 PM: Review and sign off on critical documents, respond to high-priority emails, and have a final check-in with their chief of staff.

- 7:00 PM onwards: Attend a charity board dinner or a formal event, or fly to another city for the next day's meetings. Reading and preparation for the next day often continue late into the evening.

This schedule highlights the immense demands on a CEO's time and the need to context-switch rapidly between finance, technology, marketing, and public policy.

Average Top Executive Salary: A Deep Dive

Discussions about executive compensation, especially the "Verizon CEO salary," are complex. The headline number is rarely a simple salary. Instead, it's a carefully structured package designed to align the CEO's financial interests with the long-term success of the company.

### The Verizon CEO: A Real-World Example

To provide the most accurate, authoritative data, we turn to Verizon's official 2024 proxy statement (DEF 14A) filed with the U.S. Securities and Exchange Commission (SEC). This document details the compensation for its top executives.

For the fiscal year 2023, the total compensation for Verizon's Chairman and CEO, Hans Vestberg, was $19,836,782.

It's crucial to understand that he did not receive a $19.8 million paycheck. Here is how that "total compensation" figure, as calculated by SEC rules, breaks down:

- Salary: $1,500,000. This is the fixed cash portion of his compensation, the only part that resembles a traditional salary.

- Stock Awards: $14,999,996. This is the largest component. It is the grant-date fair value of stock awards (in this case, Performance Stock Units or PSUs) that will vest over several years *only if* specific performance targets are met. These targets often relate to metrics like Total Shareholder Return (TSR) compared to peer companies and financial goals like free cash flow. If the company and its stock perform poorly, the actual value received could be much lower.

- Non-Equity Incentive Plan Compensation: $2,640,000. This is the annual cash bonus, which is based on the company's performance against pre-set financial and operational goals for that specific year (e.g., revenue, earnings, subscriber growth).

- All Other Compensation: $696,786. This category includes personal benefits and perquisites, such as contributions to retirement plans, life insurance premiums, and costs associated with personal use of company aircraft and residential security, which are standard for CEOs of this stature for security and efficiency reasons.

This breakdown reveals a critical principle of modern executive pay: the vast majority is "at-risk" and tied directly to performance. Over 90% of the Verizon CEO's target compensation is contingent on achieving specific, measurable goals over multiple years.

### Broader CEO and Top Executive Salary Benchmarks

While the Verizon example represents the top of the pyramid, it's helpful to look at broader data to understand the landscape.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for Top Executives was $196,940 in May 2023. This is a useful national baseline but is heavily skewed by the large number of executives at small and medium-sized enterprises (SMEs). The compensation structure changes dramatically with company size.

A more relevant source for large-company CEO pay is Equilar, a leading executive compensation data firm. According to their 2023 study on CEO pay at the 100 largest U.S. companies by revenue, the median total compensation was $22.3 million.

Here’s a look at how CEO compensation typically stratifies by company size and career stage, using data synthesized from sources like Salary.com, Glassdoor, and industry reports.

| Career Stage / Company Size | Typical Base Salary Range | Typical Total Compensation Range (incl. equity/bonus) | Notes |

| ------------------------------- | ------------------------- | ------------------------------------------------------- | ---------------------------------------------------------------------------------------------------------------------------------- |

| Director/VP (Large Corp) | $180,000 - $300,000 | $300,000 - $800,000+ | This is the typical feeding ground for future C-suite talent. Total compensation begins to include significant equity grants. |

| C-Suite (Non-CEO, Large Corp) | $500,000 - $1,200,000 | $2,000,000 - $15,000,000+ | Roles like CFO, COO, Group President. Pay is highly variable based on the role's strategic importance. (e.g., Verizon's CFO ~$8M total comp) |

| CEO (Mid-Cap Public Co) | $600,000 - $1,000,000 | $4,000,000 - $10,000,000 | Companies with market capitalizations between $2 billion and $10 billion. |

| CEO (Large-Cap / S&P 500) | $1,000,000 - $2,000,000 | $15,000,000 - $50,000,000+ | Companies like Verizon. Base salary is a small fraction of the total package, which is dominated by performance-based equity. |

| CEO (Well-Funded Startup) | $150,000 - $350,000 | Varies wildly based on equity stake | Base salary is often kept lower to preserve cash. The potential upside is immense but illiquid and tied entirely to the company's exit (IPO or acquisition). |

*Sources: Data synthesized from 2023/2024 reports from the U.S. BLS, Equilar, Salary.com, and analysis of public company proxy statements.*

This deep dive illustrates that the path to an eight-figure compensation package is not about climbing a salary ladder, but about taking on progressively more responsibility and having your compensation increasingly tied to the value you create.

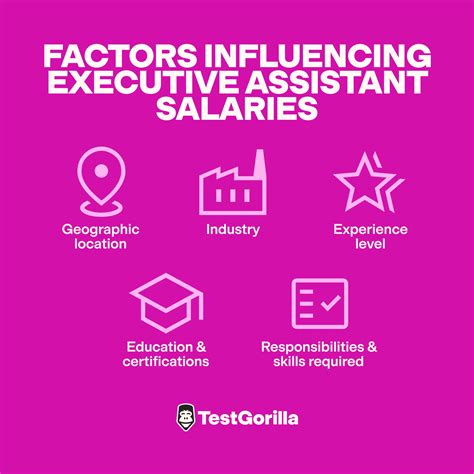

Key Factors That Influence Executive Salary

An executive's compensation is not determined by a single variable. It is a complex equation with numerous inputs. For aspiring leaders, understanding these factors is key to navigating a career toward the C-suite.

### `

` Level of Education

Education is the foundation upon which an executive career is built. While there is no single required degree, a strong academic background is a near-universal prerequisite.

- Undergraduate Degree: A bachelor's degree is the minimum entry ticket. For a company like Verizon, degrees in Engineering (especially electrical or computer), Finance, Economics, or Business Administration are common starting points. These fields provide the rigorous analytical and quantitative skills necessary to understand a complex, capital-intensive business.

- Master of Business Administration (MBA): The MBA is the most significant educational accelerator for an executive career. According to a 2023 study by *U.S. News & World Report*, a significant percentage of Fortune 500 CEOs hold an MBA. More important than the degree itself is the institution from which it was earned. An MBA from a top-tier "M7" school (Harvard, Stanford, Wharton, Northwestern, Chicago Booth, Columbia, MIT Sloan) provides three critical advantages:

1. Elite Network: Access to a global network of alumni who are leaders across every industry.

2. Prestige & Signaling: It signals a high level of ambition, intelligence, and vetting to executive recruiters and boards.

3. Advanced Curriculum: Rigorous training in strategy, finance, marketing, and leadership at a global scale.

- Other Advanced Degrees: While the MBA is most common, other advanced degrees can be highly valuable. A Juris Doctor (J.D.) is common for executives who rise through the legal or regulatory affairs track. A Ph.D. in a technical field can be a pathway for those who become Chief Technology Officer (CTO) before moving into broader management. For example, Verizon's CEO, Hans Vestberg, holds a Bachelor of Business Administration from Uppsala University in Sweden, demonstrating that while an MBA is common, a strong foundation and exceptional performance can forge alternative paths.

### `

` Years of Experience

Executive compensation is a direct reflection of a long and proven track record. The journey to the C-suite is a marathon, not a sprint, typically spanning 20-30 years of progressive experience.

- Entry-Level to Mid-Career (0-10 years): During this phase, the focus is on mastering a functional area (e.g., finance, engineering, sales) and demonstrating initial leadership potential. Compensation growth is steady but follows more traditional corporate bands. An early-career engineer at a telecom might earn $80,000 - $120,000, while a manager in finance might earn $150,000 - $200,000.

- Senior Management / Director (10-20 years): This is a critical transition. Professionals move from managing people to managing managers or entire departments. Crucially, this is where one might first gain P&L (Profit & Loss) responsibility—being accountable for the budget and financial results of a product line or business unit. This is the single most important type of experience for aspiring general managers. Compensation packages start to include more significant equity components. A Director at a large corporation could see total compensation in the $300,000 - $500,000 range.

- Vice President / Executive (20+ years): At this level, individuals are leading large, complex divisions and are part of the senior leadership team. Their decisions have a company-wide impact. They are judged on their ability to develop strategy, lead large teams, and deliver significant financial results. Total compensation packages regularly exceed $1 million, with a heavy emphasis on long-term incentives.

- C-Suite / CEO: Reaching this level typically requires over 25 years of exceptional performance, often across multiple roles and sometimes multiple companies. The compensation reflects this cumulative experience and the immense scope of responsibility.

### `

` Geographic Location

For most jobs, location dictates salary due to cost of living. For top executives, this factor operates differently. The salary is less about the cost of living in a specific city and more about the location of the corporate headquarters and the talent pool in that region.

- Major Corporate Hubs: Cities like New York, NY, the San Francisco Bay Area, Chicago, IL, and Dallas, TX are home to a high concentration of Fortune 500 headquarters. Companies in these locations must offer competitive executive compensation packages to attract and retain the best talent from a highly competitive pool. Verizon's headquarters in New York City places it at the epicenter of finance and global business, influencing its compensation philosophy.

- Data from Salary.com (2024) on CEO salaries shows this variation clearly. The median total compensation for a CEO of a large company ($5B+ revenue) in New York, NY is approximately 20-25% higher than in a smaller metropolitan area like Kansas City, MO.

- Global Experience: For a multinational corporation like Verizon, experience in international markets (e.g., leading a European or Asian division) is a significant salary and career driver. It demonstrates the ability to navigate different cultures, regulatory environments, and market dynamics, which is a prerequisite for the top job.

### `

` Company Type & Size

This is arguably the most significant determinant of an executive's pay package.

- Large-Cap Public Corporations (e.g., Verizon, AT&T, Apple): These companies have the largest revenue bases, the greatest complexity, and the highest public scrutiny. Their CEO compensation is set by a formal compensation committee of the board, often with guidance from external consulting firms. As we saw with Verizon, pay is in the tens of millions, heavily weighted towards performance-based stock.

- Startups: A startup CEO's compensation is a trade-off. The base salary is often modest ($150,000 - $350,000) to preserve cash. The real compensation is a significant equity stake (e.g., 5-15% of the company). This equity is worthless if the company fails but can be worth tens or hundreds of millions of dollars in a successful exit (IPO or acquisition). The risk/reward profile is completely different.

- Private Equity-Owned Companies: Executives in PE-owned companies often have a compensation structure that is a hybrid of the two. They receive a competitive base salary and annual bonus, but also a significant equity slice (co-invest) that pays out only when the PE firm successfully sells the company, typically on a 3-7 year timeline. The incentives are intensely focused on rapid value creation.

- Non-Profits & Government: Leadership roles in these sectors are driven by mission and public service. While a CEO of a very large non-profit (like a major hospital system or university) can earn a high six-figure or even seven-figure salary, it rarely approaches the levels seen in for-profit public companies.

### `

` Area of Specialization / Industry

The industry a company operates in fundamentally shapes the challenges its leaders face and, therefore, the skills they are paid for.

- Telecommunications (e.g., Verizon): This is a mature, capital-intensive industry. Billions are spent annually on network infrastructure. Success requires long-term strategic planning, operational excellence, and navigating a complex regulatory landscape. CEOs often rise from operational, technical, or financial backgrounds.

- Technology / SaaS (e.g., Microsoft, Salesforce): This industry is characterized by rapid innovation, intense competition, and a focus on growth. CEOs must be visionaries who understand product development and market disruption. Compensation is often heavily skewed towards stock awards to align with shareholder value creation through innovation.

- Financial Services (e.g., JPMorgan Chase, Goldman Sachs): This is a highly regulated industry where risk management is paramount. CEOs must have deep financial acumen and the ability to navigate global markets. Compensation is notoriously high but can be highly volatile, with bonuses tied directly to firm and market performance.

- Healthcare (e.g., UnitedHealth Group, Pfizer): This industry blends scientific innovation (in biotech/pharma) with complex logistics and regulation (in insurance/providers). Leaders need to understand science, public policy, and large-scale operations.

### `

` In-Demand Skills

Beyond a resume, certain skills dramatically increase an executive's value and earning potential. These are the attributes boards of directors and investors look for:

1. Strategic Vision: The ability to see beyond the next quarter and articulate a compelling vision for where the company will be in 5-10 years.

2. Financial Acumen: Deep understanding of financial statements, capital markets, and value creation. The ability to speak the language of Wall Street is non-negotiable.

3. Transformational Leadership: Proven experience leading a company through significant change, such as a digital transformation, a major merger, or a cultural turnaround.

4. Mergers & Acquisitions (M&A): Experience identifying, negotiating, and integrating acquisitions is a highly sought-after skill that can create billions in value.

5. Technology & Data Fluency: In today's world, every company is a tech company. An executive must understand how to leverage data, AI, and digital platforms to create a competitive advantage, regardless of their industry.

6. Board and Investor Relations: The ability to build trust and credibility with a board of directors and the investment community is a core function of the CEO role.

7. Crisis Management: A track record of successfully navigating a company through a major crisis (e.g., a cyberattack, a product recall, a public relations scandal) is invaluable.

Job Outlook and Career Growth

The path to the C-suite is, by its very nature, a pyramid. While many will have successful and lucrative careers in management, the number of top executive positions is inherently limited. However, for those with the ambition and ability, the opportunities remain significant.

### The Statistical Outlook

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative data on the overall profession. In their 2023 Occupational Outlook Handbook for Top Executives, the BLS projects:

- Job Growth: Employment of top executives is projected to grow 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

- New Openings: Despite the modest growth rate, the BLS anticipates about 305,400 openings for top executives each year, on average, over the decade.

- Source of Openings: It's important to note that most of these openings are not newly created positions. They result from the need to replace executives who are retiring or transitioning to different roles. This creates a constant, albeit competitive, churn at the top.

The demand is stable because every organization, from a small startup to a multinational giant like Verizon, needs effective leadership to navigate a complex and changing world.

### Emerging Trends and Future Challenges Shaping the Executive Role

The CEO role of tomorrow will look different from today. Aspiring executives must be prepared to meet a new set of challenges and leverage emerging trends.

1. The Primacy of AI and Automation: CEOs no longer need to be coders, but they must be AI-literate. They need to understand how to deploy artificial intelligence and automation to improve efficiency, create new products, and manage risks. A CEO who can articulate a clear AI strategy to their board and investors will have a distinct advantage.

2. ESG as a Business Imperative: Environmental, Social, and Governance (ESG) criteria have moved from a peripheral concern to a core business function. Investors, customers, and employees now demand that companies operate sustainably and ethically. Future leaders must be skilled in integrating ESG principles into corporate strategy, supply chains, and public reporting.

3. The War for Talent and The Future of Work: The shift towards remote and hybrid work is permanent. CEOs must lead organizations that are more geographically dispersed and culturally diverse than ever before. Winning the "war for talent" requires building a strong, inclusive culture that can attract and retain the best people, regardless of where they live.

4. Geopolitical and Supply Chain Volatility: The era of stable, predictable globalization is over. Leaders must now manage through increased geopolitical tensions, trade disputes, and fragile global supply chains. The ability to build resilient, adaptable organizations will be a key differentiator.

5. Intensified Stakeholder Scrutiny: CEOs are under a microscope like never before. They are expected to be leaders not just for their company, but also to take stands on social and political issues. This requires exceptional communication skills and a strong ethical compass.

### How to Stay Relevant and Advance

The climb to the executive level is about continuous learning and strategic career management.

- Embrace a Tour-of-Duty Mentality: Don't stay in one role for too long. Actively seek out new challenges every 3-5 years. Move between different functional areas (e.g., from finance to operations) or different business units to gain a holistic understanding of the enterprise.

- Seek International Experience: As mentioned, spending time working in a key international market is one of the most powerful career accelerators for leadership at a global company.

- Find Mentors and Sponsors: A mentor is someone who gives you advice. A sponsor is a senior leader who actively advocates for you when you are not in the room. Cultivating relationships with sponsors who will put your name forward for high-profile projects and promotions is critical.

- Build a Public Profile: Start speaking at industry conferences. Publish articles on LinkedIn or in trade journals. Become known as an expert in your field. This builds your personal brand and makes you visible to executive recruiters.

- Never Stop Learning: Read voraciously (The Wall Street Journal, Harvard Business Review, The Economist). Take executive education courses. Stay on